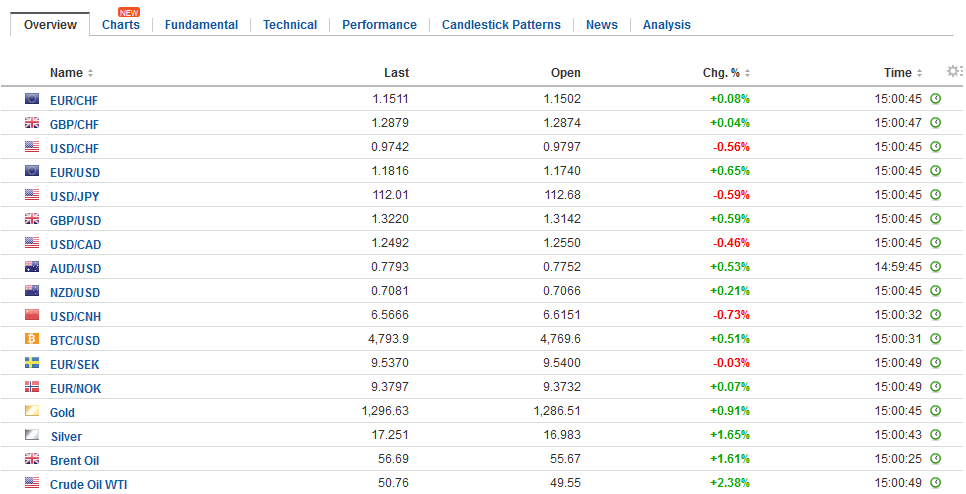

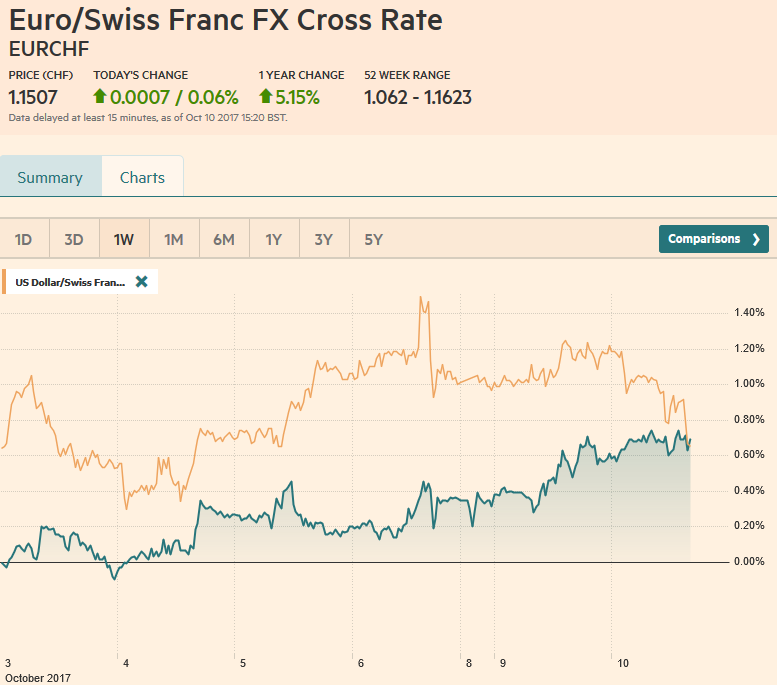

Swiss FrancThe Euro has risen by 0.06% to 1.1507 CHF. |

EUR/CHF and USD/CHF, October 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar’s advance faltered before the weekend after rise average hourly earnings and a new cyclical low in unemployment and underemployment initially fueled greenback buying. There is no doubt the data was skewed by the storms, though the upward revision to the August hourly early cannot be attributed to the weather distortions. The reversal in the dollar before the weekend has carried over into the early trading this week. Even the Turkish lira, which had been battered yesterday amid a diplomatic squabble with the US, is firmer today, though there is no resolution at hand. The dollar reached a high at the end of last week nearJPY113.45, a nearly three-month high, before reversing and finishing on it lows before the weekend nearJPY112.65. It dipped below JPY112.35 yesterday and is trading near there now. Support is seen near JPY111.75. The main driver of the dollar-yen exchange rate continues to be US Treasury yields. The yield on the 10-year note is nearly six basis points below the pre-weekend peak of 2.40%, which is the upper end of the six-month range. |

FX Daily Rates, October 10 |

| Meanwhile, the momentum behind the “Party of Hope” has begun fading. The party is not running sufficient candidates unseat the LDP, and a new party, formed from the rump of the Democratic Party of Japan, called the Constitutional Democratic Party, led by former Cabinet Secretary Edano is attracting support. The takeaway is that although there may be an underlying desire for an alternative, it will not be satisfied in the upcoming election.

