Monthly Archive: December 2017

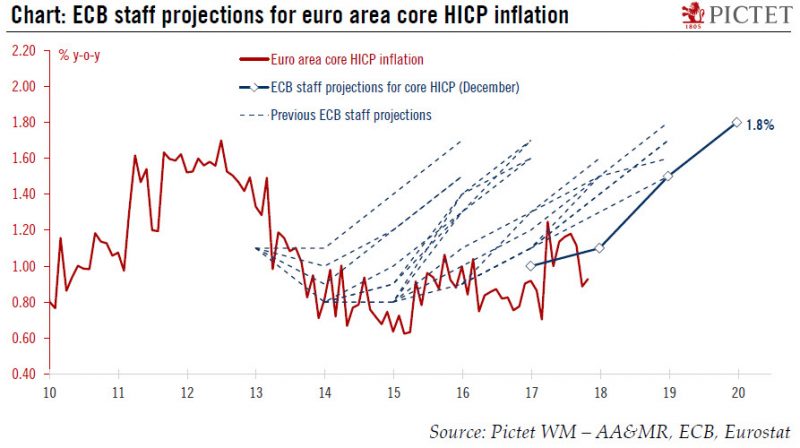

ECB closer to the 2% inflation target than meets the eye

During an uneventful ECB press conference on Thursday, attention centred on the new staff projections. The headline projections were in line with expectations, albeit slightly higher on GDP growth and lower on inflation. The key word was “confidence” - in a strong expansion leading to a “significant” reduction in economic slack, as well as in the ECB’s capacity to meet its mandate.

Read More »

Read More »

Switzerland should not act alone against tax havens

Switzerland must not go to war on its own against offshore tax havens in the wake of the Panama Papers scandal, the lower chamber of parliament has agreed. It prefers concerted action with other countries and wants to see the results of existing measures. The House of Representatives on Thursday rejected two motions and two parliamentary questions, supported by the leftwing Social Democrats and Greens, which had called for financial transactions...

Read More »

Read More »

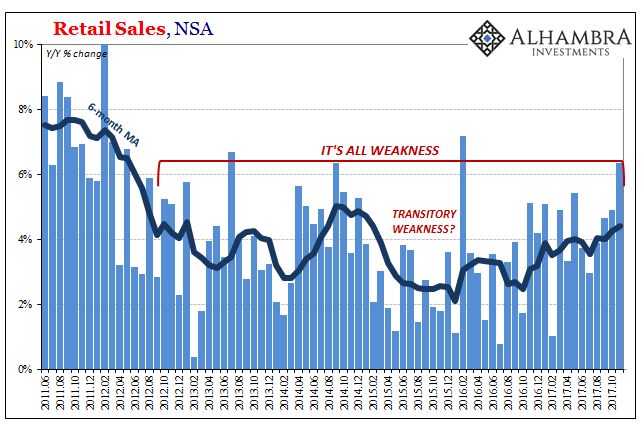

Retail Sales Bounce (Way) Too Much

Retail sales had a good month of November, or at least what counts as decent over the last five and a half years. Total retail sales (unadjusted) rose 6.35% last month, up from 4.9% (revised higher) in October. It was the highest rate of growth since the 29-day month of February 2016. For retailers, what matters is that it comes at the start of the Christmas shopping season.

Read More »

Read More »

Bubble Watch: Warning Signs That The Everything Bubble Will Burst in 2018

I believe 2018 will be the year inflation arrives. The reason, as I’ve noted throughout mid-2017, is that multiple Central Banks, particularly the European Central Bank (ECB), Bank of Japan (BoJ) and Swiss National Bank (SNB) have maintained emergency levels of QE and money printing, despite the fact that globally the economy is performing relatively well.

Read More »

Read More »

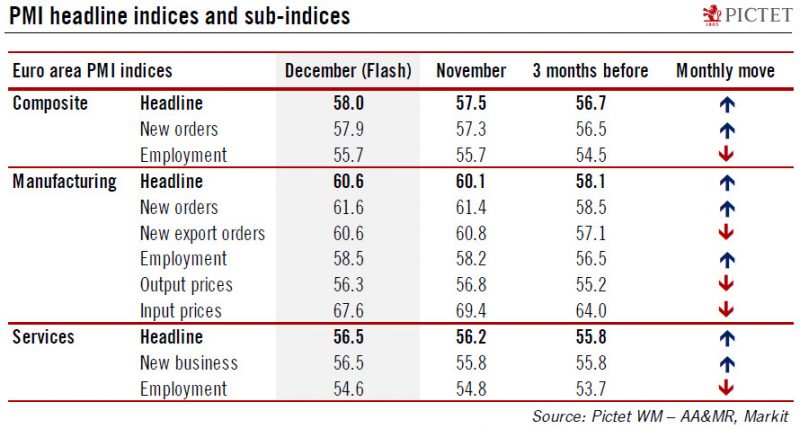

Euro area: The sky is the limit

Momentum in the euro area picked up further at the end of the year. The flash composite purchasing managers’ index (PMI) increased to 58.0 in December, from 57.5 in November, above consensus expectations (57.2). The improvement was once again broad-based across sectors.

