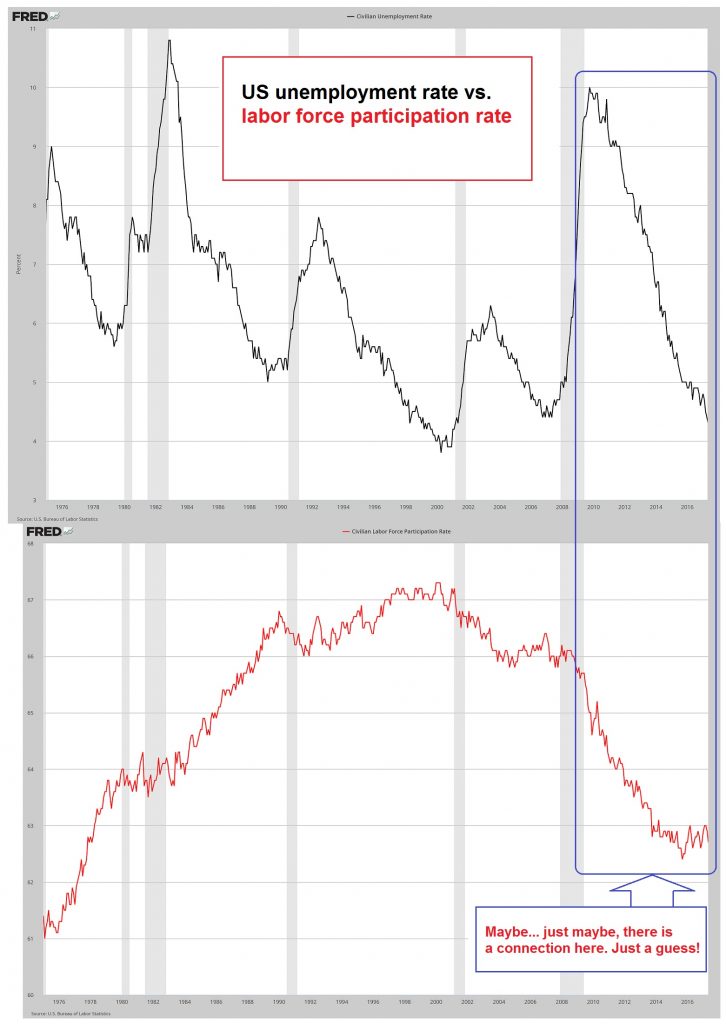

US grew nearly 300k jobs in December. The October and November jobs growth were revised up by 50k. The unemployment rate was unchanged at 5.0%, even though the participation rate ticked up.

If there was a disappointment it was that hourly earnings did not rise as much as expected. The 2.5% year-over-year growth from 2.3% in November. The market had expected a 2.7% pace. Still it is the upper end of the cycle.

Some other details were constructive. Manufacturing gained 8k jobs. The market expected a loss of 2k. The November series was revised up from -1k to +2k. The household survey found that employment rose by 485k, the most since the start of last year.

The recent string of US economic data has disappointed. Q4 GDP appears to be tracking less than 1%, according to the Atlanta Fed. However, the strong jobs report will go a long way toward assuring the Fed's leadership that the broad strategy outlined is still valid. Fed officials could hardly have hoped for a more supportive jobs report.

On the other hand, Canada's jobs report was a little less than desired. Overall jobs growth was better than expected at 22.8k, but this was all part-time work. It rose 29.2k. Full-time positions fell 6.4k (after a sharp 36.6k increase in November). The Canadian participation rate also tick up (65.9 vs 65.8.

US stocks have rallied and bonds have weakened in response. The fx-sensitive two-year swap rates are lending the dollar support. With Chinese markets and yuan stabilizing, the US jobs data, despite the implications for Fed policy, is helping emerging market currencies recover as well.

Tags: Canada Participation Rate,U.S. Participation Rate