Monthly Archive: December 2017

Emerging Markets: Preview of the Week Ahead

EM FX ended the week on a mixed note. US jobs data may refocus market attention on Fed tightening. Most EM inflation readings this week are expected to show easing price pressures, supporting a dovish EM central bank outlook. The major exceptions are Mexico and Turkey, whose central banks may be forced to tighten policy in the coming weeks.

Read More »

Read More »

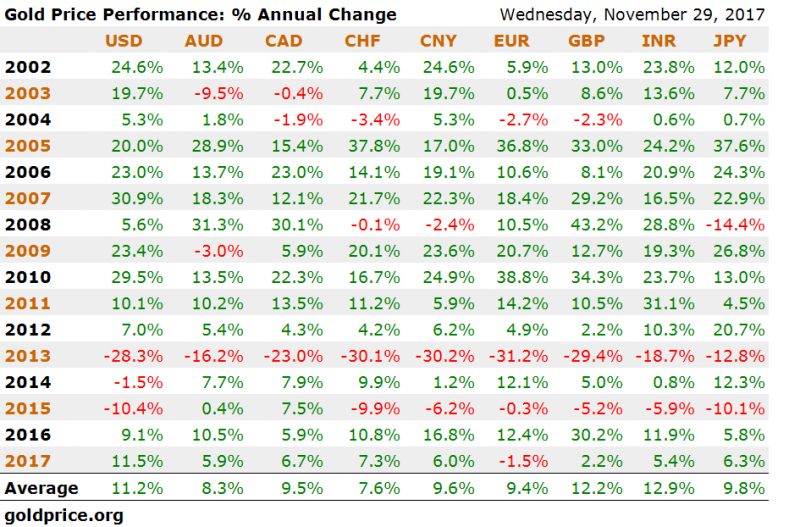

Low Cost Gold In The Age Of QE, AI, Trump and War

‘Fear and Loathing In the Age of QE … AI’ is a presentation given at Mining Investment London earlier this week. Stephen Flood, CEO of GoldCore presentation (28 minutes) was well received at the conference which is a strategic mining and investment conference for leaders in the mining and investment sectors, bringing together attendees from 20 countries.

Read More »

Read More »

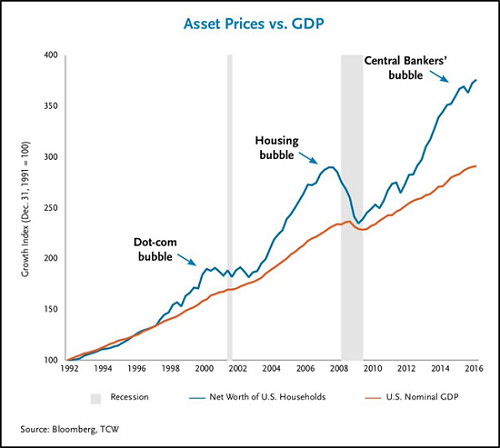

Stock Market 2018: The Tao vs. Central Banks

The central banks claim omnipotent financial powers, and their comeuppance is overdue. will be the first to admit that invoking the woo-woo of the Tao as the reason to expect a reversal of the stock market in 2018 smacks of Bearish desperation. With everything coming up roses in much of the global economy, there is precious little foundation for calling a tumultuous end to the global Bull Market other than variations of nothing lasts forever.

Read More »

Read More »

Beer sales slowly dry up in Switzerland

Swiss beer fans can enjoy an increasingly diverse selection(Keystone/Angelika Warmuth)

The amount of beer consumed in Switzerland declined last year, as it did for wine. Yet the number of specialist craft microbreweries continues to rise. Between October 2016 and September 2017, the Swiss drank 461 million litres of beer (54.5 litres per person) – down 0.2% on the previous reporting period, according to the Swiss Breweries...

Read More »

Read More »

Swiss village offering to pay people to live there inundated with applications

After the Swiss mountain village of Albinen hatched a plan to pay parents (CHF 25,000 each) and children (CHF 10,000 each) to move there, it has been inundated with applicants. Articles about the offer have been published by Time, The Sunday Times, The Sun, El Pais, and many other publications. Rather than celebrating, the picturesque town’s administration is unhappy. It published a statement on its website accusing the media of false reports that...

