Monthly Archive: April 2017

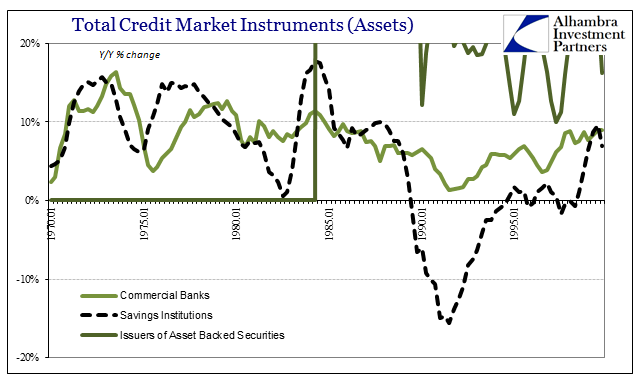

We Need To Define The ‘Shadows’, And All Parts of Them; or, ‘Rising Dollar’ Kills Another Recovery Narrative

JP Morgan’s CEO Jamie Dimon caused a stir yesterday with his 45-page annual letter to shareholders. The phrase that gained him so much widespread attention was, “there is something wrong with the US.” Dimon mentioned secular stagnation and correctly surmised it was the right idea if for the wrong reasons. He then gave his own which included a litany of globalist agenda items, including not enough access to mortgages.

Read More »

Read More »

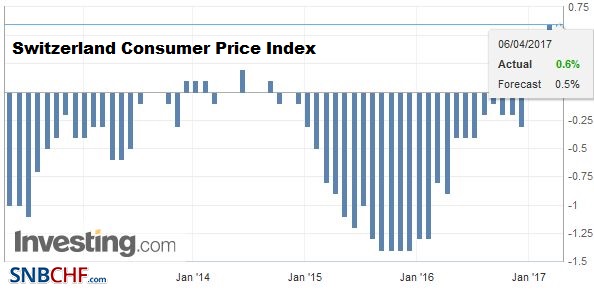

Swiss Consumer Price Index in March 2017: Up +0.6 percent against 2016, +0.2 percent against last month

The consumer price index (IPC) increased by 0.2% in March 2017 compared with the previous month, reaching 100.7 points (December 2015=100). Inflation was 0.6% compared with the same month the previous year. These are the results of the Federal Statistical Office (FSO).

Read More »

Read More »

Some UN consultants thought their income was tax free. They were wrong.

Some United Nations consultants haven’t paid taxes on their income, thinking it was exempt. When the tax authorities catch up with them they’ll risk paying back taxes and fines. As a general rule, foreign UN functionaries are not required to pay local taxes on their income. On the other hand UN consultants must.

Read More »

Read More »

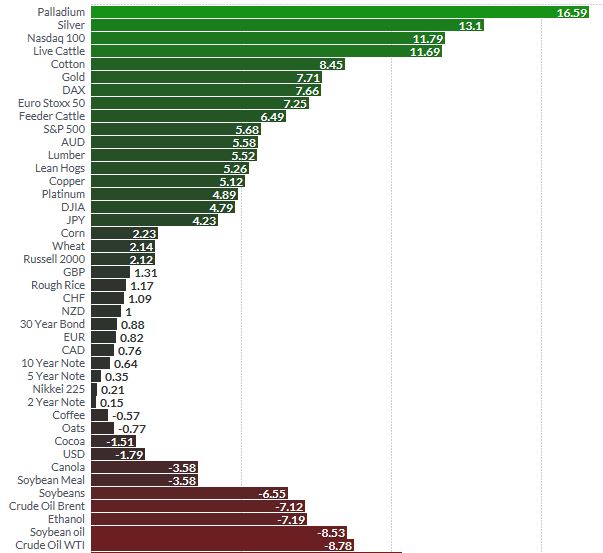

Gold, Silver Best Performing Assets In Q1, 2017

Gold, silver two of the best performing assets in the first quarter of 2017 with gains of 8% and 14% respectively. Gold outperforms benchmarks – S&P 500 up 6%, MSCI (All Country World Index) up 6.4% (see tables). Nasdaq and German DAX rise 11.8% and 7.6%. Silver best performing currency in quarter. Five best performing currencies in Q1 are in order – silver, bitcoin, Mexican peso, Russian ruble and gold.

Read More »

Read More »

Euro Saves Germany, Slaughters the PIGS, & Feeds the BLICS

The change in nations Core populations (25-54yr/olds) have driven economic activity for the later half of the 20th century, first upward and now downward. The Core is the working population, the family forming population, the child bearing population, the first home buying, and the credit happy primary consumer. Even a small increase (or contraction) in their quantity drives economic activity magnitudes beyond what the numbers would indicate.

