| As I noted on Thursday, the Fed non-announcement gave the bulls a reason to charge back into the markets as “accommodative monetary policy” is once again extended through the end of the year.

Of course, it is not surprising the Fed once again failed to take action as their expectations for economic growth were once again lowered. Simply, with an economy failing to gain traction there is little ability for the Fed to raise rates either now OR in December. |

|

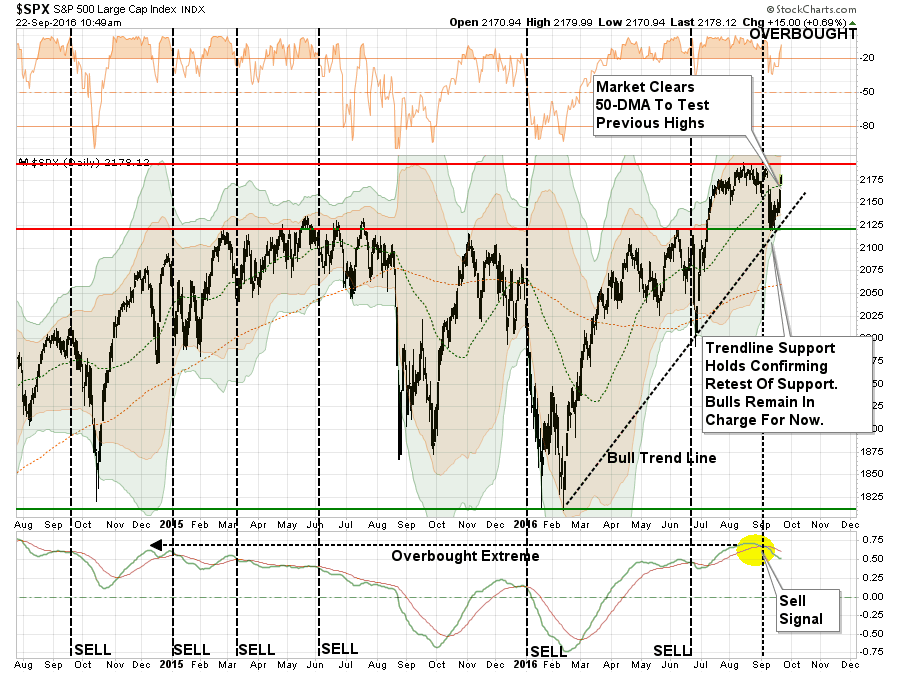

| However, it was the docile tones of the once again “Dovish” Fed that saved market bulls from a “bearish” rout. The recent test of the bullish trend line from February lows combined with a move back of the 50-dma clears the way for the markets to retest, and potentially breakout, to new highs. |

