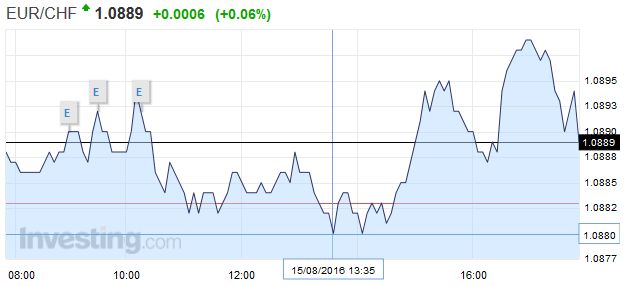

Swiss FrancThe Swiss Franc was nearly unchanged against the euro. |

|

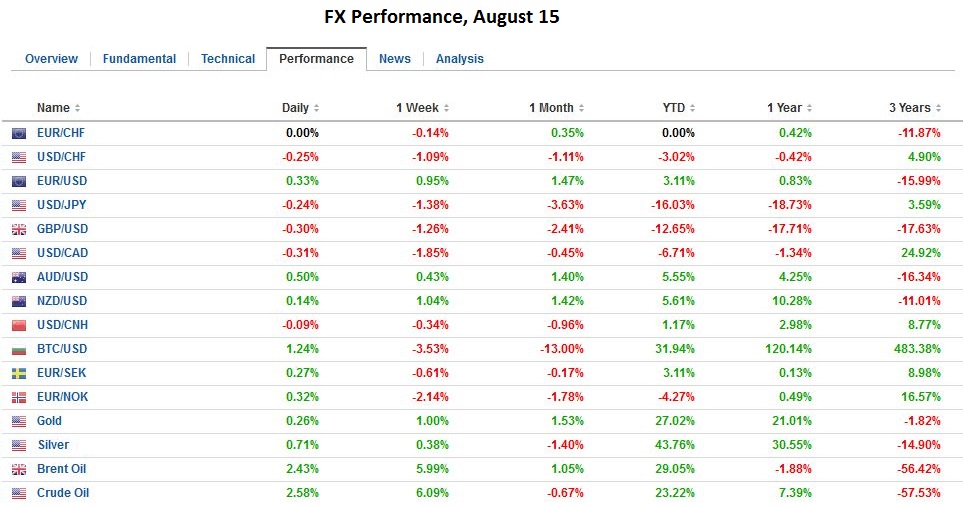

FX RatesThe US dollar closed the pre-weekend session well off its lows that were seen in response to the disappointing retail sales report. It has been unable to sustain the upside momentum, and as North American dealers prepare to return to their posts, it is trading lower against most of the major currencies. The notable exceptions are the Scandi-bloc, which are consolidating last week’s gains, and sterling, which remains pinned near $1.29. Sterling continues to trade heavily, but the bears have been unable thus far to push it below $1.2900. The main news was the house price index from Rightmove. It slumped 1.2% in August, which leave its up 4.1% year-over-year. It is the second consecutive monthly decline and the lowest year-over-year pace since May 2015. What this metric shows is that house sellers are lowering their asking price, which is what other surveys have also shown. Whereas sterling is a touch lower (-0.05), 10-year Gilts are firmer (yield is half a basis point lower) in line with other core bond markets, and the FTSE is edging higher alongside most European bourses. The Dow Jones Stoxx 600 is up 0.15% in late-morning turnover in London led by energy and health care. Materials and telecoms off around 0.25% and are the weakest sectors. Of note, Italy is on holiday, and the German Dax is flirting with breaking even on the year with it modest gain today. |

|

| The euro has been confined to a quarter cent range above $1.1150. It has reached $1.1220 in response to the disappointing US retail sales data, which saw many models shave their estimate for Q3 US data by 0.2 percentage points. Today’s is the fourth session that the euro held above $1.1100. On the upside, in addition to the pre-weekend high, a downtrend line from May and June highs is found near $1.1250 today.

The Australian dollar had a poor close before the weekend, but after the yen is the second strongest major currency today. Initially, it extended the pullback from last week’s high scored near $0.7755 in the middle of the week. It briefly traded below $0.7640 today in Asia but rebounded to $0.7680 in the European morning, but appears to be running out of steam. The Aussie fell in the last two sessions. It has not had a string of three losses in three months. |