Read More »

Read More »

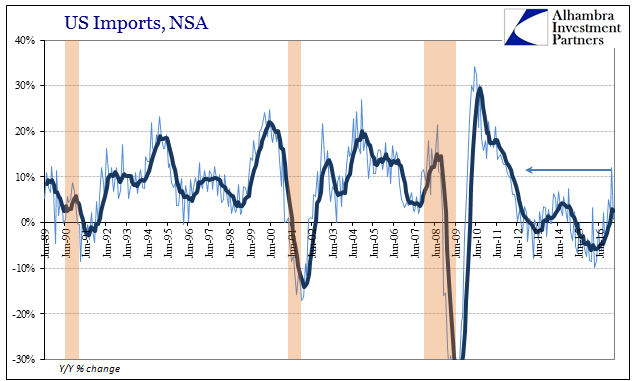

February US Trade Disappoints

The oversized base effects of oil prices could not in February 2017 push up overall US imports. The United States purchased, according to the Census Bureau, 71% more crude oil from global markets this February than in February 2016. In raw dollar terms, it was an increase of $7.3 billion year-over-year. Total imports, however, only gained $8.4 billion, meaning that nearly all the improvement was due to nothing more than the price of global oil.

Read More »

Read More »

A fifth of Swiss can’t cope with an unexpected expense of 2,500 francs

In 2015, 21.7% of Switzerland’s population was unable to cover an unexpected expense of CHF 2,500 within a month, says a report from the Swiss Federal Statistics Office. Single parent families were the least able to cope with 46.1% of them falling into this camp. Single parent families were followed by single people under 65 (27.1%) and two-parent families (24.0%).

Read More »

Read More »

FX Daily, April 05: Dialing it Up on Hump Day

he dollar is practically unchanged against the euro and yen in the first two sessions of the week. The pace can be expected to pick up starting Wednesday. Although the euro slipped through $1.0650, it was not sustained, and on Monday and Tuesday, the euro finished near its highs.

Read More »

Read More »

Systemic Depression Is A Clear Choice

Looking back on late 2015, it is perfectly clear that policymakers had no idea what was going on. It’s always easy, of course, to reflect on such things with the benefit of hindsight, but even contemporarily it was somewhat shocking how complacent they had become as a global group.

Read More »

Read More »

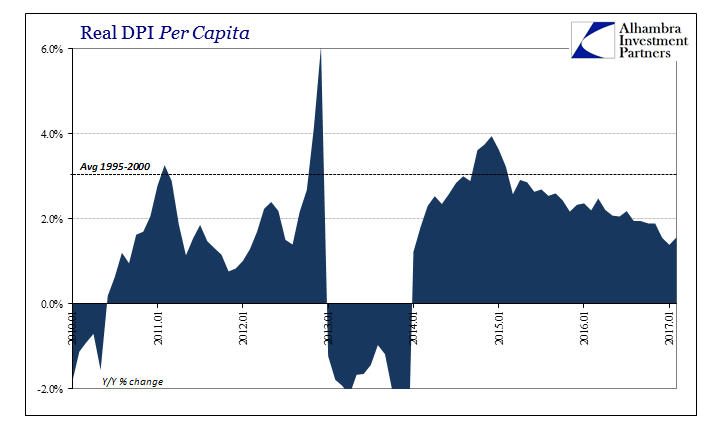

Incomes Always Deviate Negative

Personal Income growth in February 2017 was more mixed than it had been of recent months. Nominal Disposable Per Capita Income increased 3.73% year-over-year, while in real terms Per Capita Income was up 1.57%. For the former, that was among the better monthly results over the past year, while the latter was near the worst.

Read More »

Read More »

The American Empire and Economic Collapse

Despite widespread optimism among libertarians, classical liberals, non-interventionists, progressive peaceniks and everybody else opposed to the US Empire that some of its murderous reins may finally be pulled in with the election of Donald Trump, it appears that these hopes have now been dashed.

Read More »

Read More »

Inclusion in SDR Does Not Spur Official Demand for the Yuan

China's share of global reserves is in line with expectations prior to its inclusion in the SDR. Three factors influencing allocated reserves - valuation, portfolio decisions, and China's gradual inclusion in allocated reserves. The Swiss franc's as a reserve asset diminished, but the "other" category appeared robust.

Read More »

Read More »

