Swiss Franc |

EURCHF - Euro Swiss Franc December 21(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge |

|

The pound has tailed off from its recent high against the Swiss Franc over the last couple of weeks with rates for GBP CHF sitting at 1.27 for this pair. The pound seems to have climbed as far as it can against most of the major currencies with the current economic and political factors at play. In my mind the next direction will come from the Supreme Court ruling which is expected to be made early in January 2017. It has the potential to be a major market mover for the pound. Although the markets will be moving around during the festive break there will be continued volatility especially when trading volumes are thinner at this time of year. However, there is so much riding on the Supreme Court outcome that the markets are likely to be waiting for this announcement before any new found direction is found. UK Public sector net borrowing is released tomorrow morning and could create some volatility for sterling exchange rates whilst Growth for Knowledge consumer confidence figures released on Thursday will also be interesting to see how the British consumer views the state of economic affairs just before Christmas. It doesn’t end there though with Friday, the last working day before Christmas which sees the release of UK Gross Domestic Product figures for the third quarter. Expectation is for GDP to remain at 0.5% on the quarter and anything steady is likely to see the pound remain supported. |

GBPCHF - British Pound Swiss Franc December 21(see more posts on GBP/CHF, ) Source: Investing.com - Click to enlarge |

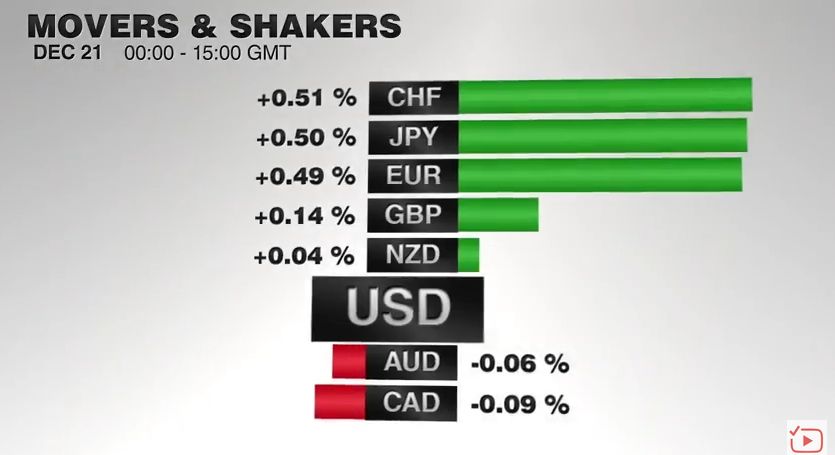

FX RatesThe US dollar is narrowly mixed as the holiday markets make for light turnover. Global equity markets are not finding much encouragement from the new record highs by the Dow Jones Industrials. |

FX Performance, December 21, 2016 Movers and Shakers Source: Dukascopy.com - Click to enlarge |

| Sterling continues to struggle to sustain even modest upticks. Consider that in the last 12 sessions, including today; sterling has risen twice. Near $1.2310, it has retraced 50% of the gains scored since the flash crash. The 61.8% retracement is close to $1.22. On the upside, $1.2420 needs to be overcome to begin repairing the technical damage.

For its part, the euro is straddling the $1.04 level. The euro has not closed above its five-day moving average since December 7. It is found a little above $1.0410 today.

|

FX Daily Rates, December 21, 2016 |

| There have been a few developments to note. First, the Swedish krona is the strongest of the major currencies, rallying 0.7% against the dollar and reaching a two-month high against the euro following the Riksbank meeting. The central bank extended its bond-buying program through H1 17, but at a slower pace.

It was a controversial decision and could be the last efforts. Two of the six-member board wanted to stop the bond purchases now. One other was interested in extending the purchases, but at half the pace that was ultimately decided. Currently, the Riksbank is buying SEK45 bln of bonds (for H2 16). In the first half of next year, it will buy SEK15 bln of conventional bonds and SEK15 bln of inflation-linked bonds. It kept the deposit rate at minus 50 bp. |

FX Performance, December 21, 2016 |

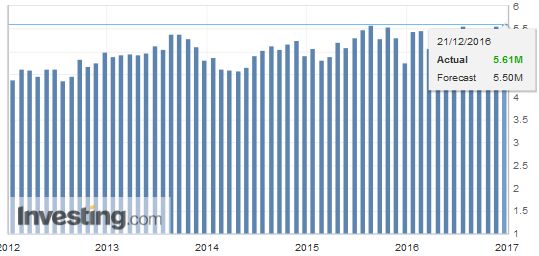

United StatesThe US reports November existing home sales. It is expected to be slightly softer after a 2% gain in October. This year, existing home sales averaged 5.42 mln (saar) compared with 5.23 mln monthly average last year and 4.92 mln in 2014. The US DOE also provides new oil inventory figures. The API estimate showed a large 4.15 mln barrel draw that supported prices. The Bloomberg survey median guesstimate is for a 2.4 mln barrel drawn, which would be the fifth consecutive liquidation of stocks. That said, supplies in Cushing have risen for the last three weeks and may be more important for the kneed jerk market reaction. |

U.S. Existing Home Sales, November 2016(see more posts on U.S. Existing Home Sales, ) Source: Investing.com - Click to enlarge |

Eurozone

Second, the European Court of Justice ruled that Spanish banks that overcharged for mortgages must offer compensation. This was a blow to Spanish banks, which fell in response to the final ruling. The preliminary ruling allowed a time-limit to claims for reimbursement, but the final court ruling disallowed the constraint. All Spanish banks are not equally affected, and some banks have put aside some of the funds. Still, financials are the worst performing sector in Spain today. They are off nearly 1.75% in late morning turnover, while the Spanish market as a whole is off about 0.75%.

Meanwhile, Italian banks are under modest pressure. The index of Italian banks is off 0.6% and is the sixth declining session of the past nine. After the cabinet approved increasing the country’s debt by 20 bln euro to help the banks, both chambers of parliament will vote on measures today. For reasons that seem to stem more from politics and economics, Italy has been slow to address its banking system woes, and when it does move, it tends to be too little. There is no shock and awe or even a pretense of getting ahead of the curve of expectations.

There is an interesting decision expected shortly from the European Court of Justice, with implications for Brexit. The Court will decide if a decision on a free-trade agreement with Singapore requires individual country approval or it is sufficient that the EU institutions approve. If individual country approval is needed, it would suggest that the UK will need to have all individual EU members to ratify a new trade deal with the UK. This could prove to be a laborious and time-consuming process.

Japan

Japanese shares finished marginally lower. It has advanced for six consecutive weeks. It is up fractionally this week. However, as it rallied, short interest has grown. As of last week, at the Tokyo and Nagoya markets, the short interest rose to JPY990 bln, a seven-year high.

The dollar is trading within yesterday’s ranges against the yen, showing little enthusiasm to push back to last week’s highs near JPY118.65. Initial support is seen near JPY117.00 and then Monday’s low near JPY116.50. In Europe, the dollar is little changed against the euro, while sterling continues to sport a heavy tone.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,EUR/CHF,gbp-chf,newslettersent,OIL,Spain,Sweden,U.S. Existing Home Sales