The broad interpretative framework we developed since late 2014, one that centers the de-synchronization of the major economies, will retain its usefulness into the New Year and beyond. The first phase of divergence was characterized by the Federal Reserve standing pat after winding down its open-ended asset purchase operations (QE3+), while many central banks from high income countries, including the eurozone, Japan, China, Canada, Australia, New Zealand, Sweden, and Norway eased policy.

Laying the Groundwork for 2016

With the Federal Reserve’s rate hike at the end of 2015, a new phase of divergence is at hand. It will be characterized by both Fed becoming less accommodative while other central banks maintain or extend current easing policies. Some central banks may have reached the end of their easing cycles, but it is possible that the door is not completely closed.

We expect the Obama dollar rally to continue in 2016. The premium one earns on US rates will continue to attract capital flows. Because of the wide, and widening interest rate differentials, one is paid to be long dollars. This has powerful implications for hedging. Dollar-based investors are paid to hedge exposure (receivables) in euros, Swiss franc, and Japanese yen for example.

Our assessment of indicative market prices suggests that the divergence meme, as much as it has been discussed, has not been discounted. By the time the ECB met in early December when it cut the deposit rate 10 bp to minus 30 bp and expand its program by six months (through March 2017), the premium the US offered over Germany for two-year borrowing had increased to nearly 140 bp. It was around 85 bp when the euro bottomed in March 2015.

The Fed funds futures strip suggests that the participants are skeptical about a second Fed rate hike in Q1 16. The Federal Reserve’s dot-plots suggest a majority of Fed officials think it would be appropriate. Several large investment houses, and Fitch, the rating agency, forecast a hike every quarter.

We recognize that the market is a great discounting mechanism. Arguably it has no rival for its ruthless ability to aggregate vast quantities of information. We have found it helpful in navigating the markets to appreciate that events can be anticipated and discounted. Buying rumors, selling facts is standard fare in the capital markets. However, conceptually, we think that the widening interest rate differentials cannot be fully discounted. The interest rate differentials, including the slopes of yield curves, provide powerful incentives driving new flows, influencing investment, hedging and liquidity decisions.

Federal Reserve:

· The pace of monetary policy normalization will depend on economic data, Fed expectations, and broad financial conditions.

· There are several factors that make this cycle unique and arguably, even more, challenging than would normally be the case, including the new policy tools used by the Fed, and lower nominal GDP.

· The Fed’s balance sheet is in play as an estimated $220bln in Treasuries are set to mature next year.

