| As summer begins to fade, and kids return to school, the focus once again turns to the annual event of Central Bankers in Jackson Hole, Wyoming. However, if you only looked at the market as a gauge as to the excitement of the event, well it must have been one pretty boring after-party. |

As summer begins to fade, and kids return to school, the focus once again turns to the annual event of Central Bankers in Jackson Hole, Wyoming. However, if you only looked at the market as a gauge as to the excitement of the event, well it must have been one pretty boring after-party. - Click to enlarge |

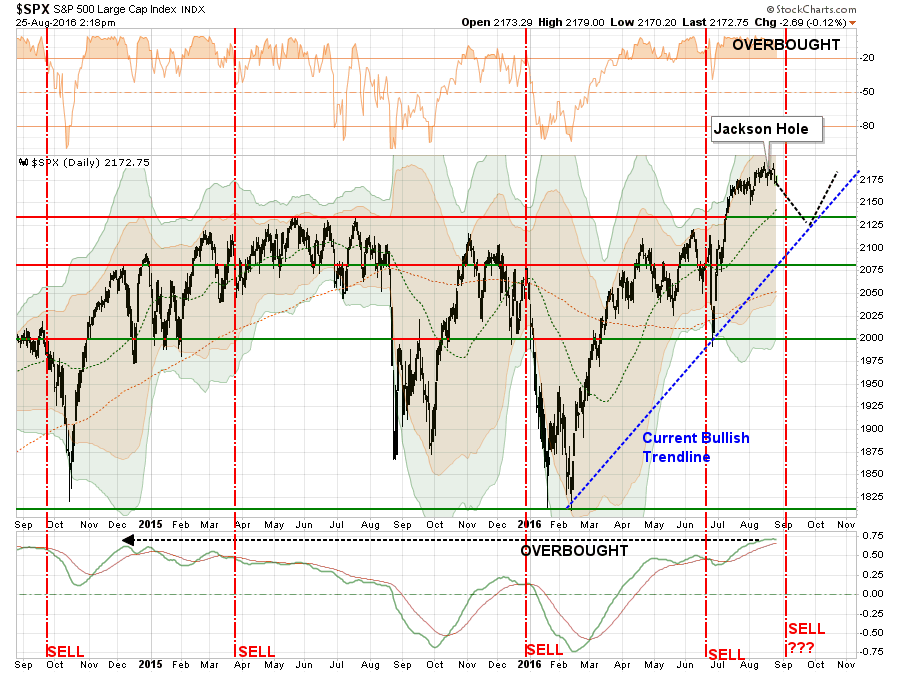

| The current action is aligning more closely with a normal corrective event from an extreme overbought condition. During such a “normalized” market correction, the market should pull back to the most recent support, hold that support level and turn higher if the current bullish trend is to remain intact.

However, with all other indicators now pushing extreme levels, a correction from current levels could be somewhat larger than currently anticipated. As I discussed recently:

|

S&P 500 Large Cap Index As summer begins to fade, and kids return to school, the focus once again turns to the annual event of Central Bankers in Jackson Hole, Wyoming. However, if you only looked at the market as a gauge as to the excitement of the event, well it must have been one pretty boring after-party. - Click to enlarge |