|

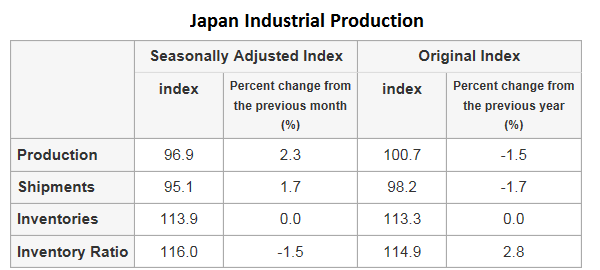

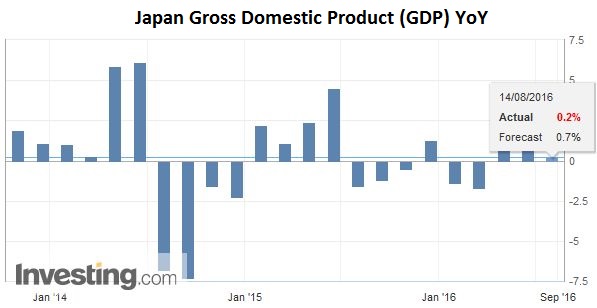

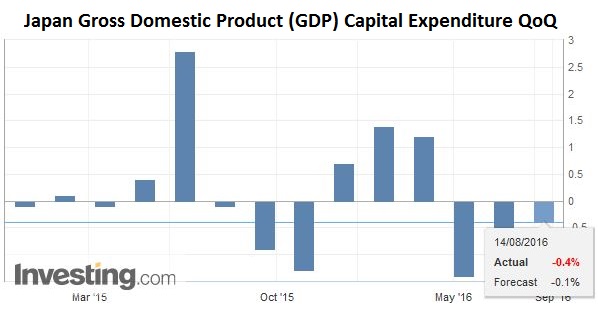

JapanThe main economic news was the disappointing Japanese Q2 GDP. The world’s third largest economy stagnated in Q2 (quarter-over-quarter). Economists had expected a small increase (~0.2%) after 0.5% in Q1. On a seasonally-adjusted annualized basis the economy grew 0.2%. The market expected something closer to 0.7%. News that Q1 was revised up to 2.0% from 1.9% did not take the sting away from the disappointment.

|

Click to enlarge. Source Investing.com |

| Consumption remained weak with a 0.2% increase, which was widely anticipated. In the first three months of the year, consumption rose 0.7% (initially it was reported at 0.6%). Business spending fell 0.4% after a 0.7% decline in Q1. It has not declined in the first two-quarters of the year since 2009. Net exports reduced GDP by 0.3 percentage points. |

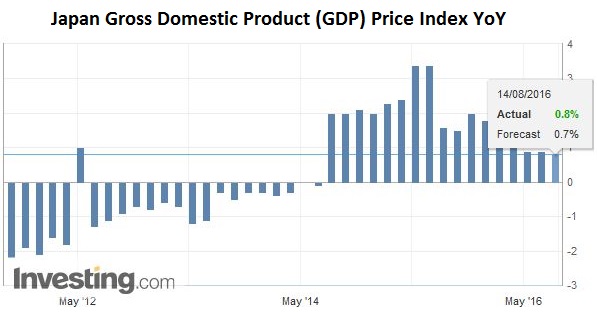

Click to enlarge. Source Investing.com |

| The GDP deflator eased to 0.8% from 0.9%. It is the third consecutive quarter that the deflator fell.

If the disappointing Japanese data was supposed to add pressure on the BOJ to provide more stimulus when it meets next month, it is not evident in the market response today. The Nikkei eased 0.3%, while the yield of the 10-year JGB rose two bp tominus9. The yen is the strongest of the major currencies today, gaining 0.3% against the US dollar. The greenback is sitting just above the shelf forged over the past two weeks in the JPY100.65-JPY100.80 area. |

Click to enlarge. Source Investing.com |

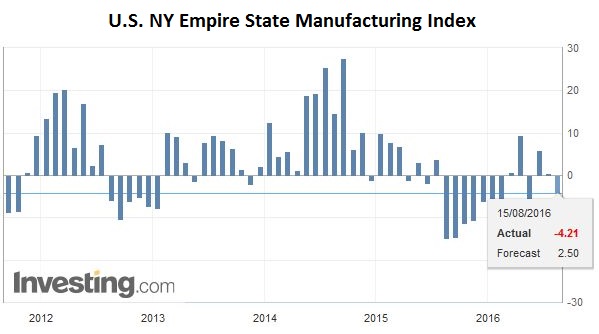

United StatesThe Canadian dollar is also in narrow ranges, consolidating its recent gains. A trendline off the US dollar’s May and June lows is found near CAD1.2875 today, but it looks to go untested today. The CAD1.2920 may hold, which would set up a test on the CAD1.2980-CAD1.3000 area. The US session features the Empire State manufacturing survey for August. The median forecast in the Bloomberg survey is for a 2.0 reading after 0.55 in July. While this does not sound like an impressive report, note that the 3, 6 and twelve-month averages are negative. US TIC data (for June) is not released until after the markets close. One notable shift is that the private sector investors appear to be buying US Treasuries from central banks. Note that Federal Reserve custodial holdings for foreign central banks were still increasing in June, but peaked in July. (~$3.379 trillion), and as of last week, are off $179 bln since then (to stand at $3.2 trillion). |

Click to enlarge. Source Investing.com |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next post

Tags: #USD,Australian Dollar,Bank of Japan,British Pound,Canadian Dollar,EUR/USD,FX Daily,Japan Gross Domestic Product,Japan Industrial Production,newslettersent,U.S. NY Empire State Manufacturing Index,usd-jpy