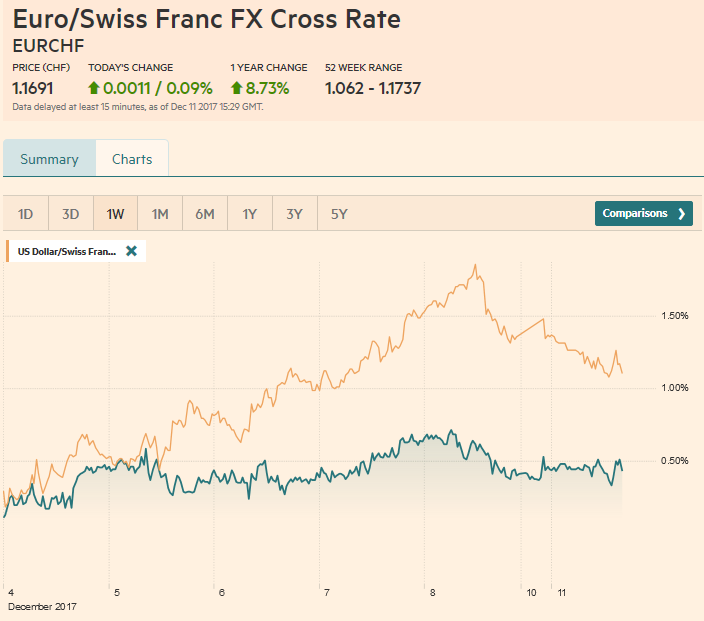

Swiss FrancThe Euro has risen by 0.09% to 1.1691 CHF. |

EUR/CHF and USD/CHF, December 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar is narrowly mixed in relatively quiet activity. Year-end adjustment is well underway, and the news stream is light to start the week that sees more than a dozen central bank meetings. There is little doubt in the market that the Federal Reserve will hike rates for the third time this year at mid-week. The strongest currency today is the New Zealand dollar. It is up over one percent in what could the largest advance in five months. A new central bank governor was announced, Adrian Orr, who currently heads the government’s sovereign wealth fund and previously was a deputy governor at the central bank. He will oversee the transition, under the Labour-led government, that will give it a dual mandate, where full employment complements the price stability goal. He is respected by investors, and his appointment eases concern that the new government was going to politicize the central bank. The New Zealand dollar appears to be carving out a bottom. The year’s low was recorded in mid-November near $0.6780. It needs to rise above $0.7000 to confirm the low is in pace. The Norwegian krone is the weakest of the major currencies. It is off nearly one percent on the back of the softer than expected inflation report. The underlying rate eased 0.3% to 1.0%. The market had expected a flat report. Norway’s central bank meets later in the weekend. The soft inflation reading reinforces ideas that the Norges Bank is on hold. Sweden reports its inflation figures tomorrow, but the krona is under pressure amid raising concern about the housing market. A private house price indicators fell to a six-year low. The weakening of the housing market has been a growing concern for investors and has kept the krona under pressure since the summer. The euro is pushed through SEK10.0 a few times since the middle of last month, but has not managed to close above it. Today the intraday move brought the euro to its highest level since November 2016, when it briefly poked through SEK10.08. |