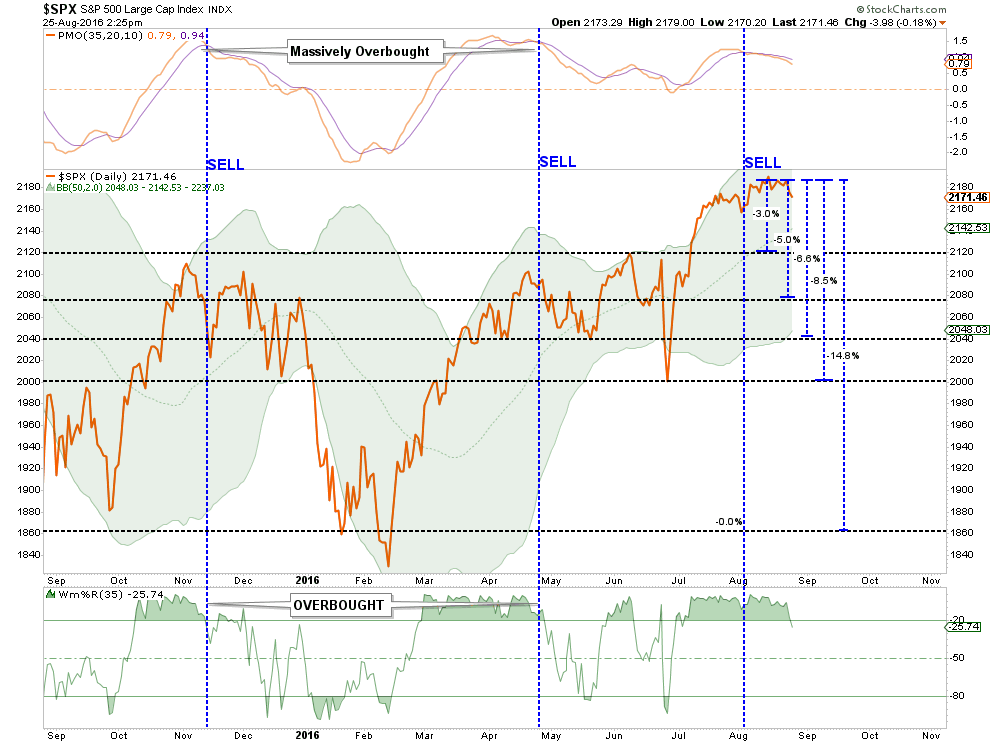

The problem for individual investors is the “trap” currently being laid between the appearance of strong market dynamics against the backdrop of weak economic and market fundamentals. There will be a collision between the fantasy of asset prices and the reality of the underlying fundamentals. This will particularly be the case if the much anticipated rebound of economic growth and earnings fails to materialize. |

As summer begins to fade, and kids return to school, the focus once again turns to the annual event of Central Bankers in Jackson Hole, Wyoming. However, if you only looked at the market as a gauge as to the excitement of the event, well it must have been one pretty boring after-party. - Click to enlarge |

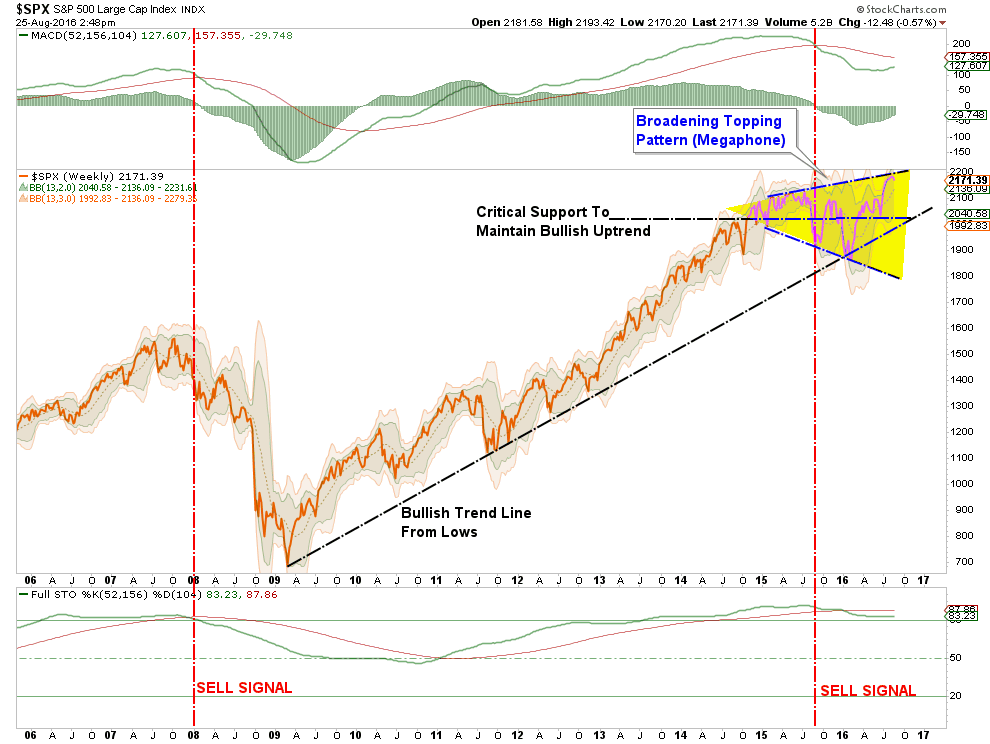

| With longer-term combined sell signals currently in place and the market still processing a broadening topping pattern, the extremely high levels of “complacency” are likely misplaced.

