Swiss FrancThe Swiss Franc is a safe haven currency and benefits in time of uncertainty. With Donald Trump now looking much more likely to win the Election the Swissie has found favour. If you are buying the Franc with sterling in the future the combination of global uncertainty and a weak pound looks set to cause problems! Even if Trump doesn’t get in the weakness on sterling looks set to continue and some would argue Hilary Clinton is by no means a safe bet for the global economy. |

EUR/CHF - Euro Swiss Franc, November 02(see more posts on EUR/CHF, ) |

| Anyone looking to monitor GBP/CHF rates should watch Thursday this week which sees the latest UK Interest rate decision and Quarterly Inflation report where we could really see some changes on sterling exchange rates. Most commentators do not expect any changes in policy from the Bank of England but we would not be wholly surprised to see some kind of movement on sterling as investors search for clues on just how the governor Mark Carney and his team view the UK economy.

Tonight is the US Interest rate decision where again no big changes are expected but investors will pore over commentary as to any hints of when the US will raise their interest rate, most likely in December. If you need to buy or sell Franc this is a very busy week for global events and next week is the US election which we know is causing movements on the Swissie. |

GBP/CHF - British Pound Swiss Franc, November 02 2016(see more posts on GBP/CHF, ) |

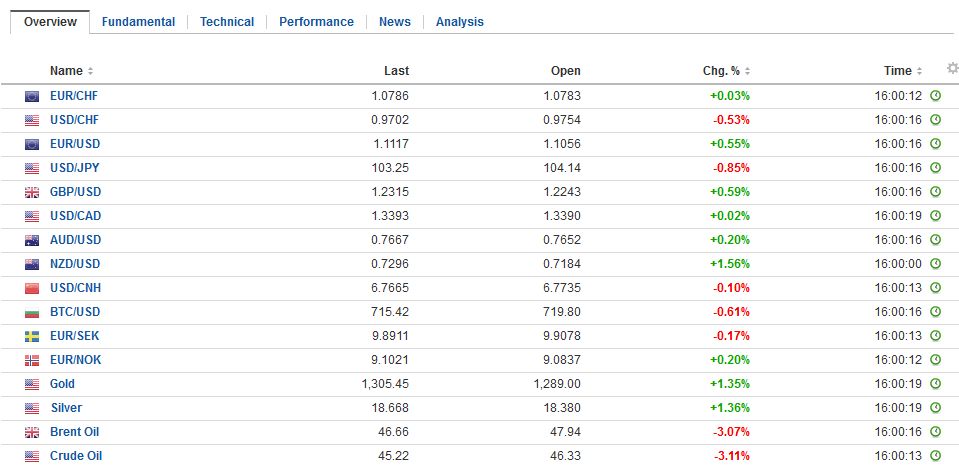

FX RatesThe single biggest driver in the capital markets is the continued narrowing of the US election polls. The prospect of a Trump presidency and the dramatic changes that could entail is rattling investors and spurring position squaring. The dollar is broadly lower as are stocks. The surge in global yields has been arrested. Even before the FBI announced a re-opening of the investigation into Clinton’s emails, Trump has been recovering from the deep hole dug in recent weeks. However, over the past five days or so, he has recovered further, and the much-watched fivethirtyeight.com has tracked a 10 percentage point decline in the likelihood of a Clinton victory to now just below 72%. Another poll tracker and analysis site, Predictwise, puts the odds at 84% chance, down from 90% over the past two weeks. |

FX Performance, November 02 2016 Movers and Shakers |

| There are two important considerations that will keep investors on edge. First, the odds have yet to bottom. The swing in opinion is a gradual process, and the momentum still is building. Second, time is of the essence. The election is a week away. However, there is a significant mitigating factor. The US president is not picked by popular vote but by an electoral college. Here the projections are not as close as some of the national polls suggest. Most calculations still see Clinton securing 303 electoral college votes, while 270 are needed.

The dollar is weaker against most of the major and emerging market currencies. Among the majors, the exception is the Australian dollar that has been dragged down by the unexpectedly sharp drop in September building approvals (-8.7%, more than twice the expected decline). Between this decline and August’s (-1.8%), July’s heady 11.5% gain has been retraced. |

FX Daily Rates, November 02 (GMT 16:00) |

| The euro has extended its recovery to $1.11 and is up almost 0.9% this week. The five-day average is crossing above the 20-day average for the first time in a month. The old trendline drawn off the January, June and July lows comes in near $1.1070. The euro broke below near-mid-October and now has resurfaced it. The next technical objective is found near $1.1115 and then $1.12.

