Swiss FrancThe euro is lower at 1.0885 (-0.18%). |

EUR/CHF - Euro Swiss Franc, May 31(see more posts on EUR/CHF, ) |

GBP/CHFCorbyn gains on the Tories. Theresa May calling a snap general selection seemed to be a wise move while the opposition was so weak. With a Tory victory seeming almost inevitable at that point Sterling strengthened against the majority of major currencies. This is due to a conservative government being deemed as better for the UK economy. May then however attacked her core voters, stating that anyone with over £100k in assets will have to pay for their own home care or care home. Corbyn has added to the reduction in a conservative lead further by promising substantial changes to the education system from nursery care up to university. Slashing student fees has encouraged young voter support and the Tory lead has been cut to just 6 points. Political uncertainty, historically weakens the currency in question so I would expect further Sterling weakness as the election draws closer particularly if Corbyn gains further popularity. The last general election saw the pound weaken around 24hrs before the vote, I would expect the same to occur especially if a hung parliament seems likely. |

GBP/CHF - British Pound Swiss Franc, May 31(see more posts on GBP/CHF, ) |

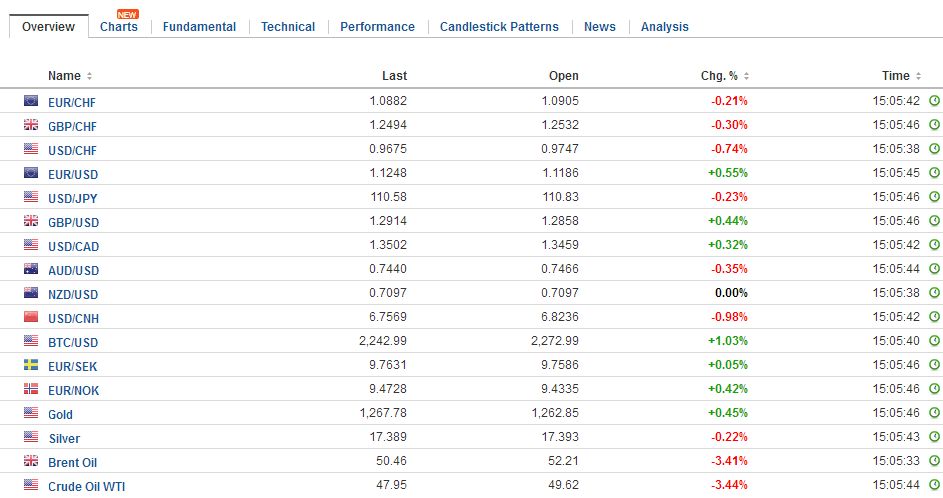

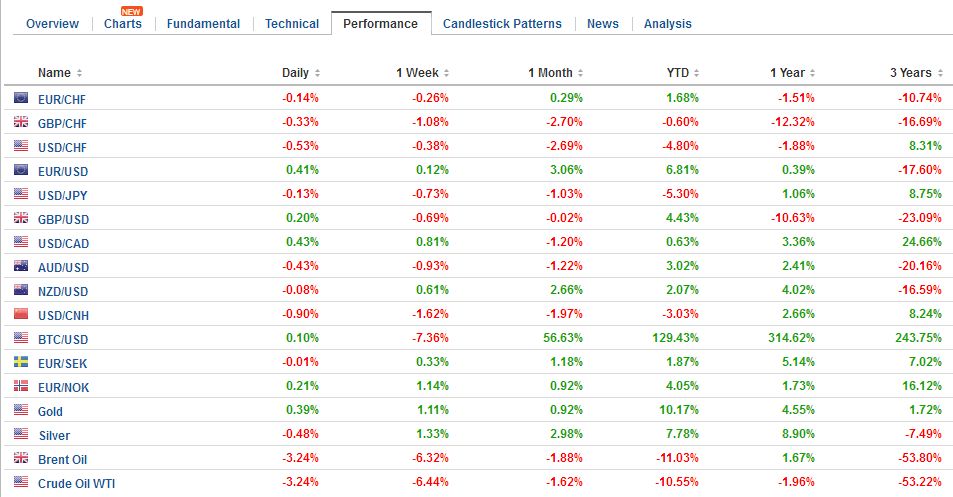

FX RatesProjections showing that the UK Tories could lose their outright majority in Parliament in next week’s election spurred sterling sales, which snapped a two-day advance. Polls at the end of last week showed a sharp narrowing of the contest, and this saw sterling shed 1.3% last Thursday and Friday. It recouped about 0.35% in the past two sessions before today’s 0.6% drop to $1.2770, the lowest level since April 21. It was May’s election to lose, and she is doing her best. A combination of reversal, a hapless campaign, against what by all reckoning was a weak opponent. The real risk may lie not so much May’s outright defeat, but rather the appearance of a weaker leader could haunt her term. One of the reasons that dollar is having difficulty gaining much traction, we argue, is that interest rates remain unexpectedly low. Fed Governor Brainard seemed to capture the sense in the markets at the moment. She said that while it may be appropriate to soon remove some accommodation (her signal of agreement for a hike in two weeks), she express some caution if inflation was not longer moving toward its target. The US 10-year yield tested 2.20% yesterday, having been near 2.60% when the Fed hiked in December 2016 and March 2017. |

FX Daily Rates, May 31 |

