Swiss Franc |

EUR/CHF - Euro Swiss Franc, November 17(see more posts on EUR/CHF, ) |

|

UK Retail Sales figures are released this morning at 09.30 and could have an impact GBP/CHF exchange rates. The Pound has gained ground against the CHF over the past month but have levelled out over the past week, as the markets digest the unexpected election results in the US. The Pound has benefitted from Trump’s victory, as it restored some much needed market confidence in regards to future growth prospects for the UK economy. This can be attributed to comments he made regarding prospective trade deals with the UK, regardless of our EU status. However, we did see Sterling dip following what we believed was a leaked memo, which indicated that up 30,000 additional civil servants would be required to facilitate our Brexit following the triggering of Article 50. This was ultimately renounced by UK Prime Minister Theresa May and the Pound bounced back but it is another example of how fragile the UK economy remains and for that reason I would not be gambling on sustainable Sterling strength over the coming months. The CHF remains a safe haven currency for investors in times of global economic uncertainty and this is why I believe it will continue to hold its value against GBP, so those clients holding the Pound may wish to take advantage of the recent spike, as the current rates could look extremely attractive in weeks to come. |

GBP/CHF - British Pound Swiss Franc, November 17(see more posts on GBP/CHF, ) |

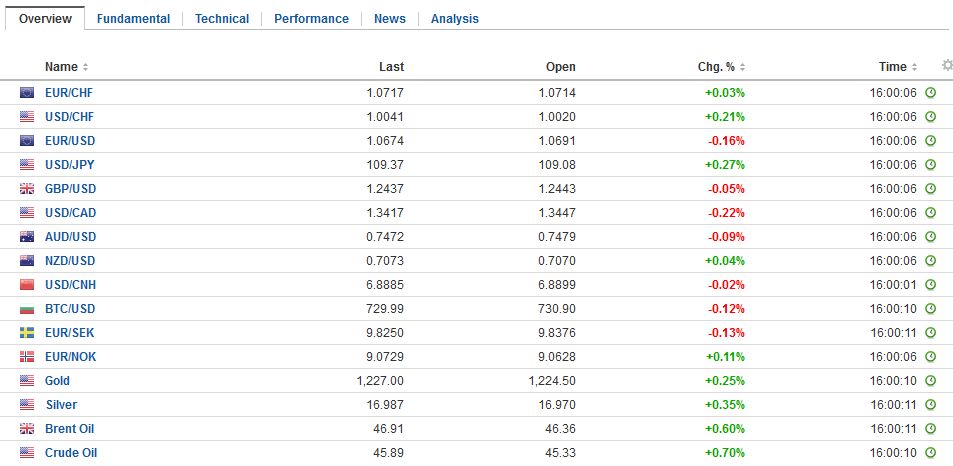

FX RatesThe US dollar is trading with a heavier bias today as its recent run is consolidated. The euro is trying to snap the eight-day slide that brought it to nearly $1.0665 yesterday, the lows for the year. It is almost as if participant saw the proximity of last year’s lows ($1.0460-$1.0525) and decided to pause, perhaps to wait for additional developments, such a Fed Chief’s Yellen’s testimony before the Joint Economic Committee of Congress. The dollar rose to about JPY109.75 yesterday. Recall that it had slumped to JPY101.20 in the first reaction to the US election news a week ago. The market appears to be pausing ahead of the psychologically important JPY110 level. The 50% retracement of this year’s dollar decline is seen near JPY110.35. The 38.2% retracement of the dollar’s retreat from the multi-year high set in the middle of 2015 was JPY109.30. The 50% is found near JPY112.45. |

