| Chinese trade statistics were for May 2017 better than expected by economists, but on the export side questions remain as to their accuracy. Earlier this year discrepancies between estimates first published by the General Administration of Customs (GAC), those you find reported in the media, and what is captured by the National Bureau of Statistics (NBS), backed up by data from the Ministry of Commerce, became noticeable. For the past few months it had disappeared again, only to show up once more for what is posted for April 2017.

The NBS data shows only a 4.2% year-over-year increase in exports compared to an 8% gain that was globally released by GAC. Having no corrections listed in the media or on press releases, the world continues on as if exports grew in April by 8% rather than 4.2%. No explanation is ever provided for the difference. |

|

| As of now, GAC figures Chinese exports rose 8.7% in May 2017, though until corroborated by the Ministry of Commerce we have to at least consider that as an upper limit (the differences are always to the downside at NBS). Either way, Chinese export growth remains underneath what appears to be a post-2012 slowdown speed limit of sorts. It is the same lack of acceleration and meaningful momentum that plagues the rest of the world. This period of positive numbers is too much 2014 and nothing of 2005, whatever might be the actual result. | |

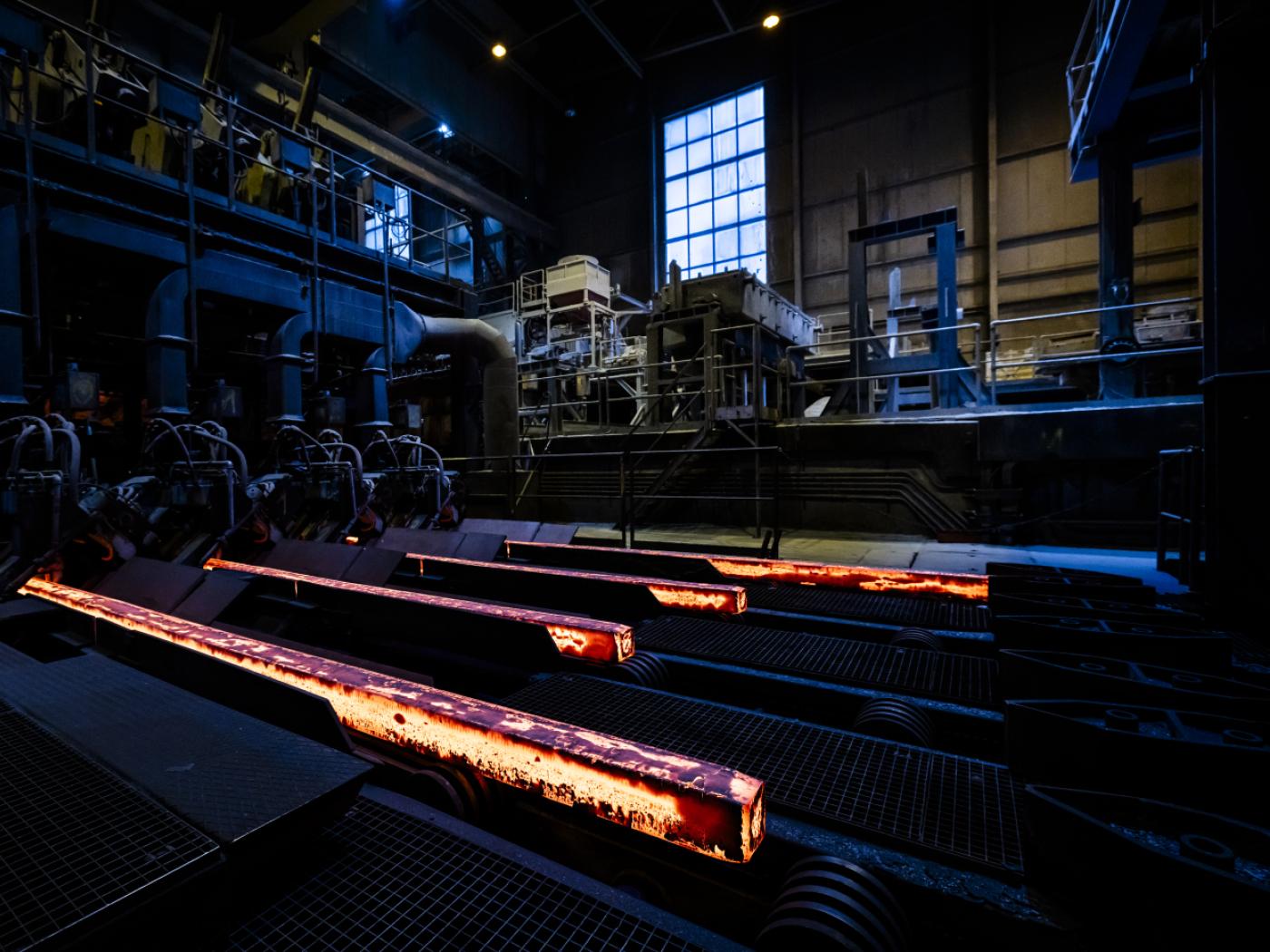

| On the import side, the estimates have tended to change by much smaller and really negligible amounts GAC to NBS. The first run estimates from GAC indicate a 14.8% year-over-year increase, and 14.6% using NBS. Price effects in especially iron, copper, and steel have faced downward pressures just as they have in oil, but volume growth remained somewhat steady in May to offset that uniform price deceleration. There are concerns, however, that much of what was additionally imported at the margins was simply Chinese firms taking advantage of recent price weakness in order to bolster inventories in front of seasonal slowing. | |

| Like exports, the pace of import expansion is on pace for more like 2013-14 than the pre-crisis era when inbound trade expanded steadily by at least 20%. After plunging by around 15% or more throughout 2015 and early 2016, to settle even back at even 14.8% growth on occasion in 2017 is highly disappointing; even more so considering that comparison to three and four years ago (levels then not preceded by a nearly two-year long contraction). | |

| It is, like European and US output, continuing in non-linear contraction that makes all the difference. Even at 9% export growth, China’s economy falls only further behind what it needs to continue its transformation. Though the media is filled with stories about “rebalancing”, manufacturing and export are clearly still the basis for Chinese economic growth.

Since early 2016, the lack of growth from manufacturing has been offset only somewhat by fiscal “stimulus” in the form of renewed state-owned construction vigor. That can’t and won’t persist much longer, which suggests the transition mechanism between the lack of Chinese export growth or momentum and what may happen to Chinese imports in the coming months. Combined with pricing trends, 14.8% may be an upper limit, too. Somewhere in that mix is what is driving commodity prices, which, again, are already suggesting lingering doubts if not rethinking wholly “reflation” implications down to the bare narrative. In other words, the lack of acceleration is becoming a clear issue rather than a hazy possible concern. More than a year past the worst of the “rising dollar” downturn, for this to be all (so far) China can manage is not just disappointing. There are serious implications, as the bond and “dollar” markets seem to have realized (again). |

Full story here Are you the author? Previous post See more for Next post

Tags: China,China Exports,China Imports,China Industrial Production,China Retail Sales,currencies,depression,dollar,economy,EuroDollar,exports,Federal Reserve/Monetary Policy,global trade,imports,Markets,newslettersent,statistics,Trade,Trade Balance