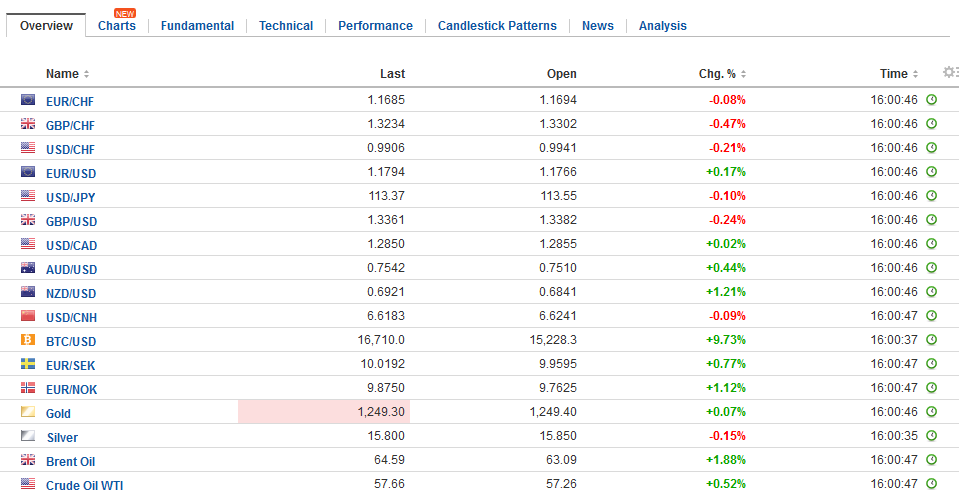

FX Daily Rates, December 11 |

| Sterling is nursing losses that keeps it pinned near last week’s lows (~$1.3320). Although the UK appears to have struck a deal that will allow heads of state summit later this week approve of starting the next stage of negotiations, the split in the government remains evident. We remain concern that the contradictory impulses are not fully appreciated. A deal with the EU exposes the fissures within the cabinet, and addressing the split in the government risk preventing an agreement with the EU.

Brexit Secretary Davies claimed that the regulatory alignment that had been promised to appease Irish and EU demands does not mean that the UK cannot have different regulations. He also suggested that the agreement may not be binding. Of course, Ireland and the EU see things differently. There are some suspicions that the EU allowed a less than satisfactory agreement (sufficient progress) amid fears that without it, there was a serious risk that May’s tenure would have been cut short and her replacement could well have been someone talking a harder line. The $1.3340 are may be important for sterling. It is where the 20-day moving average is found. It appears to have offered sterling support since mid-November. Although it has been tested on an intraday basis, sterling has not traded below it since November 16. A break of $1.3320 finds little to hang one’s hat on until closer to $1.3220. The Bank of England meets this week, but after last month’s move, is widely expected to keep policy steady with a unanimous decision. After reaching $1.1730 after the US employment data at the end of last week, the euro closed near session highs (above $1.1770), and is seeing minor follow through buying today. However, it appears to be running out of steam in the European morning at the $1.1800-level was probed. There is a large (~ 1 bln euro) option expiry that is struck there today. The dollar appears to be largely sidelined, and the demand for euros from the crosses appears to have helped give it is firmness against the greenback. |

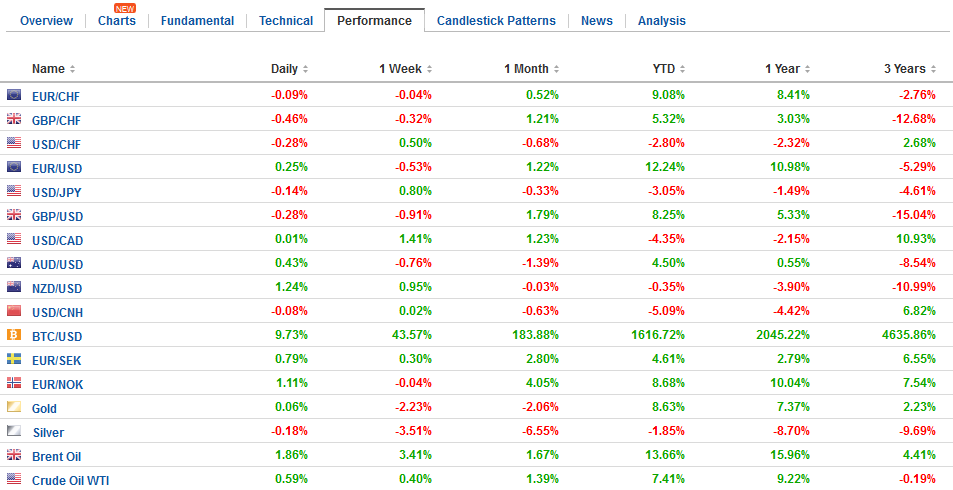

FX Performance, December 11 |

US Treasuries are flat to softer, and after extended the pre-weekend gains toward JPY113.70, the dollar fell out of favor and in early activity in Europe had eased to almost JPY113.30. Some dollar buying interest was found there, and the greenback appears poised to trade higher in the North American morning. There is nearly $1 bln in options struck JPY113.10-JPY113.20 that expire today.

Equities are continuing to recovery from the pullback seen at the start of last week. The MSCI Asia Pacific Index, which had slid eight sessions in a row, now has strung together a three-session advance. Today’s 0.7% gain brings the benchmark to its 20-day moving average, which corresponds to the 50% retracement of the decline. It finished on it highs. Nearly all the markets in the region advanced. European markets are mostly higher, though Italian and Spanish bourses are a bit lower. The Dow Jones Stoxx 600 is up about 0.2%. Materials and financials are leading the way higher, while telecoms, utilities and information technology are drags.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$EUR,$JPY,EUR/CHF,newslettersent,Norwegian Krone,NZD,SEK,USD/CHF