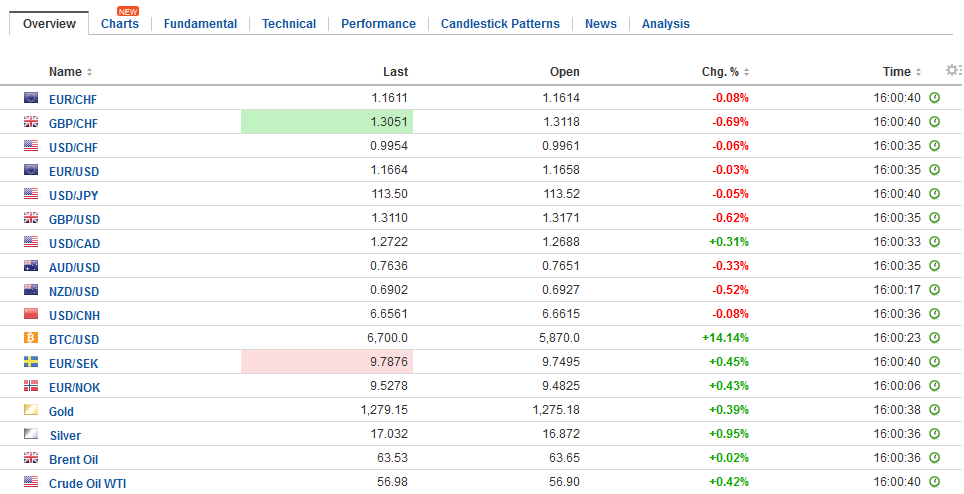

Swiss FrancThe Euro has fallen by 0.03% to 1.1607 CHF. |

EUR/CHF and USD/CHF, November 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

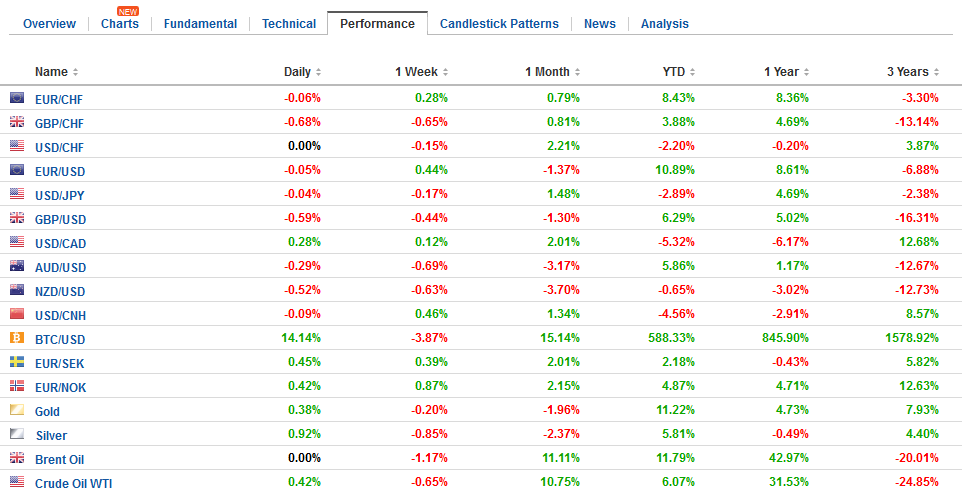

FX RatesThe US dollar has begun the new week on firm footing, without the help of either higher interest rates or increased confidence that Congress will agree on a tax plan. Indeed, over the weekend the Chair of the House Ways and Means Committee was explicit that the Senate plan to repeal the federal tax break for state and local taxes will not find support in the House of Representative. The US 10-year yield is pulling back from the 2.40% cap it approached at the end of last week, and this is allowing the yen to buck the general strength of the greenback today. Important support is seen around JPY113.00. Japanese equities extended its pullback for the fourth consecutive session today. The Nikkei lost 1.3%, the most since May. The Nikkei has rallied nine consecutive weeks through last week. Cyclically adjusted price/earnings ratio (CAPE), put Japanese shares at about 42% of there average since 1983. In comparison, US shares are 2/3 above their average valuation. Such considerations appear to have helped draw foreign investors back into Japan over the past couple of months. |

FX Daily Rates, November 13 |

| The main developments today though is sterling. It had gained 0.9% last week amid broad dollar weakness, but today it is giving it all back. Sterling tested last week’s lows near $1.3060. The main weight is political rather than economic. Prime Minister May is besieged from at least three forces that seem almost impossible to reconcile.

Sterling has not traded below $1.30 since early September. Trendline support (from June and August lows) comes in a little below there now. The euro appears poised to test the highs seen earlier this month near GBP0.8940. Sterling is testing JPY148. Additional nearby support is seen near JPY147.70. A convincing break could spur a move toward JPY146.00. |