The dollar has been trying to establish a foothold above JPY105 for the last four sessions. The US political jitters and softer US rates have pulled the greenback toward JPY103.50 now. We see the next support near JPY103.20 and then JPY102.80. Sterling is trading higher for the fourth consecutive session. It has edged above last week’s high (~1.2272) but has not been able to poke through $1.2300. If it does, which the intraday technicals suggest is possible, we see the $1.2325-$1.2350 area as a likely cap. Benchmark yields are broadly lower today. Europe is seeing a 5-9 bp decline in 10-year yields, with the periphery outpacing the core. US 10-year yields are off four bp to slip below 1.80% for the first time in a week. |

FX Performance, November 02 |

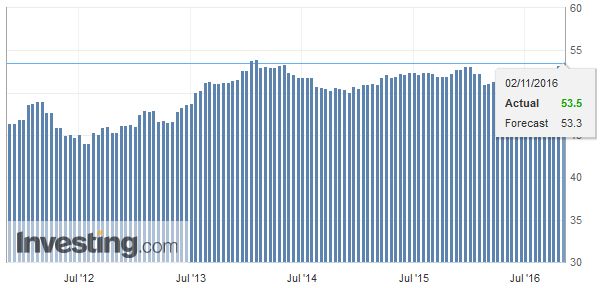

EurozoneThe eurozone manufacturing PMI was reported a little above the flash reading (53.5 vs. 53.3). This is the best since January 2014. The improvement was due to France and Spain. |

Eurozone Manufacturing PMI, October 2016(see more posts on Eurozone Manufacturing PMI, ) . Source: Investing.com - Click to enlarge |

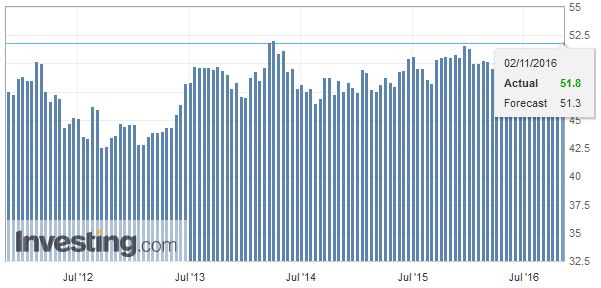

France Manufacturing PMIFrance rose to 51.8 from the flash estimate of 51.3. |

France Manufacturing PMI, October 2016(see more posts on France Manufacturing PMI, ) . Source: Investing.com - Click to enlarge |

Spain Manufacturing PMISpain rose to 53.3 from 52.3 in September. |

Spain Manufacturing PMI, October 2016(see more posts on Spain Manufacturing PMI, ) . Source: Investing.com - Click to enlarge |

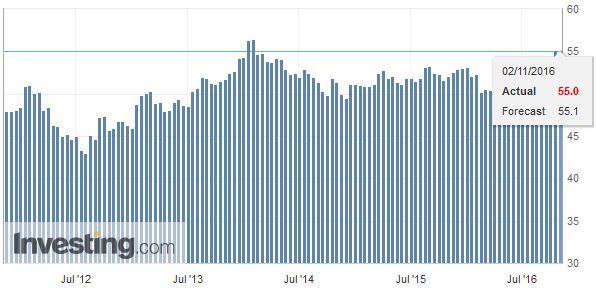

Germany Manufacturing PMIFor its part, the German reading came in a tough softer at 55.0 from 55.1. |

Germany Manufacturing PMI, October 2016(see more posts on Germany Manufacturing PMI, ) . Source: Investing.com - Click to enlarge |

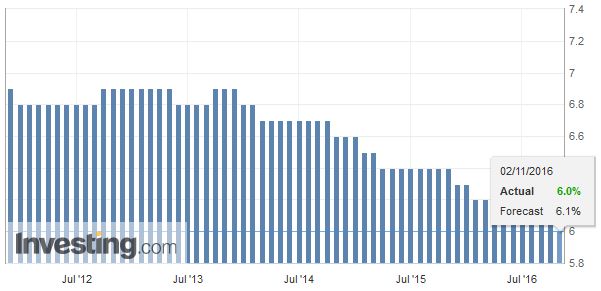

Germany Unemployment Rate |

Germany Unemployment Rate, October 2016(see more posts on Germany Unemployment Rate, ) . Source: Investing.com - Click to enlarge |

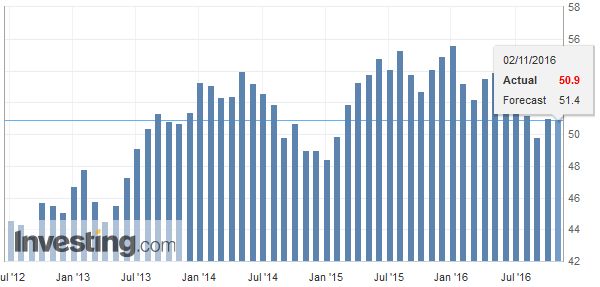

Italy Manufacturing PMIItaly disappointed by slipping to 50.9 from 51.0 in September. |