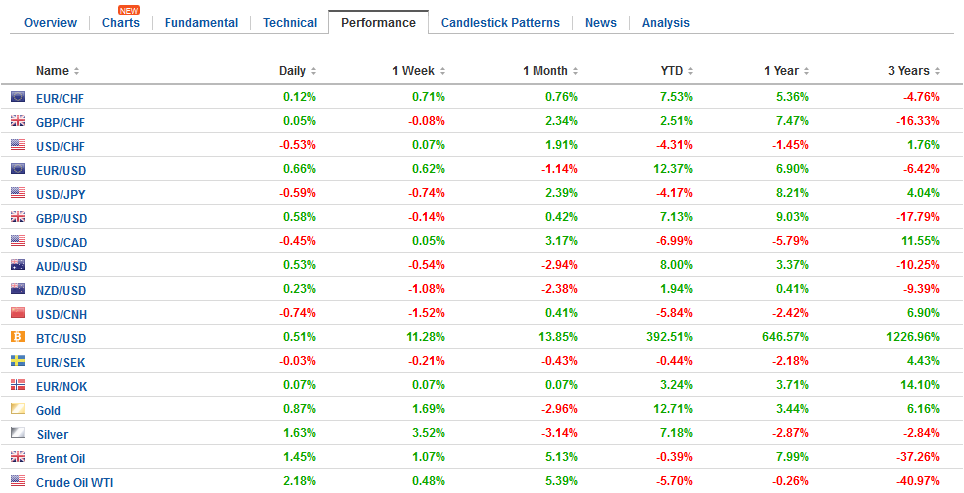

Sterling had neared $1.30 before the weekend and is pushing through $1.32 in late morning turnover in London. There is potential now toward $1.3250-$1.3270. Support is pegged initially around $1.3160. The euro is also enjoying a firmer tone. It is trading above $1.18 for the first time since October 2. The euro is higher for the third session after recovering following the US jobs data before the weekend. It is the fourth advancing session in the last five. Initial support is seen in the $1.1750 area. The price action appears corrective. Recall the euro peaked a month ago just shy of $1.21. It fell more than a 4.5 cents at last week’s lows. Initial resistance is seen in the $1.1830 area. |

FX Performance, October 10 |

JapanAt the same time, a new corporate scandal has exploded in Japan. One of the largest metal producers admitted to falsifying reports of the strength of a durability of its aluminum and copper products that are used for aircraft and autos. Kobe Steel lost more than a fifth of its value today. The Topix gained nearly 0.5% to reach a fresh two-year high. Separately, the August current account was considerably larger than expected. This reflects not only the trade account and tourism but more importantly, the income from overseas investments. The current account surplus of JPY2.38 trillion compares with a surplus of JPY1.97 trillion in August 2016. |

Japan Current Account n.s.a., Aug 2017(see more posts on Japan Current Account n.s.a., ) Source: investing.com - Click to enlarge |

United KingdomIn the UK, May’s contingency for Brexit without an agreement won praise from her hard Brexit wing, at the same time as she recognized a role for the European Court of Justice in a transition phase. |

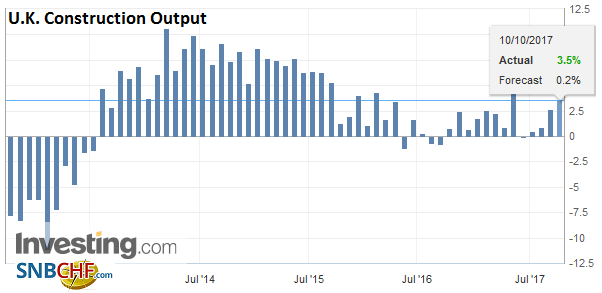

U.K. Construction Output, Aug 2017 Source: Investing.com - Click to enlarge |

| Brexit wrestles with the outlook for UK monetary policy as a driver for sterling. Last week, sterling’s drop was a function of politics as the expectations for a hike in November were little changed. |

