Swiss Franc |

EUR/CHF - Euro Swiss Franc, January 16(see more posts on EUR/CHF, ) |

FX RatesThe euro has been sold to $1.0580 in the European morning, a cent lower from the pre-weekend high. In addition to the drag from sterling, the euro appears to have been sold in response to the interview in two European papers of the next US President. Among other things, Trump reported claimed that NATO was obsolete and that other countries will leave the European Union, which is largely a German project. After being critical of US and Japanese automakers who export into the US, Trump turned on BMW. Trump also suggested he could be open to the idea of lifting sanctions on Russia in exchange for a deal on nuclear weapons. |

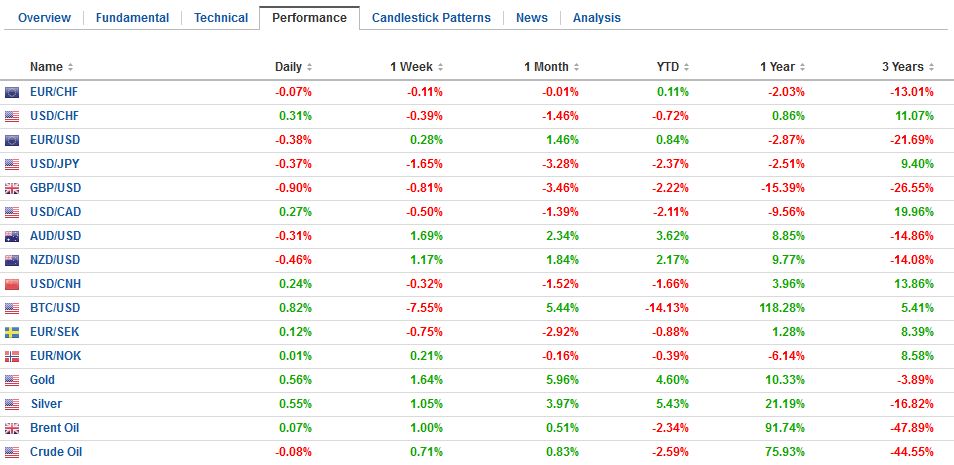

FX Performance, January 16 2017 Movers and Shakers Source: Dukascopy - Click to enlarge |

| Last Wednesday and Thursday, the euro recovered from about $1.0455 to $1.0685. The $1.0570 represents a 50% retracement, and the 61.8% retracement is near $1.0540. With US markets on holiday, the intraday technicals warn of the likelihood of consolidation now.

The dollar was sold to almost JPY113.60 in Asia, its lowest level in nearly a month. The greenback staged a recovery but faltered near JPY114.50 in Europe. The intraday technicals warn that the market may be cautious until clearer signs emerge from the US Treasury market. |

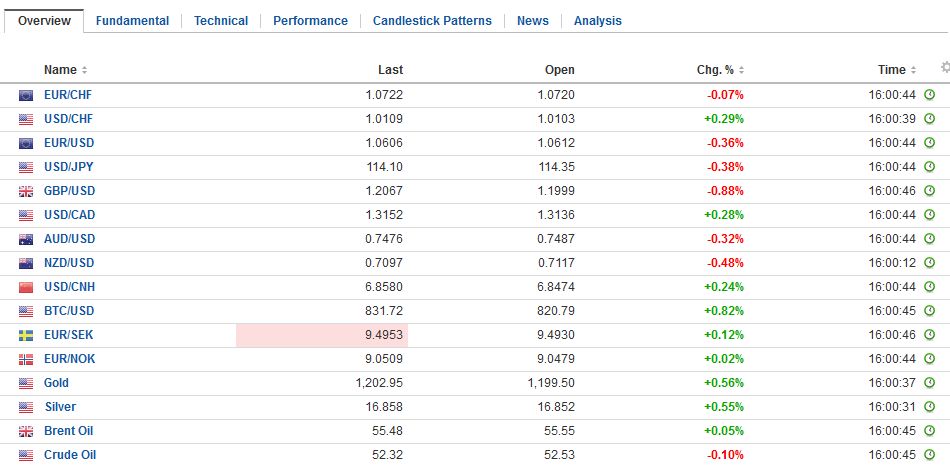

FX Daily Rates, January 16 |

| The dollar-bloc currencies did well last week, but are trading heavily today. Of note, the price of Brent oil is a little firmer but remains in the narrow range established last Thursday. Iron ore prices in China continue their New Year rally. Today’s 7.6% jump brings the year-to-date advance to almost 20%.

