When to Sell?The common thread running through the collective minds of present U.S. stock market investors goes something like this: A great crash is coming. But first there will be an epic run-up climaxing with a massive parabolic blow off top. Hence, to capitalize on the final blow off, investors must let their stock market holdings ride until the precise moment the market peaks – and not a moment more. That’s when investors should sell their stocks and go to cash. Certainly, this sounds like a great strategy. But, practically speaking, how are you supposed to pull it off? Specifically, how are you supposed to know the exact moment the stock market peaks? Is the definitive sign of the top when your shoeshine boy offers you a hot stock tip? Is it when your neighbor tells you about his surefire strategy to juice his returns by shorting the Volatility Index (VIX)? Is it when your early morning gym acquaintance proudly boasts how he just purchased a luxury pair of Sea Doos using something called a “portfolio line of credit?” From our perspective, these examples and many more – like extreme valuations – would suffice as conclusive signs of the top. But what do we know? We thought we saw the top four years ago, and every year since. If we had trusted our gut, we would have missed out on significant gains. What to make of it? |

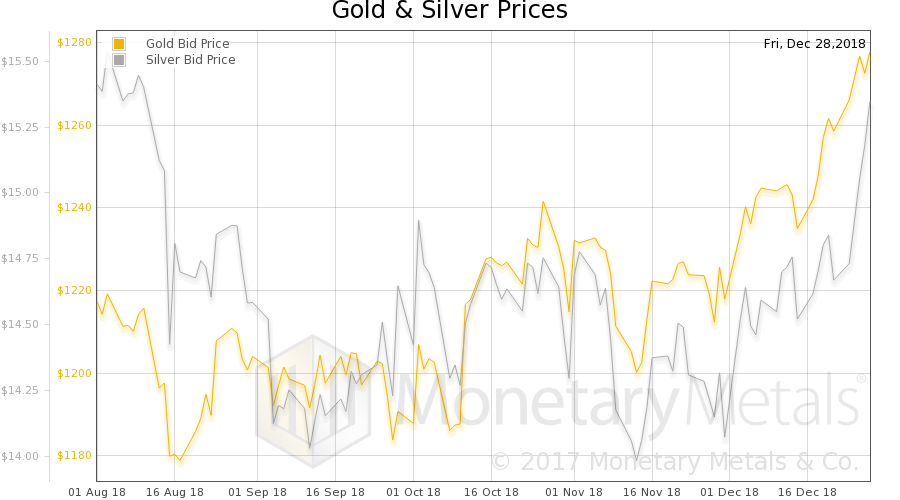

Dow Jones Industrial Average Index, Mar 2016 - Feb 2018 The DJIA over the past two years – the recent blow-off move has catapulted the average way above its 200 day moving average. - Click to enlarge As we recently pointed out, the DJIA has posted unprecedented overbought readings in longer-term time frames and we suspect that the distance from the 200 dma it recently reached was quite a rare extreme as well. By itself, none of this would be overly concerning, but in conjunction with foaming-at-the-mouth bullish sentiment, stretched valuations and a sharp slowdown in money supply growth, it is hard to be anything but concerned. |

Meaningless or MeaningfulRoughly five years ago one of our more challenging clients told us in painstaking detail that our significance, in the grand scheme of things, was that of a gnat on an elephant’s ass. This insightful comparison was generously delivered moments after we were accused of big jobbing his venture. Naturally, we grinned and thanked our client for this novel compliment. The point is, on Tuesday the Dow Jones Industrial Average (DJIA) dropped a full 362 points. This amounted to a loss of 1.37 percent and was the second biggest single day decline since President Trump was elected. For a moment, a touch of panic enveloped Wall Street [it has blossomed since then]. |

Japan Nikkei, 1989 - 2018So far it is still better than the 68 year long bear market in European stocks after the collapse of the Mississippi and South Seas bubbles. It is astonishing that it has taken the index so long to show some serious strength again, considering Japan has a fiat money system and a central bank that never shied away from trying to print the country back to prosperity. |

| Yet in the grand scheme of things, a 1.37 percent loss has the significance of a gnat on an elephant’s ass. It is utterly meaningless, next to nothing. But how did you deal with it? Did you panic? Did your stomach tie in knots? Did you sell out of some of your positions? Or did you brush it off?