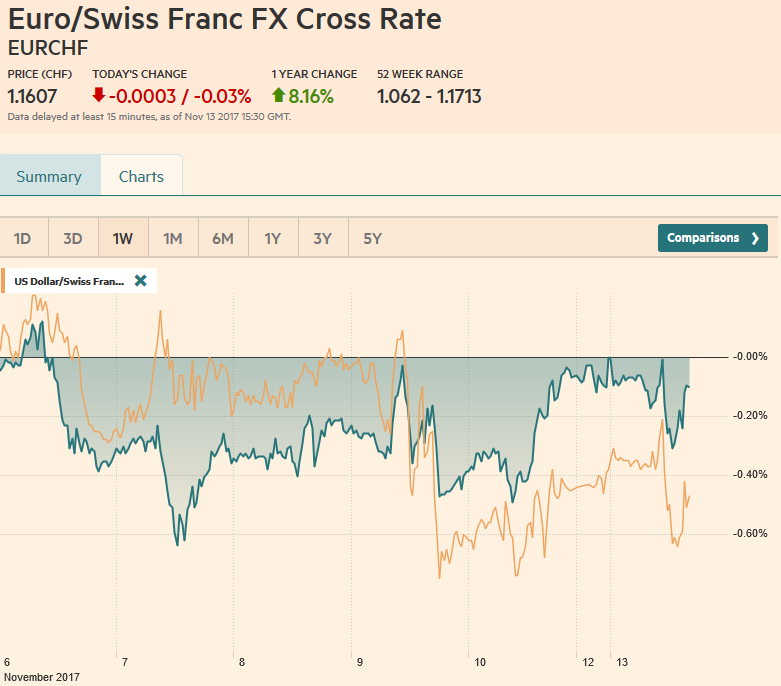

FX Performance, November 13 |

First, according to a UK paper, there are 40 Tory MPs that would sign a letter of no confidence in May. Under party rules, 48 signatures are needed to trigger a formal leadership challenge. This weakens her hand in Brexit negotiations and opens her up to criticism from Labour, which also supports Brexit, but holds out the promise of a softer Brexit (whatever that means).

Second, a UK paper reports that the hardline Brexit ministers, Johnson and Gove wrote a “secret” letter to May. Reportedly they outlined their plan for an exit without a deal with the EU and was critical of some in the government who want a less confrontational approach (Chancellor of the Exchequer Hammond). While the substance of leaks is interesting to be sure, they should always be embraced with a question of whose interest is it to “leak.” It seems May would have not interested in revealing the letter’s content. Johnson and/or Gove would seem to have the more to gain, at least in the short-term, in their battle for Brexit, but it would seem to further taint their candidacy to replace May.

Third, May is facing increased pressure from the EU. Last week, it was given two weeks to make progress on its financial obligations to the EU, propose how to resolve Northern Ireland’s border with Ireland post-Brexit. A number of solutions are possible, but the UK government’s choices are compromised by its reliance on the Democratic Unionists from Northern Ireland to secure a parliamentary majority.

These political developments are ahead of what many expected to be a week dominated by important economic data, like CPI, retail sales, and the latest labor market and earnings update. While the driver today is political, VISA did report a sharp drop in household expenditures.

There have been two other developments to note. First, the loss of another dual-citizenship MP means that Prime Minister Turnbull now leads a minority government. The government is supported by independent MPs, but the distraction is significant and may undermine Turnbull’s legislative agenda. The latest polls show Labour is extending its lead over the government coalition (55%-45%). Support for Turnbull is slipping to its lowest (~36%) since he became Prime Minister in July last year. The Aussie is trading a bit heavy, but it remains within the range set last Tuesday (~$0.7627-$0.7701) for the fourth consecutive session.

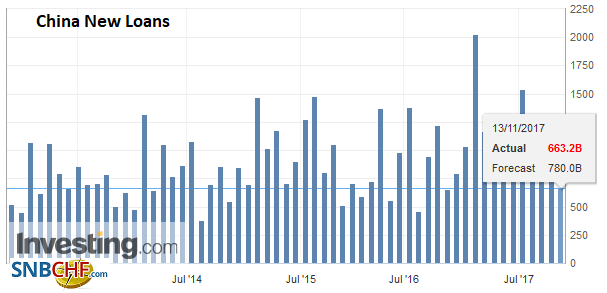

ChinaThe other development to note is from China. It reported money supply and lending figures. Money supply and new lending slow considerably in October. It may be related to the 19th Party Congress, but it is also consistent with the slower activity anticipated after a stronger than expected first half. Separately, note that reports suggest that mainland investors bought the most Hong Kong share of the year today. The net CNY5.07 bln (~$765 mln) was the most since the end of last year. The Hang Seng Index rose 0.2%, and Chinese markets were also higher, which bucked the heavier regional tone. The MSCI Asia Pacific Index fell 0.6%, after shedding 0.3% before the weekend. |

China New Loans, Oct 2017(see more posts on China New Loans, ) Source: Investing.com - Click to enlarge |

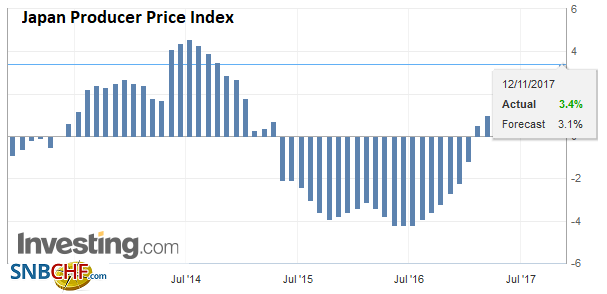

Japan |

Japan Producer Price Index (PPI) YoY, Oct 2017(see more posts on Japan Producer Price Index, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CNY,$JPY,China New Loans,EUR/CHF,Japan Producer Price Index,newslettersent,USD/CHF