S&P 500 Large Cap Index(see more posts on S&P 500 Large Cap Index, ) |

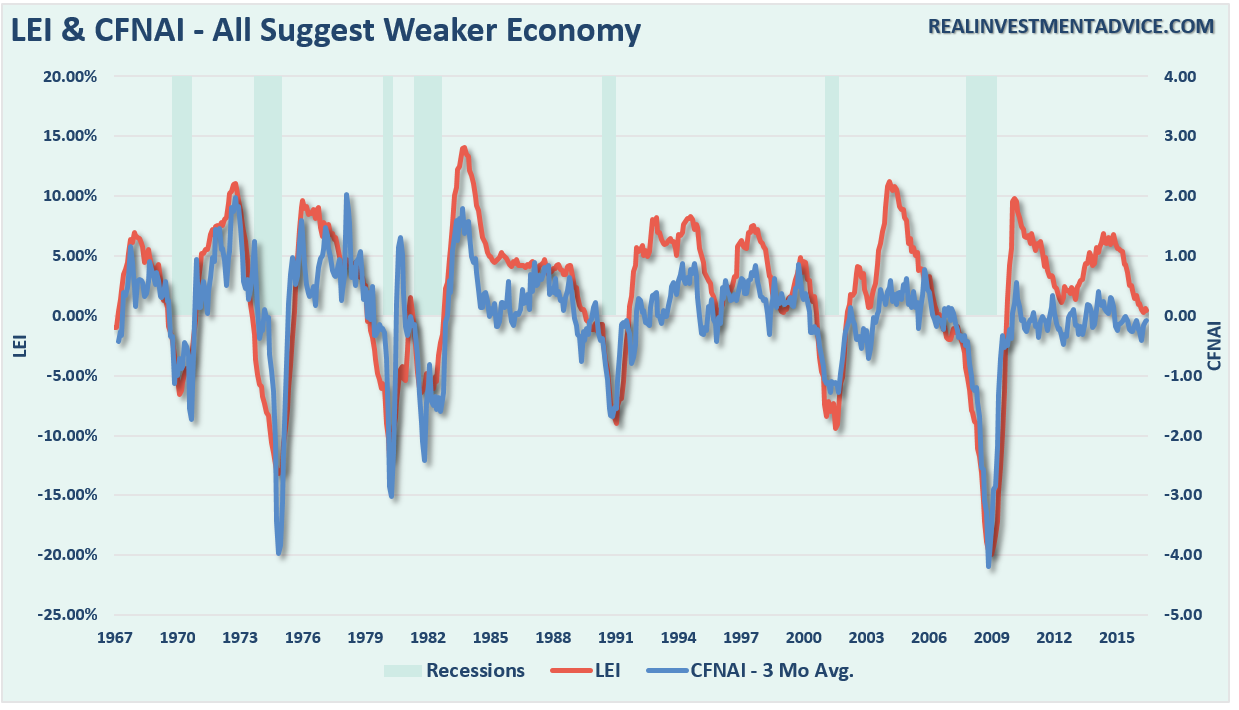

| With economic data remaining extremely weak, and leading indicators continuing to roll over, the “bad news is good news as the Fed stays on hold” scenario continues to play to investor’s favor….for now.

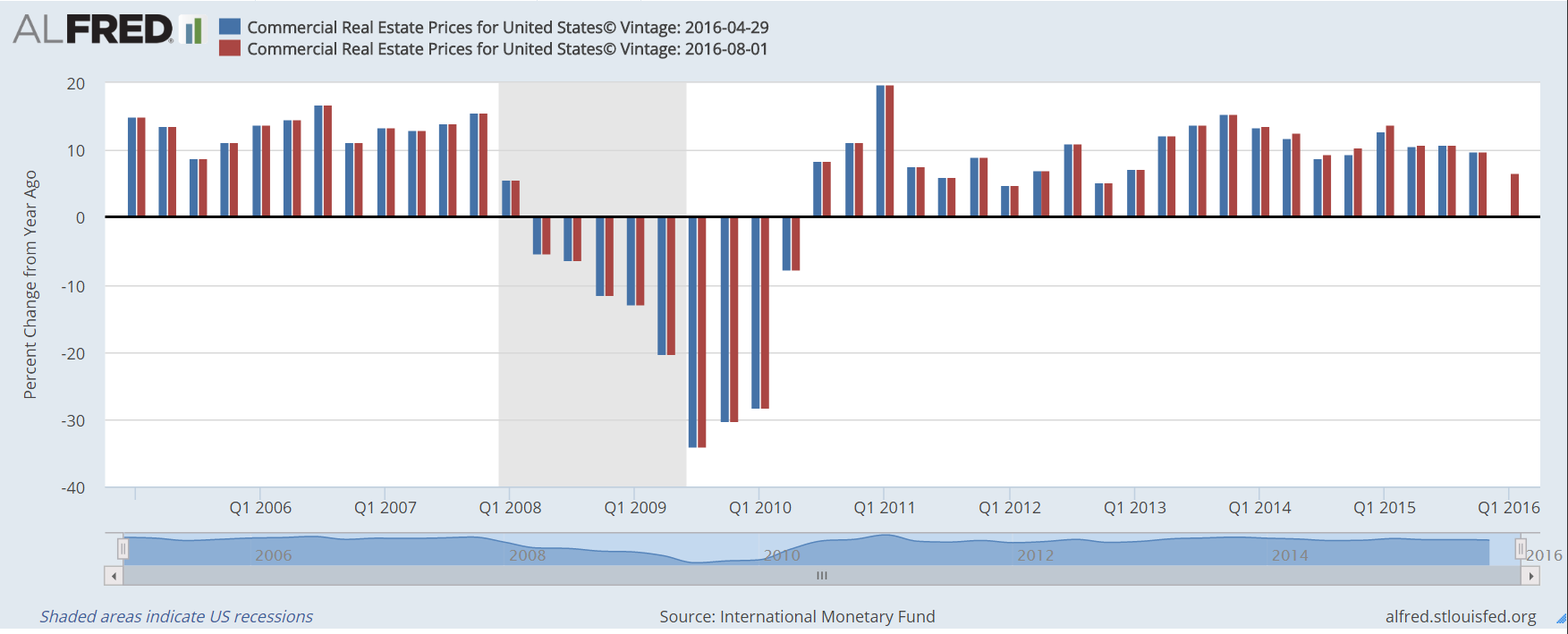

The question that remains, of course, is when does the reality of the weak economic environment begin to impact the fantasy of stock prices. It was interesting that Janet Yellen mentioned “commercial real estate values” in her latest comments to the press. To wit:

|

LEI & CFNAI - All Suggest Weaker Economy |

|

DO NOT misunderstand the gravity in her statement. Commercial Real Estate (CRE) valuations are a direct function of the economic cycle. The tenants of CRE buildings are companies that are affected by the ebb and flow of the economy. The reason that valuations are high relative to rent is due to the fact we are at a peak of an economic cycle. CRE values FALL during an economic recession as tenants give back space and vacate buildings.

