A Simple WayIn their efforts to beat the market, many investors are spending a lot of time searching for rare undiscovered gems or sophisticated trading rules. There is actually a simpler way. I will show below how one could have beaten the market by a sizable margin over approximately the past 90 years – with only two trades per month, while being invested only one third of the time and without employing any leverage. |

|

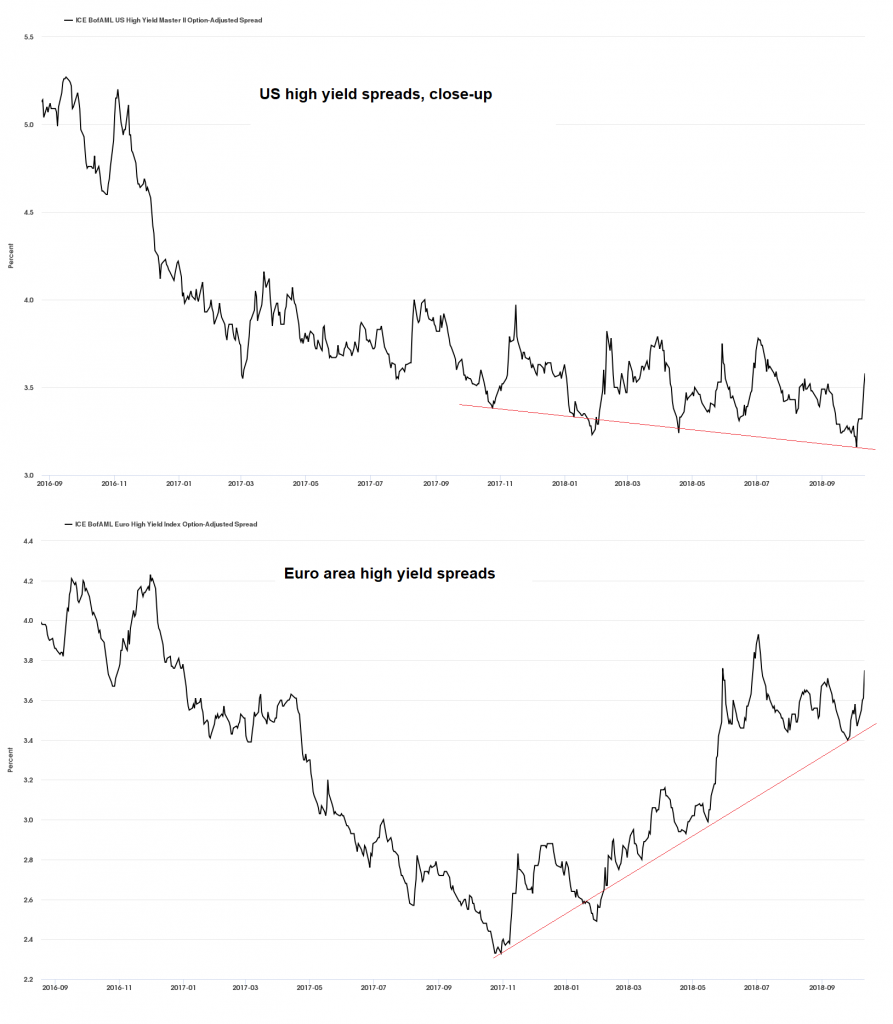

Gains are Only Generated Around the Turn of the MonthTake a look at the following chart. It shows the capital gains delivered by the S&P 500 Index since 1928, depending on the days of the month in which a position in it was held. The blue curve shows the cumulative return generated by the index between the 26th of every month and the 5th of the subsequent month. The red “curve” – which actually looks suspiciously like the x-axis – shows the return generated by the index during the rest of the time, i.e., between the 6th and the 25th of every month. Cumulative return of the S&P 500 Index around the turn of the month (blue line) and the rest of the time (red), indexed (100), 1928 to 2017 As can be seen, the time period around the turn of the month outperformed the rest of the time rather handily. The average gain achieved during the profitable time period was 7.60 percent, while an average loss of -1.86 percent was recorded in the rest of the time. |

Turn of the month, Rest of the month compared |

Conclusion

The phenomenon is aptly named the “turn-of-the-month effect”. It is tied to payment streams around the end of the month, such as salary payments and pension plan contributions.

The calculation also shows that calendar-related effects can remain stable and profitable for a great many years. Take advantage of them!

Dimitri Speck is the founder of Seaonax and Head Analyst of Seasonal Insights. He is a well-known financial analyst and book author and the former manager of Stay-C, one of the most successful commodity funds ever listed in Germany.

Chart by: Seasonax

Full story here Are you the author? Previous post See more for Next post

Tags: newslettersent,The Stock Market

1 comments

orkydea

2017-02-24 at 11:44 (UTC 2) Link to this comment

Do your caculations are based on Open-of-day trading or Close-of-day trading? In other words do you buy on Open of the 26th or on Close of the 26th. And you sell on Open of 5th or on Close of 5th? I guess all on Close time, but anyway, just asking ))