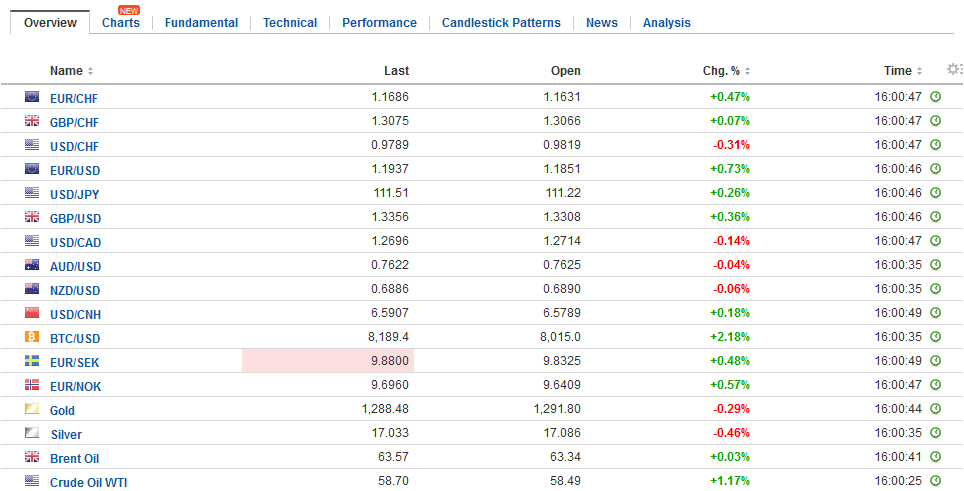

Swiss FrancThe Euro has risen by 0.38% to 1.1674 CHF. |

EUR/CHF and USD/CHF, November 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

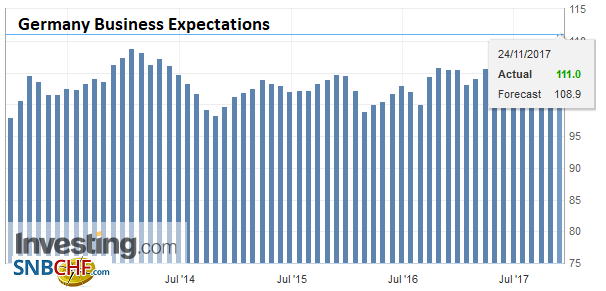

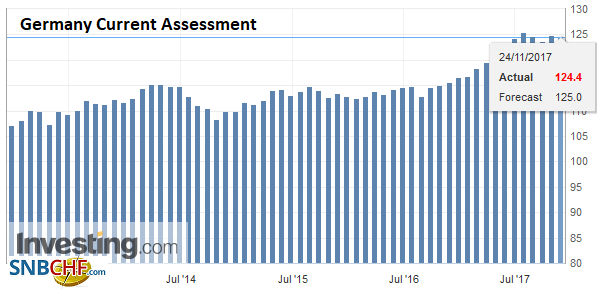

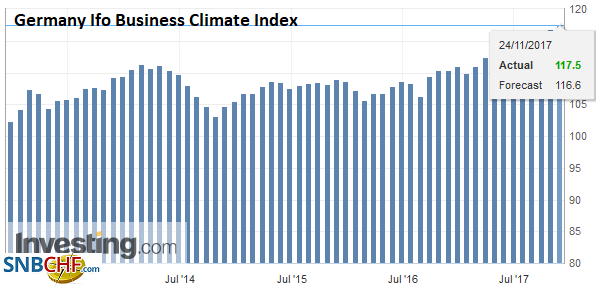

FX RatesThe euro is edging higher to trade at its best levels since the middle of last month. It is drawing closer to the $1.1880 area, which if overcome, could point to return to the year’s high seen in early September near $1.2100. There is a combination of factors lifting the euro. The recent data, including yesterday’s flash PMI, suggests that the regional economy is re-accelerating here in Q4. Today’s German IFO survey provides corroboration. The assessment of the overall business climate rose to a new record high of 117.5 from an upwardly revised 116.8. The breakdown showed that even though the assessment of the current economy eased a touch, the improved expectations more than offset it. One of the reasons that the current assessments may have softened is the political uncertainty since the elections two months ago that saw both of the main two parties draw the least voter support in modern times. While the attempt to forge a complicated coalition between the center-right CDU/CSU, the liberal (meaning pro-market) Free Democrats, and the Greens faltered, the Social Democrats are rising to the occasion and are now open to talks. |