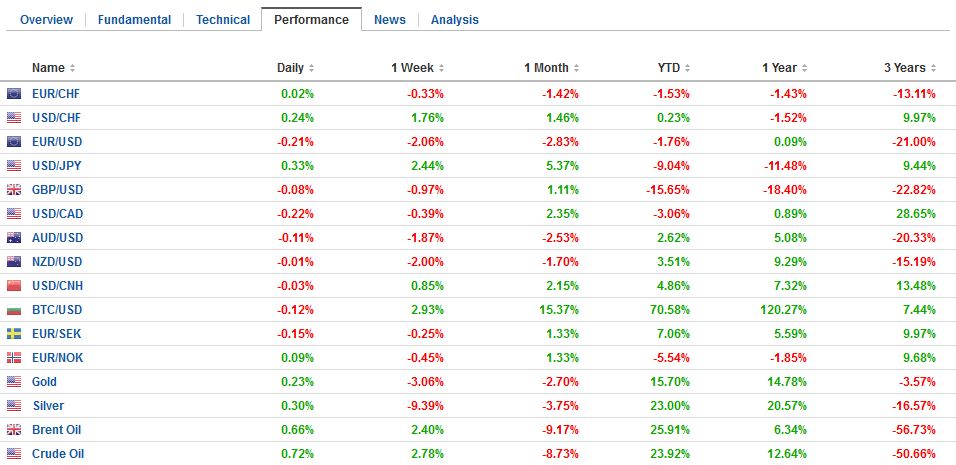

FX Performance, November 17 2016 Movers and Shakers . Source: Dukascopy - Click to enlarge |

| The dollar was pulling back in the Tokyo session when the BOJ stepped in and surprised market participants. It did not intervene in the foreign exchange market, but under the new monetary policy framework are facilitating a steeper yield curve, it offered to buy unlimited amounts of one-to-five year JGBs at fixed rates. This helped stabilize the JGB market, which was being dragged into the rising yields that had swept the global markets, emanating from the US. The debt purchases also appeared to help put a floor under the dollar near JPY108.50.

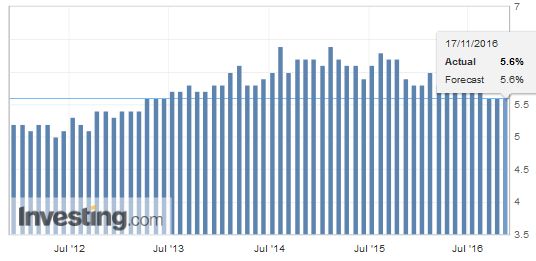

The Australian dollar also has not responded as one might expect to news that the country had created 41.5k full-time jobs in October and that the unemployment rate eased to 5.6% from 5.7%. The Aussie was punched through $0.7500 yesterday, and buyers on a pullback that have emerged in recent months near these levels have been notable in their absence. It has been unable to benefit from a weaker US dollar today. Short-term speculators have been caught leaning the wrong way in terms of positioning. The immediate risk is the mid-September lows near $0.7440. A break signals a test on $0.7400, which the Aussie has not traded below since the end of H1. |

FX Daily Rates, November 17 (GMT 16:00) |

| That the BOJ focused on the short-end of the coupon curve suggests that it was not particular concerned about the rise in the 10-year yield, which is an aid to keep around zero. The yield on the 10-year bond rose five consecutive sessions coming into today, reaching a high yield of 5 bp. It closed just above one basis point today. |

