Swiss Franc |

EUR/CHF - Euro Swiss Franc, February 17(see more posts on EUR/CHF, ) |

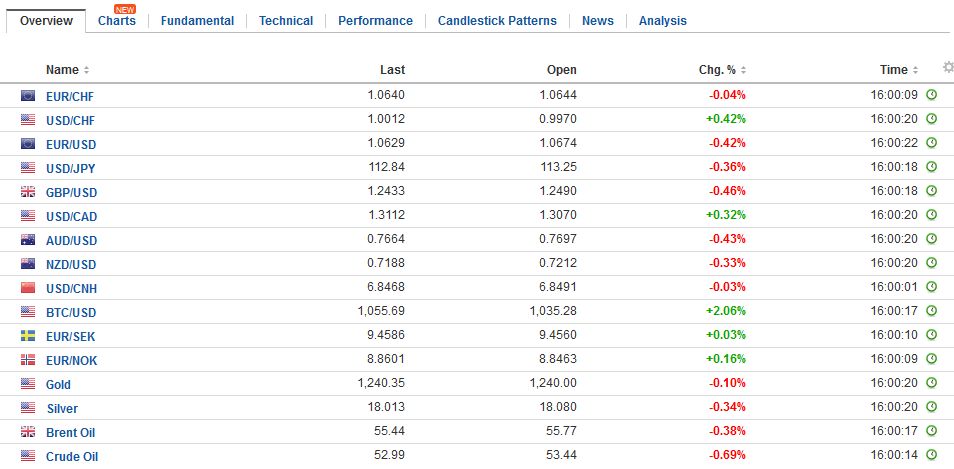

FX RatesThe US dollar is finishing the week on a steady to firmer note against the major currencies but the Japanese yen. The softer yields and weaker equity markets often are associated with a stronger yen. For the week as a whole, the dollar is mostly lower, though net-net it has held its own against sterling, the euro and Canadian dollar. An important takeaway from this week is the combination of mostly firmer US data (including February Fed surveys, and January CPI, industrial output and retail sales) coupled with clear indications from the Fed’s leadership (Yellen, Fischer and Dudley) that normalization process is likely to accelerate this year (from 2015 and 2016) but remain gradual. The implied yield of the March Fed funds futures rose a single basis point to 69 bp, while the implied yield on the June contract rose 3.5 bp to 85.5. The implied yield on the December contract rose five bp to 115.5. Bloomberg calculates the odds that the Fed funds target range at the end of this year is 1.25%-1.50% (three hikes) is 26.5% up from 23.9% at the end of last week. One implication is that there is more scope to discount a third hike, which ostensibly would be supportive for the dollar. Two more pieces of the European macro picture have emerged. First, the record of the ECB meeting suggested an internal compromise or trade-off is possible. On the one hand, the Eurosystem is authorized to buy instruments yielding less than theminus40 bp deposit rate. There does, in fact, seem to be a few purchases along those lines. However, it apparently does not set right with some members. |

FX Daily Rates, February 17 |

| The meeting’s record confirmed what many have suspected, that “limited and temporary” deviations from the capital key in the asset purchases. In effect, either Germany buys instruments below the deposit rate, or the Euro system does not stick strictly to the capital key. The implication was good for the bonds of France, Spain, and Italy. They advanced smartly yesterday, with spreads over Germany narrowing. Today the move has been pared.

The second development involves the IMF participating in the Greek aid program, which was seen as a condition demanded especially by Germany and the Netherlands. However, there is an impasse. The non-European members of the IMF board argue that Greece’s debt is not sustainable, and therefore the IMF should not contribute funds. The European board members argue that the IMF is too pessimistic. Simply put, the question is who blinks first. It seems that it will not be the IMF. Rather, virtue will be attempted to be made from necessity and ahead of the spate of elections, European officials can claim that it doesn’t need the IMF’s funds; that Europe can take care of European problems. This is not yet the official stance, but there are some signals of this direction. The European finance ministers meet at the start of next week, and a Greek deal is expected to remain elusive. It is seen as the last window until May because the Dutch parliament, which needs to approve an agreement, will be dissolved shortly ahead of next month’s election, and then the French election in April-May. Greece does not need the funds until July. |

FX Performance, February 17 |

EurozoneThere have been two economic reports today of note. The first is Sweden’s inflation. This is important because the Riksbank has been engaged in QE and has negative deposit rates. At this week’s meeting, the Riksbank left policy on hold and expressed concern that the currency’s strength would counter the progress made to reverse the deflation. January consumer prices fell 0.7%, which was in line with expectations, but the year-over-year pace eased to 1.4% from 1.7%. The median forecast was for 1.5%. The underlying rate, which used fixed rate mortgages for the calculation also fell 0.7%, but the year-over-year pace slipped to 1.6% from 1.9%. This spurred a rally in Swedish government bonds, where the 10-year yield fell 6-7 bp. The rally offset the weakness earlier this week, and the benchmark 10-year yield eased four bp on the week to 65 bp. |