| The $1.2780 area corresponds to the 50% retracement objective of sterling’s advance since the election announcement. The 61.8% retracement is near $1.2720. Technical indicators favor additional losses. Technical indicators (e.g. MACDS, RSI) did not confirm sterling’s high from the middle of the month, creating bearish divergence. In a word, sterling’s technical tone was fragile before the threat of a “hung parliament” spurred the sales.

The dollar is trading within yesterday’s range against the yen. It has been confined to about a quarter of a yen both sides of JPY111.00. The JPY110.50 area is the 61.8% retracement objective of the dollar’s bounce from the middle of last month. The low from May 18 was near JPY110.25, which also corresponds to the 200-day moving average. Meanwhile, the yuan has strengthened. It is at its best level since last November, appreciating by 1% over the past three sessions. Spurred in part by a funding squeeze in Hong Kong, the offshore yuan (CNH) has rallied 1.5% in the same time. Note that China’s officials have also formally introduced a new element (counter-cyclical adjustment) to the black box of the fixing. The suspicion is that officials want a stronger yuan to deter capital outflows, and allow the kind of reforms that would address some MSCI concerns. Officials have also introduced a new benchmark fixings for one, seven, and 14-day reports. The euro is little changed against the dollar, though gaining on a trade-weighted basis. It is consolidating in about a third a cent below $1.12. Support is seen near $1.1160 on an intraday basis. The euro continues to be a major beneficiary of the unwinding of the so-called Trump trade. Investment advisers, banks, and the media have advocated equity investments in Europe over the US, and for all the fund flow trackers, the Dow Jones Stoxx 600, flat today, is up 0.8% this month. The S&P 500 is up 1.2% coming into today’s session. |

FX Performance, May 31 |

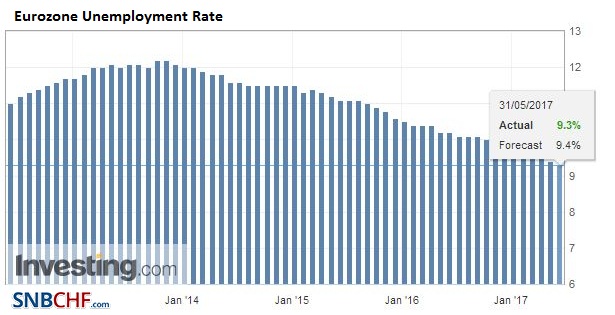

EurozoneThe ECB may formally recognize what has long been recognized by investors. The risk of lower rates has diminished considerably. The downside risks to the economy have materially eased. It was also reported that April unemployment fell to 9.3% from a revised 9.4% (was 9.5%) in March. It is the lowest rate since 2009. The economic expansion is a necessary but not sufficient pre-condition of the end the unorthodox monetary policy. Political risks have diminished, but clearly not entirely gone away, with German, Austrian, and probably Italian elections, this year, and the UK vote and Brexit, coupled protectionist and nationalist thrust of US policy. |