FX Performance, November 17 |

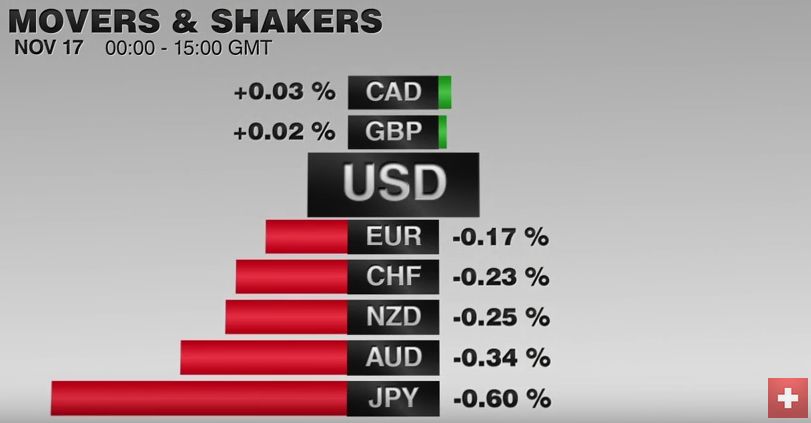

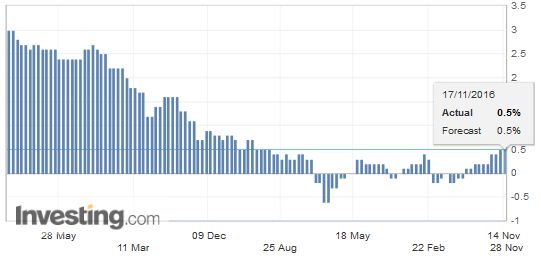

United KingdomThe UK reported an over-the-top jump in retail sales, but the foreign exchange market was non-plus. Sterling is slightly firmer against the dollar, but like yesterday has spent today within the range seen on Tuesday (~$1.2380-$1.2530). Sterling is flat against the euro. Headline retail sales rose a dramatic 1.9% in October, following a 0.1% rise in September. The change in the weather is thought to have spurred a shopping spree for clothes and shoes. Those products account for about 12% overall retail sales and rose 5.1%, the most in more than two years. Home goods and food purchases rose by 0.8% each. Of note, internet sales surged by nearly 27%, the largest rise in almost six years. On a year-over-year basis, UK retail sales are up 7.2%. Last October retail sales stood only four percent above the previous year comparison. |

U.K. Retail Sales YoY, October 2016(see more posts on U.K. Retail Sales, ) . Source: Investing.com - Click to enlarge |

United StatesThe US data calendar features the October CPI, housing starts (and permits), and the November Philadelphia Fed survey. |

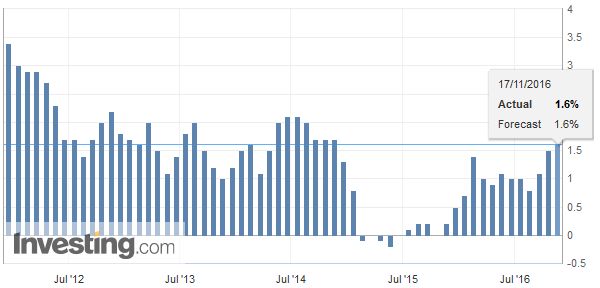

U.S. Consumer Price Index (CPI) YoY, October 2016(see more posts on U.S. Consumer Price Index, ) . Source: Investing.com - Click to enlarge |

| Core CPI is expected to hold steady at 2.2%, but the headline rate may edge up to 1.6% (from 1.5%). It would be the highest reading of the year. |

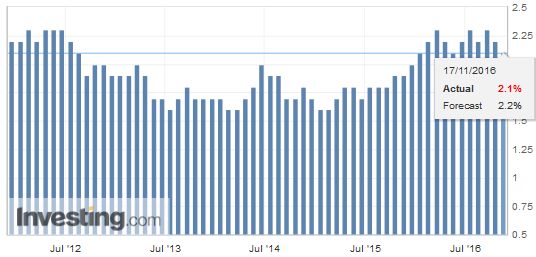

U.S. Core Consumer Price Index YoY October 2016(see more posts on U.S. Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

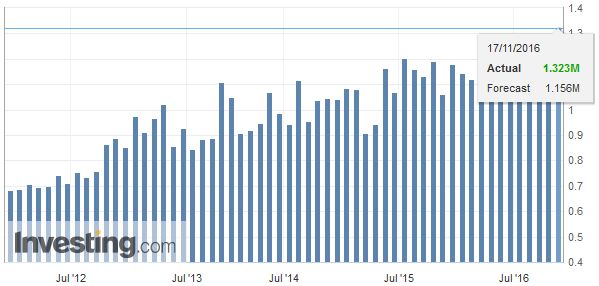

| Housing starts are expected to recover after the 9% drop in September. |

U.S. Housing Starts, October 2016(see more posts on U.S. Housing Starts, ) . Source: Investing.com - Click to enlarge |