Read More »

Read More »

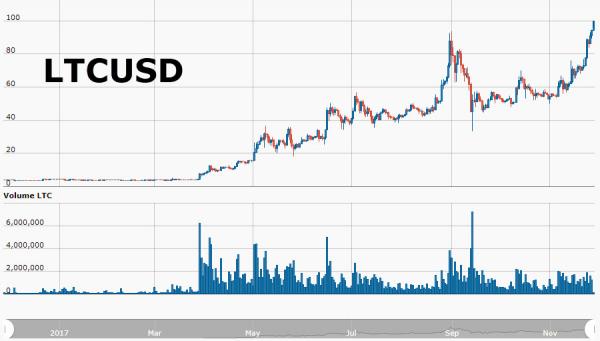

Bitcoin Tops $10,100 – Fed’s Powell Says “Cryptocurrencies Just Don’t Matter”

Update: Cryptocurrencies are widely bid tonight with Bitcoin over $10,150, Ether holding $475, and LiteCoin topping $100 for the first time. Bitcoin has now soared over 20% since Black Friday's close, topping $10,000 for the first time in history (rising from $9,000 in just 2 days)... now up over 950% year-to-date.

Read More »

Read More »

Own Gold Bullion To “Support National Security” – Russian Central Bank

We own gold bullion to “support national security” – Russian Central Bank. Russia warns Washington: Confiscating fx reserves would be “declaration of financial war”. Russia has quadrupled its gold bullion reserves in decade. BRICs discussing ‘the possibility of establishing a single (system of) gold trade’. Russia, China & maybe Saudi Arabia form alliances to unseat petrodollar. Putin warns state-owned and private companies: be ready for rapid...

Read More »

Read More »

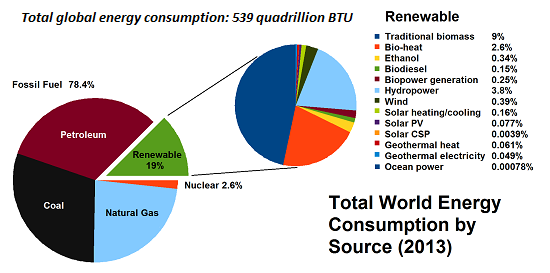

Did Anyone Do Even a Minimal Check on the Sensationalist Bitcoin Electrical Consumption Story?

Check the context before uncritically accepting sensationalist conclusions. Let's start with a primer on how to write a sensationalist story that can be passed off as "journalism:" 1. Locate credible-sounding data that can be de-contextualized, i.e. sensationalized. 2. Present the data as "fact" rather than data that requires verification by disinterested researchers.

Read More »

Read More »

Cool Video: Short Take on Bitcoins

I stopped by Bloomberg near midday to talk with Vonnie Quinn and Shery Ahn. We talked about many macro issues, but this clip that Bloomberg provided covers is the one topic that has overshadowed the big rally in US equities, tax reform and Matt Lauer: Bitcoins. In this two minute clip, I mention that despite Bitcoins capturing the headlines, most Americans are not and cannot be involved.

Read More »

Read More »

Bitcoin $10,000 – Huge Volatility of Cryptocurrencies and Risky Fiat Making Gold Attractive

Bitcoin tops $10,000, soaring more than 850% since beginning of 2017. Irrational exuberance arguably main driver of price performance. Google Trends shows search for ‘Bitcoin Bubble’ hit highest level this morning. Buyers need to be aware of hacking and security risks. Other primary risks to widespread adoption is volatility and liquidity risk. World’s largest online trading platform IG Markets suspends BTC trading

– Volatility of...

Read More »

Read More »

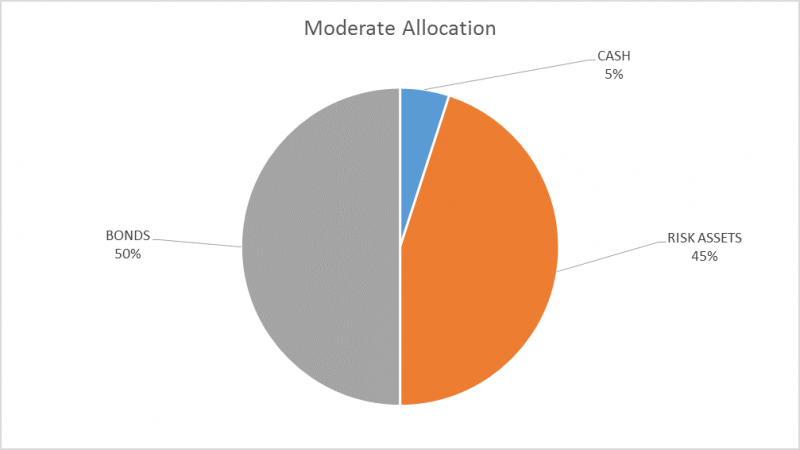

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market did not correct since the last update and so I will continue to hold a modest amount of cash.

