Monthly Archive: November 2017

German Politics: What’s Next?

Coalition talks will resume in the coming days, and failing this a minority government is more likely than new elections. The is a general agreement among the political elites, and a hubris of small differences. The rate differentials and cross currency swaps show the incentive structure for holding dollars is increasing.

Read More »

Read More »

Cool Video: Bitcoin Discussion on Bloomberg

I had to be on Bloomberg's Day Break with David Westin and Alix Steel earlier today. We talked about the collapse of talks to put together a new coalition following the results of the September election. I suggested that the initial reaction was exaggerated, negotiations will likely resume in some fashion, and speculation of Merkel's demise are premature.

Read More »

Read More »

Swiss Watchmaker Optimistic about Business Prospects

The chief executive of the Swatch Group, a leading Swiss manufacturer of watches and jewelry, is upbeat about business prospects for the coming year. Nick Hayek says the Swatch Groupexternal link hopes to reach the ambitious target of a 7%-9% increase in sales this year.

Read More »

Read More »

Brexit Budget – Grim Outlook As UK Economy Downgraded

Brexit budget – Grim outlook as UK economic forecasts downgrade. UK Chancellor uses housing market policy as smoke-screen for deteriorating economy. UK budget matters more than ever due to BREXIT risks. Policy on stamp duty will fail to aid worsening housing market. Real GDP expected to grow by just 1.5%, 40% less than projections 2 years ago. Households now face an unprecedented 17 years of stagnation in earnings. Critics claim Budget failed to...

Read More »

Read More »

How Uncle Sam Inflates Away Your Life

“Inflation is always and everywhere a monetary phenomenon,” economist and Nobel Prize recipient Milton Friedman once remarked. He likely meant that inflation is the more rapid increase in the supply of money relative to the output of goods and services which money is traded for.

Read More »

Read More »

FX Daily, November 22: Global Equity Rally Resumes, while Dollar Slips

Global equities are on the march. US indices shrugged off their first back-to-back weekly decline in three months to set new record highs yesterday. The MSCI Asia-Pacific followed suit and recorded their highest close. The Dow Jones Stoxx 600 is struggling, as the CAC and DAX are nursing small losses.

Read More »

Read More »

What do the Swiss spend their money on?

The Swiss had an average net household disposable income in 2015 of CHF6,957 ($7,007) a month, the Federal Statistical Office has reported. Every month, around CHF560 was spent on leisure and cultural activities – and CHF89 on cats and dogs.

Read More »

Read More »

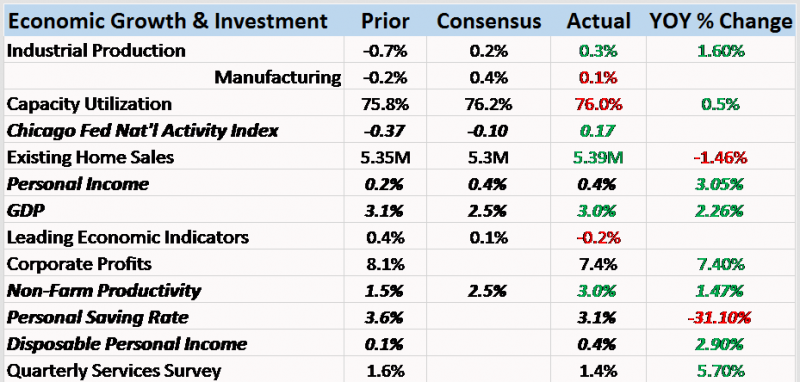

Bi-Weekly Economic Review: A Whirlwind of Data

The economic data of the last two weeks was generally better than expected, the Citigroup Economic Surprise index near the highs of the year. Still, as I’ve warned repeatedly over the last few years, better than expected should not be confused with good. We go through mini-cycles all the time, the economy ebbing and flowing through the course of a business cycle.

Read More »

Read More »

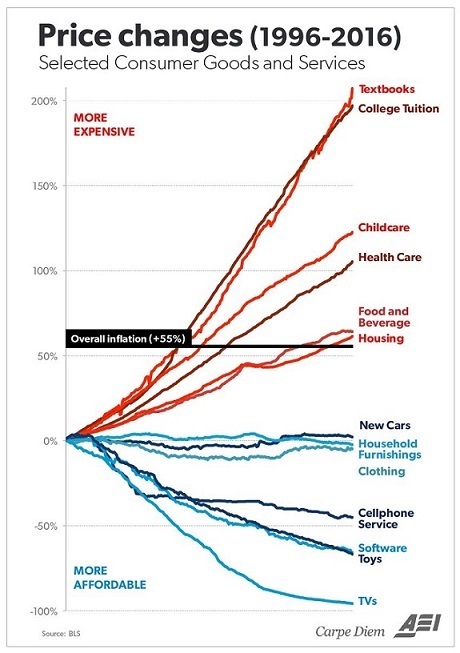

Want Widespread Prosperity? Radically Lower Costs

As long as this is business as usual, it's impossible to slash costs and boost widespread prosperity. It's easy to go down the wormhole of complexity when it comes to figuring out why our economy is stagnating for the bottom 80% of households. But it's actually not that complicated: the primary driver of stagnation, decline of small business start-ups, etc. is costs are skyrocketing to the point of unaffordability.