As I wrote previously:

In other words, over the next few days to weeks the market is at best a “coin flip” currently. However, the longer-term outcomes are heavily stacked against those betting the markets only go up from here. Here is what I will be reading this weekend. |

As summer begins to fade, and kids return to school, the focus once again turns to the annual event of Central Bankers in Jackson Hole, Wyoming. However, if you only looked at the market as a gauge as to the excitement of the event, well it must have been one pretty boring after-party. - Click to enlarge |

Fed / Economy

- Old Faithful Meets New Normal by Danielle DiMartino-Booth via Money Strong

- Fed Turns Up Volume, Market Tunes Out by Caroline Baum via MarketWatch

- The Fed Needs A New Way Of Thinking by Kevin Warsh via WSJ

- The Great Unraveling by Tyler Durden via Zero Hedge

- Crash Coming Despite Fed by Chris Vermeulen via TheStreet

- Too Late For Fed To Raise Rates by David Nelson via David Nelson, CFA

- Politics Of Negative Rates by Yanis Varoufakis via Project Syndicate

- Recent Economic Data To Confuse Fed by Robert Johnson via Morningstar

- 3-Tough Questions For Central Bankers by Matthew Lynn via The Telegraph

- Central Banks Have Broken The Market by Alexandra Scaggs via FT

- Dollar Weakness & Fed Expectations by Marc Chandler via Real Clear Markets

- Fed Is Hostage To Wall Street by James Grant via Finanz Und Wirtschaft

- Fed Rate Hike Would Be A Disaster by Ron Insana via CNBC

- Matt King: How CB’s Got It All Wrong by Tyler Durden via Zero Hedge

Markets

- The Lowest Vol In A Lifetime by Macro Man

- Surging Stocks But Investors Unhappy by Suzanne McGee via The Guardian

- These Charts Flashing A Recession by John Schoen via CNBC

- Millennials – Stick All Your Money In Stocks by Sean Williams via USA Today

- It’s Scarily Quiet In The Market by James Mackintosh via WSJ

- Slide In Dividend Stocks by Michael Kahn via Barron’s

- Long Term Sell Signal For Stocks? by Chris Ciovacco via Ciovacco Capital

- Technical Indicators & The Markets by Sid Verma via Bloomberg

- You Can’t Win With Active Management by Eric Nelson via Seeking Alpha

- Passive Investing Worse Than Marxism by David Keohane via FT

- Are Index Funds The Road To Serfdom by Matt Levine via Bloomberg

- Bad News From T.I.N.A. Land by Pater Tenebrarum via Acting Man Blog

- 5 Things To Derail Stock Market Rally by Adam Shell via USA Today

- 10 Charts Signal A Correction Ahead by Sue Chang via MarketWatch

Just Great Reads

- The Hidden Risks In Corporate Balance Sheets by AP via SFGate

- Something Amiss With Home Sales by Aaron Layman

- 23 Signs Of Pundits Or Professionals by Charlie Bilello via Tumblr

- 5 Factors Weighing On America by Todd Buchholz via MarketWatch

- Healthcare Isn’t A Right by Megan McArdle via Bloomberg

- Looking Ahead To A Bullish Outlook via John Hussman via Hussman Funds

- The Dollar & Productivity Puzzle by Joe Calhoun via Alhambra Partners

- Earnings Recession Finally Bottomed? by IronMan via Political Calculations

- Corporate Profits Head For Big Bounce by Anthony Mirhaydari via Fiscal Times

- Why Markets Obsess Over Yields by The Economist

- Euphoria Is Already Upon Us by Eric Parnell, CFA via Seeking Alpha

- NYT’s Dire Warning About Polling by Michael Krieger via Liberty Blitzkrieg

- Bubbles In Bond Land by David Stockman via Contra Corner

- No Complacency? by Dana Lyons via Tumblr

- A Generational Peak In Corporate Profits by Jesse Felder via The Felder Report

“Discipline, which is but mutual trust and confidence, is the key to all success in peace and war.” ― General George S. Patton, Jr.

Questions, comments, suggestions – please email me.

Lance Roberts

Full story here Are you the author? Previous post See more for Next postTags: Economics,Federal Reserve,Investing,Lance Roberts,negative rates,newslettersent,recession,stock market,stocks