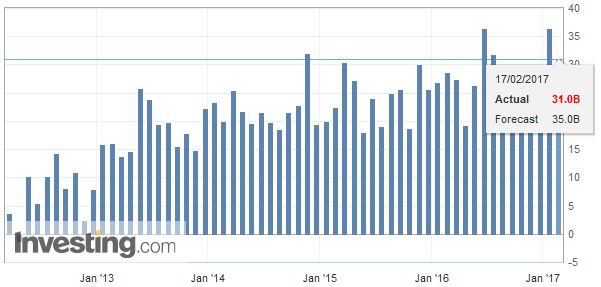

Eurozone Current Account, January 2017(see more posts on Eurozone Current Account, ) Source: Investing.com - Click to enlarge |

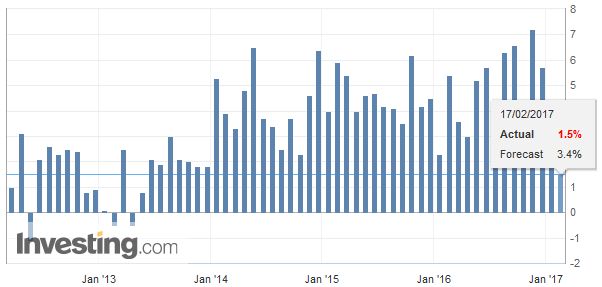

United KingdomThe second economic report was also disappointing. After sizable declines in December retail sales (-1.9% including gasoline and -2.0% excluding it), economists had expected a recovery in January. Instead, UK consumers stayed at home. Retail sales fell 0.3% including gasoline and -0.2% without it. And, adding insult to injury, the December series was revised lower to show a 2.1% and 2.2% decline respectively. The year-over-year pace fell to 1.5% from 4.1% at the headline level and 2.6% from 4.7% excluding petrol. |

U.K. Retail Sales YoY, January 2017(see more posts on U.K. Retail Sales, ) Source: Investing.com - Click to enlarge |

Gilt yields fell, with the 10-year slipping six basis points to 1.2%. The yield is off nine basis points on the week, easily the most among the high income countries. Sterling had been trading near $1.25 in Asia and slipped a little in early European turnover. The news pounded sterling below $1.24, though the initial thrust held the week’s low set on Wednesday near $1.2380. With today’s losses, sterling is set to be the weakest performer among the major currencies, losing about 0.8% on the week (at ~$1.24).

The North American session features the US Leading Economic Indicators and Canada’s international securities transactions. The market does not appear particularly sensitive to either report. There are no Fed officials scheduled to speak. The US is on holiday on Monday, and this means liquidity may drop off more than usual what Europe closes. Of note, there are several chunky option maturities struck near current spot levels that could impact activity today. In the euro, these are stuck at $1.06 (1.6 bln euros), $1.0625 (425 mln euros), $1.0685 (1.2 bln euros) and $1.07 (734 mln euros). In the yen, the relevant strikes are JPY112.50 ($385 mln), JPY112.90 ($310 mln), JPY113.00 ($1.2 bln) and JPY113.45 ($595 mln). In sterling, there is a $1.2390 strike for GBP425 mln). In the Australian dollar, there is a $0.7700 strike for A$260 mln. Lastly, in the Canadian dollar, there are strikes between CAD1.3050 and CAD1.3070 for a little more than $1 bln.

Yesterday’s decline in the S&P 500 was only the second decline this month. It was the first loss in eight sessions, and the loss was minor (less than 0.1%). Still, it set the tone for Asia, where the MSCI Asia Pacific Index slipped 0.25%, but finished 0.7% higher on the week, for the fourth successive weekly advance. Chinese shares that trade in Hong Kong lost 0.9% to pare this week’s gains to 2.3% after last week’s 4.5% advance. European shares are also heavy, nursing a 0.6% loss to shave this week’s gain to a vulnerable 0.2%.

The dollar’s pullback since mid-week has tested retracement objectives of the recent run. The $1.0675 level in the euro represents the 50% retracement target of the decline from February 2. The similar level of the Dollar Index is found near 100.50. The dollar is heavier against the yen. It has retraced a little more than 61.8% of its gains from the February 7 low near JPY111.60 to nearly JPY115 on February 15. That retracment is about JPY112.90. Elsewhere, the Australian dollar finished above the $0.7700 cap on February 15 but the disappointing employment data yesterday saw it close back within its range. It is trading heavier today but is finding support near $0.7660.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next post

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,EUR/CHF,Eurozone Current Account,newslettersent,SPY,U.K. Retail Sales