Swiss Franc |

EUR/CHF - Euro Swiss Franc, January 10(see more posts on EUR/CHF, ) |

|

Sterling is on the ropes following Brexit comments made by UK Prime Minister Theresa May over the weekend. It’s been a tough day’s trading for any clients holding the Pound with losses against all of the major currencies. GBP/CHF rates have dropped by a cent and a half with the pair now trading in the mid 1.23’s, following the high of 1.24765. UK Prime Minster has increased market fears surrounding the UK’s upcoming exit from the EU, as she stated the UK would look towards a “hard Brexit”, which ultimately means that we will be cutting near all ties with the EU. This has caused investors to panic and the markets have reacted accordingly with today’s losses the result of this. Despite these obvious fears she also mentioned she wanted the best deal for the UK in terms of leaving the EU but stated that we will not be keeping part membership we were going to break off completely. This means that trade deals and immigration rights will be renegotiated and this causes a huge amount of market uncertainty. Market uncertainty is a currencies killer and this is why the Pound is fighting an uphill battle. Talk of Brexit and how we will facilitate this is likely to drive investor confidence and in turn the Pound’s value for months if not years to come. Therefore I would be keen to protect any Sterling positions, whilst rates continue to hold above 1.20 and with the CHF status as a ‘safe haven’ currency it is unlikely that a sustainable increase is likely, whilst global risk appetite in the UK economy remains fragile at east. |

GBP/CHF - British Pound Swiss Franc, January 10(see more posts on GBP/CHF, ) |

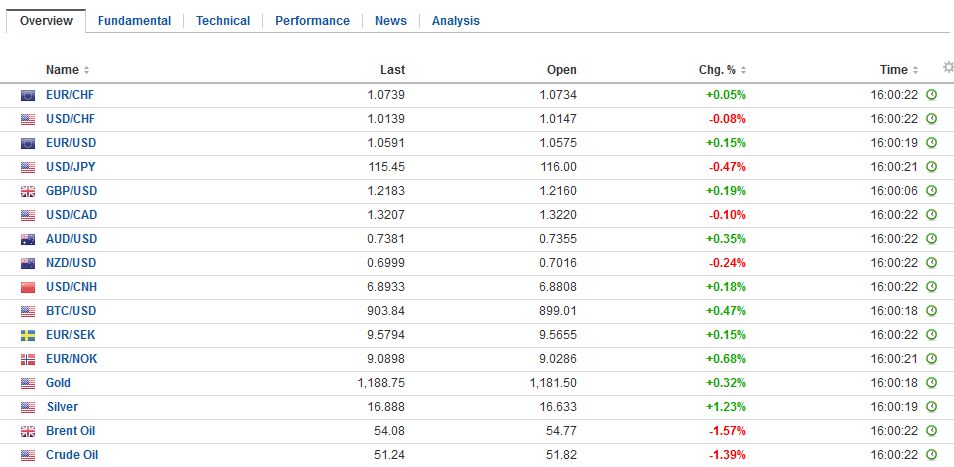

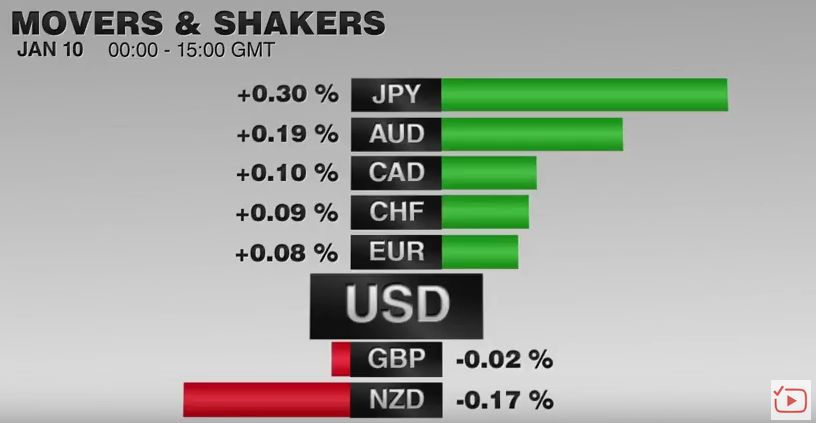

FX RatesAfter strong moves to start the year, the capital markets continue to consolidate. Many observers are suggesting a fundamental narrative behind the loss of momentum, but in discussions with clients and other market participants, it seems as if the main source of caution is coming from an understanding of market positioning rather than a reevaluation of the macro drivers. Speculators are carrying large long dollar positions in the futures market, and nearly everyone seems bullish. Similarly, the bears have a record short position in US 10-year note futures and a near-record long position in the light sweet crude oil futures. |

FX Performance, January 10 2017 Movers and Shakers Source: Dukascopy - Click to enlarge |

| The news stream also has not been particularly notable. Yes, the data suggest that the main economies finished last year on a firm note. US wage growth accelerated in December, though given the base effect, it is unlikely to sustain those gains this month. OPEC may be making good on its promise to cut output, while the US rig count continues to rise ( ~100 since the end of Q3). Although Prime Minister May eschews the terminology, investors are pricing in a harder Brexit, by which is meant, one that sees the UK lose access to the single market.

Chinese and Japanese shares traded lower, but the MSCI Asia Pacific index rose for the second sessions and four of the past five. It is currently testing levels that held in back in the mid-December around when the Fed raised US rates. European shares are trading higher after a soft opening. The Dow Jones Stoxx 600 slipped to its lowest level since the first trading day of the year but recovered as the European morning progressed. Led by materials, health care, and industrials, are helping to blunt the drag from utilities and financials. |

FX Daily Rates, January 10 |

| Asia-Pacific and European bonds are trading firmer after US Treasury rally yesterday. The US 10-year yield is stable near 2.36%. The yield closed at 2.47% the day before the Fed hiked rates on December 14. The two-year yield was at 1.16% on the eve of the Fed’s decision. It stands just below 1.19% now.