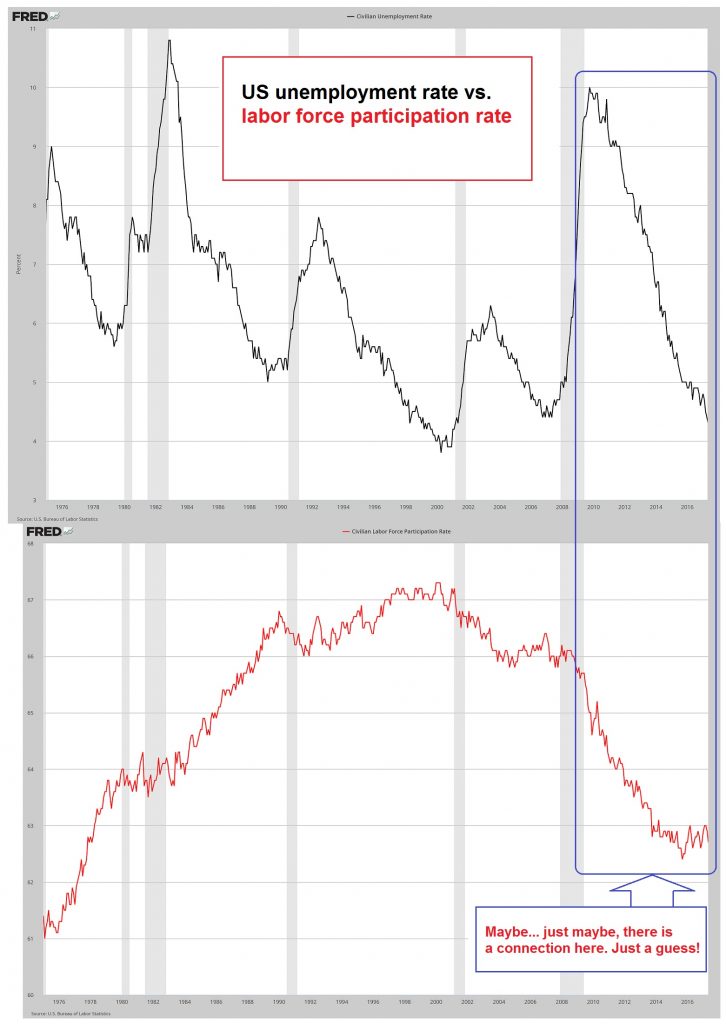

The pace that monetary policy can be normalized will be a function of the economic data in absolute terms and about Fed expectations. At the same time, the broad financial conditions, which includes the dollar’s exchange rate and financial markets, will also be taken into account. We expect the pace of job growth to moderate, but without a marked increase in the participation rate, it may still be sufficient to absorb slack in the labor market. This means that the unemployment (and underemployment) will likely decline. The fall in energy prices may help check headline inflation. Core measures are likely to increase on the back of higher rents and medical services.

Presidential election years without an incumbent running have tended to be associated with a small decline in equity prices. We do not see the election as having much impact on the trajectory of Fed policy. At most, the Fed may want to avoid action at the 2 November 2016 FOMC meeting, which does not include updated economic forecasts, nor is it followed by a press conference.

There are several factors that make this cycle unique and arguably, even more, challenging than would normally be the case. Lower nominal GDP means that interest rates will be below levels that prevailed in previous cycles. The Federal Reserve has new tools, like interest on excess reserves and scaled-up reverse repos that have not been battle-tested.

Unlike past cycles, the Federal Reserve has set a target range for Fed funds rather than a fixed point target. It is not clear where Fed funds will trade relative to its range. We have argued that to maximize the effectiveness of its new tools, the Fed may want to provide sufficient liquidity to keep the effective Fed funds rate (weighted average) somewhat below the mid-point of the range. That would also help officials drive home the point that rate increases will be gradual.

The Fed’s balance sheet is also in play in a way it was not in past cycles. An estimated $220 bln of US Treasuries the Fed owns may mature in 2016. It cannot be expected to allow the full amount to roll-off, but maybe around mid-year, the Fed may begin exploring this tool. Letting some fraction mature and/or refrain from reinvesting interest payments would be seen as providing a tightening impulse.

- Immigration challenge may be more concerning than Greece.

- The UK’s EU membership could occur in the second quarter; the risk of rejection may lead to an underperformance of sterling and UK assets.

- We continue to expect that the Bank of England will be the next major central bank to hike rates.

It is not clear when the UK will hold a referendum on its membership in the EU. Many expect it late in the second quarter of 2016. The UK has long seen its interest extended in joining Continental initiatives. Membership gave an opportunity to shape directions and outcomes. The expansion of the EU eastward has provided the UK new support for some of its positions.

If the UK does opt to exit, we would expect sterling and UK assets, in general, to be marked down, and potentially sharply (depending on what had been discounted). However, in the end, we expect that the UK will remain in the EU.

The Bank of England is widely perceived to be the second of the G7 central banks to hike rates after the Federal Reserve. A hike in late-H1 seems a reasonable time frame as 2015 draws to a close. However, wage growth, one of the few arguments favoring a hike, has already lost the upward momentum, and there are other signs that the UK economy may be slowing. The risk seems to be toward a later rather than a sooner BOE lift-off.

Easing monetary policy in December takes the ECB out of the picture in Q1 16. But if there is little improvement in inflation prospects nearer midyear, and if the euro remains resilient and oil heavy, then the doves may push for more action. Unlike previously, though it did not prove to be the case, Draghi did not indicate that the -30 bp deposit rate exhausts interest rate policy. Fiscal policy also looks to be less restrictive in 2016 than it has looked to be the case until late 2015.

- As China transitions to a services and consumption focused economy, officials recognize the need for more flexible prices for money.

- The close link between the yuan and the dollar injects an unwanted tightening impulse in the rising dollar environment that we anticipate.

- There is a significant change in the market now that China is experiencing capital outflows, yet China should not use this as a pretense to devalue, and then re-link to the dollar when the greenback’s cycle turns.

The world’s second-largest economy is engaged in a multi-faceted transition. Partly driven by its desires of its political elite, and in part driven by competitive pressures, China is moving up the value-added production chain: It is shifting from manufacturing to services, and investment (debt) to consumption.

To facilitate this transformation, Chinese officials seem to recognize the need for more flexible prices for money. This necessitated the liberalization of money market rates and greater flexibility of its monetary policy. This in turn requires the loosening of the link between the yuan and the dollar.