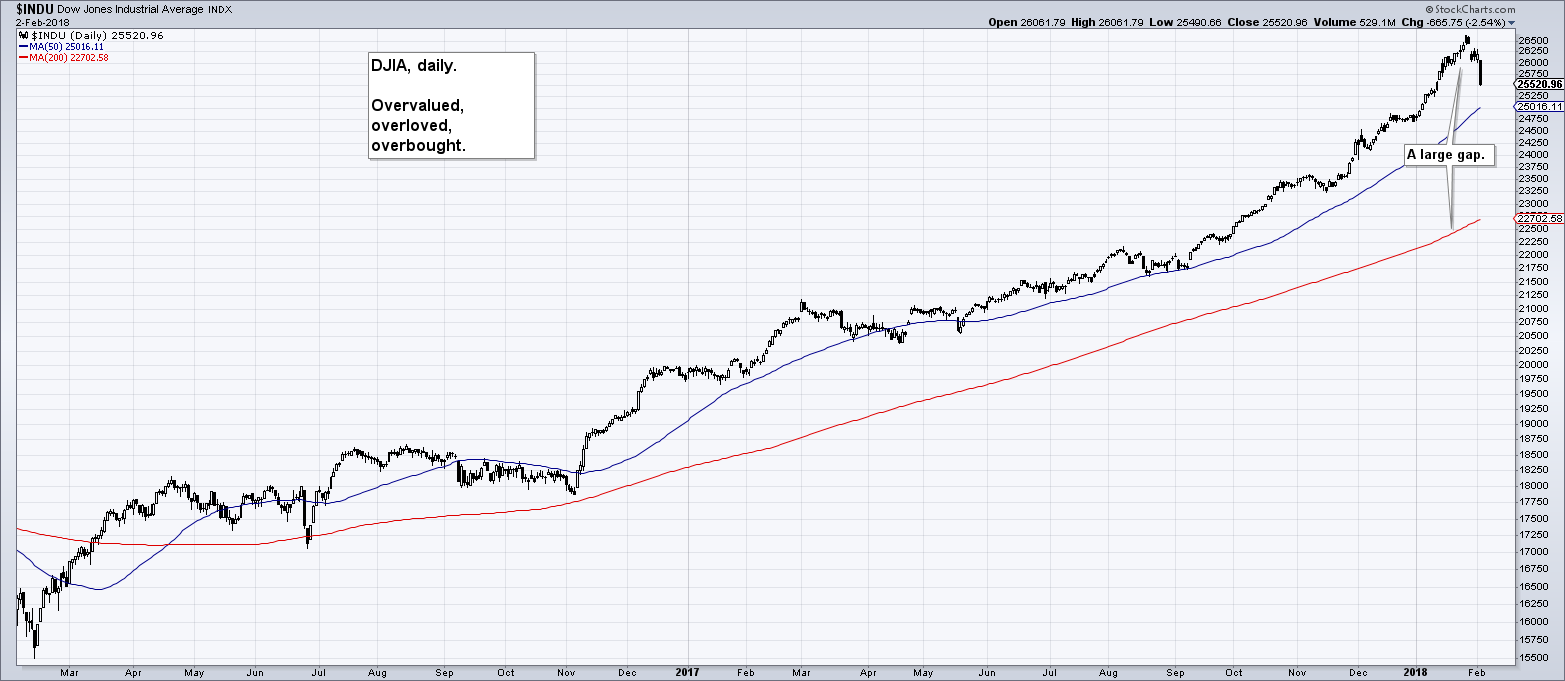

Remember, a 1.37 percent loss may be meaningless. But it could also very well be the start of something meaningful. In short, are we now past the peak? Did the blow off top already occur? Will the January 26th DJIA record close of 26,616 end up being the ultimate top of this bull market? These are the questions. But what are the answers? As of market close on Thursday, the DJIA had yet to approach its January 26th peak. What if it doesn’t set a new record high for another 20 or 30 years? Sure, given the DJIA had over 70 record closes in 2017, this is hard to believe. Of course, no one thought it would take nearly 15 years for the NASDAQ to reach a new all-time high after it peaked in early-2000. And if you recall, the Japanese Nikkei hit close to 39,000 in early 1989. Nearly 30 years later, and in an era of mass currency debasement, the index has barely scratched its way back to 23,000. Unfortunately, at present, there’s no way to know if the DJIA has peaked or not. It may bounce up and hit a new high tomorrow. Or it may not. What we do know, however, is that the popular strategy to hold stocks through the blow off top and then sell the precise moment the market peaks is premised on the flawed idea that you’ll be able to guess the correct time to sell. So what should you do? Should you buy the dip? Should you sell the drop? The correct answer, no doubt, is different for each individual. Unquestionably, there are worse things you can do than sell out of some of your stock market positions and take profits at this late stage of a 9 year bull market. You’ll have already locked in significant gains and will be able to put the extra cash to good use when the impending bear market drags valuations down to bargain basement levels. But what else can you do? Again, the correct answer is different for each individual. However, with a little imagination a vast array of opportunities come into focus. |

Shiller P/E Ratio, 1980 - 2018Note that the even more extreme reading in early 2000 was skewed by the moves concentration in a relatively small number of large cap tech stocks. Valuations may remain lower in terms of a cap-weighted index like the S&P 500, but these eye-bleed valuations are far more broadly distributed. |

