Monthly Archive: December 2017

Santa’s Stock Market Rally: Tears of Joy, Or Just Tears?

Judging by this year's version of Santa Claus's reliable year-end stock market rally, risk has vanished, not just in stocks but in bonds, junk bonds, housing, commercial real estate, collectible art--just about the entire spectrum of tradable assets (with precious metals and agricultural commodities among the few receiving coals rather than rallies).

Read More »

Read More »

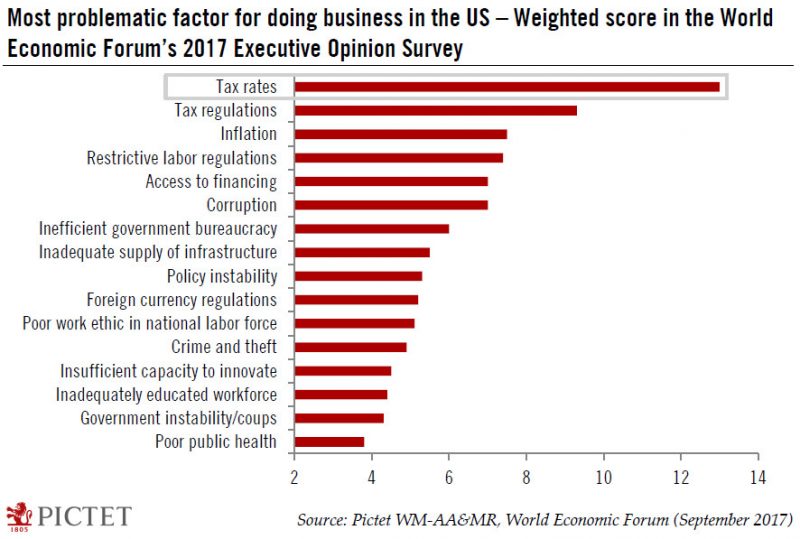

US to overtake Switzerland in WEF competitiveness survey?

The US is about to enact significant corporate tax cuts, and could therefore edge closer to the number 1 spot in the World Economic Forum’s ranking – currently held by Switzerland. The US is about to enact significant corporate tax cuts, that will see the federal statutory corporate tax rate drop to 21%, from 35%, starting in January (see our latest note ‘US tax cuts update – 19 December 2017’).

Read More »

Read More »

How much more you need to earn in Switzerland to breakeven

Recently published international price comparison numbers show just how expensive life is in Switzerland. The price of a standard basket of items, including food, clothing, accommodation, healthcare, transport, education and other regular expenses, was far higher in Switzerland than in the rest of Europe.

Read More »

Read More »

Veterinary office lifts quarantine for Swiss chicken farm

A poultry farm in southern Switzerland has been given a clean bill of health following a recent outbreak of the virulent Newcastle virus that resulted in thousands of chickens being put down. Veterinarians in canton Ticino confirmed that the farm is no longer infected and that all remaining animals are now free of the disease.

Read More »

Read More »

New Rules For Cross-Border Cash and Gold Bullion Movements

New EU Rules For Cross-Border Cash, Gold Bullion Movements. War on cash continues and expands to affect non-criminals including gold owners. New definitions of “cash” to be drawn up by EU to include gold and precious metals. Claim cash and gold bullion “often used for criminal activities such as money laundering, or terrorist financing”. Legislation will allow authorities to seize assets from those ‘without a criminal conviction’. New rules usurp...

Read More »

Read More »

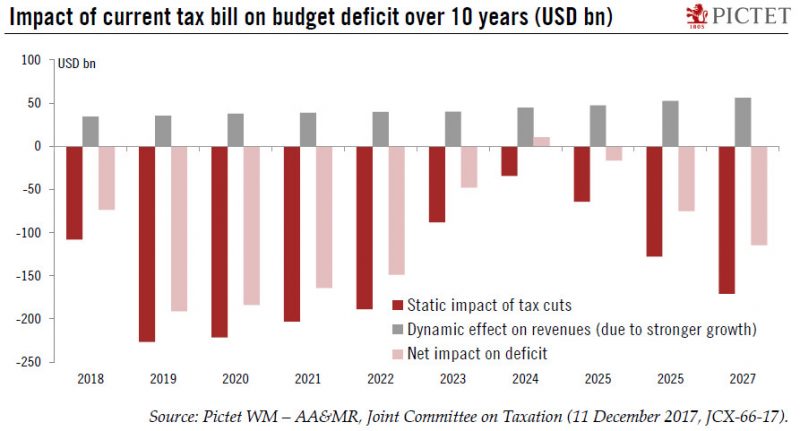

US tax bill looks set to pass

The tax bill continues to make its way through Congress at a swift pace, and now looks increasingly likely to be enacted into law this week, after clearing the conference committee hurdle (a compromise between the House and Senate versions). A few hesitating Republican Senators have eventually said they will vote in favour of the bill, which is key as the Republican majority in the Senate is slim at 52-48. It will shrink to 51-49 in January after...

