I had to be on Bloomberg’s Day Break with David Westin and Alix Steel earlier today. We talked about the collapse of talks to put together a new coalition following the results of the September election. I suggested that the initial reaction was exaggerated, negotiations will likely resume in some fashion, and speculation of Merkel’s demise are premature.

We also discussed Brexit. I opined that the rights of EU citizens in the UK post-Brexit appears to have been largely resolved, and the UK would pay more than its initial offer. That leaves the Irish border as the most thorny issue. I suspect the doom and gloom may be a bit much, leaving room for an upside surprise.

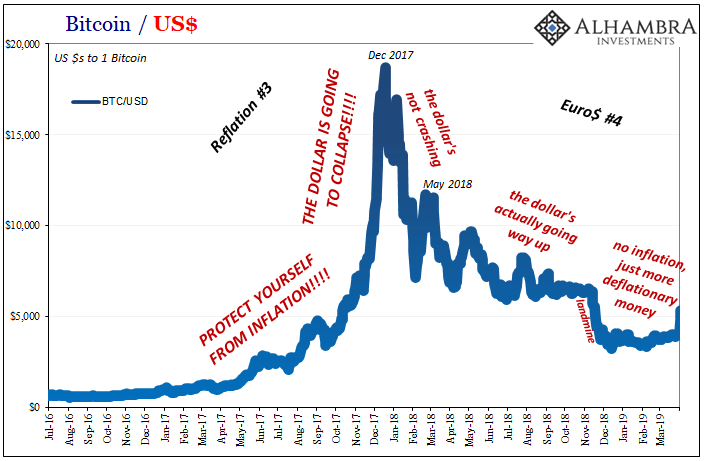

Yet in the video clip here captures our brief discussion of Bitcoins. I admit I have not clue as to where the Bitcoin will trade. It has not income stream. It has no use value. Its means of exchange (use to buy goods or services) is practically non-existent. I know many cybercurrency aficionados will curse me for saying so, but can fulfill the functions money as my Facebook followers are friends. I have argued there is an contradiction in at the heart of the so-called cybercurrencies. To the extent they are an alternatives to fiat money (even though they are fiat themselves, as in not backed by gold or silver), they will be hoarded. And yet to the extent they are hoarded, they will not reach the critical mass of networking to be used a means of exchange.

I am not being stubborn about this, and came up with a simple test. When a major government allows tax obligations to be satisfied through cybrecurrencies, I will become a believer. I note in the interview the problem with scale. Not only is that “asset class” too small to draw institutional money (think mutual funds, pension funds, endowments, etc) funds, but the cost in terms of electricity and computing power is astronomical. It terms of number of transactions, even some credit cards are superior.

Tags: Bitcoin,Cool Video,newslettersent