Swiss Franc |

EUR/CHF - Euro Swiss Franc, October 07 2016 |

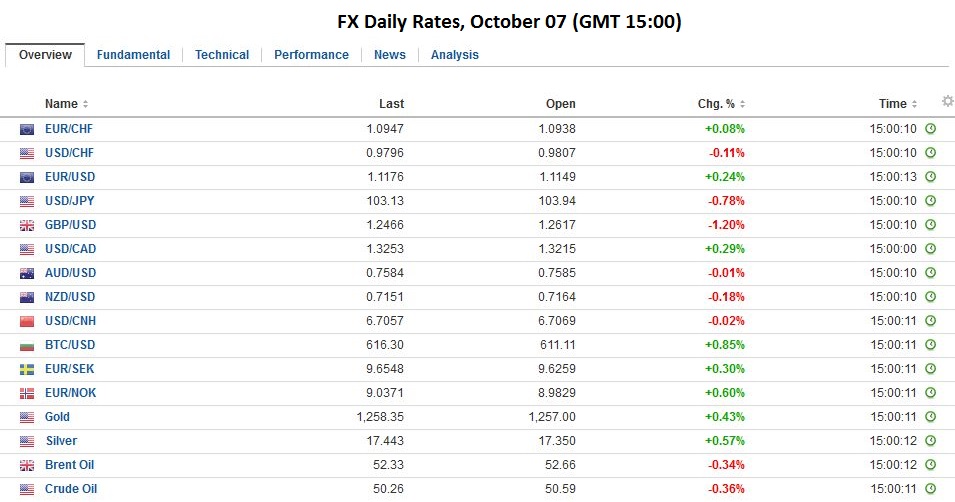

FX RatesSterling again steals the limelight. In early Asia, sterling inexplicably dropped nearly eight cents in minutes (to ~$1840), and on some platforms, may have traded below $1.1380. It almost immediately rebounded but has not resurfaced above $1.2480. Over the last couple of years,there have been a number of sudden dramatic moves in the foreign exchange market. They have involved currencies like the New Zealand dollar and South African rand. However, major currencies, like the Swiss franc, have also seen dramatic moves, though there was a clear fundamental trigger. The yen has often been subject to sharp moves. And now sterling. |

