Swiss FrancThe euro has depreciated by 0.24% to 1.0868 CHF. |

EUR/CHF - Euro Swiss Franc, June 02(see more posts on EUR/CHF, ) |

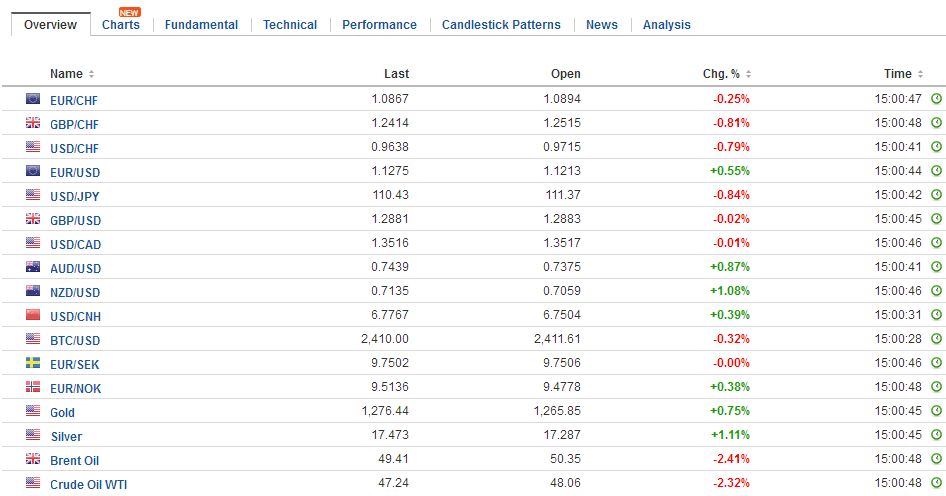

FX RatesThe foreign exchange market is becalmed, leaving the US dollar narrowly mixed. The euro has been confined to less than a 20-pip range through the Asian session and most of the European morning. The news stream is light. The US withdrawal from the Paris Accord may have garnered the headlines, but as a market force, it is difficult to detect the immediate impact. Sterling had been sold to near $1.2770 in the middle of the week before recovering to post an outside up day. It has spent yesterday and today within the mid-week range. A break of the $1.2820-$1.2920 range could spur a cent move. Note the euro is flat against sterling this week. If this is sustained, a five-week advancing streak for the euro will have been snapped. After relative strong gains this week, the Chinese yuan weakened ahead of the weekend. We suggested that yesterday’s loss in the offshore yuan, which had led this week’s move, spurred at least in part by the liquidity squeeze in Hong Kong, may have been an indication of waning demand. The offshore yuan (CNH) is off by about 0.6% today, while the onshore yuan (CNY) was off 0.1%. The dollar had fallen against the yen for four sessions before yesterday when the gained 0.5%. It is seeing a marginal extension of those gains today and recorded the week’s high today near JPY111.70 The JPY111.20 offers support. A move, and ideally a close, above last week’s high near JPY112.15, would lift the technical tone. |

FX Daily Rates, June 02 |

| Stocks and bonds are firmer today. The S&P 500 and Dow Jones Industrials finished yesterday at a record high. Asian equities followed suit. The MSCI Asia Pacific Index gained nearly 1%. It was practically flat on the week coming into today. It is at its best level since 2015. The Nikkei closed above 20k for the first time since August 2015. Korea’s Kospi is at new record highs despite the elevated tensions on the peninsula

The decline in oil prices this week has been a talking point. Both Brent and WTI are off around 2% today, bringing the loss on the week toward 4.8%. It is the biggest loss in four weeks. Although US inventories continue to fall (eighth week), the output is rising. US output rose another 22k barrel a day in the most recent week. It is the 14th weekly increase in the past 15 weeks. Libyan and Nigerian output increased last month, which is not including in the OPEC output caps, by estimated 315k barrels a day. The euro has not been below $1.12 since early Wednesday. It is not above $1.1260 either. The week’s range is rough $1.1160-$1.1260. Options struck at $1.12 (537 mln euros) and $1.13 (1.1 bln euros) roll-off today. Next week’s ECB meeting looms large. It is widely expected that the forward guidance is tweaked, adjusting the risk assessment, and acknowledging that rate has bottomed. The staff may revise its growth forecast higher, but there is a risk that its inflation forecasts are shaved. The Australian dollar has underperformed this week, losing almost 1% before stabilizing today. It is consolidating at near yesterday’s lows, after losing 0.7%. The lack of follow through selling is notable given that one of the narratives, weak industrial metal prices, remains intact. Copper, nickel, lead, zinc and iron ore prices are all lower today. Meanwhile, the US dollar is extending its advancing streak against the Canadian dollar to a fifth session. At CAD1.3545, it has retraced 38.2% of May’s decline. The 50% retracement target is near CAD1.36. Its April trade figures that will be reported today will be overshadowed by the US jobs report. Benchmark 10-year yields are 1-2 bp softer throughout most of Europe. The yield on the 10-year JGB and US Treasuries are fractionally lower. At 2.21%, the US 10-year yield is off 3.5 bp on the week, while the German Bund is flat at 29 bp. The UK yield backed up four basis points this week and is essentially matched by the Italian benchmark, where the chances of a fall election have weighed on sentiment. |