Italy Manufacturing PMI, October 2016(see more posts on Italy Manufacturing PMI, ) . Source: Investing.com - Click to enlarge |

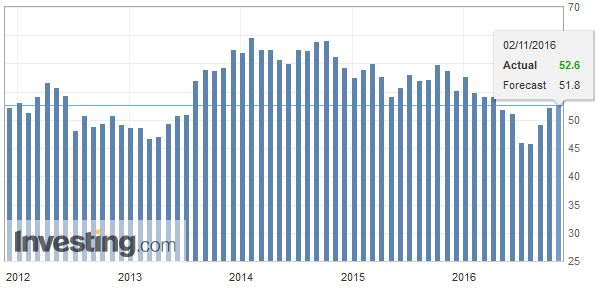

United KingdomThe UK reported a stronger than expected construction PMI. The 52.6 reading represents a small improvement over September’s 52.3 and is the best since March. The median expectation was for a small decline. The Bank of England meets tomorrow. Reports today have NIESR forecasting steady rates now until H2 19, which perhaps not coincidentally may coincide with the end of Carney’s tenure. |

U.K. Construction PMI, October 2016(see more posts on U.K. Construction PMI, ) . Source: Investing.com - Click to enlarge |

United States

|

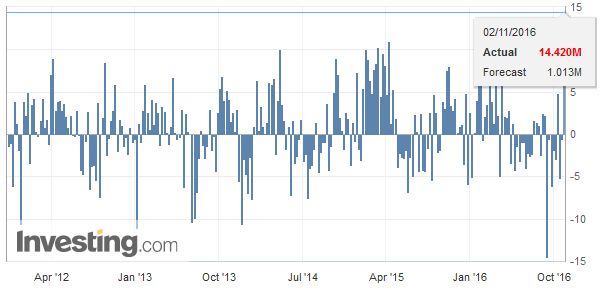

U.S. Crude Oil Inventories, November 02 2016(see more posts on U.S. Crude Oil Inventories, ) . Source: Investing.com - Click to enlarge |

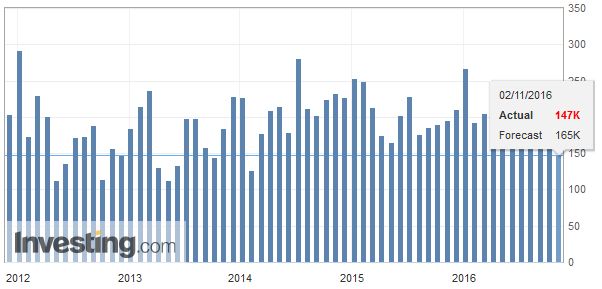

| There are two events in North America that may briefly command attention over the politics today. The first is the ADP private sector employment report. A small improvement is anticipated. Expectations for Fed policy may be impacted by the electoral outcome. If a Trump victory leads to a dramatic market reaction, as if what is happening now is a small pre-taste of what could happen, this may become a factor in the Fed’s contemplation in December. |

U.S. ADP Nonfarm Employment Change, October 2016(see more posts on U.S. ADP Employment Change, ) . Source: Investing.com - Click to enlarge |

Equities are under after yesterday’s slide in the US. The MSCI Asia-Pacific Index fell a little more than 1%, its largest drop in more than a month. The Nikkei gapped lower after reaching six-month highs yesterday. European shares are extended their losing streak. The Dow Jones Stoxx 600 is off for the eighth consecutive session, the longest slide in at least five years. Like the Nikkei, the DAX and CAC gapped lower at the open today.

The second event is the FOMC meeting. Barring a surprise, it should pose only a little headline risk on the announcement. No one expects a change in policy today. There is a long tradition of expressing its apolitical stance by not grabbing headlines from the election. There is simply no precedent for change policy this close to a national election. Moreover, there is not the urgency to demands overcoming the inertia of tradition and the logistical challenge of not having a scheduled press conference. Last October, the FOMC clearly pre-committed to a December hike. While we expect some minor tweaks in the FOMC statement, we do not expect such an explicit commitment. If it does materialize, though, it could allow one or more voting members to drop their dissent.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,EUR/CHF,Eurozone Manufacturing PMI,Federal Reserve,France Manufacturing PMI,FX Daily,gbp-chf,Germany Manufacturing PMI,Germany Unemployment Rate,Italy Manufacturing PMI,newslettersent,Spain Manufacturing PMI,U.K. Construction PMI,U.S. ADP Employment Change,U.S. Crude Oil Inventories