| I don’t think Milton Friedman would have made much of chess player. For all I know he might have been a grand master or something close to that rank, but as much as his work is admirable it invites too the whole range of opposite emotion. He was the champion libertarian of the free market who rescued economics from the ravages of New Deal socialism, but in doing so he simply created the avenue for where Economics of that kind could be transposed directly from the Treasury Department to the central bank. Neo-Keynesians of today are indistinguishable from so-called monetarists pulled down from Friedman’s lifelong struggles.

His views on the free markets were almost as dogmatic as the antithetical results that are today carried out in his name (econometrics). I have no doubt it was a result of the emergence of rational expectations theory, which by force of infinity made all markets perfectly efficient – in theory. Thus, Friedman said in 1977 about politics:

The timing of the statement is perfectly apt, given the mirrored similarities between 2017 and 1977. Both were times of great social upheaval drawn out by great and grave economic dissatisfaction. Populism was so often the only choice simply because entrenched interests on “both” sides meant nothing would ever change. Friedman’s pronouncement above was in response to a question from someone in the audience wishing to “throw the bums out”, a timeless sentiment. How do we get the wrong people to do the right things? In the 2010’s, the answers are as simple as they were in the 1970’s. Economists are again the wrong people who feel, apparently, no compunction to do the right thing. They only choose over and over again to do the same thing regardless of how each time it turns out the same way – with no success. The Japanese have been at it for a quarter century and Japan’s economy remains in stasis today just as it was when it fell into it at the end of the 1980’s. Perhaps the worst part is that all these people doing the wrong things are doing almost exactly what Milton Friedman said must be done. In the case of Japan, it was the literal truth. He urged, practically begged the Bank of Japan in the late 1990’s to go beyond interest rate policies, even ZIRP, to expand the monetary base in order to get the economy moving again. They did; it didn’t. At times like this it is useful to notice that dogma prevails including much of it that bears his name. Was it really the monetary base that the Bank of Japan affected so greatly by the first QE? That one and every one that has followed empirically proves that it wasn’t. Friedman wasn’t wrong, but he was; he had the right idea but the wrong means to achieve it. The problem was never a shortage of bank reserves so much as bank capacity. |

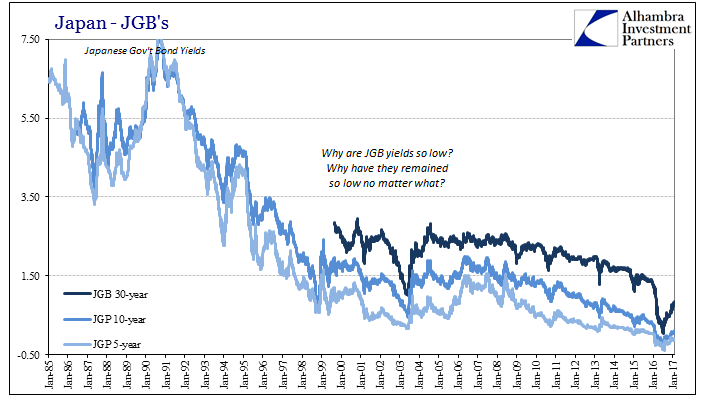

Japan Government Bond Yields, January 1985 - May 2017(see more posts on Japan Government Bonds (JGB), ) |

| The predominating feature of the Japanese financial condition is not the Bank of Japan, even though that is what everyone seems to believe. It is instead its bond market that no matter how reckless the Japanese government can become there isn’t any bid for its debt that won’t eagerly be filled. It is perhaps the paradox of all paradoxes, in financial terms anyway, for the greater the credit risk of Japan the greater the demand for its riskier debt.