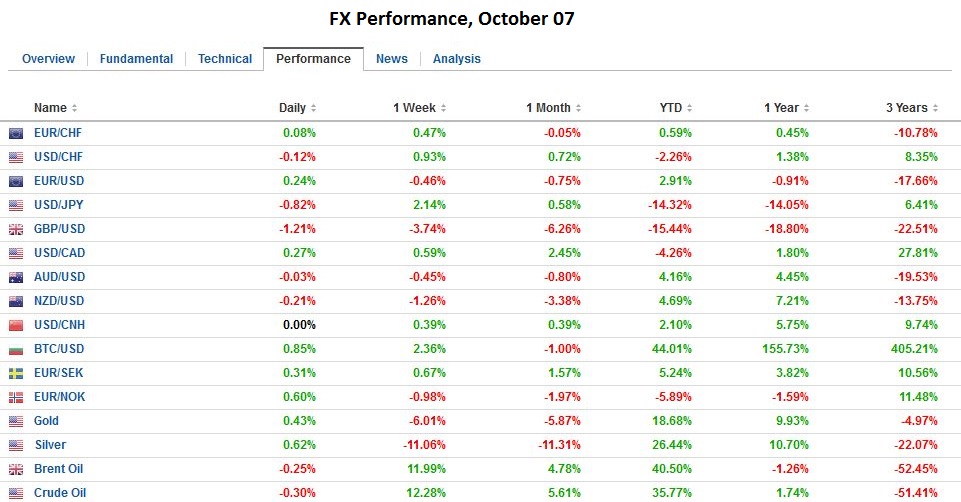

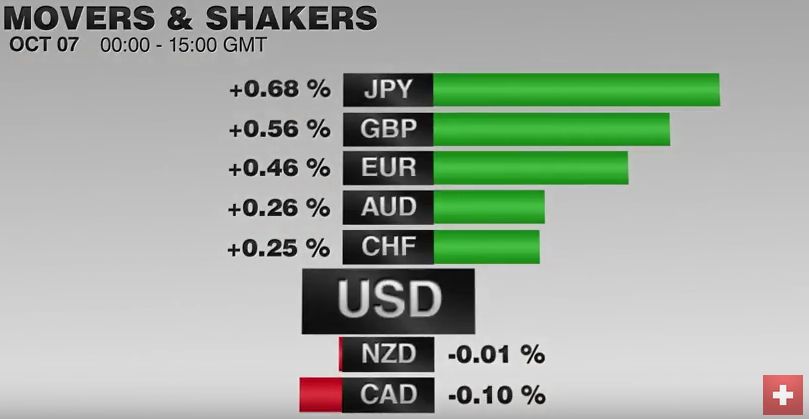

FX Performance, September 7, 2016 Source: Dukascopy - Click to enlarge |

| There are two main schools of thought. The first looks at the micro-market structure.The fragmentation, which is partly made possible by technological advances, changes the liquidity distribution. There is the rise of the algo, machine-based trading. There has been a reduction of risk-taking (proprietary trading) at banks. The market is more exposed to short-term leveraged operators, often using reverse knockouts/ins, and one-touch options, which are force multipliers.

The other approach looks at macro-developments. The price of reducing overall volatility in the capital markets is occasional and self-reinforcing spikes. Perhaps it is like a summer storm. The storm itself is partly a function of the previous calm. |

|

| Remember the neoliberal argument. If the price of capital is allowed to move, it can act as shock absorber. It can make the adjustment so the real economy (employment, output), doesn’t have to adjustment so much. Capital markets volatility is low. Some say it is a function of market direction, which itself is underwritten by the orthodox and unorthodox monetary policy measures. The economic activity appears to have gotten more volatile.

Between tradition and the lack of updated forecasts, we think the bar to a November hike is very high. Even if our suspicions are accurate, that the US delivers a robust jobs report, there still two other jobs reports that Fed officials will see before the December meeting. There is clearly scope for the market to price in a greater chance of a rate hike before the end of the year. The issue is whether it does so today. Our recent commentary, in the emerging markets as well as out profiles of major countries (EMU, Japan, Canada, Norway and Sweden) we show how interest rates appear to be re-emerging as an important driver. |

|

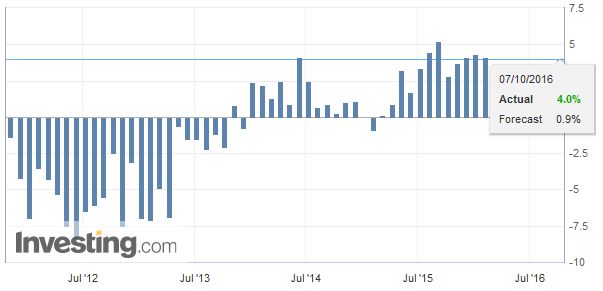

EurozoneNo news is able to rival the dramatic move in sterling today. However, it is notable that the German, French and Spanish industrial output data were consistently stronger than expected. After reporting a jump in industrial orders to five-month highs yesterday, Germany reported a 2.5% rise in industrial production, more than twice what the median had forecast. It follows a 1.5% decline in July. Manufacturing output rose 3.3%, while energy production rose 1.1%. Construction fell 1.2%. French industrial output rose 2.1% in August, more than three times the median forecast. It more than offsets the 0.5% (initially 0.6%) fall in July. Manufacturing output jumped 2.2%. The Bloomberg median was for a 0.3% increase. The data stands in stark contrast with the manufacturing PMI, which has been below 50 since March and fell to 48.3 in August from 48.6 in July. Spanish industrial output rose 1.4% in August. Economists had expected a small decline, though the July series was revised to 0.1% from 0.2%. Italy will report next on Monday. In the middle of next week, the aggregate figures will be published. There are upside risks to the previous median forecast of a 0.7% increase. |

Spain Industrial Production YoY, September 2016(see more posts on Spain Industrial Production, ) . Source: Investing.com - Click to enlarge |

Japan

There were two reports in Asia to which we draw your attention. First, Japan reported labor cash earnings fell 0.1% year-over-year in August. This is down from 1.4% in July. Real cash earnings (adjusted for inflation) slowed to 0.5% from 2.0%. The combination of low wage growth and low interest rates may exacerbate the propensity to save (one expression of which is larger current account surplus).

China

Second, although Chinese markets are still closed for the national holiday, September reserve figures were reported. They fell to $3.166 trillion from $3.185 trillion. This is a new five-year low. This was a somewhat larger drawdown than surveys anticipated.