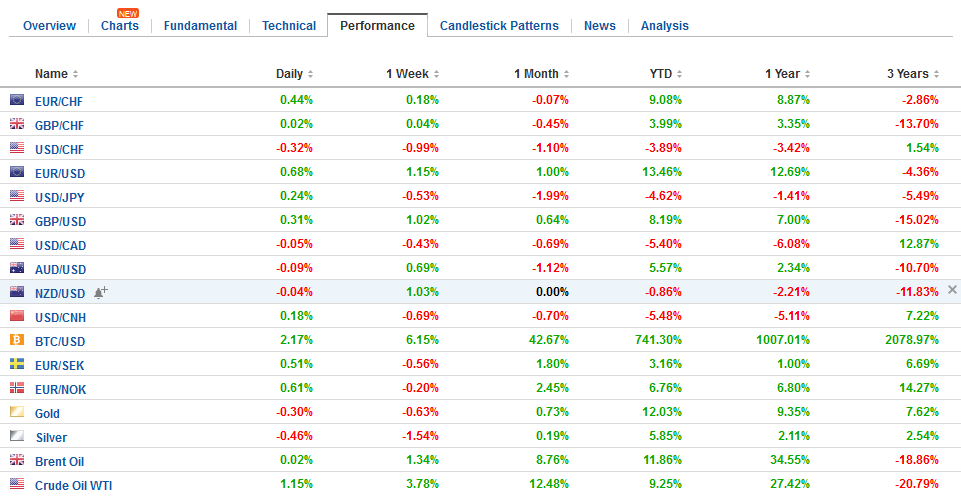

FX Daily Rates, November 24 |

| The SPD has been the junior member of two of three governments headed by Merkel. They appear to have lost their identity, and after the disastrous election results were going back into opposition. There was an additional wrinkle. The AfD emerged as the third largest party. If the SPD join the government, the AfD would be the main opposition party, for which there are special parliamentary privileges. Being in opposition allows those privileges to bestowed on the SPD.

The other wrinkle is the SPD leader Schulz is under pressure within his party to step down and make room for the next generation. The SPD holds a special party conference on December 7-9 and leadership contest. The backing up of US 10-year Treasury yields appear to be lending support to the greenback against the yen. The dollar had slipped to almost JPY111.00 yesterday. The US 10-year yield is up nearly three basis points today (to almost 2.35%), and this has coincided with dollar upticks toward the lower end of the previous band of support (JPY111.65-JPY111.80). |

FX Performance, November 24 |

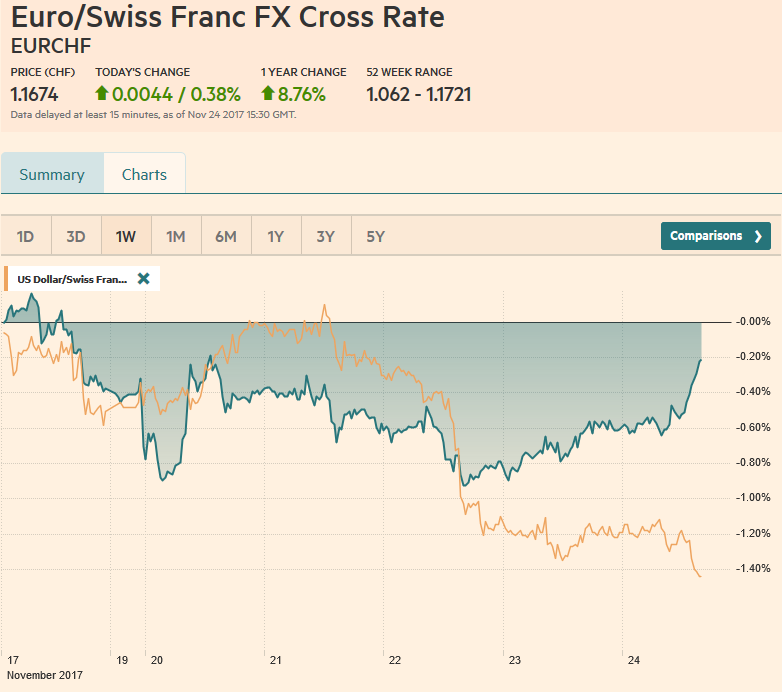

JapanThe Bank of Japan reduced the number of long bonds (25 years-plus) it is purchasing by JPY10 bln to JPY90 bln. It is the first reduction since March. The unexpected move weighed on JGBs. There had been talking among primary dealers in Japan that the government was considering reducing issuance of bonds will very long maturities (40 years) in the next fiscal year, and this had resulted in what some thought was an undesirable flattening of the curve. Separately, we note that last week was the first in four weeks that the Ministry of Finance data showed Japanese investors turned net buyers into foreign bonds. |

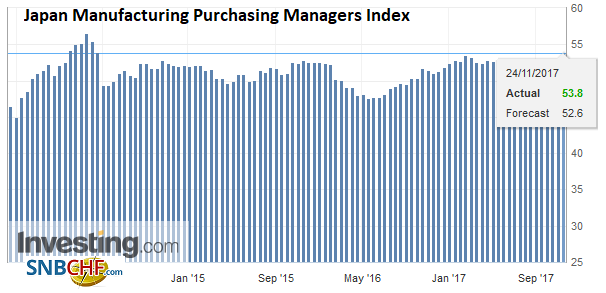

Japan Manufacturing Purchasing Managers Index (PMI), Nov 2017(see more posts on Japan Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

