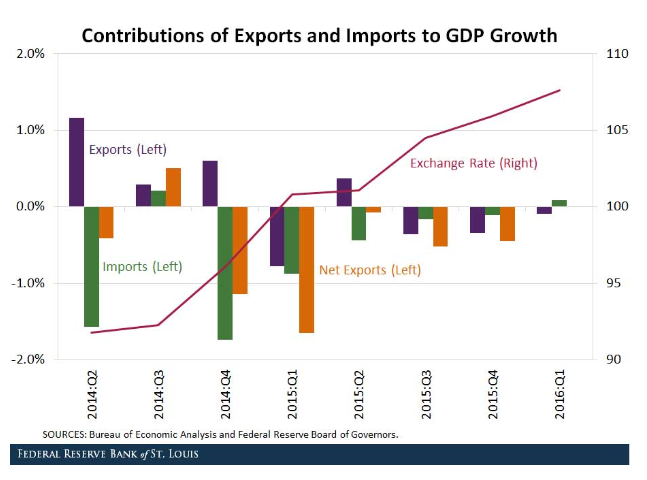

| Investors appreciate that a strong dollar can impact US growth through the net export component of GDP. The dollar’s appreciation can push up the price of exports and lower the cost of imports. The St. Louis Fed took a look at how the strong dollar from 2014 to the beginning of 2016 impacted the net export function of GDP.

It is clear that a strong dollar in this period was associated with a drag on growth from net exports. Of the two-year period, the St. Louis Fed reviewed, trade contributed positively to growth in only one quarter. The review found that the impact the strongest in the first half of the appreciation period reviewed. In the Q4 14 and Q1 15, net export took 1.14% and 1.65% respectively from GDP growth. As the dollar advance continued, the drag on net exports diminished. In Q4 15, net exports took 0.5% off GDP even though the dollar rose another 10%. The St. Louis Fed took another step. This Great Graphic that they produced drills into the net export functions components, exports, and imports, to better understand how the rising dollar impact trade. The conclusion is that the dollar’s appreciation impacts imports more than exports. The report found that the cumulative impact of imports was to shave GDP by 4.6%, while the cumulative impact of exports was actually slightly positive (0.85%). The broad trade-weighted dollar index, tracked by the Federal Reserve, rose in seven of the last eight months of 2016. If the relationships do not change, the dollar’s appreciation will likely weigh on GDP more through an increase in imports than the decline in exports. |

Contributions of Exports and Imports to GDP Growth |

Full story here Are you the author? Previous post See more for Next post

Tags: #USD,Great Graphic,newslettersent,Trade