Eurozone Unemployment Rate, April 2017(see more posts on Eurozone Unemployment Rate, ) Source: Investing.com - Click to enlarge |

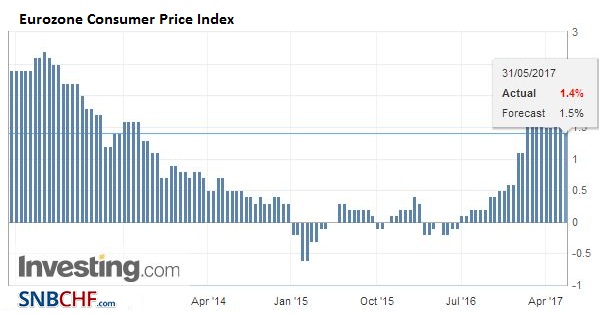

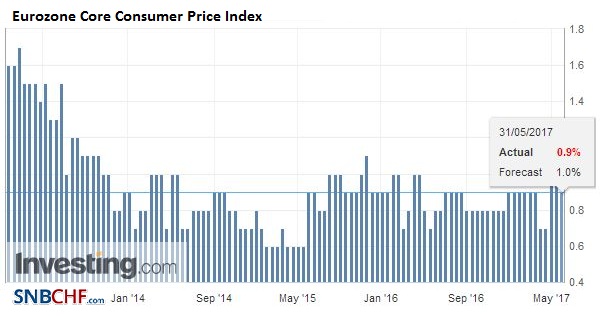

| The euro barely responded to the soft preliminary May CPI report. Germany, France, and Italy reported less price pressures than expected, which may have stolen whatever potential thunder today’s aggregate report had. |

Eurozone Consumer Price Index (CPI) YoY, May 2017(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| The headline pace fell to 1.4% from 1.9%, and the core eased to 0.9% from 1.2%. This underscores the points Draghi (and several other ECB officials) have made about the lack of a sustainable inflation path toward the target and the need for continued extensive monetary support. Even the Bundesbank’s Weidmann has acknowledged the need for support monetary policy presently. |

Eurozone Core Consumer Price Index (CPI) YoY, May 2017(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Germany |

Germany Unemployment Rate, May 2017(see more posts on Germany Unemployment Rate, ) Source: Investing.com - Click to enlarge |

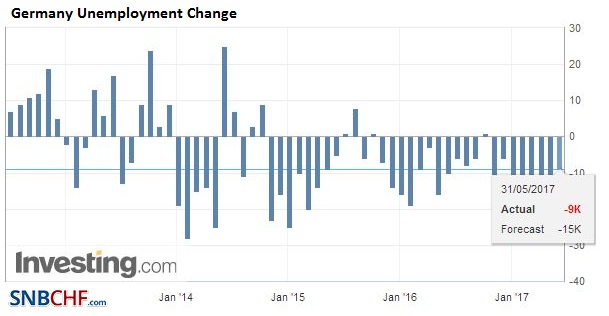

Germany Unemployment Change, May 2017(see more posts on Germany Unemployment Change, ) Source: Investing.com - Click to enlarge |

|

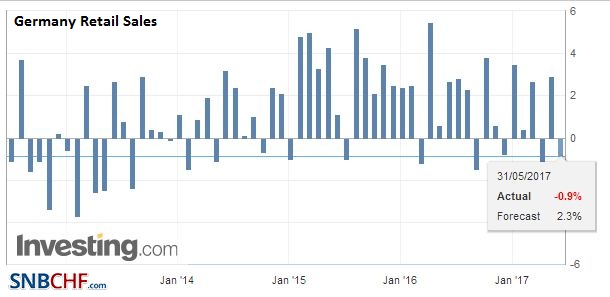

Germany Retail Sales YoY, April 2017(see more posts on Germany Retail Sales, ) Source: Investing.com - Click to enlarge |

|

Italy |

Italy Consumer Price Index (CPI) YoY, May 2017(see more posts on Italy Consumer Price Index, ) Source: Investing.com - Click to enlarge |

