| In October 2015, Federal Reserve Vice Chairman Bill Dudley admitted that the US economy might be slowing. In the typically understated fashion befitting the usual clownshow, he merely was acknowledging what was by then pretty obvious to anyone outside the economics profession.

Dudley was at that moment, however, undaunted. His eye was cast toward the unemployment rate and that was nothing but encouraging no matter the “transitory” factors increasingly lining up against it.

If that was true, meaning slack and inflation tied together through wages, the reverse must also be true. In other words, if inflation failed to materialize as the unemployment rate fell further, we would have to conclude less or not enough “pressure on resources.” It’s a powerfully contrary economic possibility. Just about one year ago, in August 2016, Mr. Dudley was again opining on the topic of conforming inflation and the Fed’s exit ostensibly due to it. He said yet again, “the labor market continues to tighten” and that wage data, though only rising by 2.5%, “suggests we are getting closer to full employment.” |

US Employment Cost Index, Jan 2001 - Aug 2017(see more posts on U.S. Employment Change, ) |

Today, the Vice Chairman was on Bloomberg, and I bet you can easily guess what he had to say:

Because of this, Dudley anticipates the Fed will begin unwinding its balance sheet and press through another “rate hike” later this year. The reaction in markets was pretty much non-existent, perfectly describing so-called data-dependent monetary policy. Eurodollar futures and US Treasury yields pay very little attention anymore to what the Bill Dudley’s of the world have to say (apart from the occasional Draghi comments from which reactions to them, or other things, get blown way out of proportion), a far different proposition than how the world is described. |

China and U.S. Consumer Price Index and Eurozone Harmonised Index of Consumer Prices, Jan 2007 - Aug 2017(see more posts on China Consumer Price Index, Eurozone Consumer Price Index, U.S. Consumer Price Index, ) |

| The June 2020 eurodollar futures contract, a fair and important benchmark for market perceptions of money rates in the long run, are down all of 2.5 bps (price) from Friday’s anti-“reflation” high close, off about 1 bps (price) from the when Dudley’s comments were published. The price direction, as in UST’s, was set not by this important Fed official but instead by other things (some Korean relief).

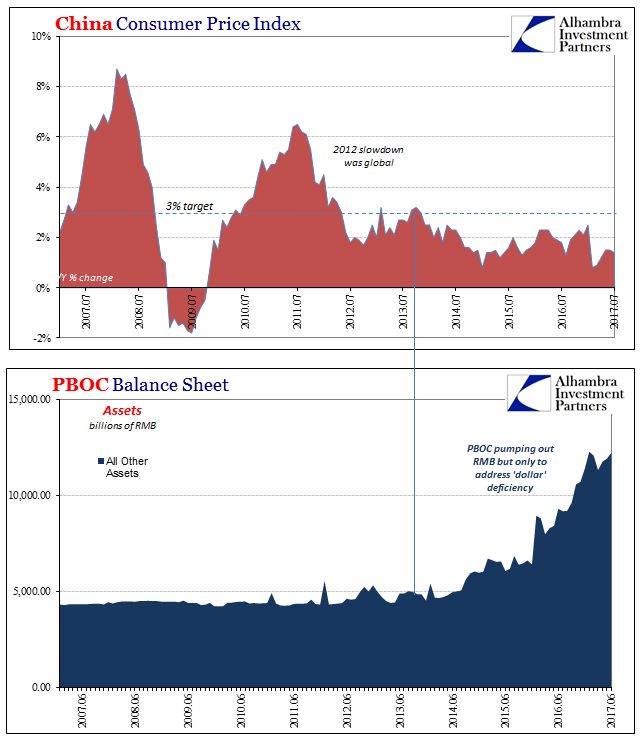

No matter where you look, inflation stands out for all the wrong reasons (from the policymaker perspective). The US CPI as its PCE Deflator has disappointed and in very predictable fashion; in Europe, the pattern for EU HICP is eerily similar; and in China, the CPI continues to undershoot significantly despite in local terms anyway huge and sustained RMB injections. |

China Consumer Price Index and PBOC Balance Sheet, Jan 2007 - Jun 2017(see more posts on China Consumer Price Index, pboc balance sheet, People's Bank of China, ) |

