Economic Nirvana“Inflation is always and everywhere a monetary phenomenon,” economist and Nobel Prize recipient Milton Friedman once remarked. He likely meant that inflation is the more rapid increase in the supply of money relative to the output of goods and services which money is traded for. |

Famous Monetarist School representative Milton Friedman thought the US should adopt a constitutional amendment limiting monetary inflation to 3% – 5% per year, putting inflation so to speak on autopilot.But why should there be any central bank-directed inflation at all? To his credit, in 1968 Friedman wrote the following in the American Economic Review: “[M]onetary action takes a longer time to affect the price level than to affect the monetary totals and both the time lag and the magnitude of effect vary with circumstances. As a result, we cannot predict at all accurately just what effect a monetary action will have on the price level and, equally important, just when it will have that effect. Attempting to control directly the price level is therefore likely to make monetary policy itself a source of economic disturbance because of false stops and starts.” This is quite correct and was the reason why he thought discretionary central bank policy should be replaced with some fixed rule, while naively adding that “Perhaps, as our understanding of monetary phenomena advances, the situation will change.” Of course the situation will never change – the failure of the bureaucracy to centrally plan money is simply a special case of the socialist calculation problem, which cannot be overcome (as an aside, it is not all clear why students of economic history should accept that central banks have been established for anything other than nefarious reasons). The most elegant solution would of course consist of simply replacing central planning with a truly free market in money. But that would mean abandoning a major tool of political and economic control that benefits the State and its cronies. Moreover, a great many economists would have little to do in such a free market, as central banks have essentially bought the entire profession. Naturally, most economists know better than to bite the hand that feeds them. |

| As more and more money is issued relative to the output of goods and services in an economy, the money is watered down and loses value. By this account, inflation as such is not defined as rising prices. Rather, it is an inflating money supply (with the loss of purchasing power a consequence thereof).

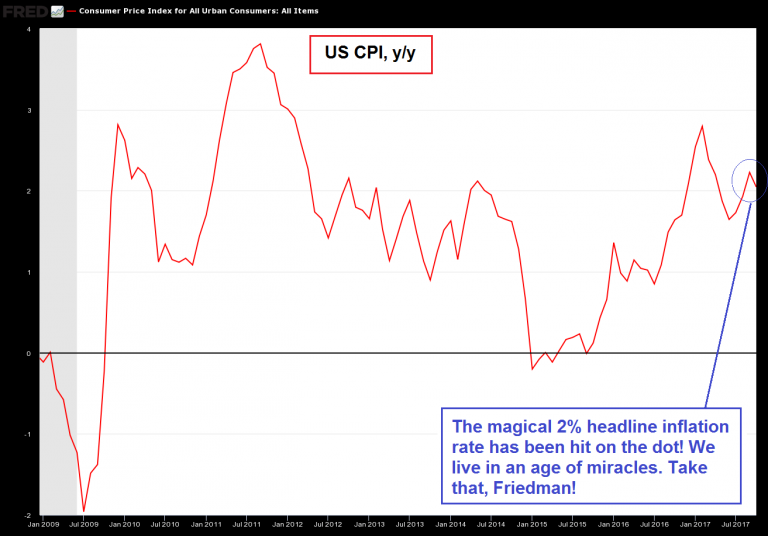

Indeed, Friedman offered a shrewd insight. However, he also accompanied it with an opportunist mindset. Friedman saw promise in the phenomenon of monetary inflation. He saw it as a means to improve human productivity and economic growth. You see, a stable money supply was not good enough for Friedman. He advocated for moderate levels of monetary growth and inflation to perpetually stimulate the economy. By hard-wiring consumers with the expectation of higher prices, policy makers could compel relentless consumer demand. This desire to harness and control the inflation phenomenon has infected practically every government economist’s brain since the early 1970s. Over the decades they’ve somehow come to a consensus that 2 percent price inflation is the ideal rate for creating economic nirvana. The Fed tinkers with its federal funds rate for the purpose of targeting this magic 2 percent rate of price inflation. |

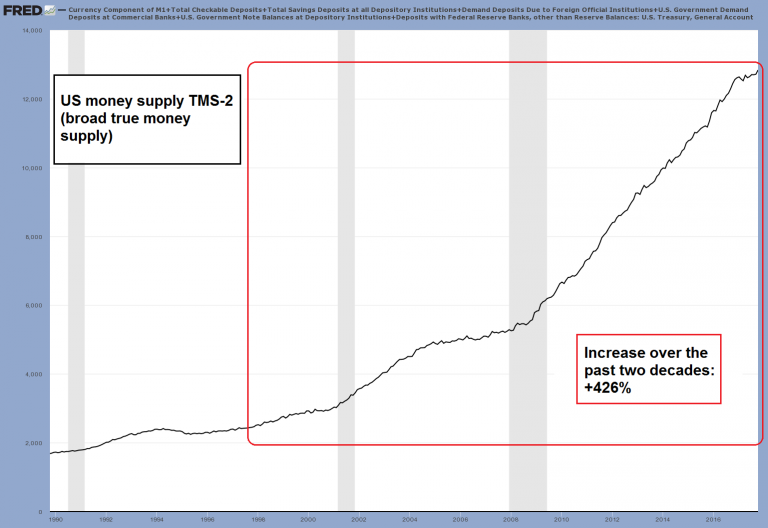

US Money Supply, 1990 - 2017 The “we’re not in Kansas anymore” chart of the true US money supply. In the past two decades (Oct. 1997 – Oct. 2017) the money supply has been pumped up by 426%, which is a compound annual growth rate of 8,63%. - Click to enlarge The latter figure doesn’t seem too bad at first glance (compared to hyper-inflating economies, it isn’t), but don’t forget that this is cumulative: it means a 51.27% increase in just 5 years, an increase by more than 110% in nine years, and an increase of more than 218% in 14 years – more than a tripling of the total money supply; another 6 years later, in just 20 years, the money supply has increased more than 5-fold. In what way precisely is this supposed to enhance prosperity? |