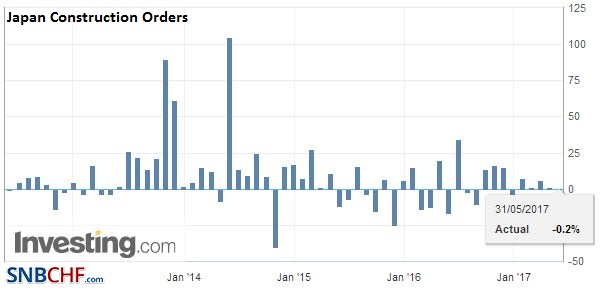

JapanThere were two notable economic reports from Asia. Japan reported its strongest rise in industrial production in six years, with a 4.0% rise in April. It followed a 1.9% decline in March. While rising manufacturing exports helped, auto production surged (16.3% year-over-year from a revised 4.5% pace in March). Housing starts were also stronger than expected. And the Japanese economy appears to have begun Q2 on firm footing. |

Japan Construction Orders YoY, April 2017(see more posts on Japan Construction Orders, ) Source: Investing.com - Click to enlarge |

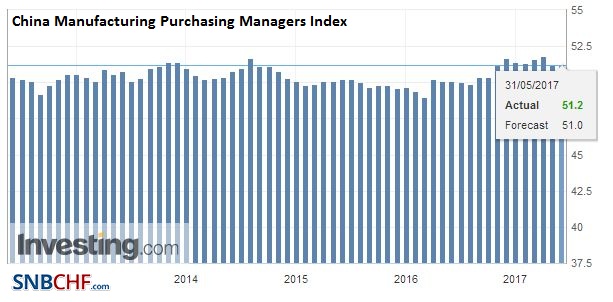

ChinaThe other report from Asia was China’s PMI. The manufacturing PMI was unchanged at 51.2, |

China Manufacturing Purchasing Managers Index (PMI), May 2017(see more posts on manufacturing, ) Source: Investing.com - Click to enlarge |

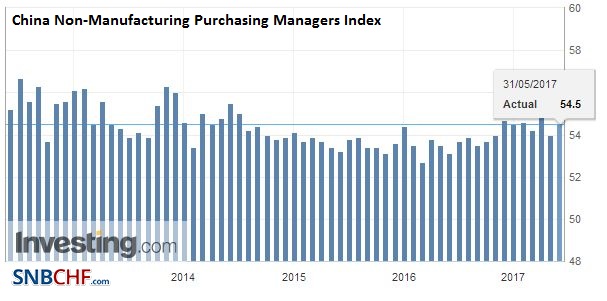

| while the non-manufacturing PMI rose from 54.0 to 54.5. One takeaway, ahead of the Caixin readings due tomorrow, is that the world’s second-largest economy may not be slowing as much as had been feared. On the margins, this may, in turn, help keep the debt concerns at bay a little longer. |

China Non-Manufacturing Purchasing Managers Index (PMI), May 2017(see more posts on China Non-Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

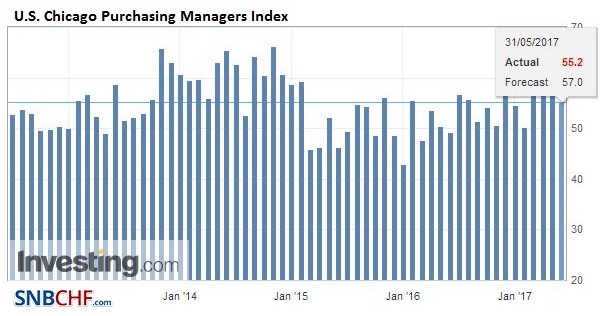

United StatesThe US reports the Chicago PMI, pending home sales, while the Fed releases the Beige Book. The EIA updates its monthly supply reports today. Late today, Brazil’s central bank is expected to cut the 11.25% Selic Rate. Many are looking for a 100 bp cut; there is some risk of a smaller move. |

U.S. Chicago Purchasing Managers Index (PMI), May 2017(see more posts on U.S. Chicago PMI, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$CNY,$EUR,$JPY,China Manufacturing PMI,China Non-Manufacturing PMI,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Eurozone Unemployment Rate,gbp-chf,Germany Retail Sales,Germany Unemployment Change,Germany Unemployment Rate,Italy Consumer Price Index,Japan Construction Orders,manufacturing,newslettersent,U.S. Chicago PMI