Read More »

Read More »

Federal Council adopts measures to tackle high prices in Switzerland

On 20 December the Federal Council decided to unilaterally remove tariffs on imported industrial goods. Tariffs will also be reduced on selected agricultural goods not produced in Switzerland. Furthermore, the government wants to apply the Cassis de Dijon principle more widely by reducing the number of exceptions to it. These measures should lead to considerable savings of around CHF 900 million for businesses and consumers. Previously, on 8...

Read More »

Read More »

‘Gold Strengthens Public Confidence In The Central Bank’ – Bundesbank

‘Availability of gold strengthens public confidence in the central bank’s balance sheet’ say Bundesbank. Bundesbank has Audited Reserves amounting to almost 3,400 tonnes, around 68% of Bundesbank’s reserve assets. Bank taken series of steps to increase transparency around Germany’s gold holdings. Germany has second largest gold holdings in the world; U.S. believed to be largest. Transparency important and all central banks should follow the...

Read More »

Read More »

Helvetia chairman resigns amid ongoing FINMA probe

The chairman of the Swiss insurance company Helvetia, Pierin Vincenz, has resigned. The Swiss financial regulator, FINMA, is currently investigating his activities during his time in charge of the Raiffeisen bank. In a statementexternal link released on Monday, Helvetia said Vincenz had stepped down with immediate effect.

Read More »

Read More »

How the Asset Bubble Could End – Part 2

There is just one more positioning indicator we want to mention: after surging by around $126 billion since March of 2016, NYSE margin debt has reached a new all time high of more than $561 billion. The important point about this is that margin debt normally peaks well before the market does. Based on this indicator, one should not expect major upheaval anytime soon. There are exceptions to the rule though – see the caption below the chart.

Read More »

Read More »

The Economy Likes Its IP Less Lumpy

Industrial Production rose 3.4% year-over-year in November 2017, the highest growth rate in exactly three years. The increase was boosted by the aftermath of Harvey and Irma, leaving more doubt than optimism for where US industry is in 2017. For one thing, of that 3.4% growth rate, more than two-thirds was attributable to just two months.

Read More »

Read More »

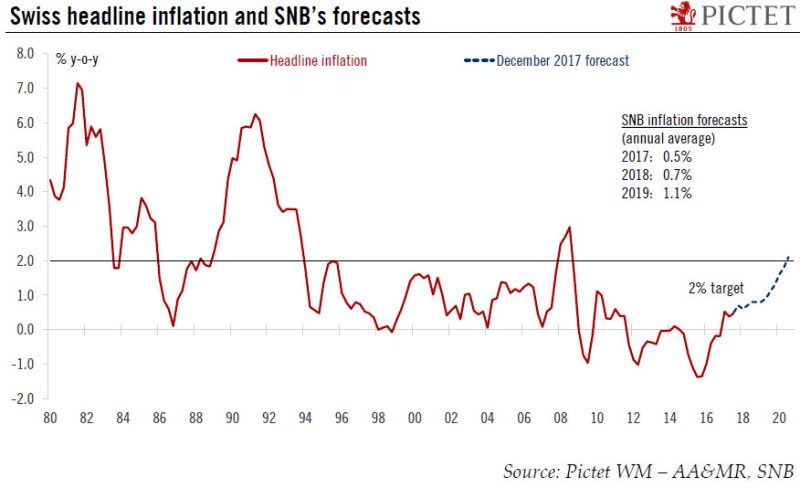

Increasingly optimistic on Swiss outlook

At its December meeting, the Swiss National Bank (SNB) left its accommodative monetary policy unchanged. More specifically, the SNB maintained the target range for the three-month Libor at between - 1.25% and-0.25% and the interest rate on sight deposits at a record low of - 0.75%. The SNB also reiterated its commitment to intervene in the foreign exchange market if needed, taking into account the “overall currency situation”.