Read More »

Read More »

China tops export destination ranking for Swiss SMEs

A study commissioned by Switzerland Global Enterprise (SGE) indicates that China is the most attractive export destination for Swiss small and medium enterprises (SMEs). A total of 107 countries were evaluated using a set of 15 criteria that included market size, market potential, export volume and average market growth in recent years.

Read More »

Read More »

A Gold Guy’s View Of Crypto, Bitcoin, And Blockchain

Bitcoin was on my radar far back as 2011, but for years, I didn’t think much of it. It was a curiosity. Nothing more. Sort of like the virtual money you use in World of Warcraft or something. In 2015, looking deeper, I slowly (not the sharpest tool in the shed) arrived at that “aha” inflection point that most advocates of honest money arrive at. I realized that a distributed public ledger has the power to change, well, everything.

Read More »

Read More »

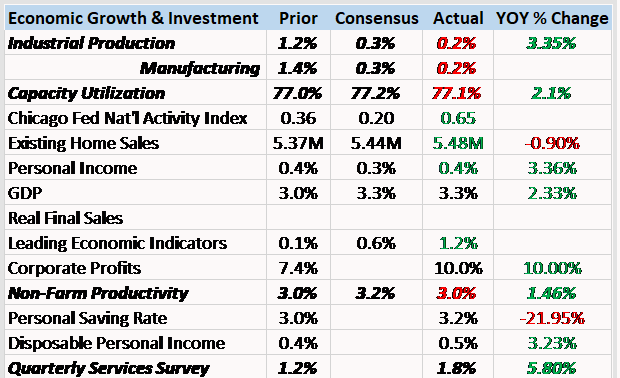

Bi-Weekly Economic Review: Animal Spirits Haunt The Market

The economic data over the last two weeks continued the better than expected trend. Some of the data was quite good and makes one wonder if maybe, just maybe, we are finally ready to break out of the economic doldrums. Is it possible that all that new normal, secular stagnation stuff was just a lack of animal spirits?

Read More »

Read More »

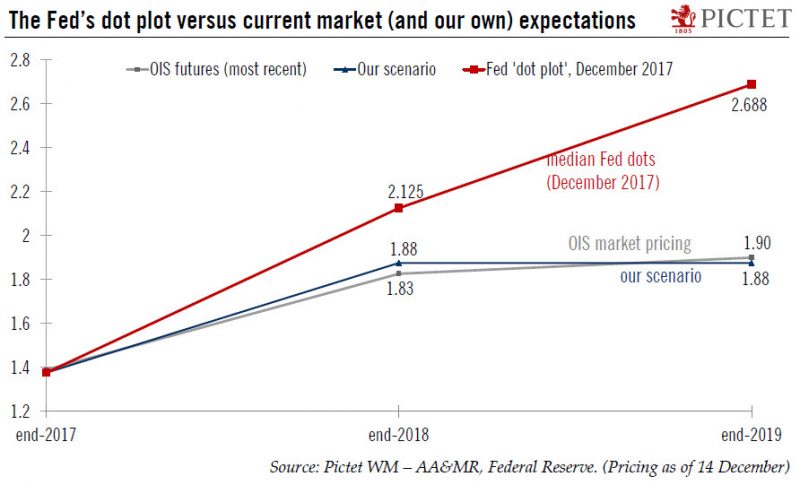

Fed’s enthusiasm on tax cut plans remains limited

The 13 December Fed decision – and Chair Yellen’s last press conference – was much as expected. The Fed hiked rates 25bps, bringing the interest rate on excess reserves to 1.5%. Meanwhile, Fed officials maintained their rate-hiking forecasts for next year: three rate increases, according to the ‘dot plot’.

Read More »

Read More »

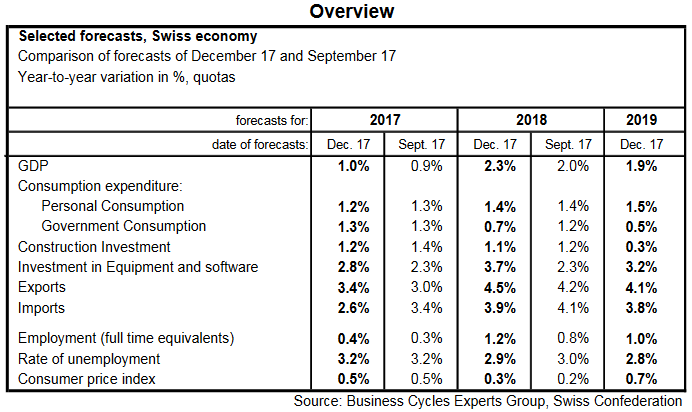

Switzerland’s Economic Recovery gains momentum

Economic forecasts by the Federal Government’s Expert Group – Winter 2017/2018* The Federal Government’s Expert Group expects the Swiss economy to make a speedy recovery over the next few quarters. While only moderate GDP growth of 1.0% is anticipated in 2017 due to a weak first half of the year, the forecast for GDP growth in 2018 is strong at 2.3% in the course of the global economic upturn.

