Swiss Franc |

EUR/CHF - Euro Swiss Franc, December 23(see more posts on EUR/CHF, ) |

FX RatesAsian shares trade heavily. The MSCI Asia-Pacific Index ex-Japan fell 0.4%. It is the fourth lower close this week and brings the loss to 1.75% for the week. It is fallen in seven of the past nine weeks. The Dow Jones Stoxx 600 is little changed on the session and is nursing a minor loss on the week and could snap a two-week advance. The S&P 500 has eased for the past two sessions, but it is holding on to less than a 0.15% gain on the week coming into today’s session. |

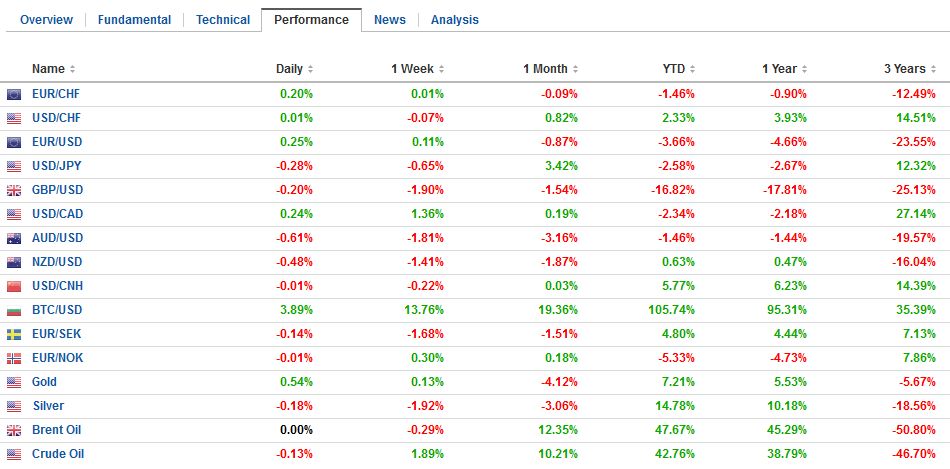

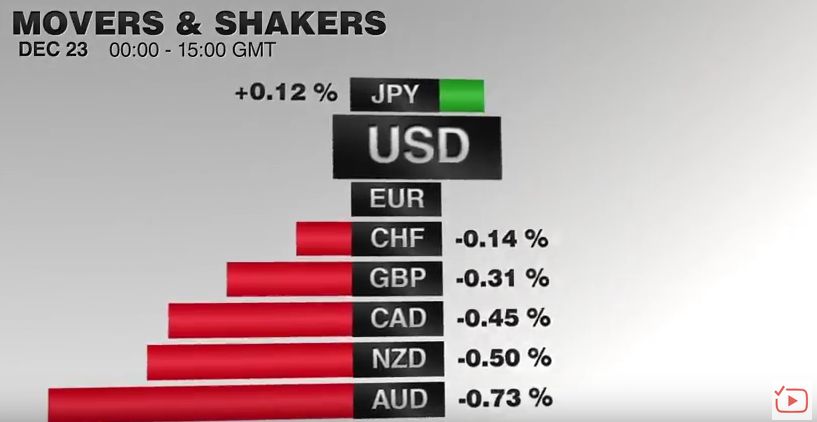

FX Performance, December 23 2016 Movers and Shakers Source: Dukascopy - Click to enlarge |

| Asian bond yield was mostly higher, but in Europe, led by Italy and Portugal yields are lower.Premiums over Germany are slightly narrower. At 2.54%, the US benchmark 10-year yield has risen less than a single basis point this week. |