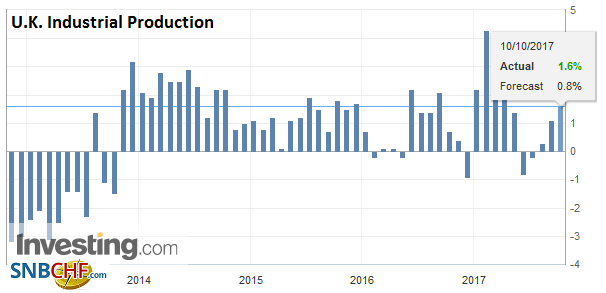

U.K. Industrial Production YoY, Aug 2017(see more posts on U.K. Industrial Production, ) Source: Investing.com - Click to enlarge |

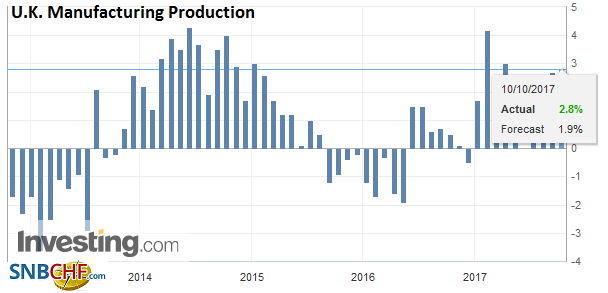

| This week, the estimates of high unit labor costs (lower productivity), and today’s news of stronger industrial output (0.2%), and especially manufacturing (0.4%), with a recovery in construction (0.6%) helped keep sterling’s recovery intact. |

U.K. Manufacturing Production YoY, Aug 2017(see more posts on U.K. Manufacturing Production, ) Source: Investing.com - Click to enlarge |

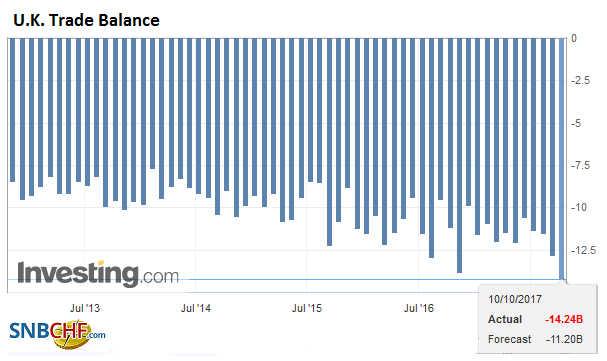

| Separately, note that the UK’s trade account continues to deteriorate. The visible trade balance (goods) widened to GBP14.245 bln. It had been averaging GBP11.22 bln this year, and August is the fourth consecutive month of deterioration. The overall trade deficit widened to GBP5.63 bln from GBP4.24 bln. The August shortfall is twice as large as the year’s average before today’s report. |

U.K. Trade Balance, Aug 2017(see more posts on U.K. Trade Balance, ) |

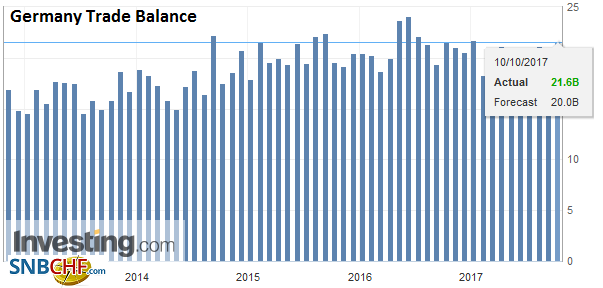

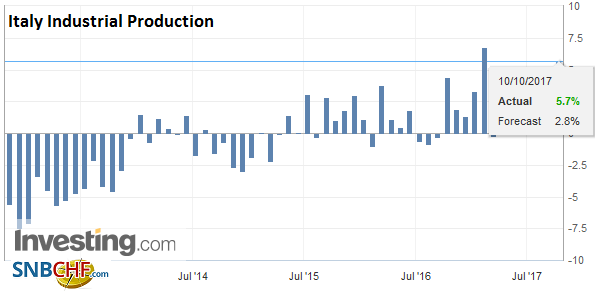

GermanyAhead of tomorrow’s EMU industrial production report, Germany reported a 2.6% surge yesterday, and Italy followed suit today. |