Read More »

Read More »

Darwin Airline planes grounded

Switzerland’s Darwin Airline, the Lugano-based regional carrier, was forced to halt all its flights on Tuesday after its licence was revoked by the Federal Office of Civil Aviation (FOCA) over financial problems.

Read More »

Read More »

Emerging Markets: What Changed

Bank of Korea hiked rates by 25 bp to 1.50%, the first hike in six years. Egypt central bank lifted the last remaining currency controls. S&P cut South Africa’s foreign currency rating one notch to BB with stable outlook. Turkey President Erdogan was implicated in an alleged plot to help Iran evade US sanctions. Moody’s upgraded Argentina one notch to B2 with stable outlook.

Read More »

Read More »

FX Daily, December 01: Dollar Consolidates Weekly Gain, while Equities Ease to Start New Month

The release of the manufacturing PMIs confirm that the synchronized global expansion remains intact. The focus today is on three unresolved political challenges: US tax reform, the UK-Irish border and the talks that may produce another grand coalition in Germany. The US dollar is mixed, with the dollar-bloc currencies and Scandis pushing higher.

Read More »

Read More »

Great Graphic: US 2-year Yield Rises Above Australia for First Time since 2000

The US and Australian two-year interest rates have diverged. There is scope for a further widening of the spread. Directionally the correlation between the exchange rate and the rate differentials is strong, but not stable. Near-term technicals are supportive but the move above trendline resistance is needed to confirm.

Read More »

Read More »

Amazon coming to Switzerland

According to the newspaper Bilanz, Amazon has signed an agreement with Swiss post to provide rapid customs clearance. The head of postal customs, Felix Stierli, confirmed discussions with the company.A maximum customs clearance time of 3 hours will allow 24-hour delivery, one element of Amazon’s Prime offer.

Read More »

Read More »

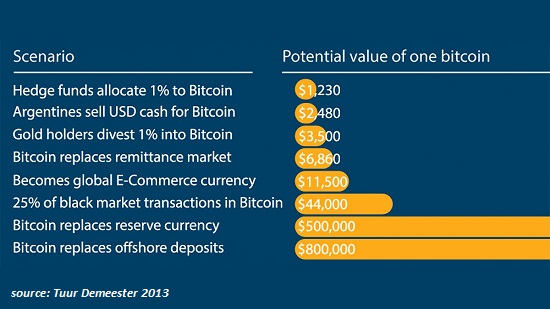

My Crazy $17,000 Target for Bitcoin Is Looking Less Crazy

The basis of this admittedly crazy forecast was simple: capital flows. I think we can all agree that bitcoin (BTC) is "interesting." One of the primary reason that bitcoin (and cryptocurrency in general) is interesting is that nobody knows what will happen going forward. Unknowns and big swings up and down are characteristics of open markets.It's impossible to forecast bitcoin's future price because virtually all the future inputs are unknown.

Read More »

Read More »

The Asymmetry of Bubbles: the Status Quo and Bitcoin

Regardless of one's own views about bitcoin/cryptocurrency, what is truly remarkable is the asymmetry that is applied to questioning the status quo and bitcoin. As I noted yesterday, everyone seems just fine with throwing away $20 billion in electricity annually in the U.S. alone to keep hundreds of millions of gadgets in stand-by mode, but the electrical consumption of bitcoin is "shocking," "ridiculous," etc.

Read More »

Read More »

Japan: It isn’t What the Media Tell You

For the past few decades, Japan has been known for its stagnant economy, falling stock market, and most importantly its terrible demographics. For almost three decades, Japan’s GDP growth has mostly been less than 2%, has been negative for several of these years, and has often hovered close to zero. The net result is that its GDP is almost at the same level as 25 years ago.

Read More »

Read More »