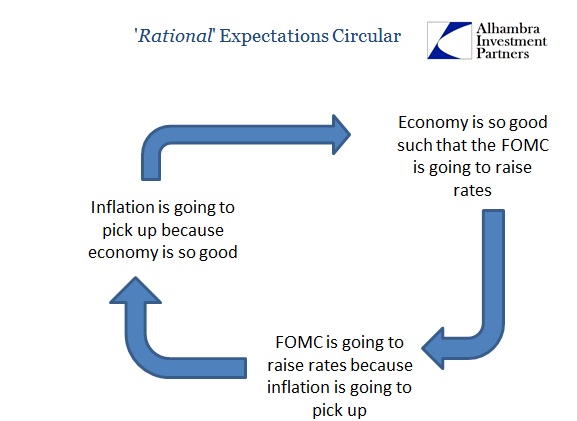

| The common theme for all these indications is not really consumer prices, it is instead Dudley’s forever unchanging expectation for them. It is the epitome of central bank circular logic; consumer prices will have to behave at some point because consumer prices will have to behave. The error is as glaring as it is basic; the monetary system is not what they think it is, which is why global consumer prices have become so durably synchronized. |

Productivity Recovery Circular |

Real Gross Domestic Product and WTI, Mar 2012 - 2017 |

|

China Fixed Asset Investment, Jul 2013 - 2017(see more posts on China Fixed Asset Investment, ) |

|

| It is, in contrast to Dudley, Draghi, Yellen, etc., markets that have become truly data-dependent. Rhetoric is no longer enough, and why should it be given the obviously unflinching dedication to it from all monetary officials? That’s why “reflation” happened so quickly last year, because it appeared however briefly there was a chance these economists may have been right for once; global CPI’s and inflation measures did start to rise.

Even if it was only due to predictable oil price base effects, the risks that it was more than that, that it was indeed wages and resources as Dudley suggested long ago in October 2015, were viewed as then slightly more than trivial. That’s why the disappointing results from Europe to China to America in inflation have been so important in 2017. Markets are back to wondering why Fed officials even bother to speak, accomplishing little more than pull back the curtain on the wizard that much further. |

Running Out of Reflation, Apr 2013 - Oct 2016 |

Dudley again today:

No, the jury’s verdict was read into the record a long time ago, the “rising dollar” providing all the necessary evidence as to what really sets the “more fundamental going on.” If it was the other way, Dudley wouldn’t still be talking about wage pressures in the future tense. Transitory doesn’t count if the word still lingers in the official vocabulary year after year after year. These markets have noticed, forcing even the formerly recalcitrant orthodoxy to notice, too. In still another “interest rates have nowhere to go but up” article published today, also in Bloomberg, the author admits there might be more than Korea holding down yields:

Those last two sentences are really the central thesis, just not in the way the article or even the narrative is written. Markets (outside of stocks) don’t care anymore if or by how much the Fed might “raise rates.” As noted last week, what truly matters is why they might be doing so. Reviewing Dudley’s speech history, or Yellen’s, it is instructive in that regard. The most that can be concluded given economic as well as inflation data is that they intend to “raise rates” because they intend to raise rates. It is why UST yields and eurodollar futures prices have moved this year in the “wrong” direction, just as they did three years ago. Policymakers and economists are still seeking the economy that “should be” when by now it is obvious there is no such thing. What’s really out there is one “unexpected” lost decade turning “unexpectedly” into two. That scenario justifies lower rates and higher eurodollar futures prices no matter what the empty suits at the FOMC do about wage pressures that never seem to materialize. |

Running Out of Reflation, Apr 2013 - 2017 |

Tags: bill dudley,bond market,Bonds,China,China Consumer Price Index,China Fixed Asset Investment,Consumer Prices,conundrum,CPI,currencies,economy,EuroDollar,eurodollar futures,Europe,Eurozone Consumer Price Index,Federal Reserve/Monetary Policy,hicp,inflation,Janet Yellen,lost decade,Markets,Monetary Policy,newslettersent,pboc balance sheet,People's Bank of China,rate hikes,rhino,slack,U.S. Consumer Price Index,U.S. Employment Change,U.S. Treasuries,wages