Most emerging market currencies are moving lower against the dollar. The notable exception is he Russian ruble which is posting a small gain (~0.3%). The Turkish lira, South African rand, and Mexican peso remain under pressures. The beleaguered Turkish lira had rallied at the end of last week as the central bank drained liquidity. The dollar is recouping about a third of its two-day decline. |

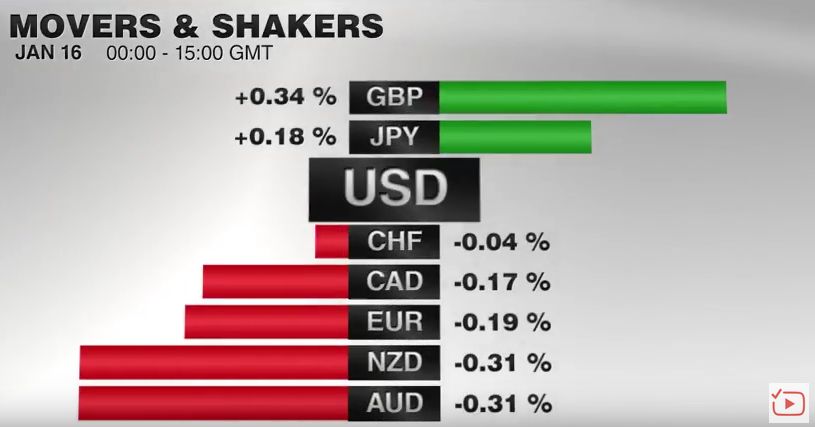

FX Performance, January 16 |

EurozoneEuropean equities are mostly lower while bonds are mostly firmer. Following the DBRS downgrade of Italy before the weekend, Italian bonds are under performing. |

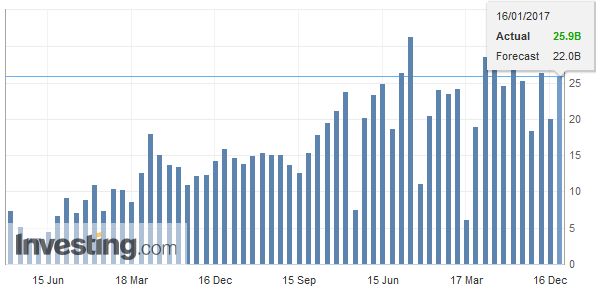

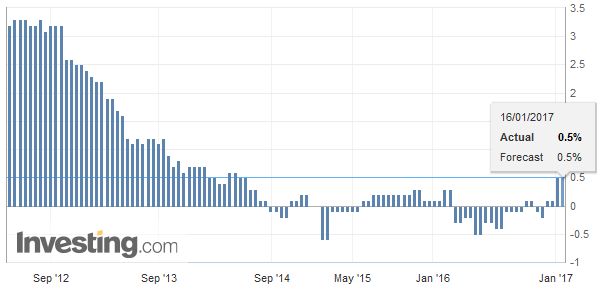

Eurozone Trade Balance, December 2016(see more posts on Eurozone Trade Balance, ) Source: Investing.com - Click to enlarge |

ItalyMost sovereign yields are lower, but Italy’s 10-year is steady to slightly (less than a single basis point higher) while Italian bank shares are surrendering half of the 3% pre-weekend gain. The Dow Jones Stoxx 600 is off around 0.6% in late-morning dealings, led by financials and energy. |

Italy Consumer Price Index (CPI) YoY, December 2016(see more posts on Italy Consumer Price Index, ) Source: Investing.com - Click to enlarge |

The UK government strategy for Brexit is becoming clear. Even though roughly half of UK immigrants come from non-EU countries, in orders to control the other half, the UK will leave the single market. It will also not be subject to the European Court of Justice. A week ago Prime Minister May suggested this and sterling fell below $1.22 for the first time since last October. The general thrust of the comments was echoed by the Chancellor of the Exchequer Hammond over the weekend, with an added seemingly implicit threat to compete through lower corporate taxes if the EU negotiations force the UK to seek other comparative advantages.

Sterling gapped lower and proceeded to fall to almost $1.1985 before recovering a bit. It has entered the gap, which extends to last Friday’s low a little above $1.2120. The thin conditions in early Asia may have exacerbated the move, but the direction was clear. It risks oversimplification, but a hard exit, which is understood to be the loss of access to the single market, is understood as negative for sterling, while developments that slow the process (like the Supreme Court decision expected next week) or cushion it (like a fast trade agreement with the US, that President-elect Trump indicated over the weekend) are seen as supportive for sterling.

From a technical perspective, there are different types of gaps, which are uncommon in 24-hour markets. It may take a day or two of price action to determine the kind of gap The most benign gap would be filled today or tomorrow. A more significant gap would not be filled and could signal the start of a new leg lower. Sterling traded as high as $1.2085 in the European morning before seeming to stall.

The weaker pound, however, is not buoying UK stocks. In fact, the FTSE 100’s 14-day rally is being threatened. On the other hand, the 10-year Gilts are rallying, with the yield slipping three to five basis points after a seven basis point increase before the weekend.

More broadly, the US dollar is higher against all the major currencies but the Japanese yen, which appears to be drawing support uncertainty and heavier equities. The Nikkei lost one percent in the sell-off that took the MSCI Asia Pacific Index off 0.5%, for its second consecutive loss, the first of the year. All the markets in the region were lower save India and Australia. Of note, Chinese shares tumbled hard initially with the Shanghai off around 2.5% and the Shenzhen Composite down more than 6% before a rally in late turnover. The Shanghai finished near its highs off 0.3%, while Shenzhen finished down 3.6%. Reports that the initial public offerings could be accelerated weigh on sentiment as new supply loomed.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,Brexit,EUR/CHF,Eurozone Trade Balance,FX Daily,Italy Consumer Price Index,newslettersent