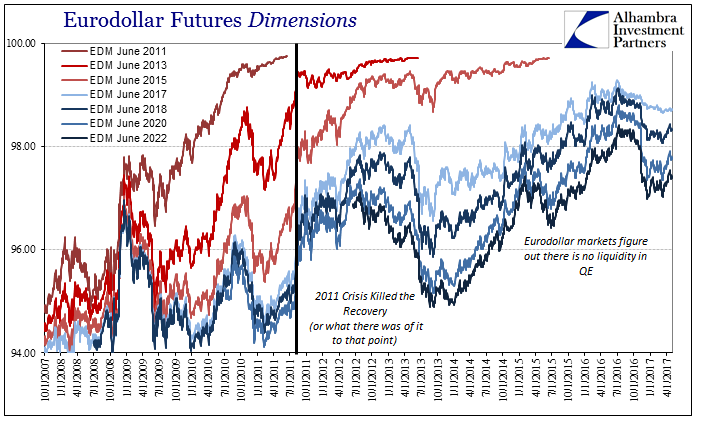

But this isn’t actually a paradox so much as an oversimplification. Credit risk is but one among several of the primary considerations especially among Japanese banks who dominate the landscape. What the Bank of Japan proved especially in its 11 (or 24) QE’s is that it knows how to buy the government’s debt, so is there really any credit risk? But quite apart from that, in buying the government’s debt to a higher degree each time there isn’t actually any liquidity generated from it, certainly none that might reach out into the real economy. What we are seeing in the depression history of the JGB market is the reprioritizing of risks. Credit risk is a distant consideration especially when compared to liquidity risk. There is a reason Friedman pleaded for the Bank of Japan to expand the monetary base, because all the symptoms were there for a monetary shortage (and shortage is a much looser term than might be appreciated, too, since shortage could apply to a situation where money is actually growing but at a relatively slower rate than the demand for it or the economy overall). What the Bank of Japan ended up expanding was the level of bank reserves, one form of bank liability lost in sea of other forms with much more dynamic and useful capabilities. Though the Japanese experience had been the most studied in history, “we” have learned absolutely nothing from it. Instead, our own “experts” decided that Japan’s problem was the Bank of Japan, and that when it came time for the ECB or Federal Reserve to answer the call they would shine and make us all proud. They didn’t; their efforts practically indistinguishable from the Japanese as if using Japan’s template the very day after cursing it. Now global bond markets look very Japanese, and in some cases more Japanese than Japan. You would think Friedman’s monetary disciples would recognize the warning generated by this unending circumstance, especially the whole liquidity risk thing, but they instead rationalize it as benign or a bond bubble. That latter takes being self-unaware to dangerous proportions, seeing as central banks most often deny bubbles exist as they certainly did in the proceeding ones before each and every collapse (do we really have to wonder why after each and every collapse liquidity risk might become such a high priority?). |

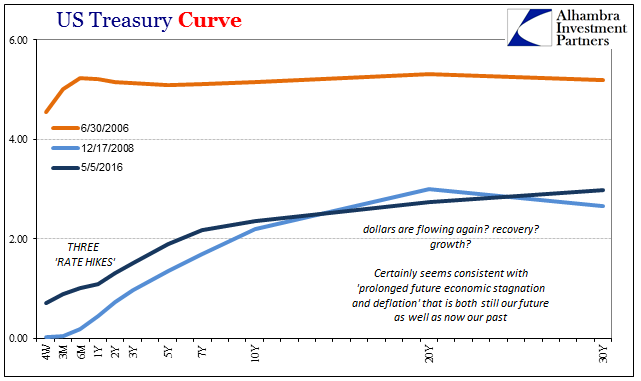

US Treasury Curve |

Economists and bonds, however, do not have an easy history together, which actually says a lot about economists. Bonds are easy. After twenty-five years in Japan and now a decade practically everywhere else, they have performed an even more valuable service by allowing the wrong people to identify themselves. To wit:

I read these words carefully several times expecting the error to have surely been my own. Maybe it was the translation. I do hope that turns out to be the case, because if it isn’t it is far too much of a profound disappointment. It wasn’t like the message was delivered by some talking head in the media, rather it was spoken by Hyun Song Shin, head of research at the BIS of all places. It’s another sign that the BIS may have taken a wrong turn somewhere lately, as before last year they were one of the few orthodox places where actual science seemed possible, legitimate exploration in the name of answers. What is presented above is a tautology masquerading as a very confused excuse. If institutional investors, like Japanese banks, taking starring roles in both Japan’s descent as well as the post-2007 global crisis, seek to limit risk they are doing so because whatever the central banks are doing doesn’t work. And if whatever central banks are doing doesn’t work, that does “necessarily signal prolonged future economic stagnation and deflation” because otherwise the central bank would be doing nothing. This idea is spreading out in 2017 just as it did in 2013-14, just as it did in 2010-11, or in 2001 Japan. And it boils down to a very simple formulation; the bond market must be wrong because the central bank can’t be. Every time I hear this statement in its various forms, especially in the context of the US economy, the last thing I think is that the bond market (especially since 2011) has it all wrong and economists are the side to believe. And it’s not just the bond market, either. How do we get the wrong people to do the right thing? As much as I am an admirer of Dr. Friedman, who I think deserved his Nobel Prize far more than many others who have come to be awarded one, this is just wrong. It’s been ten years already and policymakers show not the slightest hint of reconciling the last lost decade with what they have predicted, claimed, and done; they, in fact, remain predisposed to rationalizing rather than truly rational analysis. Maybe the wrong people are just the wrong people. |

Eurodollar Futures Dimensions, November 2007 - November 2017 |

Full story here Are you the author? Previous post See more for Next post

Tags: Bank of international Settlements,Bank of Japan,bank reserves,bond market,currencies,depression,economy,EuroDollar,Federal Reserve,Federal Reserve/Monetary Policy,Japan,Japan Government Bonds (JGB),Liquidity,Markets,Milton Friedman,newslettersent,QE,U.S. Treasuries