See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

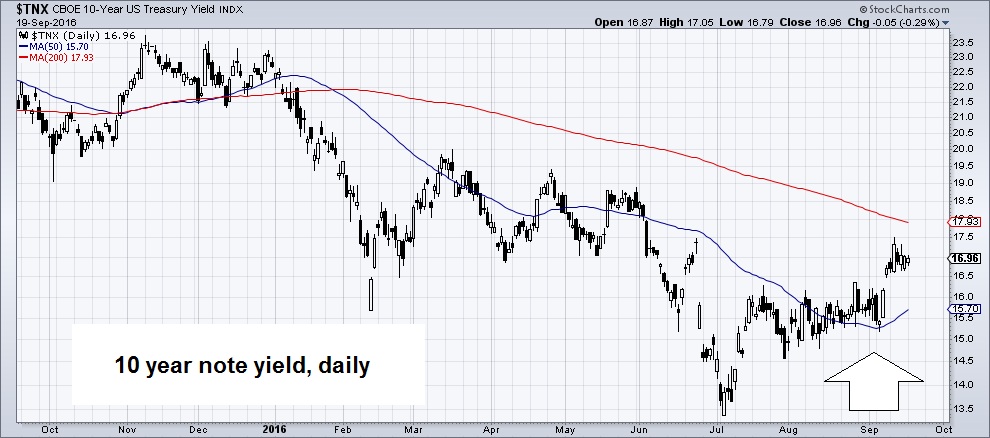

Interest Rate ConvulsionsThe prices of both metals were down again this week. We would guess that it has something to do with the fact that everyone knows: higher rates are coming to the dollar. The yield on the 10-year Treasury closed the previous week at 1.762% and this week at 1.701%. It may not look like much, but this is a change of +1.7%. Just repeat after me: “the Fed makes the economy more stable.” In any case, there are a few holes in the “bonds are in a bubble” bubble. One is that the worldwide trend for 35 years is falling rates. If one wishes to argue that this trend is over, one would have to acknowledge its cause and argue that this cause is no longer in effect (one would need a real theory, not just the old “inflation expectations” saw). More immediately, why are junk bonds and equities not dropping commensurately? If you look at a chart of junk bond yields, you see less volatility and the opposite trend. Since July 1, the Bloomberg High Yield Corporate Bond index is up 3.8%. |

Ten year treasury note yield(see more posts on U.S. Treasuries, )The short term trend has changed from down to up, but a much bigger rise would be needed to endanger the long term downtrend that has been in place since the early 1980s. |

| In the same period, the Bloomberg US Treasury Bond Index is down 1.1%. When a bond price falls, that means the interest rate is higher. For reference, 6-month LIBOR is up from 0.92% to 1.25%, or +36% (thirty six, not a typo).

We aren’t bond or equity traders, but we think it’s crystal clear that if rates are truly moving up, a lot, and durably, then all assets will be repriced lower. And if the US dollar is alone in bucking the falling rates trend, then look for a rising dollar index (i.e. all the other currencies will fall further, as traders will short them to get the even-greater interest rate differential). Needless to say, the idea of a rising dollar does not fit the bond-bubble-burst rising-rates Narrative. So for the moment, the prices of the metals—silver more than gold—are driven by this Narrative. How long until this Narrative bursts? There was an interesting news item this week, CME Group announced that it will presently launch a futures contract for the gold-silver ratio. This security will make it easier for the public to trade the gold-silver ratio. We think this is good, as it encourages arbitrage thinking. Of course, like every product in the market-casinos today, this one is designed to generate dollars (unlike our fund, which deals in physical metal, and generates gains in gold). We will have more to say about this contract as it gets closer to launch (Oct 24). |

LIBOR, London Interbank Offered RateLIBOR has been on a tear – partly this is the result of new regulations for money marker funds, which have led to liquidity in the euro dollar market drying up. But there is more to it than that actually. |