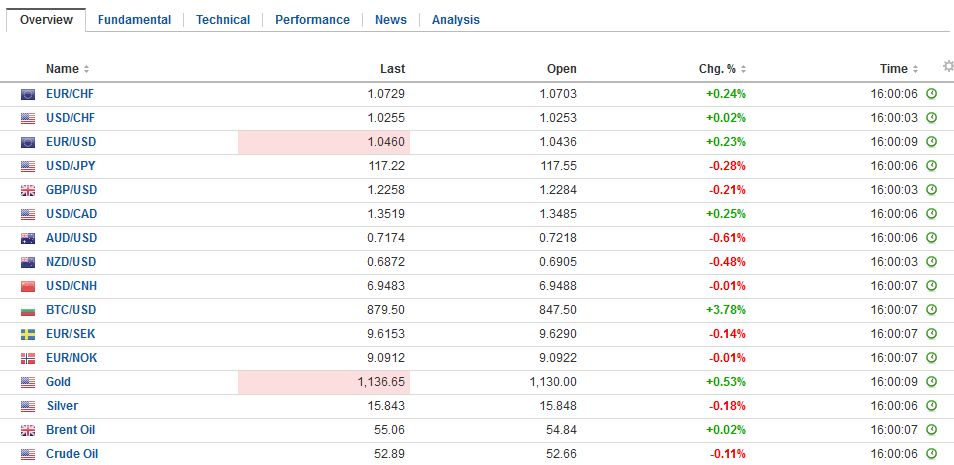

FX Daily Rates, December 23 |

| The euro is roughly confined to a 15-tick range on either side of $1.0450. If it closes higher, it would be the third consecutive advance, but it has to close above the midpoint of today’s range if it is to snap a two-week decline. Sterling continues to struggle. It has fallen every day this week, which will be the third consecutive weekly decline. Six months after the referendum and the risks of a hard exit remain. The $1.22 area represents the next retracement target of the rally since the early-October flash crash. The dollar is trading a touch heavier against the yen. The greenback is edging lower for the third consecutive session and the fifth decline in the past six sessions. It is snapping a six-week advance, though it remains well above the JPY116.55 low seen at the start of the week.

The dollar-bloc remains under pressure. The Australian dollar is pinned near $0.7200. It has risen only once in the past eight sessions and is set to finish lower for the third consecutive week. A move above $0.7230 would help stabilize the technical tone. The US dollar poked through CAD1.35 yesterday and is consolidating in tight ranges ahead of the opening of the local markets and the GDP figures. The US dollar has fallen only once in the past nine sessions. The upside momentum does not appear to have been exhausted, and a retest on the mid-November high near CAD1.3590 appears likely, perhaps before the end of the year. |

FX Performance, December 23 |

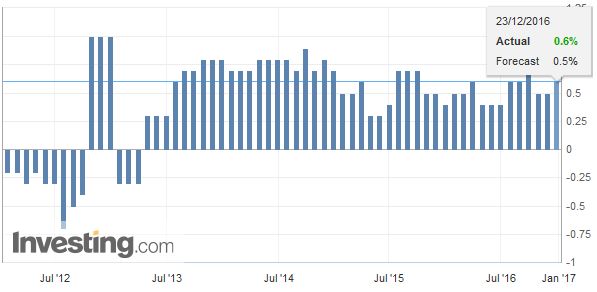

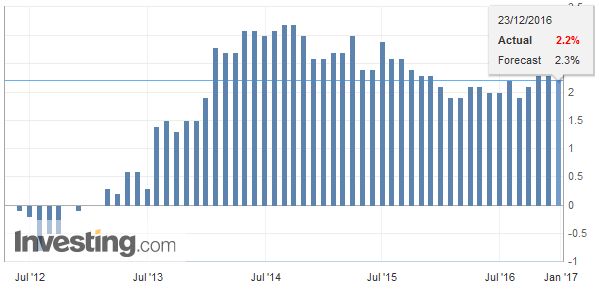

United KingdomIn terms of economic data, investors learned that the UK economy expanded by 0.6% in Q3 rather than 0.5%. |

U.K. Gross Domestic Product (GDP) Q3 2016(see more posts on U.K. Gross Domestic Product, ) |

| However, the year-over-year pace slipped to 2.2% from 2.3%. |

U.K. Gross Domestic Product (GDP) YoY, November 2016(see more posts on U.K. Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