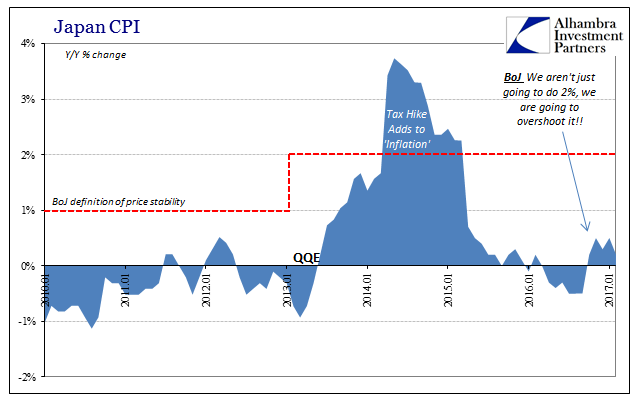

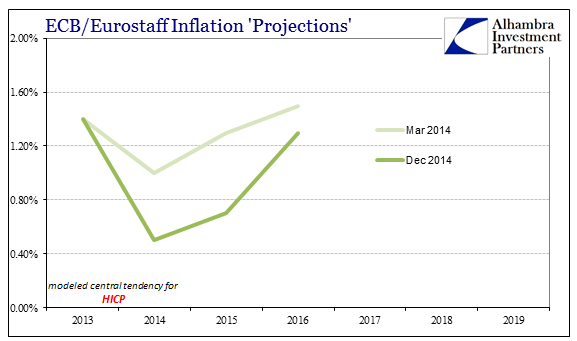

Consensus Inflation (Again)

Why did Mario Draghi appeal to NIRP in June 2014? After all, expectations at the time were for a strengthening recovery not just in Europe but all over the world. There were some concerns lingering over currency “irregularities” in 2013 but primarily related to EM’s and not the EU which had emerged from re-recession. The consensus at that time was full recovery not additional “stimulus.” From Bloomberg in January 2014:

Read More »

Read More »

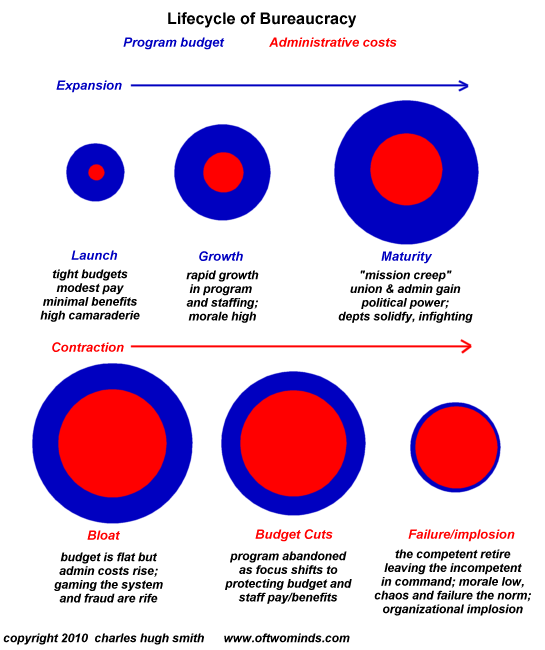

When the “Solutions” Become the Problems

Those benefiting from these destructive "solutions" may think the system can go on forever, but it cannot go on when every "solution" becomes a self-reinforcing problem that amplifies all the other systemic problems.

Read More »

Read More »

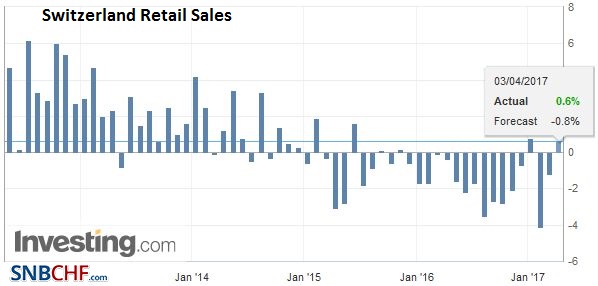

Swiss Retail Sales, February: +0.5 percent Nominal and +0.6 percent Real

Turnover in the retail sector rose by 0.5% in nominal terms in February 2017 compared with the previous year. However, excluding turnover from service stations, retail turnover fell by 0.3%. Seasonally adjusted, nominal turnover rose by 0.9% compared with the previous month. These are provisional findings from the Federal Statistical Office.

Read More »

Read More »

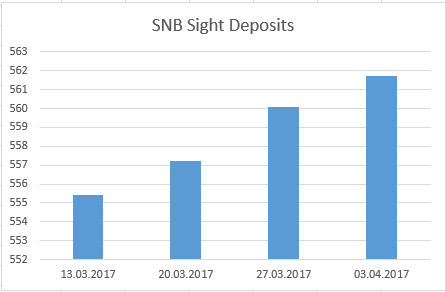

Weekly Sight Deposits and Speculative Positions: SNB interventions are rising again

The SNB intervenes for 1.6 bn CHF at EUR/CHF 1.07 - 1.0750. This is less than previously.

Read More »

Read More »

Weekly Speculative Positions: Last Reduction of Euro Short Positions?

Speculators continued to reduce their net short euro exposure until March 28. Apparently they do not understand the difference between core inflation and the headline figure.

Read More »

Read More »

FX Weekly Preview: The Macro Backdrop at the Start of the Second Quarter

The macroeconomic fundamentals have not changed much in the first three months of the year. The US growth remains near trend, the labor market continues to improve gradually, both headline and core inflation remain firm, and the Federal Reserve remains on course to hike rates at least a couple more times this year, even though the market is skeptical. The uncertainty surrounding US fiscal has not been lifted, and it may not be several more months.

Read More »

Read More »