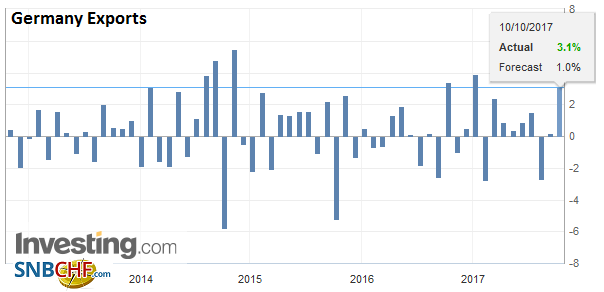

Germany Exports, Aug 2017(see more posts on Germany Exports, ) Source: Investing.com - Click to enlarge |

Germany Imports, Aug 2017(see more posts on Germany Imports, ) |

|

Germany Trade Balance, Aug 2017(see more posts on Germany Trade Balance, ) Source: Investing.com - Click to enlarge |

|

ItalyItaly’s 1.2% gain was well above expectations, and the year-over-year pace (workday adjusted ) rose to 5.7% from an upwardly revised 4.6% in July (from 4.4%). |

Italy Industrial Production YoY, Aug 2017(see more posts on Italy Industrial Production, ) Source: Investing.com - Click to enlarge |

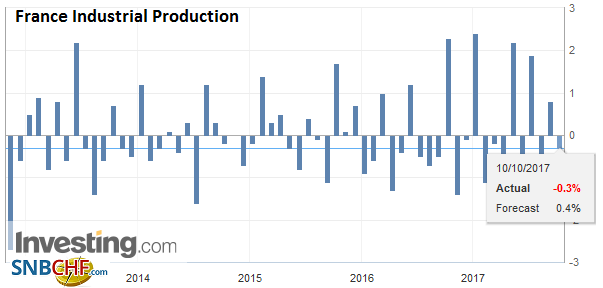

FranceFrance, on the other hand, disappointed. Industrial and manufacturing output fell 0.3% and 0.4% respectively in August. |

France Industrial Production, Aug 2017(see more posts on France Industrial Production, ) Source: Investing.com - Click to enlarge |

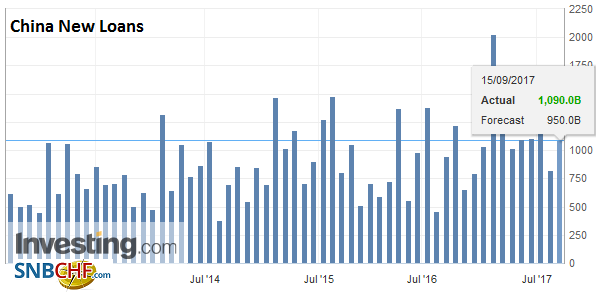

China |

China New Loans, Sep 2017(see more posts on China New Loans, ) Source: Investing.com - Click to enlarge |

Catalonia’s President Puigdemont is slated to speak to the regional parliament early evening (early afternoon EST). Talk is that he made trying to square the circle and talk about a “gradual independence,” but without a parliamentary vote, its legal meaning is not clear. The challenge for the Catalonians is to turn the constitutional crisis into a government crisis. Rajoy heads up a minority government that can be toppled with a vote of confidence. This requires allies in the form of the Socialists, Podemos, the Catalonia, and the Basque Nationalists.

The Bloomberg median forecast had expected a 0.4% rise in industrial output. Industrial output for the region is expected to have risen 0.6%, and the strength of Germany and Italy offsets the negative surprise from France. Separately, German reported a slightly larger than expected August trade balance (20 bln euros), helped by a 3.1% rise in exports (after a 0.2% rise in July) and a 1.2% rise in imports (2.4% in July).

The North American session features Canada’s housing starts and permits (looks for softer numbers), and speeches by Fed Presidents Kashkari and Kaplan. The annual meetings of the IMF and World Bank also kick-off. The key US data, consumer price inflation and retail sales, will be reported at the end of the week and the storms will likely skew both reports to the upside.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,China New Loans,EUR/CHF,France Industrial Production,Germany Exports,Germany Imports,Germany Trade Balance,Italy Industrial Production,Japan Current Account n.s.a.,newslettersent,U.K. Industrial Production,U.K. Manufacturing Production,U.K. Trade Balance,USD/CHF