What Janet Yellen said, without saying it, is that stock market valuations are high as stock prices have been bid up by investors just as with CRE. When CRE valuations fall, so will asset prices along with valuations.

However, for the moment, none of this matters. Global Central Banks continue to push assets into the market for now in the ongoing “chase for yield.” However, it is worth repeating that nothing last forever, but it can, and often does, last longer than you can imagine.

|

Commercial Real Estate prices for U.S. |

Unfortunately, so does the reversion to the mean.

But, in the meantime, here is what I am reading this weekend.

Fed / Economy

- Promise In Sept., Deliver In December by Danielle DiMartino-Booth via Money Strong

- When The Music Stops by Teddy Vallee via Pervalle.com

- Trump’s Guide To Weak Labor Market by Sarah Ponczek via Bloomberg

- Harvard University Crushes Obama’s Recovery Story by Tyler Durden via Zerohedge

- Deutsche Bank: Recession Indicators Are On by Akin Oyedele via BI

- The Wealth Effect Was Never Valid by Jeffrey Snider via Alhambra Partners

- Is The Fed Politically Biased by Jim Puzzanghera via LA Times

- The Fed Of Yesteryear Is Dead by Robert Samuelson via RCM

- Balance Sheet Anxiety by Scott Sumner via Econolib

- Monetarists Are Out Of Ideas by Noah Smith via Bloomberg

- US Economy Recovering? Hardly! by Jim Clifton via Gallup

- Fed Faces A Credibility Problem by Patrick Gillespie via CNN Money

- The Fed’s Growing Economy; Never Mind by Joe Calhoun via Alhambra Partners

Markets

- This Market Sell-Off May Be Different by Mohamed El-Erian via Bloomberg

- The Most Important Charts by Akin Oyedele via BI

- S&P To Tumble To 20-year Lows by Sue Chang via MarketWatch

- Goldman: Stocks Could Crash By 25% by Bob Bryan via Business Insider

- The Economy & The Stock Market by Pater Tenebrarum via Acting Man blog

- How The Fed’s Decision Could Affect Stocks by Michael Kahn via Barron’s

- Is The Mother Of All Corrections Coming? by Jeremy Warner via The Telegraph

- Oil Prices At $70? Not A Chance by Tim Daiss via Forbes

- Inflation! The Good Kind & The Bad by Ed Yardeni via Yardeni Research

- Bond Market Will End Badly by Brett Arends via MarketWatch

- Investors Have No Place Hide by Nigam Arora via MarketWatch

- More Pain For Stocks To Come by Michael Kahn via Barron’s

- Most Dangerous Market I’ve Ever Witnessed by Tyler Durden via ZeroHedge

- The Shrinking U.S. Stock Market by Political Calculations

- Fed & Stock Market Performance by Mark DeCambre via MarketWatch

Interesting Reads

- Deplorables: Who We Are & What We Want by Brandon Smith via Alt-Market

- The Coming Anti-National Revolution by Robert J Shiller via Project Syndicate

- Obama’s Victory Lap On Incomes Premature by Stephen Moore via The Washington Times

- The Essence Of Decision by Ben Hunt via Financial Sense

- 7 Lessons People Learn Too Late In Life by Nicolas Cole via Inc.

- Everything Paul Krugman Says Is Wrong by Robby Soave via Reason

- WFC – TBTF & Too Arrogant To Admit It by Dana Milbank via Washington Post

- Justify Your Smart Beta Methodology by Rob Arnott & Chris Brightman via ETF.com

- Fed Meetings And The Markets by Value Walk

- Support Drops Away by John Hussman via Hussman Funds

- Just Plain Pathetic by David Stockman via Contra Corner

- Traders Quickly Get Comfortable With Stocks Again by Dana Lyons via Tumblr

- C0rporate Buy Back Binge Blows Another Bubble by Jesse Felder via The Felder Report

“Fed Says Economy Is Weaker And Stocks Go Up. If We Get A Depression I Will Be Rich!” — Richard Rosso, CFP.

Questions, comments, suggestions – please email me.

Full story here Are you the author? Previous post See more for Next postTags: Economics,Federal Reserve,Investing,Lance Roberts,negative rates,newslettersent,recession,S&P 500 Large Cap Index,stock market,stocks