Monthly Archive: April 2017

It Was And Still Is The Wrong Horse To Bet

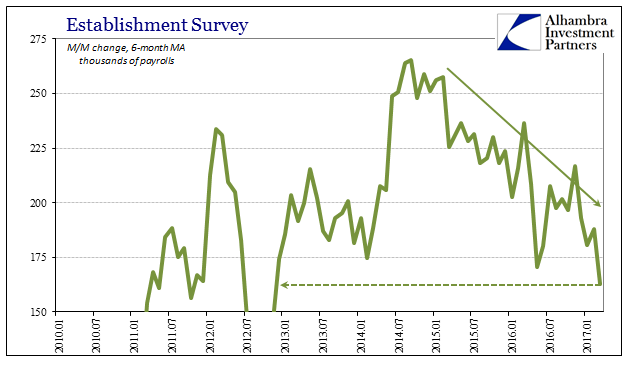

The payroll report disappointed again, though it was deficient in ways other than are commonly described. The monthly change is never a solid indication, good or bad, as the BLS’ statistical processes can only get it down to a 90% confidence interval, and a wide one at that. It means that any particular month by itself specifies very little, except under certain circumstances.

Read More »

Read More »

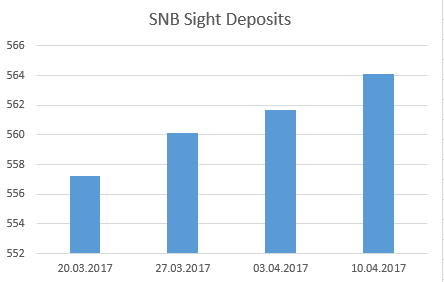

Weekly SNB Interventions and Speculative Positions: Back to 2.4 bn Intervention per Week

SNB sight deposits changed by 2.4 bn last week, hence the SNB intervened for this amount. This value is a movement back to the weekly intervention trend. We expect a further downtrend of EUR/CHF in the next 2 years.

Read More »

Read More »

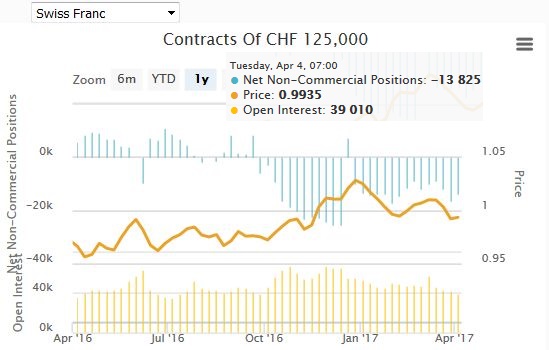

Weekly Speculative Positions (April 4 Data): Reduction in CHF Net Shorts

Speculators continued to reduce their net short euro exposure until March 28. Apparently they do not understand the difference between core inflation and the headline figure. In the last week, finally they increased their Euro shorts again.... and reduced their CHF shorts.

Read More »

Read More »

FX Daily, April 10: Dollar Narrowly Mixed at Start of Holiday Week

The US dollar is narrowly mixed after a brief attempt in Asia to extend its pre-weekend gains fizzled, and a consolidative tone has emerged. The news stream is light and largely limited to the current Japanese account and the Sentix survey from Europe.

Read More »

Read More »

Emerging Markets Preview for the Week Ahead

EM FX ended the week on a soft note, as the weaker than expected US jobs data was unable to derail the dollar’s rally. For the week, the worst performers were ZAR (-3%), TRY (-2.5%), and RUB (-2%). CZK bucked the trend, rising after the CNB exited the cap. This week, higher inflation readings in the US could draw market focus back to Fed tightening, which would be negative for EM.

Read More »

Read More »

FX Weekly Preview: A New Phase Begins

There were no celebrations; no horn or trumpets, nary a sound, but an important shift took place last week. The shift was signaled by two events. The first was the US strike on Syria, and the second was investors' willingness to look past Q1 economic data.