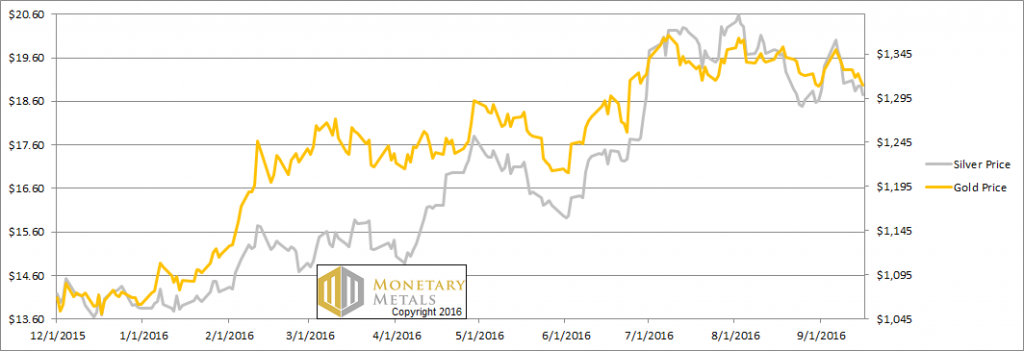

Fundamental DevelopmentsRead on for the only true picture of the fundamentals of the monetary metals. But first, here’s the graph of the metals’ prices. |

Prices of gold and silver(see more posts on gold price, silver price, ) |

Gold-silver ratioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It did not change this week. |

Gold-silver ratio(see more posts on gold silver ratio, ) |

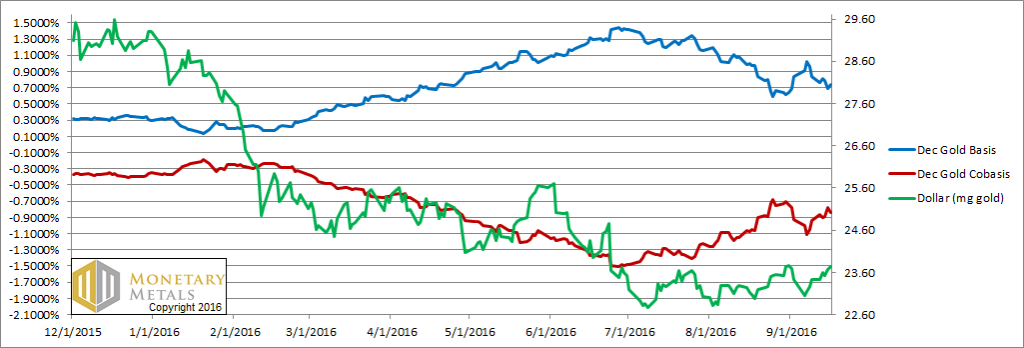

Gold basis and co-basis and the dollar priceHere is the gold graph. We switched from the October to December contract this week. The price of gold fell this week, as did the basis. The Monetary Metals fundamental price of gold is down just about as much as the market price. |

Gold basis and co-basis and the dollar price(see more posts on gold basis, Gold co-basis, ) |

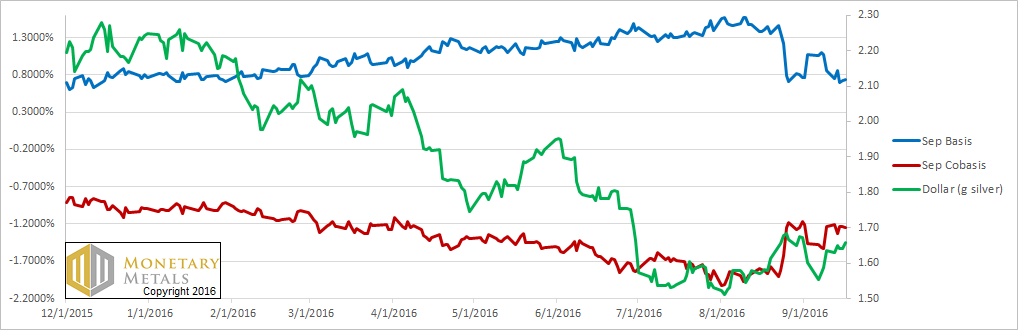

Let’s look at silver.

Silver basis and co-basis and the dollar priceThe price of silver dropped just as much as gold, in proportion. The basis dropped more. Our fundamental price is now two bucks under the market price. Does this mean the market price has to drop immediately, now that we know this? No, right now the market is in the grips of a mini silver mania (we would not dare say bubble, at least not without trigger warnings). Like the interest rate anomalies, it would be strange to see the price of silver take off like the famed mythological silver bug rocket while the price of gold languishes, moribund. |

Silver basis and co-basis and the dollar price(see more posts on silver basis, Silver co-basis, ) |

Charts by: StockCharts, Monetary Metals

Stockcharts captions by PT

Full story here Are you the author? Previous post See more for Next post

Tags: dollar price,gold basis,Gold co-basis,gold price,gold silver ratio,newslettersent,Precious Metals,silver basis,Silver co-basis,silver price,U.S. Treasuries