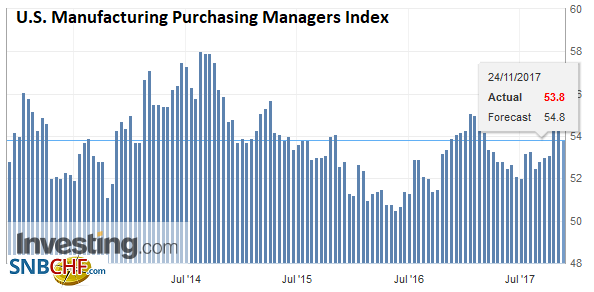

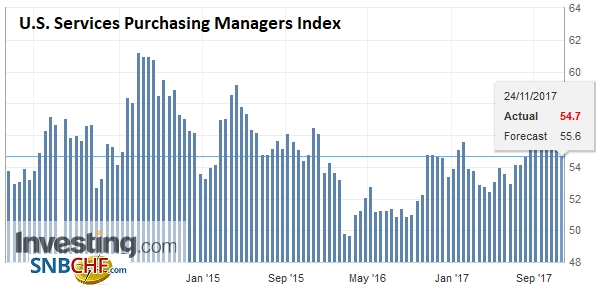

United StatesThe North American session features the Markit’s preliminary PMI readings for the US. While there may be some headline risk, the economy appears to be tracking its third consecutive quarter of 3%+ annualized growth. |

U.S. Manufacturing Purchasing Managers Index (PMI), Nov 2017(see more posts on U.S. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

| While there is concern that an inverted yield curve portends a recession, the fact of the matter is the curve (2-10 yr) is flat but not inverted. And even there, flattening has stabilized in recent sessions just below 60 bp. |

U.S. Services Purchasing Managers Index (PMI), Nov 2017(see more posts on U.S. Services PMI, ) Source: Investing.com - Click to enlarge |

Spain |

Spain Producer Price Index (PPI) YoY, Nov 2017(see more posts on Spain Producer Price Index, ) Source: Investing.com - Click to enlarge |

Germany |

Germany Business Expectations, Nov 2017(see more posts on Germany Business Expectations, ) Source: Investing.com - Click to enlarge |

Germany Current Assessment, Nov 2017(see more posts on Germany Current Assessment, ) Source: Investing.com - Click to enlarge |

|

Germany Ifo Business Climate Index, Nov 2017(see more posts on Germany IFO Business Climate Index, ) Source: Investing.com - Click to enlarge |

Chinese stocks stabilized after yesterday’s sharp fall, and the Shanghai Composite and the CSI 300 posted fractional gains. Yesterday’s rout did not rattle global investors, but the steadier note today is seen as a constructive development. The MSCI Asia Pacific Index rose for the fourth session and finished the week with a nearly 1.6% rise. In so doing, it recouped fully last week’s loss. The benchmark has posted only three weekly losses since the first week of July.

Chinese officials surprised investors by announcing a cut in the tariff (tax on imports) for a wide range of consumer goods. The average tariff was cut from 17.3% to 7.7% effective December 1. While may read this as an attempt to placate the US, the bilateral trade balance (China runs ~$370 bln surplus) is unlikely to be impacted very much. US exports, which are near record levels, tend not to be consumer goods, but semi-finished goods and capital equipment.

Sterling continues to knock on the ceiling that has capped it since the beginning of October (~$1.3340). A convincing break targets $1.3420. It seems to be more a reflection of dollar weakness than sterling strength. Sterling is slipping easing against the euro for the fourth consecutive session. Still, since the middle of September, sterling has been alternating between weekly gains and losses against the euro.

The UK appears to have made progress on two of the three issues that the EC is demanding. A resolution of EU citizens’ rights post-Brexit appears near, and the UK appears willing to improve its initial financial offer. The Irish border remains an important sticking point. The UK is testing the waters to push off the issue until later by granting Ireland a “process veto.” This would allow Ireland the right to veto the Brexit agreement at another stage and grants that “nothing is agreed until everything is agreed.”

The EC appears to see this as promising, but not apparently not sufficient. It is afraid the UK will later try to use it as a negotiating chit, and the EC apparently does not want to surrender so much to Ireland. Note too that the Irish government (a minority government) is having its own challenges. Fianna Fail, the main opposition party, withdrew its support for Deputy PM Fitzgerald over that her actions in the previous government over the police scandal. It is a delicate balancing act for Prime Minister Varadkar and a wrong turn, could see his government collapse.

The probe into Russia’s attempt to influence last year’s US election took another turn with reports suggesting former national security adviser Flynn has stopped talking to the White House, which perhaps signals his cooperation with the special investigation, led by Mueller. Meanwhile, the Senate appears to be set to hold a floor vote on the tax reform bill next week.

Graphs and additional information on Swiss Franc by the snbchf team.

Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,EUR/CHF,Germany Business Expectations,Germany Current Assessment,Germany IFO Business Climate Index,Japan Manufacturing PMI,newslettersent,Spain Producer Price Index,U.S. Manufacturing PMI,U.S. Services PMI,USD/CHF,yuan