Read More »

Read More »

FX Weekly Review, April 03-08: Dollar Recovery Can Continue, 10-year Yield Set to Rise

The US dollar appreciated against most of the major currencies last week. The Japanese yen was the chief exception. It rose about 0.5% as US yields remained heavy and equities were mostly softer. The Dollar Index did not fall in any session last week. It has had one losing session over the past nine, and that was the last day in March when the Dollar Index slipped less than 0.1%. It finished the week a bit above thee 61.8% retracement objective of...

Read More »

Read More »

End of EUR/CZK peg: Czech National Bank

The Czech National Bank (CNB) ended the EUR/CZK floor today. Timing was a little earlier than expected, but rising inflation and a robust economy warranted it. We think it’s too soon to talk about a rate hike, as we expect the koruna to overshoot to the strong side.

POLICY OUTLOOK

Price pressures are rising, with CPI accelerating to 2.5% y/y in February. March data will be reported April 10, with consensus at 2.6% y/y. If so,...

Read More »

Read More »

Time to Hedge State Reserve Funds with Gold?

Financially prudent individuals set aside surplus funds to protect against unforeseen expenditures. This way, when faced with loss of income, house repairs, car trouble, or anything else, they will have a buffer against unanticipated downturns. In the same vein, almost every state in the United States has established a “savings account” for government operations.

Read More »

Read More »

US Jobs: Who Carries The Burden of Proof?

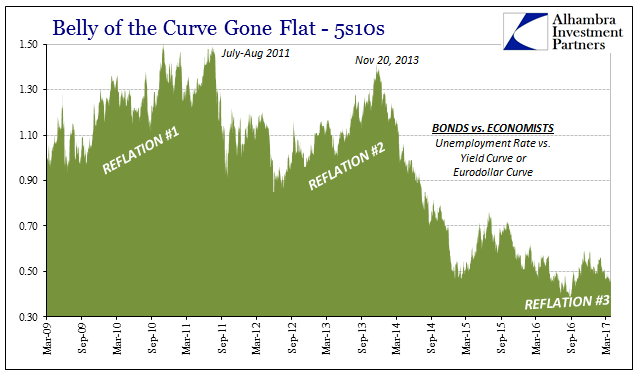

The idea that interest rates have nowhere to go but up is very much like saying the bond market has it all wrong. That is one reason why the rhetoric has been ratcheted that much higher of late, particularly since the Fed “raised rates” for a third time in March. Such “hawkishness” by convention should not go so unnoticed, and yet yields and curves are once more paying little attention to Janet Yellen.

Read More »

Read More »

US Jobs Growth Disappoints

The US jobs growth slowed considerably more than expected in March and the disappointment pushed the dollar and equities initially lower. The US created 98k jobs in March, well below market expectations for around 175k jobs. Adding insult to injury, revisions to the January and February data took off another 38k job.

Read More »

Read More »

The Swiss municipalities with too many second homes – latest figures

On 11 March 2012, Swiss voted to accept a law restricting the construction of secondary residences, homes that are only used occasionally by owners living somewhere else. Under the law no more than 20% of a municipality’s housing can be second homes. Those with percentages above 20% run into building restrictions.

Read More »

Read More »

Emerging Markets: What has Changed

Reserve Bank of India surprised markets with the start of the tightening cycle. The Czech National Bank (CNB) ended the EUR/CZK floor. Israeli central bank said it won’t hike rates until Q2 2018. Both S&P and Fitch cut South Africa’s rating one notch to sub-investment grade BB+. Moody's put South Africa’s Baa2 rating on review for a downgrade.

Read More »

Read More »