Shadow StatsOn Wednesday the Bureau of Labor Statistics (BLS) published its October Consumer Price Index (CPI) report. According to the government number crunchers, consumer prices are increasing at an annual rate of 2 percent. Of course, anyone who lives and works in the real world knows prices are rising much faster. For example, John Williams of Shadow Government Statistics calculates the CPI using early-1980s methods. Williams re-creates how the government previously calculated the CPI before they reconfigured their scheme to understate inflation versus common experience. By Williams’ calculations the CPI is increasing at an annual rate of 9.8 percent. What price inflation number you believe is up to you. We’re merely providing information for your consideration. Are consumer prices rising at 9.8 percent per years, as Williams suggests? Are they rising at 5 percent? Are they going down? We suppose it depends on if you’re buying a flannel shirt at Wal-Mart or paying your utility bill. Still, many would agree that, overall, their day to day experience includes price increases far greater than 2 percent per year. If we assume price inflation to be 3 percent per year, that means the purchasing power of your cash drops by more than 30 percent over a 12 year period. Hence, if you retire at age 62, that means you’ll see the purchasing power of each dollar you own decline to less than $0.70 by age 74. By age 86, your purchasing power will be cut in half. In short, 3 percent annual price inflation reduces each dollar you own to just $0.50 in less than 25 years. Without question, this is a significant loss in purchasing power. What’s more, generating consistent investment income to overcome this loss in purchasing power is a tall order. Surely, you can’t rely on the government’s cost of living adjustments (COLA), which are tied to the CPI, to maintain your living standard. |

US Consumer Price Index, Jan 2009 - Jul 2017(see more posts on U.S. Consumer Price Index, )We want to interpose here that for a number of reasons, no-one can really know how fast the purchasing power of money is declining: there is no such thing as a “general price level”. It is literally impossible to measure it, since there exists no fixed yardstick that could be used to make such a measurement; the supply of and demand for money affect prices just as the supply of and demand for goods does. There is no way of telling which of these effects predominates in a given time period. Moreover, not everybody buys the same goods in the same relative quantities. Which basket of goods and services is relevant to people depends on their income, tastes and valuations, the supply, quality and types of goods available, and so on, all of which are subject to constant change. The fact that the prices of different goods can never change to the same extent and at the same time, continually brings about changes in relative demand and supply, altering patterns of production and consumption. “Price stability” is an illusion in a world of constant change, but that is the world in which we live. As Mises notes: “The pretentious solemnity which statisticians display in computing indexes of purchasing power and cost of living is out of place. These index numbers are at best rather crude and inaccurate illustrations of changes which have occurred. In periods of slow alterations in the relation between the supply of and the demand for money they do not convey any information at all. In periods of inflation and consequently of sharp price changes they provide a rough image of events which every individual experiences in his daily life. A judicious housewife knows much more about price changes as far as they affect her own household than the statistical averages can tell. She has little use for computations disregarding changes both in quality and in the amount of goods which she is able or permitted to buy at the prices entering into the computation. If she “measures” the changes for her personal appreciation by taking the prices of only two or three commodities as a yardstick, she is no less “scientific” and no more arbitrary than the sophisticated mathematicians in choosing their methods for the manipulation of the data of the market. In practical life nobody lets himself be fooled by index numbers. Nobody agrees with the fiction that they are to be considered as measurements. Where quantities are measured, all further doubts and disagreements concerning their dimensions cease. These questions are settled. Nobody ventures to argue with the meteorologists about their measurements of temperature, humidity, atmospheric pressure, and other meteorological data. But on the other hand nobody acquiesces in an index number if he does not expect a personal advantage from its acknowledgment by public opinion. The establishment of index numbers does not settle disputes; it merely shifts them into a field in which the clash of antagonistic opinions and interests is irreconcilable.” |

How Uncle Sam Inflates Away Your LifeWe doubt that the dollar devaluing effects of price inflation is a new concept for you. Most likely you’ve heard this many times before. Certainly, you experience it as you go about your business. However, this stealthy destruction of your wealth bears repeating. The fact is over the course of your retirement half of your life-savings will be covertly confiscated from your bank account. We find this to be wholly intolerable. Remember, your life-savings is just that. It represents your life. Specifically, it’s stored up time you traded a portion of your life to earn. So, too, it’s a measure of your financial discipline and ability to save and invest overtime in lieu of super-sized spending. |

|

| When Uncle Sam confiscates your life-savings via the inflation tax something more is happening. Not only are you being robbed of your money, you’re being robbed of your life. Your life is simply inflated away. Poof!

Factor in federal and state income taxes, social security, disability, Medicare, capital gains taxes, outrageous health insurance costs, subsidizing luxury electric vehicles and grape flavored soda pop, and a vast array of fees and exactions, and it is a miracle you have any money left over at all. Alas, what money you somehow manage to hold onto will be inflated away long before you need it most. |

This reportedly extinct animal has shown itself to be very much alive over the past century. - Click to enlarge After 200 years of fairly stable prices and strong economic growth, someone decided it would be best to do away with all that and replace it with centrally planned volatility and constant, long term monetary debasement. Today a veritable army of professional gatekeepers and apologists ensures that any fundamental questions about this subject are practically banned from public debate. |

Tags: central-banks,newslettersent,On Economy,U.S. Consumer Price Index