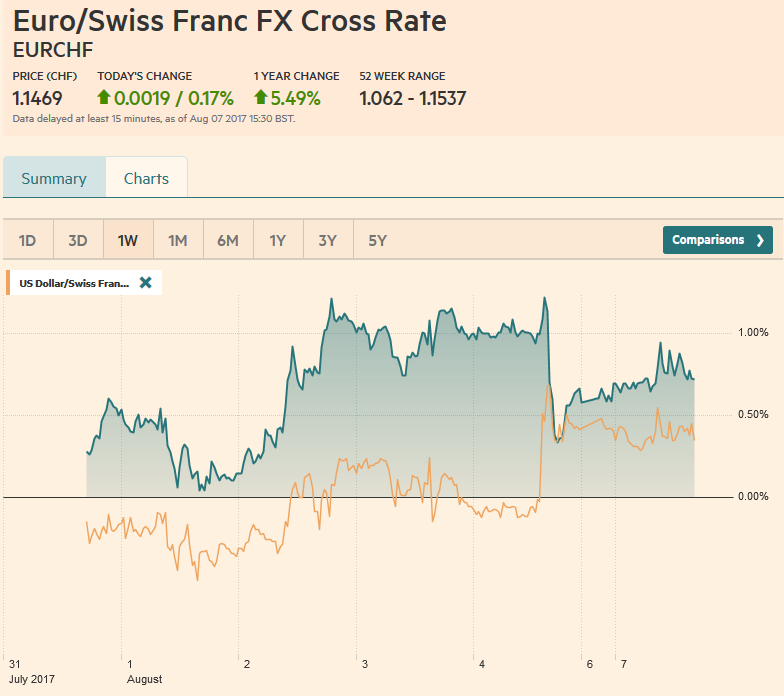

Swiss FrancThe Euro has risen by 0.17% to 1.1469 CHF. |

EUR/CHF and USD/CHF, August 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

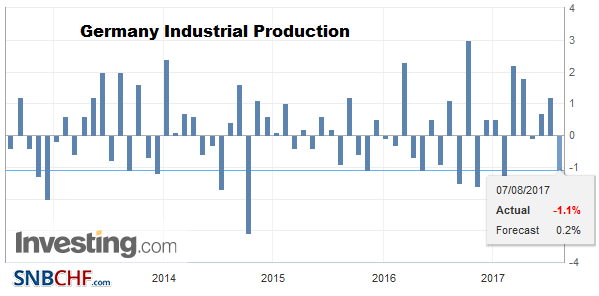

FX RatesThe US dollar is narrowly mixed to start the new week. Two main developments stand out. First, the dollar-bloc currencies are trading heavily. The Australian dollar is pushing lower for the fifth consecutive session. The greenback is advancing against the Canadian dollar for the sixth consecutive session. The New Zealand dollar is weaker for the fifth time in six sessions. The other development is the continued resilience of the euro. The euro reached almost $1.1815 after slumping to nearly $1.1725 before the weekend. However, the euro appears to have peaked in front of a corrective retracement target near $1.1830. News that German industrial production unexpectedly fell in June, for the first time this year, may help deter further euro gains today. |

FX Daily Rates, August 07 |

| The South Korean won eased 0.2%, and the Kospi edged 0.2% higher. Korean stocks are up five of the past six sessions, but gains have lagged the region. The MSCI Asia Pacific Index rose 0.4% and is looking to extend its four-week advance. News that Toyota raised its full year guidance helped lift the Topix nearly 0.5%, snapped a two-day down move. Most equity markets in the region advanced, but those open late seemed to be dragged down by early losses in Europe. By mid-morning in Europe, most bourses were little changed, and the Dow Jones Stoxx 600 was off marginally, with utilities, information technology, and consumer sectors, leading the way. Materials and energy were doing best.

Sterling had been sold down to $1.3025 before the weekend, a roughly 2.25 cent loss in two days. Sterling had posted a key reversal in response to the BOE’s more dovish tilt on August 3. Today’s upticks carried it to $1.3060. The 20-day moving average is found near $1.3055. The pre-weekend close below it was the first time since June 26, and resurfacing about it on a close basis would help signal a near-term low is in place. On the upside, the $1.3120 may provide resistance. |

FX Performance, August 07 |

GermanyGerman industrial output fell 1.1% in June. The median expectation in news wire surveys was for around a 0.2% gain. The drop follows a 1.2% gain in May. The euro’s exchange rate for German producers, and the better stronger demand in Europe, and the world has underpinned world’s fourth largest economy. Industrial output grew 1.8% in Q2 and contributed around 0.5 percentage points to Q2 GDP. Recall that the July manufacturing PMI slipped to 58.1 from 59.6, which was the weakest reading since March. |

Germany Industrial Production MoM, June 2017(see more posts on Germany Industrial Production, ) Source: investing.com - Click to enlarge |

In an otherwise, relatively light news session, China reported that the value of its reserves rose more than expected in July. China’s reserves increased for the sixth consecutive month. The $3.081 trillion follows June holdings of $3.057 trillion. It is about $5 bln more than expected. Recall China’s reserves briefly slipped below $3 trillion at the start of the year. A combination of capital controls, and a stronger yuan, (reflecting in no small measure, the weakness of the US dollar), and improved economic activity have helped officials rebuild reserves.

Meanwhile, over the weekend, the UN Security Council unanimously supported increased sanctions on North Korea. That China and Russia consented is a diplomatic victory for the Trump Administration. Some reports linked the lack of new trade action against China that was anticipated to be announced at the end of last week on intellectual property rights was held up by seeking China’s cooperation.

Recall that like other presidential candidates including Bush and Obama, Trump threatened to cite China as a currency manipulator and later backed down. Similarly, the investigation into steel imports on national security grounds has reportedly been completed, and an aluminum one may be opened. US policy toward China does not appear to have changed, even if the rhetoric has.

The four basis point rise in the US 10-year yield before the weekend, encouraged by the fairly constructive jobs report, lifted yields in the Asia-Pacific region earlier today. European benchmark yields are up another basis point today. UK Gilts are faring better. News that Visa reported slower UK spending in July for the third consecutive month, as UK consumers pulled back, especially for discretionary clothing and household goods purchases, may have helped. At the same time, the UK appears to make a new concession in the Brexit talks. For the first time, it made a counter-proposal GBP36 bln monetary compensation to cover the commitments it had previously made. It wants to link the concession to a commitment from the EU for a transitional agreement.

OPEC (and Russia) meet today to discuss compliance with the output agreement. Reports suggest compliance fell to 86% in July. Note that Libyan output reached a three-year high in July, but news today suggests its largest field has been closed due to protests. Oil is trading heavily, off about 1.2% today. Brent was up 0.8% before the weekend, while WTI had gained 1.1%.

On Friday, the dollar traded on both sides of Thursday’s range against the yen but failed to finish the week above the high set on Thursday. Still, the price action was encouraging. Higher US yields and rising stocks helped. The dollar has been confined to a narrow 10 tick range on either side of JPY110.75 today. A move above JPY111.20 would lift the tone.

The US and Canadian calendars are light today. US consumer credit, due late in the session may attract economists’ attention but may mean little for the markets. The highlight of the week is the July CPI figures. The Fed’s Bullard and Kashkari speak today, while Dudley speaks later in the week.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,$JPY,EUR/CHF,FX Daily,Germany Industrial Production,newslettersent,U.K.,USD/CHF