Swiss FrancOnce again, EUR/CHF reverses in the middle of the week. A part from technical reasons, the weak French CPI (+0.4% YoY) and Italian CPI (-0.2% YoY) exercised downwards pressure on the euro. |

|

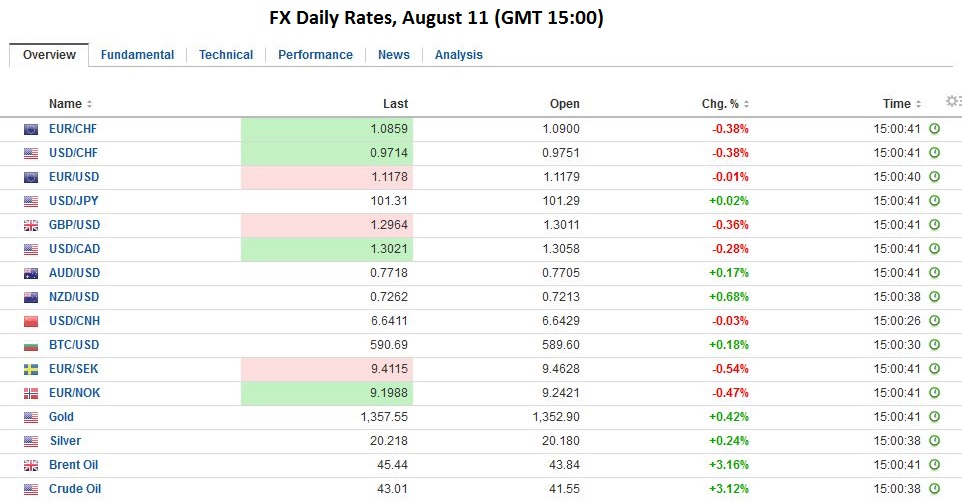

FX Rates

|

|

|

Not only was the rate cut widely anticipated, but in recent days, there was talk of the chances of a 50 bp rate cut. The derivatives market appeared to discount about a 20% chance of a 50 bp move, which Governor Wheeler indicated he did not seriously consider. The RBNZ’s path for the 90-day bill implies a trough in the official cash rate of 1.50%-1.75% rather than 2% previously. This is a little above what the market prices implied. Still, officials made it clear that the strength of the currency was a challenge. By suggesting that the inflation target is more important than ever, it points market participants which data to pay particular attention to going forward.

With today’s pullback, the euro has retraced 38.2% of the post-US jobs report rally. That retracement is found near $1.1135. The next retracement is $1.1120, which also corresponds to the 20-day moving average. It looks as if today’s pullback is over or nearly so, and regaining the $1.1160 level could spur the euro for a running start at $1.12 again.

|

|

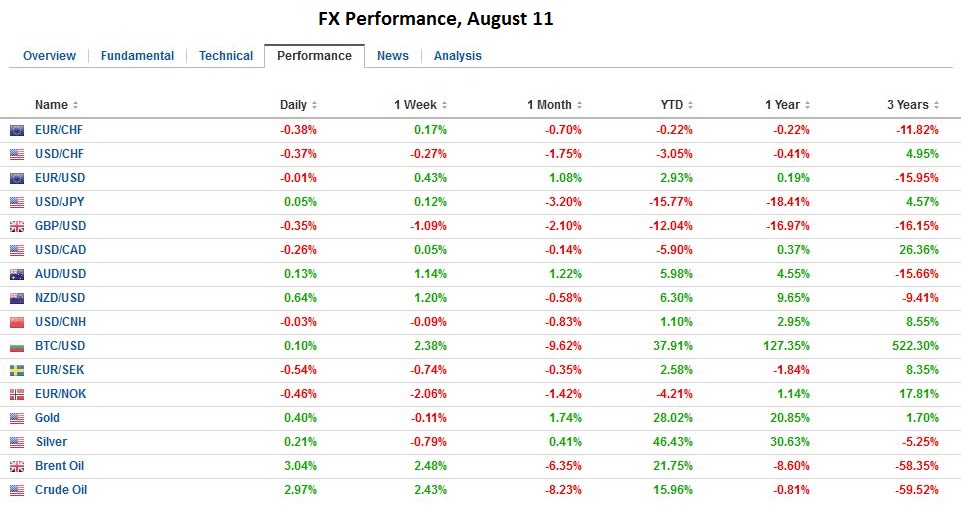

SwedenThe news stream remains stuck in the summer lull, but following Norway earlier in the week, Sweden reported firmer than expected consumer prices. The 0.1% rise in July is the third consecutive increase, the longest advancing streak in two years. The year-over-year pace edged up to 1.1%, the highest in four years.

|

Click to enlarge. Source Investing.com |

|

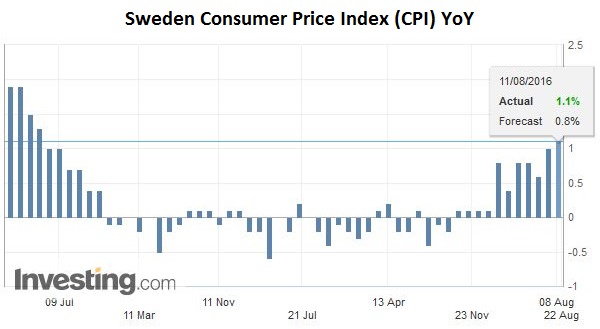

The underlying rate of inflation in Sweden is not what is often thought of as a core measure (excluding food or energy or both) but is calculated using fixed mortgage interest rates. By that measure, the year-over-year pace is 1.4%, down from 1.5% in June. It remains near its highest levels in five years.