FX Performance, June 02 |

United KingdomThe UK reported stronger than expected construction PMI. Unlike the manufacturing PMI reported earlier in the week, where the decline was not as much as anticipated, the construction PMI rose outright. The 56.0 reading is a new two-year high and compares with April’s 53.1. An interesting insight into this smallest of the three surveys is that the higher prices from sterling’s past depreciation appear to be fading as input prices rose by their least in seven months. The economic news in the UK is playing second fiddle to the politics. More polls will be released over the weekend. Net-net since the election was called, the Tories support in a poll of polls is little changed. The tightening of the polls seems to reflect a gain in Labour’s support at the expense of the Lib Dems and UKIP. Although we have pointed out developments in the options market that show at least some investors are buying downside protection, we remain surprised by the stability of sterling. At $1.2860, it is up 0.4% on the week. It fell about 0.5% in the month of May. |

U.K. Construction Purchasing Managers Index (PMI), May 2017(see more posts on U.K. Construction PMI, ) Source: Investing.com - Click to enlarge |

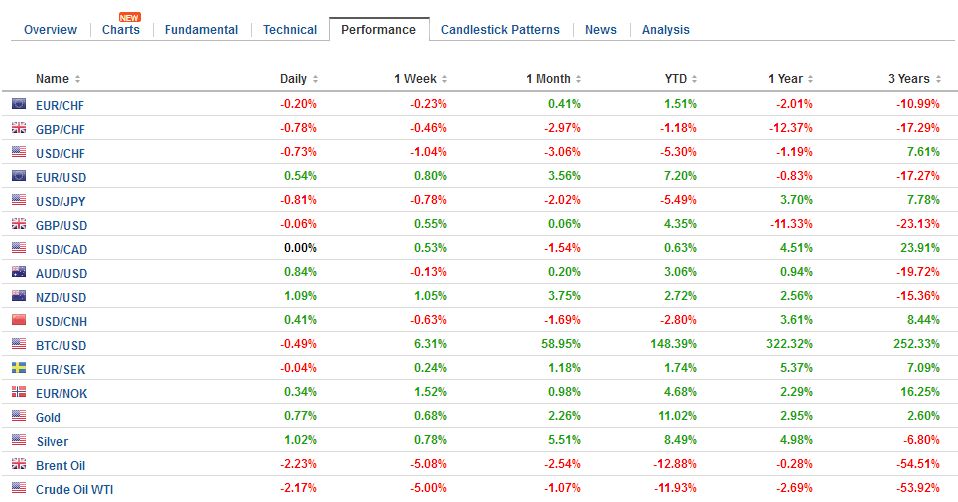

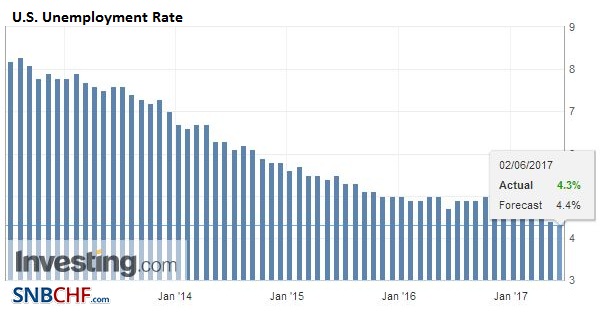

Eurozone

|

Eurozone Producer Price Index (PPI) YoY, April 2017(see more posts on Eurozone Producer Price Index, ) Source: Investing.com - Click to enlarge |

