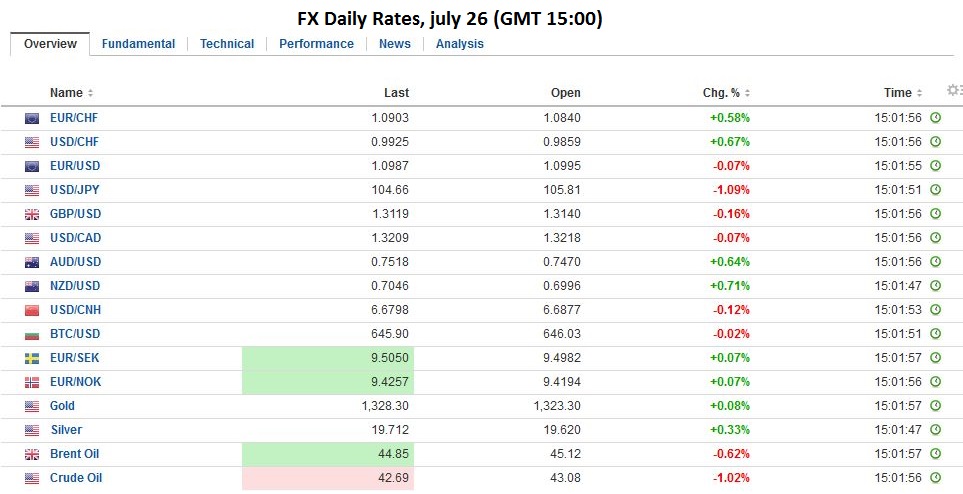

Swiss FrancThe Swiss Franc strangely depreciated on a day, when the other safe-haven, the yen strongly improved. The euro went up to 1.0899 by 0.54%. The reason seems to be technical. |

|

USD/CHF Finally over 200DMA?After USD/CHF broke the 200 days moving average (0.9854), and a descending channel since November 2015. This break could lead to a new pattern building. If the SNB has sustained the rise with some stronger FX interventions, is open until next week’s sight deposits. We often emphasized that the dollar is currently too high for FX interventions and that the SNB might focus on EUR. |

JapanThe strength of the Japanese yen is the main development in the foreign exchange market today. It has gained nearly 1.5% as short-term participants grow skeptical of the kind of stimulus that had driven the yen around 7.5% lower between July 8 and July 21’s six-week high. The pendulum of market sentiment has swung wildly. One set of estimates had risen from JPY10 trillion to JPY30 trillion over that period. There was also the fascination with a version of helicopter money by which the Japanese government would issue non-marketable, perpetual, zero coupon bonds that the BOJ would buy through newly created credits. Despite the illegality of such a policy, some observers seemed too hasty to shrug off Kuroda’s assessment because it was made in the middle of June. In our discussions of the fiscal stimulus, we have emphasized the distinction between the inflated headline figure, puffed up by rolling up other programs and commitments, and the fresh water figure, which the is the stripped down new news. We read yesterday’s report that the stimulus was going to be JPY6 trillion instead of JPY3 trillion to be referring to the fresh water. Today’s comment by Finance Minister Aso that the size of the package, expected as early as next week, as not been decided yet only adds to the uncertainty and confusion. The market seems less sure of what the BOJ will do at the end of this week. And even if one knew what the BOJ was going to do, there is not much confidence in anticipating the yen’s direction. We had thought there was room for disappointment with the BOJ. Of the three dimensions of its current policy, the quantity of assets being purchases, the quality of those assets, and interest rates, we had thought that increasing ETF purchases, and perhaps some other risk assets, maybe the likely course. |

Click to enlarge. Source Investing.com |

FX Rates

|

|

| In the heavier US dollar context, sterling has managed to recover from the initial slide to $1.3060 on news that MPC member Weale, who last week voiced some opposition to the dovish signals from Carney (and the minutes), says the flash PMIs convinced him of the need for immediate monetary support. Initial resistance is seen near $1.3160 and then $1.3220.

Tomorrow’s first estimate of Q2 GDP may only be interesting in passing, and despite some claims that the referendum was already having an impact in Q2, the economy may have actually accelerated a touch. More important may be Thursday’s house prices and business survey. Reports suggest prices of residential real estate in the London area have fallen sharply over the past month. The euro is firm today after testing the $1.0950 area yesterday, which was the first session since early-March that the euro did not trade north of $1.10. Today it is, but not by much. It appeared to stall near the lower end of a band of resistance that extends from $1.1030 to $1.1060. The news stream is light, and the market is awaiting the stress test results at the end of the week. |

|

United StatesThe North American session features S&P Case-Shiller house prices for May, which are expected to have ticked up slightly and the June new home sales reports, where a small increase is anticipated after a 6% fall in May. The first estimate of Q2 GDP is out on July 29. The Bloomberg median of 2.6% is a little above the NY and Atlanta Feds’ GDP trackers. Barring a shocking Fed hike tomorrow, Q3 data is more important from a policy point of view than Q2 data. |

Click to enlarge. Source Investing.com |

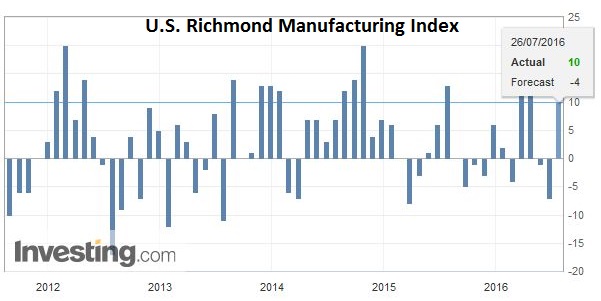

| The Richmond July manufacturing survey hardly has heft, though we note that much stronger than expected recovery in the Dallas Fed manufacturing index yesterday plays on ideas that the US belt is basing for recovery. Markit’s preliminary service PMI for July is also on tap, along with the Conference Board’s measure of July‘s consumer confidence. |

Click to enlarge. Source Investing.com |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,200-day moving average,Australian Dollar,Bank of Japan,British Pound,EUR/USD,FX Daily,Haruhiko Kuroda,Helicopter Money,Mark Carney,newslettersent,SPY