Read More »

Read More »

Lawsuit seeks freezing of Tezos Foundation assets

A fourth Tezos lawsuit filed in the United States has called on Californian courts to freeze an estimated $1 billion (CHF990 million) of investor assets sitting in a Swiss-based foundation. Law firm Block & Leviton argues that the recent departure of a Tezos Foundation director and the apparent replacement of the entity’s auditor gives weight to its demand for funds, derived from an initial public offering (ICO) in July, to be frozen.

Read More »

Read More »

Swiss tourism – sharp rises and falls from some countries over the summer

The number of visitors to Switzerland rose 6% this summer, but this headline figure hides some steep rises and falls. From May to October 2017, 11 million people holidayed in Switzerland, 644,000 more than the over same period in 2016.

Read More »

Read More »

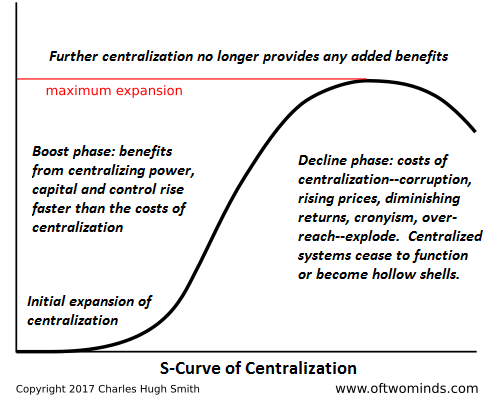

Regulating Cryptocurrencies–and Why It Matters

Nations that attempt to limit cryptocurrencies' ability to solve these problems will find that protecting high costs and systemic friction will grind their economies into dust. There's a great deal of confusion right now about the regulation of cryptocurrencies such as bitcoin. Many observers seem to confuse "regulation" and "banning bitcoin," as if regulation amounts to outlawing bitcoin.

Read More »

Read More »

Chinese Are Not Tightening, Though They Would Be Thrilled If You Thought That

The PBOC has two seemingly competing objectives that in reality are one and the same. Overnight, China’s central bank raised two of its money rates. The rate it charges mostly the biggest banks for access to the Medium-term Lending Facility (MLF) was increased by 5 bps to 3.25%. In addition, its reverse repo interest settings were also moved up by 5 bps each at the various tenors (to 2.50% for the 7-day, 2.80% for the 28-day).

Read More »

Read More »

How the Asset Bubble Could End – Part 1

We recently pondered the markets while trying out our brand-new electric soup-cooling spoon (see below). We are pondering the markets quite often lately, because we believe tail risk has grown by leaps and bounds and we may be quite close to an important juncture, i.e., the kind of pivot that can generate both a lot of excitement and a lot of regret all around.

Read More »

Read More »

In Unprecedented Intervention, Swiss Central Bank Bails Out Firm That Prints Swiss Banknotes

In the most ironic story of the day, the company that makes the paper that Swiss banknotes are printed on was just bailed out by the money-printing, stock-purchasing, plunge-protecting, savior-of-global equities…Swiss National Bank. While The SNB has a long and checkered history of buying shares in companies… as we have detailed numerous times.

Read More »

Read More »

Swiss National Bank acquires majority stake in Landqart AG

Yesterday, the Swiss National Bank (SNB) acquired 90% of the shares in Landqart AG. The remaining 10% of the share capital will be purchased by Orell Füssli Holding Ltd. The vendor is a subsidiary of Fortress Paper Ltd, which is listed on the Toronto stock exchange.

Read More »

Read More »

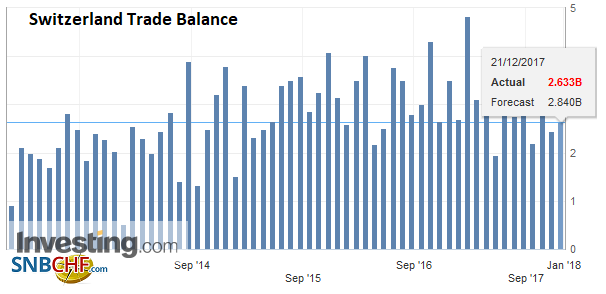

Swiss Trade Balance November 2017: Foreign Trade in Verve

Swiss foreign trade proved dynamic in November 2017. After correction of working days, exports grew by 9.5% and imports even 16.4% year on year, both boosted by rising prices. In real terms, they increased by 4.4 and 6.8%, respectively. The balance commercial loop with a surplus of 2.7 billion francs.

Read More »

Read More »