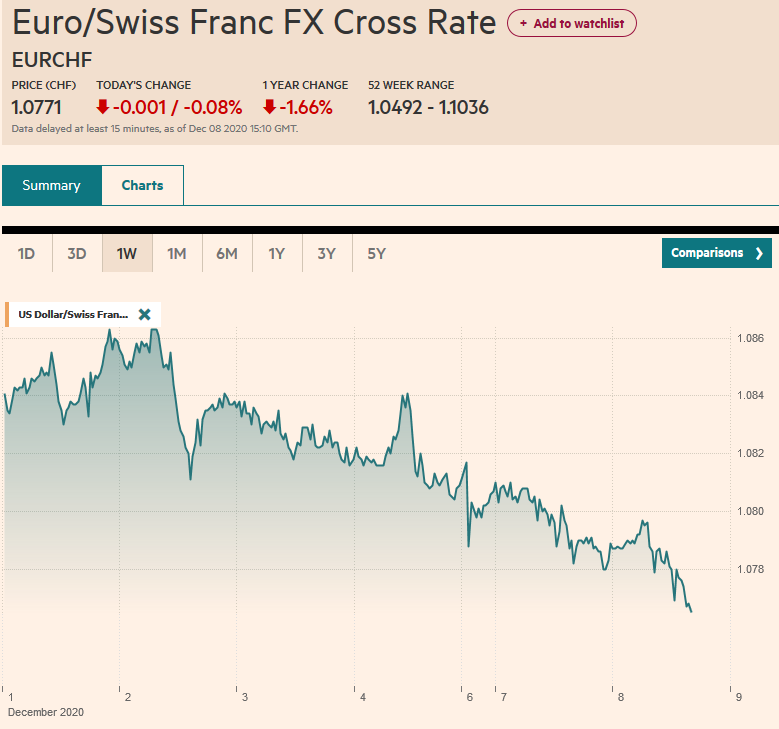

| The Australian dollar bottomed in early December $0.7500 after having tested $0.8100 a couple of times in September. Since early December, however, the Australian dollar appreciated by nearly 6.5%. As it tested the $0.8000 area, the momentum faded.

Yesterday it managed to close above that threshold and new buying lifted it above yesterday’s highs briefly in Asia earlier today. However, there is a growing sense that the market has gone too far, and the 4% decline in iron ore prices provided the fodder for the profit-taking that has now pushed the Aussie below yesterday’s lows. Although the outside down day needs to be confirmed with a close below $0.7980, it is the kind of reversal pattern we have been anticipating. The RSI was at multi-year highs and has turned down today. The Slow Stochastics have not confirmed the new highs, leaving a minor bearish divergence in its wake. As the Great Graphic posted above and created on Bloomberg shows, the MACDs are also poised to cross lower from elevated levels. The Aussie had carved out a little shelf near $0.7940. A break of this area would strengthen the technical case for a corrective phase. The $0.7835 corresponds to the 38.2% retracement of the rally from the December 8 low. The $0.7770 area houses the 50% retracement and the 100-day moving average. Ironically, the bearish technical tone has coincided with the 50-day moving average poised to cross above the 200-day moving average, which is what technicians call the “golden cross”, which is understood as a bullish development. |

AUD BGN Currency, Jul 2017 - Jan 2018 |

Full story here Are you the author? Previous post See more for Next post

Tags: $AUD,Great Graphic,newslettersent