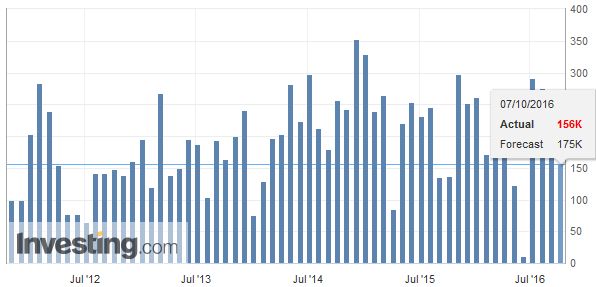

United StatesAttention turns to the US employment data, which will overshadow the Canadian jobs report released at the same time. Outside of the ADP data, other pieces of data pertaining tothe US employment were favorable. The one cautionary note is that in recent years, the market has consistently over-estimated job growth in September. The surveys suggest the median guess is around 170k, but we suspect it has crept higher. |

U.S. Unemployment Rate, September 2016(see more posts on U.S. Unemployment Rate, ) . Source: Investing.com - Click to enlarge |

| A significant challenge is that perhaps it is globalization. Perhaps it is technology. Those with a college degree have a 2.5% unemployment rate. The unemployment rate is more than twice as high for high school graduates. The unemployment rate for those without high school is almost the sum of the other two cohorts (~7.5%). That education/economic dynamic has become a political force to be reckoned. |

U.S. Participation Rate, September 2016(see more posts on U.S. Participation Rate, ) . Source: Investing.com - Click to enlarge |

U.S. Nonfarm Payrolls |

U.S. Nonfarm Payrolls, September 7(see more posts on U.S. Nonfarm Payrolls, ) |

|

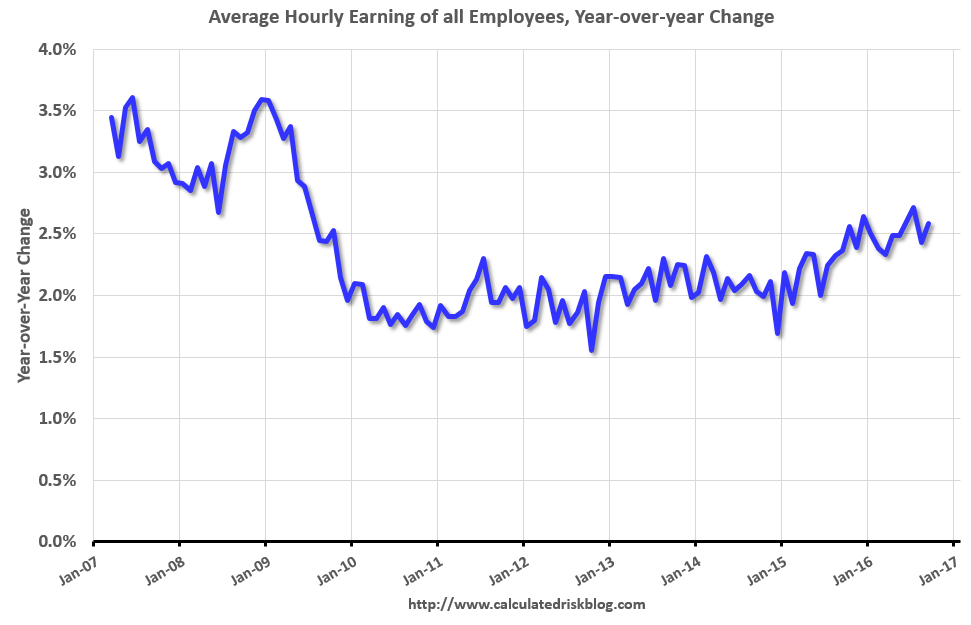

Other details from the report will also be important, like hourly earnings and average hours worked. The short-term market is going into the US report having extended the dollar’s gains and with the two-year note yield near four-month highs. The US two-year premium over EMU and the UK is the most in a decade. The CME model, based on the futures prices, estimates a 55.1% chance of a December hike and a 14.5% chance of a Nov move. Bloomberg puts the odds at 51.3% and 23.6% respectively. |

U.S. Average Hourly Earnings(see more posts on U.S. Average Earnings, ) |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,Canada Employment Change,Canada Unemployment Rate,FX Daily,newslettersent,Spain Industrial Production,U.S. Average Earnings,U.S. Nonfarm Payrolls,U.S. Participation Rate,U.S. Unemployment Rate