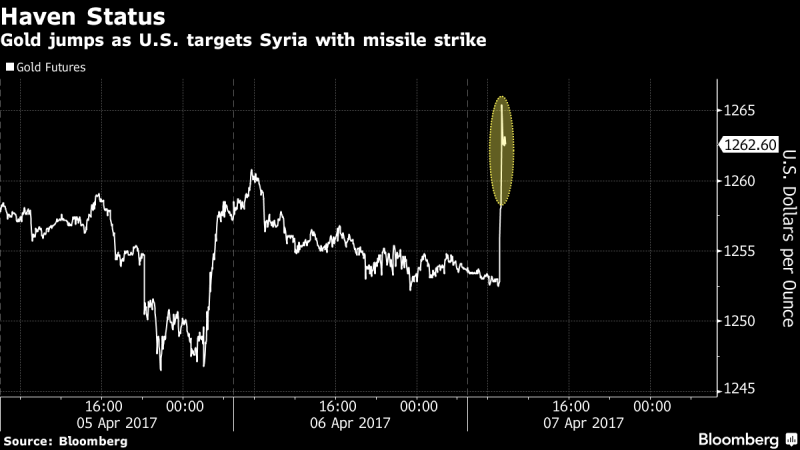

Gold Silver Oil Spike After U.S. Bombs Syria

Gold silver oil spike after U.S. bombs Syria. Gold and silver spike 1% as oil rises 1.4%. Gold breaks 200 day moving average, 4th week of gains. Stocks fall after U.S. strikes in Syria rattle markets. U.S. missiles hit airbase; Lavrov says no Russian casualties; Russia deploys cruise missile frigate to Syria.

Read More »

Read More »

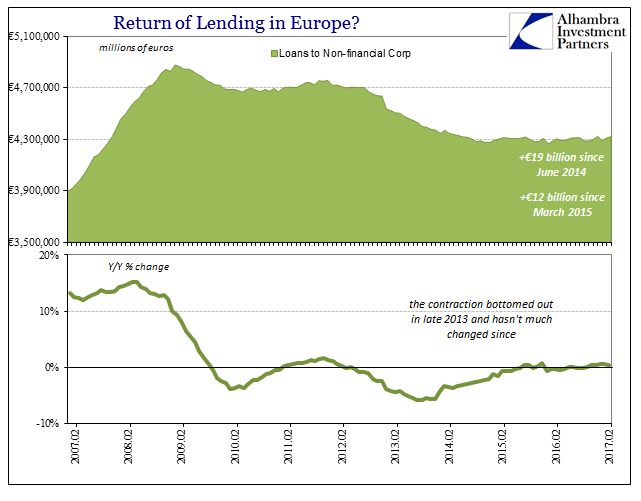

Ultra-Loose Terminology, Not Policy

As world “leaders” gathered in Davos in January 2016, they did so among financial turmoil that was creating more economic havoc than at any time since the Great “Recession.” Having seen especially US QE as the equivalent of money printing, their focus was drawn elsewhere to at least attempt an explanation for the contradiction.

Read More »

Read More »

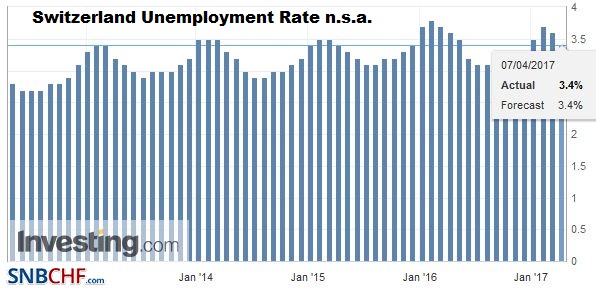

Switzerland Unemployment in March 2017: Decreased from 3.6 percent to 3.4 percent, seasonally adjusted unchanged at 3.3 percent

Registered unemployment in March 2017 - According to the State Secretariat for Economic Affairs (SECO) surveys, 152,280 unemployed persons were registered at the regional employment services centers (RAV) at the end of March 2017, 7,529 less than in the previous month. The unemployment rate thus fell from 3.6% in February 2017 to 3.4% in the reporting month.

Read More »

Read More »

Short Note on US Employment Report

The US jobs data is notoriously difficult to accurately forecast consistently. I do not claim to do so now. My intent is more modest. It is simply to point out why I there is risk that the jobs data is disappointing, especially after the stronger than expected ADP estimate.

Read More »

Read More »

Paris says no to sand from Swiss company that bid for Trump wall

The French-Swiss group, described as “disreputable” by the Ville de Paris, will not be supplying sand to the city of Paris this summer. Paris Plages (Beaches), a project that creates temporary beaches of sand along the banks of the river Seine every summer, said it would take no more sand from LafargeHolcim because of its willingness get involved in Donald Trumps’s disastrous Mexican wall project.

Read More »

Read More »