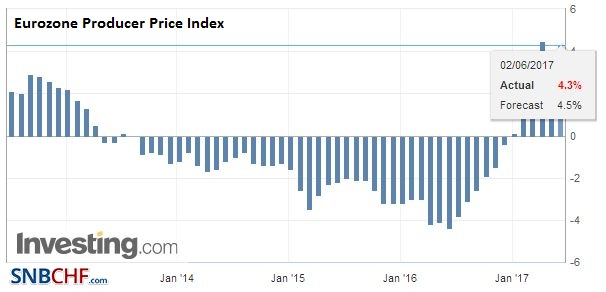

United StatesThe US employment report is the economic highlight. |

U.S. Unemployment Rate, May 2017(see more posts on U.S. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

U.S. U6 Unemployment Rate, May 2017 Source: Investing.com - Click to enlarge |

|

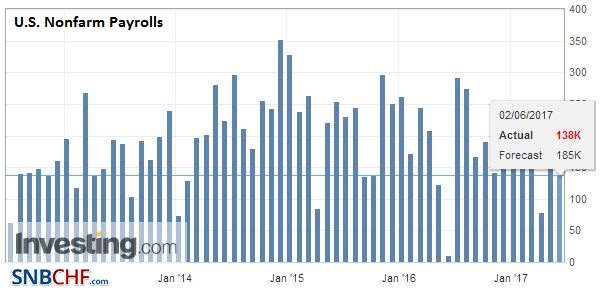

| Although the non-farm payroll report is notoriously hard to forecast consistently accurate, the inputs to forecasts like the weekly jobless claims, ADP, withholding taxes, and the ISM all suggest a reasonably strong report. The median forecast in the Bloomberg survey is for the 182k increase. We suspect the risk is asymmetrically tilted to a stronger rather than a weaker report. |

U.S. Nonfarm Payrolls, May 2017(see more posts on U.S. Nonfarm Payrolls, ) Source: Investing.com - Click to enlarge |

| Ahead of the US jobs data, the market has discounted a near certainty that the Fed will raise interest rates on June 14. The Bloomberg estimate puts the odds just below 93%, and the CME model puts it a little more than 91%. Our work suggests a fair value for the June Fed Funds contract o a 25 bp hike is about 98.96 (1.04%) while the contract is at 98.9725. |

U.S. Participation Rate, May 2017(see more posts on U.S. Participation Rate, ) Source: Investing.com - Click to enlarge |

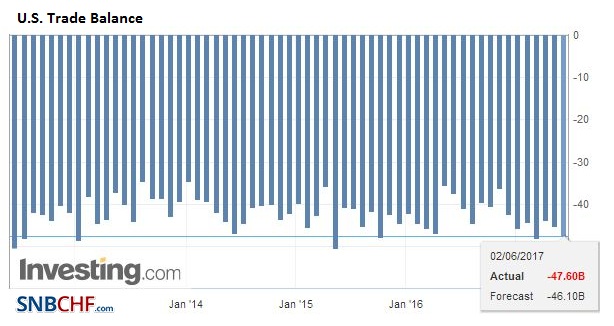

U.S. Trade Balance, April 2017(see more posts on U.S. Trade Balance, ) Source: Investing.com - Click to enlarge |

|

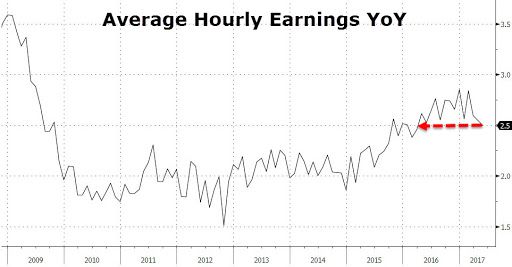

| Given the three-month decline in the core PCE deflator, and comments by some Fed officials, including Governor Brainard, investors may be particularly sensitive to the average hourly earnings component of the jobs report. A downside disappointment from the 0.2% expected increase could buoy the bond market and weigh on the dollar. |

U.S. Average Earnings, May 2017(see more posts on U.S. Average Earnings, ) Source: Zerohedge.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,$JPY,EUR/CHF,Eurozone Producer Price Index,FX Daily,newslettersent,OIL,U.K. Construction PMI,U.S. Average Earnings,U.S. Nonfarm Payrolls,U.S. Participation Rate,U.S. Trade Balance,U.S. Unemployment Rate