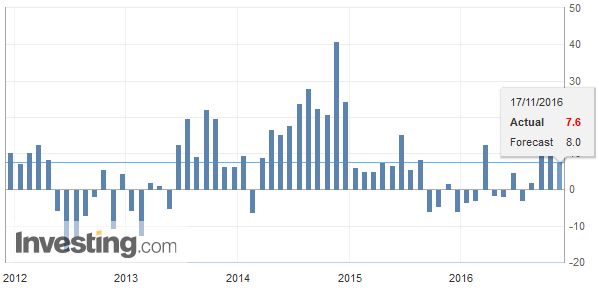

| The Philly Fed survey is expected to be a little softer but mostly little changed. The Atlanta Fed’s GDPNow tracker is estimating Q4 GDP at 3.3%. It will update its estimate after today’s data. |

U.S. Philadelphia Fed Manufacturing Index, October 2016(see more posts on U.S. Philadelphia Fed Manufacturing Index, ) . Source: Investing.com - Click to enlarge |

Eurozone |

Eurozone Consumer Price Index YoY, October 2016(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

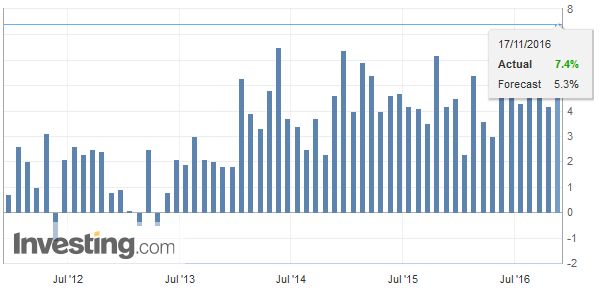

AustraliaAustralia’s jobs data was not all that. The impressive full-time job growth does not offset the revised 74.3k full-time job loss in September (initially was a 53k loss). And the decline in the unemployment rate appears to be a function of a decline in the participation rate (to 64.4%). Ironically, as the Reserve Bank of Australia has moved to a neutral stance from its easing bias, the market has turned the Aussie away from the $0.7700 area that has provided a formidable cap for the last several months. |

Australia Unemployment Rate, October 2016(see more posts on Australia Unemployment Rate, ) Source: Investing.com - Click to enlarge |

Today will be the first time Fed Chair Yellen speaks since the election and the sharp rise in US yields. Before the Joint Economic Committee of Congress, she is unlikely to deviate from what has already been said. The last two FOMC statements acknowledged that the opportunity to take another step toward normalization of monetary policy approaching. Even the doves at the Fed, like Chicago President Evans and Governor Tarullo, seem more receptive to a rate hike than they appeared to be previously.

If pressed, Yellen will likely agree that it is premature for the Fed to respond in word or deed to the campaign promises of substantial fiscal stimulus. There will be plenty of time to react when more precise details are known. She may also be asked the size of the Fed’s balance sheet. There have been some press reports quoting some economic advisers of the President-elect, apparently wanting the Fed to reduce its balance sheet. The Fed has said it will do so after the normalization process is well underway. Yellen can be expected to defend the independence of the Federal Reserve while trying to avoid antagonizing some of its critics, who may see an opportunity with a Republican Congress and President to alter the Fed’s mandate.

Lastly, Yellen may also be asked about inflation expectations. The survey results suggest little change from low levels, but the market-based breakevens have risen sharply. The 10-year breakeven (the difference between the yield of the conventional note and the inflation-protected security) jumped from 1.55% at the end of September to almost 2% at the start of this week. Yellen will likely be careful about reading too much into the rise, recognizing the liquidity premium means that the breakeven is sensitive to the direction of U.S. Treasuries, with the TIPS acting like a high beta version. This means that during periods of rising yields, TIPS yields typically rise faster than Treasuries.

(***Updates will be irregular over the next week or so as I put the finishing touches on my new book, Political Economy of Tomorrow, that is expected to be published in the middle of February 2017…stay tuned. I appreciate your patience and understanding***)

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$EUR,$JPY,Australia Unemployment Rate,EUR/CHF,Eurozone Consumer Price Index,gbp-chf,newslettersent,U.K. Retail Sales,U.S. Consumer Price Index,U.S. Core Consumer Price Index,U.S. Housing Starts,U.S. Philadelphia Fed Manufacturing Index