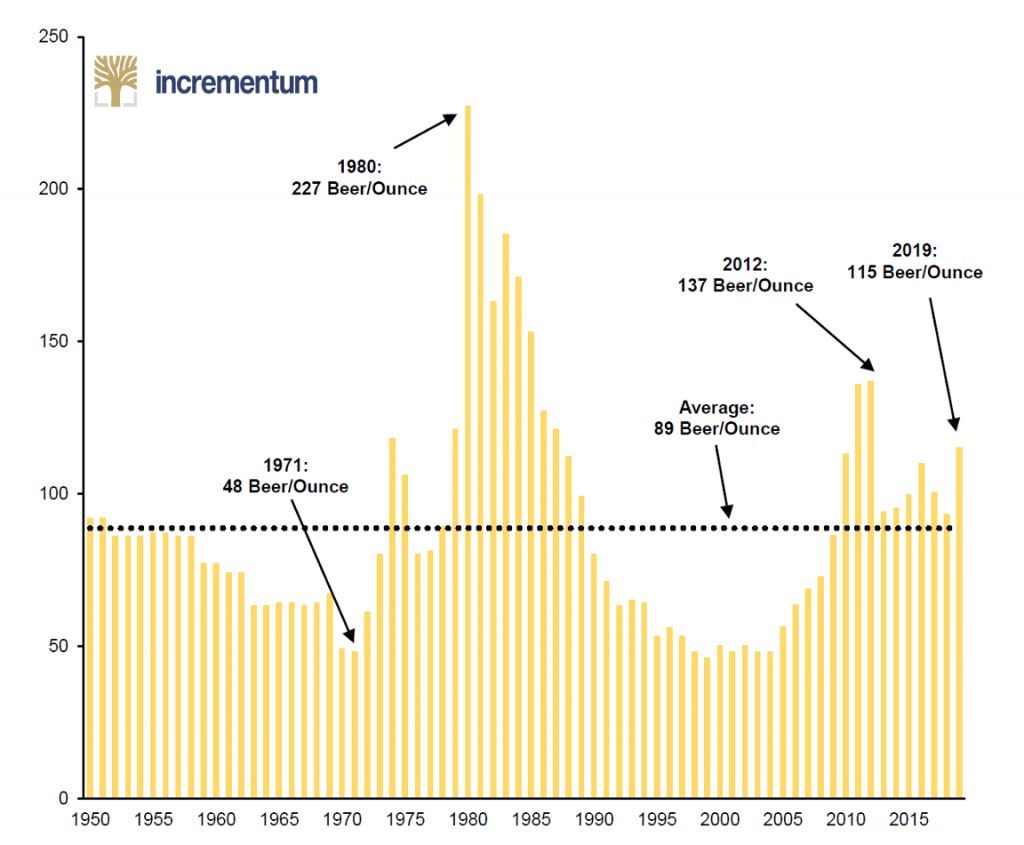

How to Buy Low When Everyone Else is Buying HighBy all accounts, a tried and true method to accumulating investment capital is to buy low and sell high. Conversely, a guaranteed system for losing money is to buy high and sell low. Buying an S&P 500 index fund, at this moment, amounts to buying high. So, perhaps, that’s not a wise idea. Alternatively, it may be wiser to buy something that amounts to buying low. |

Lettuce give some love to the legumes… we once walked with Jim Rogers across the inner city of Vienna in search of a famous local craftsman, and we still remember his brisk walking speed (we were soon out of breath) and the wide range of topics we discussed in a relatively short time, ranging from the potential for social unrest in the wake of the banking crisis to the situation in Zimbabwe. Commodities were definitely a topic as well. |

| For example, several weeks ago legendary investor Jim Rogers – a man who knows a thing or two about buying low and selling high – mentioned that now is the time to invest in the “disastrous” agriculture sector. Rogers’ logic is quite simple – the world is running out of farmers at a time of increasing food demand:

Indeed, Rogers is on to something. Yet, like most everyone else, we don’t want to be farmers. However, that doesn’t mean we cannot be armchair farmers. In fact, it is possible to participate in the potential agriculture boom without planting a single seed.You can do this simply by investing in the PowerShares DB Agriculture exchange traded fund (ETF) (NYSE Arca: DBA), which invests in a basket of commodities, including corn, wheat, soybeans, and sugar futures contracts. Presently, this ETF trades at about $19 per share. A decade ago, it was over $41. For those with the conviction and patience to let the agricultural cycle play out, this is a modest alternative to mindlessly buying the S&P 500 index like everyone else. In other words, you can buy low rather than buying high. |

PowerShares DB Agriculture Fund, Apr 2007 - Feb 2018From hero to zero – the ETF was launched shortly before agricultural commodities peaked in the final stages of a mad-cap rally that saw numerous prices reach new all time highs. Almost all agricultural futures were in backwardation during the blow-off and the contract roll often provided merriment by producing what looked like painful short squeezes. The bears sure did get their revenge though, shortly after they had been wiped out. From a longer-term perspective the sector is beginning to look like a potentially sound prospect – after all, something is always entering a bull market, and it is often whatever has done badly while other assets bubbled into stratosphere. |

Tags: Chart Update,newslettersent,The Stock Market