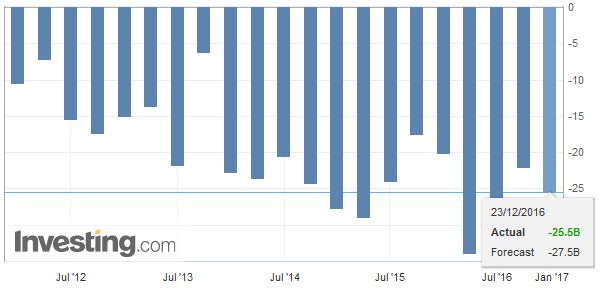

| The current account also grew in Q3 to 5.2% of GDP from 4.6% in Q2. Separately, the UK reported October services expanded by 0.3% maintained the September pace. |

U.K. Current Account, Q3 2016 Source: Investing.com - Click to enlarge |

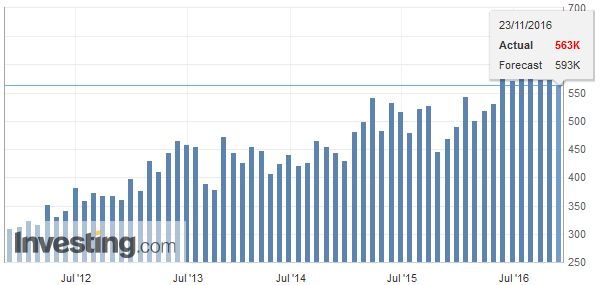

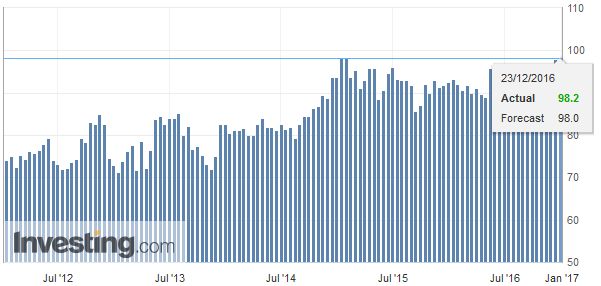

United StatesThe US reports new home sales and the University of Michigan consumer confidence (with inflation expectations). |

U.S. New Home Sales, November 2016(see more posts on U.S. New Home Sales, ) Source: Investing.com - Click to enlarge |

Canada

|

U.S. Michigan Consumer Sentiment, November 2016(see more posts on U.S. Michigan Consumer Sentiment, ) Source: Investing.com - Click to enlarge |

Japan

Japanese markets were closed today. Activity in Europe is light, and the same is expected in North America today. Japanese markets will open on December 26, while the US and European markets re-open on Tuesday, December 27.

Eurozone

Banks dominate the light news stream. Deutsche Bank agreed to a $7.2 bln settlement with the Department of Justice, while Credit Suisse agreed to a $5.3 bln settlement A lawsuit against Barclays was announced when the bank balked at the terms it was offered, seemingly preferring to take its chances with the new administration.

The Italian government will inject 20 bln euros into three banks, Monte Paschi, Veneto Banca and Popolare di Vicenza. Some retail bondholders will be able to seek compensation. Monte Paschi was only able to raise about half of the five bln euros it sought, and European officials had refused to grant it an extension. Italian bank share index (FTSE Italia All-Share Banks Index) is up about 1.6% near midday in Milan. Barring a reversal in the waning hours, it will close higher on the week for the fourth consecutive weekly advance.

It is far from clear that this is any meaningful closure to the long-troubled banking sector. Italian banks have an estimated 360 bln euros of troubled loans. The next major challenge is the capital raising exercise by Unicredit, Italy’s largest bank. It seeks to raise about 13 bln euro early next year, while is a little less than its market capitalization.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$AUD,$CAD,$JPY,$TLT,Canada Gross Domestic Product,EUR/CHF,EUR/GBP,Italy,newslettersent,SPY,U.K. Gross Domestic Product,U.K. Gross Domestic Product (QoQ),U.S. Michigan Consumer Sentiment,U.S. New Home Sales