Swiss Franc |

EUR/CHF - Euro Swiss Franc, May 08(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge |

FX RatesThe US Dollar Index initially fell to its lowest level since mid-November to 98.50. It rebounded but stalled in front of the pre-weekend high near 99.00. This area must be overcome to lift the tone. Sterling stretched to a marginal high but faded in front of $1.30. Initial support is seen near $1.2940. The dollar traded to almost JPY113.15 before reversing lower. A break of JPY112.40 would see a re-test on JPY112.00. US 10-year Treasuries are hovering a little below 2.35%. A move above 2.38%-2.40% may be needed to help lift the dollar further against the yen. The US dollar staged a key downside reversal against the Canadian dollar before the weekend. There has been no follow through so far today. A break of CAD1.3625, the recent low, to signal another leg lower toward at least CAD1.3500. Initial resistance is pegged in the CAD1.3700-CAD1.3720 area. |

FX Daily Rates, May 08 |

| The euro initially opened higher in Asia following confirmation that Macron was elected the next president of France, but quickly fell below $1.0960 before bouncing back toward $1.10 only to be sold again in early Europe below the pre-weekend low near $1.0950. A break now of $1.0930 could signal a return to the lower end of the range seen since the first round of the French election near $1.0850-$1.0870.

While Asian shares rallied, with the MSCI Asia-Pacific Index breaking a three-day skid to close 1.4% higher, European shares are heavier, with the French CAC leading the way. The Dow Jones Stoxx 600 is off about 0.25% in late morning turnover, led by materials, industrials and financials. The CAC 40 is off 0.6% after closing at its highest level since early 2008 before the weekend. It has rallied more than 7% in the two weeks since the first round of the election. On the other hand, in the debt market, the French premium over Germany is slightly narrower today. South Korea goes to the polls tomorrow to elect a new president. South Korean shares rallied 2.3% today to new record highs. The South Korean won edged a little higher against the US dollar. Over the past five sessions, it has been the strongest currency in Asia, rising 0.55%. |

FX Performance, May 08 |

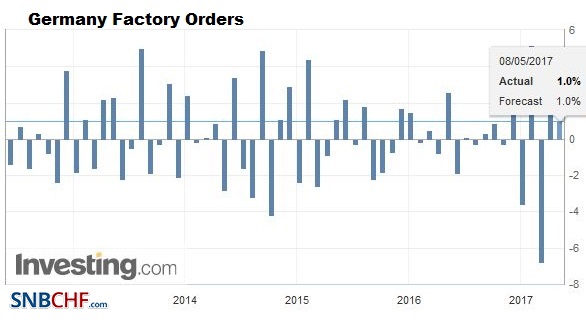

GermanySeparately, Germany reported March factory orders. They rose 1.0%, a bit more than expected and the February series was revised slightly higher. However, the risk is still on the downside for the industrial output report that will be released tomorrow. The strength of the factor orders derived from strong demand from the eurozone, where orders for capital equipment rose 7%, and consumer goods rose 20.5%. |

Germany Factory Orders, March 2017(see more posts on Germany Factory Orders, ) Source: Investing.com - Click to enlarge |

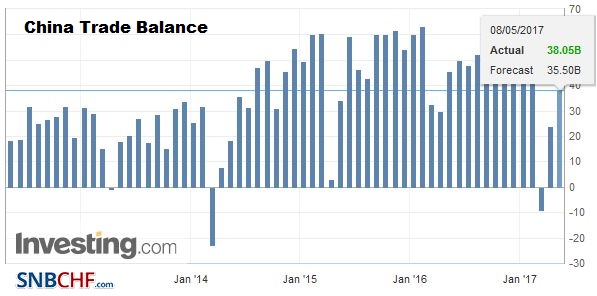

ChinaChina reported that its reserves rose by $20.4 bln in March. It was the third consecutive rise and the largest increase since April 2014. Part of this was due to valuation. Grant a conservative assumption that 25% of China’s $3.009 trillion in reserves in March were invested in euro-denominated assets. The euro rose nearly 2.3% against the dollar in April. This appreciated would have boosted the dollar value of Chinese reserves by over $16 bln. The dollar-bloc currencies depreciated in April, but we suspect PBOC holdings are marginal. We also note that the price of sovereign debt instruments, including US Treasuries increased as yields fell in April. China also reported April trade figures. Import and export growth was less than expected, but the trade surplus swelled to $38.05 bln from $23,92 bln in March. The average monthly surplus last year was near $42.5 bln and last April the surplus stood at $39.8 bln. |

China Trade Balance April 2017(see more posts on China Trade Balance, ) Source: investing.com - Click to enlarge |

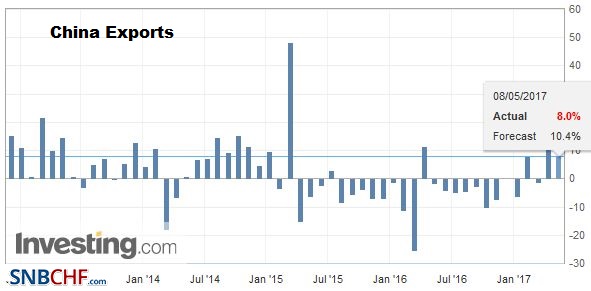

| Exports rose 8% year-over-year. The market expected an 11% increase. |

China Exports YoY, April 2017(see more posts on China Exports, ) Source: investing.com - Click to enlarge |

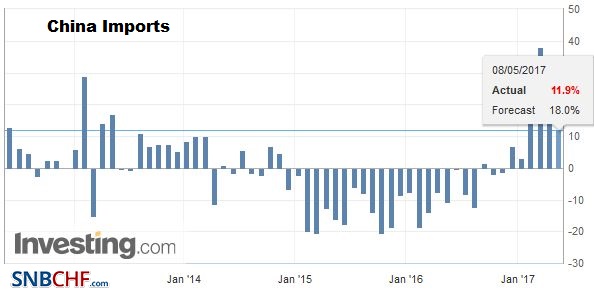

| Imports rose 11.9%. The median guesstimate in the Bloomberg survey was for an 18% increase.

Of note, China’s oil imports slowed, while coal imports hit a four-month high and refined copper imports fell to six-month lows. The slower pace of both imports and exports is being cited as evidence that the world’s second-largest economy’s growth spurt in Q1 may be easing and that the window of opportunity to curb some of the financial excesses may close quickly. |

China Imports YoY, April 2017(see more posts on China Imports, ) Source: Investing.com - Click to enlarge |

Eurozone

Le Pen drew 34% of the vote in France, and many are concerned about a divided France. Yet, those who wanted the UK to leave the EU carried the referendum by 52%-48%, and we are told that it’s a mandate in a non-binding vote. In addition, Trump lost the popular vote in the US 46% to 48%, and we have repeatedly been told is was a decisive election refuting the last eight years.

There was also an election in the German state of Schleswig-Holstein. The CDU picked up 1.2 percentage points on top of the 3.085 vote it got in 2011. The SPD, with its new leaders, slipped by more than three percentage points to 27.2%. One potentially important story is the resurrection of the Free Democrat Party. It had all most committed collective suicide over European issues several years ago, but it has slowly rebuilt. It received 11.5% of the vote in the state election compared with 8.2% in 2011. It makes a CDU-led state government possible and could help set the stage for a federal alliance if it does as well nationally. Next week there is the election in North Rhine-Westphalia, the largest German state and the home of the SPD leader Schulz.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$CAD,$CNY,$EUR,$JPY,China Exports,China Imports,China Trade Balance,Daily FX,EUR/CHF,Germany Factory Orders,newslettersent