The euro firmed a little through $1.0625, a cent above the pre-weekend jobs-induced low and edged through the same day’s high near $1.0620. Sellers emerged in the European morning to provide the cap. The dollar initially extended its North American pullback to fall to JPY115.20 in Asia but has steadily recovered. It was a big figure higher in Europe before stalling. Sterling’s apparent Brexit-related losses were extended to almost $1.21 after yesterday breaking below $1.22 for the first time since October. That will now likely offer resistance. The dollar-bloc currencies are steady. |

FX Performance, January 10 |

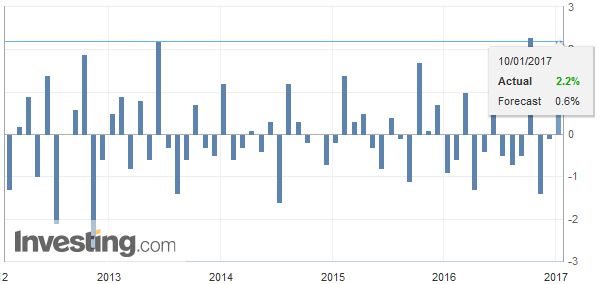

FranceTwo pieces of economic news today helps round out the macro picture. First, France reported a strong November industrial output figure that will help boost expectations for Q4 GDP, and the aggregate eurozone industrial production when reported later this week. French industrial output was up more than four-times what the Wall Street Journal survey expected. The 2.2% gain follows two contracting months and declines in five of the past six months. Manufacturing was particularly strong with a 2.3% month-over-month increase. Gains were broad based but especially strong in coking and refining (6.3%), transportation materials (3.4%), and agriculture (1.3%). Construction was an exception. The data, on balance, is unlikely to change the political climate, where the first round of the presidential election is still a few months away. Still, it is important to recognize that the political surprises last year (UK and US) were in two major economies that have generally fared among the best since the financial crisis, and were experiencing what economists believe to be near full employment. |

France Industrial Production, December 2016(see more posts on France Industrial Production, ) Source: Investing.com - Click to enlarge |

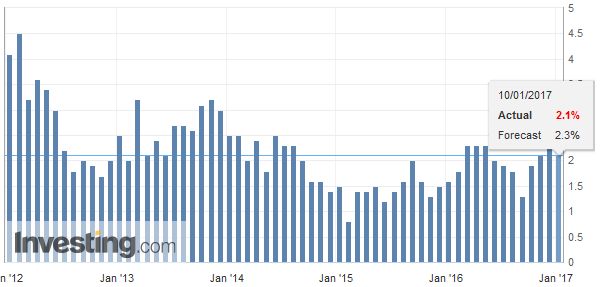

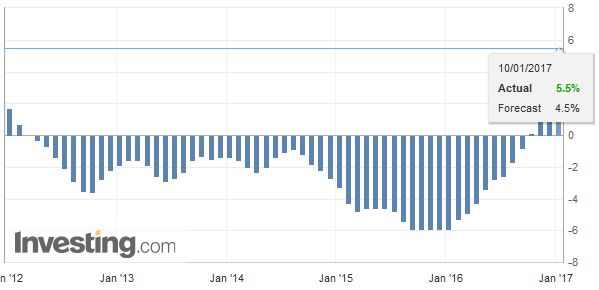

ChinaThe other economic news came from China. The focus has been in China’s CPI. It has been fairly stable in early 2015 mostly between 1.5% and 2.3%. December’s CPI eased to 2.1% from 2.3%, just above the 12-month average of 2.0%. Food prices rose 2.4% while non-food prices increased by 2.0%. Nothing particularly remarkable. The increase in producer prices, especially in the context of stable consumer prices may be a short-term help for China. However, short-term benefits may be offset if the higher prices slows, or even reverses, efforts to address the vast surplus capacity China has built in various industries, including steel, aluminum, glass, and cement. The onshore yuan (CNY) ticked higher today, offsetting yesterday;s losses in full. However, the offshore yuan (CNH) weakened for the third sessions. The offshore yuan is understood to be more of a speculative vehicle than the more restricted onshore yuan. As for last week’s short-squeeze fades, CNH is expected to trade through CNY. |

China Consumer Price Index (CPI) YoY, December 2016(see more posts on China Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| However, as we have previously noted, the focus is on producer prices, which escaped from multi-year deflation a few months ago. They have risen sharply since. In December producer prices rose 5.5%. The Bloomberg median was for a 4.6% increase after the 3.3% rise in November. Mining (21.1%) and raw materials (9.8%) drove the headline increase. Separate, but related iron ore prices rose 5.5% today to their best level in nearly a month. |

China Producer Price Index (PPI) YoY, December 2016(see more posts on China Producer Price Index, ) Source: Investing.com - Click to enlarge |

United States

US politics may overshadow economics today. The Senate begins taking up the President-elect’s nominees. The interest today is on Senator Sessions who is to be the next attorney general. Although his civil rights views are controversial, and other nominees will be grilled, rarely do a President’s cabinet nominees blocked by the Senate. The US data includes wholesale inventories, which will be useful in fine tuning Q4 GDP forecasts and the JOLTS report on job openings. Neither are market movers. The main release this week is the retail sales report at the end of the week. Note that late yesterday; the US reported a stronger than expected rise in November consumer credit, where revolving credit, (credit cards) growth is beginning to surpass non-revolving credit growth. Canada reports December housing starts.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,China,China Consumer Price Index,China Producer Price Index,EUR/CHF,France,France Industrial Production,FX Daily,gbp-chf,newslettersent