Read More »

Read More »

FX Daily, December 19: US Equities Set Pace, While Greenback Consolidates Inside Monday’s Ranges

US tax changes appear to be providing fuel for the year-end advance that has carried the major indices to new record highs. The coattails are a bit short, and while global equity markets are firm, they are unable to match the strength of US. Despite a heavier tone in Japan, Taiwan, and Korea, the MSCI Asia Pacific Index edged higher for the second session but remains around one percent below the record highs set in late November.

Read More »

Read More »

Great Graphic: Sterling Toys with Three-Year Downtrend Line

Sterling is the second major currency this year after the euro (and its shadow the Danish krone). The downtrend line from mid-2014 is fraying. Is this the breakout?

Read More »

Read More »

Weekly Technical Analysis: 18/12/2017 – USD/CHF, USD/JPY, EUR/USD, GBP/USD, EUR/CHF

The USDCHF pair traded with clear negativity yesterday to break 0.9892 level and settles below it, which stops the recently suggested positive scenario and put the price within the correctional bearish track again, noting that there is a bearish pattern that its signs appear on the chart, which means that breaking its neckline at 0.9840 will extend the pair's losses to surpass 0.9800 and reach 0.9730 as a next station.

Read More »

Read More »

Switzerland Is Well-Prepared For Civilizational Collapse

More than any other country, Switzerland’s ethos is centered around preparing for civilizational collapse. All around Switzerland, for example, one can find thousands of water fountains fed by natural springs. Zurich is famous for its 1200 fountains, some of them quite beautiful and ornate, but it’s the multiple small, simple fountains in every Swiss village that really tell the story. Elegant, yes, but if and when central water systems are...

Read More »

Read More »

National Precious Metals Company Announces Sound Money Scholarship Winners

December 13, 2017 (Eagle, Idaho) -- A national precious metals dealer has selected four outstanding students to receive tuition assistance from America’s first gold-backed scholarship fund. Beginning last year, Money Metals Exchange, a national precious metals dealer recently ranked “Best in the USA,” teamed up with the Sound Money Defense League and well known members of academia and freedom-minded non-profits to offer the first gold-backed...

Read More »

Read More »

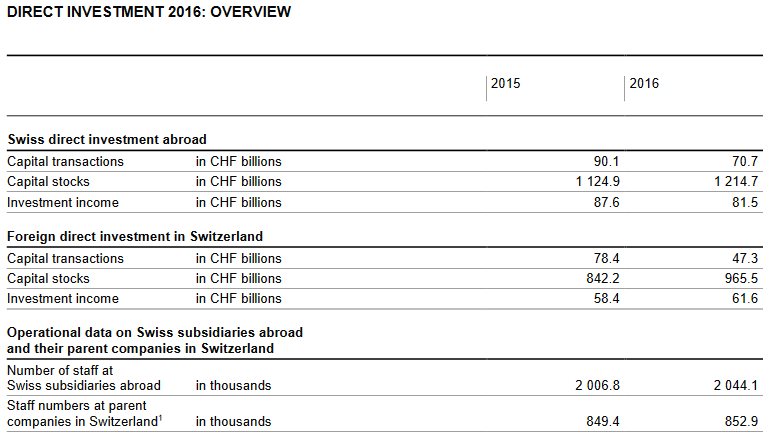

Direct Investments in 2016

In 2016, companies domiciled in Switzerland invested CHF 71 billion abroad. Swiss direct investment abroad thus fell short of the CHF 90 billion recorded in 2015, due primarily to lower investment activity by finance and holding companies. All other industry categories combined actually exceeded the level of the previous year with investment abroad of CHF 62 billion (2015: CHF 46 billion). Of this total, CHF 29 billion was accounted for by...

Read More »

Read More »

Swiss Perfectionism

In Der Bund, Adrian Sulc comments on the Swiss National Bank’s perfectionism. Keine andere Schweizer Organisation kommuniziert so professionell wie die SNB, keine andere Organisation kann so gut dichthalten.

Perfectionism is costly. Der Personalbestand ist in den letzten fünf Jahren um 18 Prozent auf 795 Vollzeitstellen gestiegen. … Die durchschnittlichen Lohnkosten pro Mitarbeiter betragen mittlerweile 155 000 Franken pro Jahr. Dies weil gemäss...

Read More »

Read More »

FX Daily, December 18: Trade Tensions with China Set to Escalate

The two main legislative initiatives in the US this year, the repeal of the Affordable Care Act and the tax changes, are not particularly popular. However, the next items on the agenda appear to enjoy broader support. The infrastructure initiative is likely to be unveiled as early as next month. Before that, the US is poised to ratchet up the tension on China.

Read More »

Read More »

FX Weekly Preview: Policy Mix Underlines Positive Fundamental Backdrop for the Dollar

The prospects that the Republican-controlled legislative branch would find a compromise to tax cuts were enhanced when a few senators appeared to capitulate without much to show for it may have helped lift US stocks and dollar ahead of the weekend.

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX was mixed last week, with political optimism driving the big winners ZAR and CLP. We remain cautious, as the Fed has signaled its intent to continue tightening in 2018.

Read More »

Read More »