The takeaway is it appears that rising consumer inflation reduces pressure on the respective central banks to ease policy, and both currencies are appreciating against the euro. Today is the third session that the Swedish krona is gaining against the euro and the sixth in the past nine sessions. The euro is only slightly lower today against the Norwegian krone after falling 1.1% yesterday. It losing streak is extending into the fourth session. The euro has only risen against Nokkie in two of the past 10 sessions.

|

Click to enlarge. Source Investing.com |

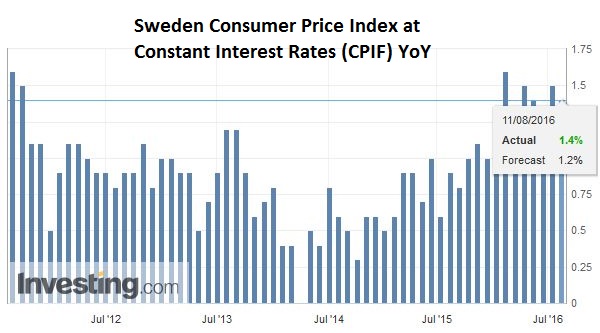

Crude Oil

|

Click to enlarge. Source Investing.com |

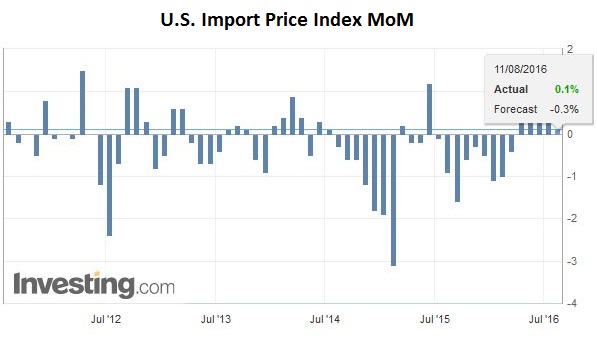

United StatesThere are a few economic reports from the US and Canada today, but nothing that is likely to move the markets. The US reports July import prices. A decline much larger than 0.4% could impact expectations for tomorrow’s PPI report.

|

Click to enlarge. Source Investing.com |

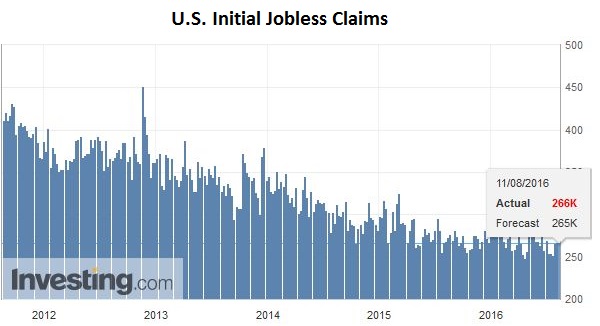

| Weekly jobless claims are the closest thing to a real-time report on the US labor market. Next week’s report will be more important as it covers the week of the nonfarm payroll survey.

Tomorrow the US reports retail sales. Auto sales improved more than expected in July and that will keep the headline firm. The GDP components are expected to rise 0.3% after two months of 0.5% increases. Consumption in Q2 rose over 4%. Some moderation in Q3 is expected, with investment picking up some slack, and the inventory headwind diminishing. |

Click to enlarge. Source Investing.com |

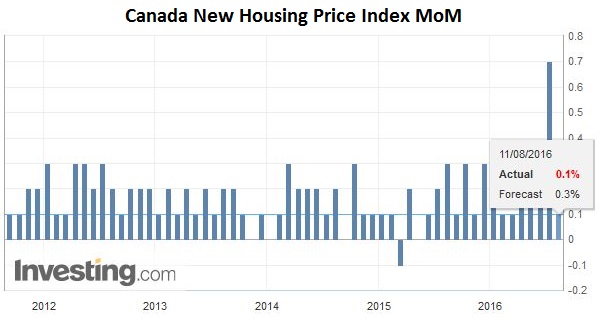

| Separately, Canada reports new house prices. A 0.3% increase is expected in June after a 0.7% rise in May. It would probably keep the year-over-year rate near 2.7%. |

Click to enlarge. Source Investing.com |

Tags: #USD,British Pound,Crude Oil,EUR/USD,FX Daily,New Zealand,newslettersent,Norway,OIL,Sweden,U.S. Initial Jobless Claims