Read More »

Read More »

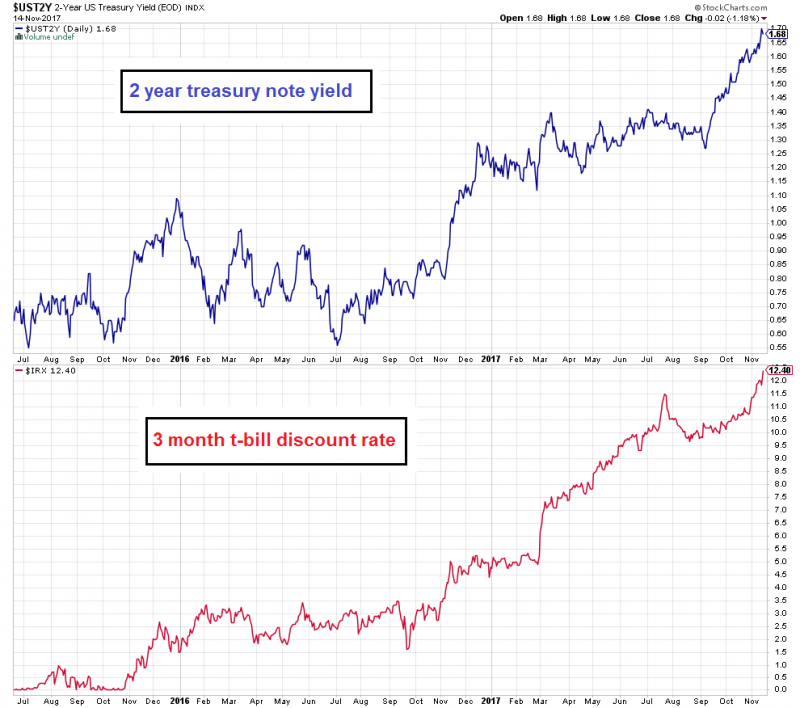

Business Cycles and Inflation, Part II

We recently received the following charts via email with a query whether they should worry stock market investors. They show two short term interest rates, namely the 2-year t-note yield and 3 month t-bill discount rate. Evidently the moves in short term rates over the past ~18 – 24 months were quite large, even if their absolute levels remain historically low.

Read More »

Read More »

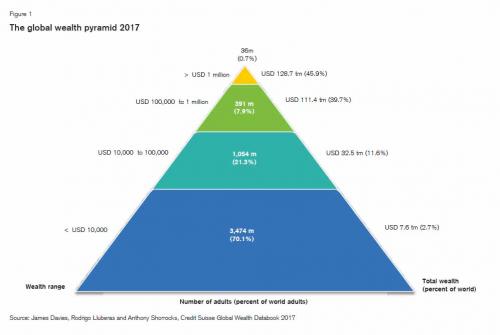

For The First Time Ever, The “1 percent” Own More Than Half The World’s Wealth: The Stunning Chart

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what has become the single biggest reason for the recent "anti-establishment" revulsion: an unprecedented concentration of wealth among a handful of people, as shown in Swiss bank's infamous global wealth pyramid, an arrangement which as observed by the "shocking" political backlash of the past year, suggests that the lower 'levels' of the pyramid are...

Read More »

Read More »

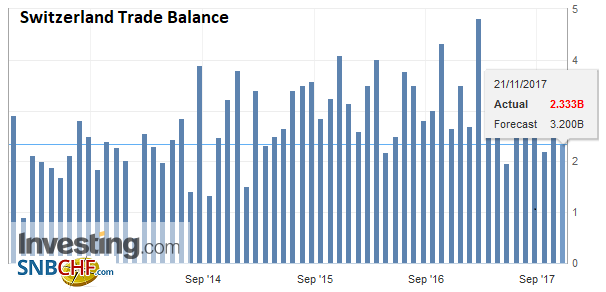

Swiss Trade Balance October 2017: A Slowdown at a High Level

In October 2017, Swiss foreign trade continued its advance. Adjusted for working days, exports grew by 5% against 7% for imports. Growth, however, weakened slightly compared to previous months. The trade balance is closing with a surplus of 2.4 billion francs.

Read More »

Read More »

FX Daily, November 21: Dollar Marks Time

The US dollar has largely been confined to yesterday's trading ranges against the major currencies amid light news. The North American session does not hold much hope for fresh impetus. The US reports October existing home sales, which are not typically market moving in the best of times. Yellen does not speak until after the markets close, and even then is unlikely to sway expectations, which have priced in a rate hike next month.

Read More »

Read More »

Oil Trader Slams “defamatory” NGO Teport

Commodities trading company Vitol has taken legal action against “inaccurate and defamatory” allegations made by the Swiss NGO Public Eye in the wake of the Paradise Papers revelations. Public Eye issued a press release and report on November 10 accusing four Swiss-based commodities traders, including Vitol, of doing business “with dodgy individuals or politically exposed partners” and colluding with the Appleby law firm to conceal “business...

Read More »

Read More »

SNB: It’s A Bonfire Of The Absurdities

This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my head now and then to “WTF” moments several times a week.

Read More »

Read More »

FX Daily, November 20: German Political Impasse Roils Euro…Briefly

News that the attempt to forge a four-party coalition in Germany collapsed Sunday saw the euro marked down in early Asian activity. The euro fell to nearly $1.1720 in the immediate response to the news, stabilized before turning higher in early European turnover. It quickly recovered and poked through $1.1800. The pre-weekend high was seen near $1.1820.

Read More »

Read More »

FX Weekly Preview: Another Week that is Not about the Data

The contours of the investment climate are unlikely to change based on next week's economic data from the US, Japan, or Europe. The state of the major economies continues to be well understood by investors. Growth in the US, EU, and Japan remains solid, and if anything above trend, as the year winds down.

Read More »

Read More »