This iswholly desirable and necessary. The divergence theme is not only about Europe and Japan, but China too. The cyclical pressures in China will likely prompt further easing from the PBOC. The close link between the yuan and the dollar injects an unwanted tightening impulse in the rising dollar environment that we anticipate.

The yuan depreciated by 3.87% against the US dollar in the year through mid-December. A decline of a similar magnitude (4%-5%) in 2016 would not be surprising. It would still likely translate into some appreciation on a trade-weighted basis.

We suspect that without being in a clear uptrend against the dollar (and Hong Kong dollar), the extent of the yuan’s internationalization may slow. We have suggested that part of what was happening was the conversion of China’s trade with its Special Administrative Region (Hong Kong) and that this exaggerated the extent of the yuan’s use outside of China. Cyclical factors, including the carry trade that favored the yuan, may have also exaggerated how much internationalization of the yuan was actually taking place.

In any event, a country with a large current account surplus would be expected to export its savings. For many years, China also experienced capital inflows. The currency was not allowed to appreciate as much as these forces would have suggested necessary.

Now China is experiencing capital outflows. That is a significant factor that has changed. US officials have long harangued Chinese officials to operationalize their declaratory policies of letting market mechanisms drive the exchange rate. US officials have argued against the practices that led Chinese officials to hold so many (over $1 trillion) Treasuries.

It may be well and good that China now sees these actions are no longer in its self-interest and ceases. However, and here is where the long-game comes in, China should not use this as a pretense to devalue, and then re-link to the dollar when the greenback’s cycle turns. In the short-run, however, if the yuan appears to be more market driven and the market takes it a bit lower, we do not anticipate loud voices of objections. That said, the election year in the US means that a greater news cycle risks.

Commodities and Emerging Markets:

- The price of energy has far-reaching economic impact.

- A Although there is the risk of a weather shock or a geopolitical disruption in supply, the base case is for oil output to increase over demand in the first half of 2016.

- Many emerging market economies have been hit be a painful negative terms of trade shock: the price of their products are falling faster than imports and global investors are pulling funds.

We anticipate that the turn of the calendar will not alleviate the pressure that has bedeviled commodity producers and many emerging market economies. The slow, mostly domestic driven activity of the high income countries, and notably the transition in China, dampens demand growth.

High fixed cost producers discover powerful incentives to produce at a loss even if it weighs on prices further. When prices are high, countries do not recognize the incentives to diversify away from their reliance on commodities. When prices are low, they cannot afford to, and this is how the cycle plays out, again.

The rising commodity prices in the 2005-2008 period provided, with some lag, producers incentives to boost output. Similarly, the drop in prices will, with some lag, force a rationalization of supply through failures, combinations that destroy inefficient capacity, and spur productivity-enhancing, capital-saving technological advances.

The price of energy has far-reaching economic impact. Petrol and natural gas products are a key cost of agribusiness, including fertilizers and pesticides. It is important in manufacturing and transportation. The decline in gasoline prices has helped boost consumers’ purchasing power in the US, Europe, and Japan. The drop in energy prices provided economic support in some sectors, even as it weakened energy sector earnings, slashed investment, and undermined share performance. Benchmarks that exclude the energy sector are being developed and will likely to begin to be adopted in 2016.

The decline in non-OPEC output in the coming months, half of which may come from the US, will likely be offset by increased Iranian and Libyan output. By its reckoning, OPEC output in November was about 900k barrels a day more than it estimates 2016 demand for its product.

Although there is the risk of a weather shock or a geopolitical disruption in supply, the base case is for oil output to increase over demand in the first half of 2016. Inventory levels may grow relative to seasonal averages. Downward pressure is likely to continue. The charts warn that the price of light sweet crude oil could drop into the $20-$30 a barrel region. This could force a more rapid industry restructuring and make for a different OPEC meeting a year from now.

Many emerging market economies have been hit by painful negative terms of trade shock. The price of their products (commodities) has fallen faster than what is typically imported (manufactured goods and capital equipment). At the same time, global investors generally appear to be pulling funds from the emerging markets as an asset class. Additional pressure is coming from the unwinding of the currency mismatch that many emerging market countries and companies took on by borrowing cheap dollars in the past.

These are significant economic challenges. Even with strong, decisive and responsive leadership, the waters are difficult to navigate. Weak, ineffective, or incompetent and corrupt leadership exacerbate the economic challenges. It accelerates capital flight and aggravates both inflation and recession, which in turn leaves officials choices among poor alternatives. Investors watch macroeconomic indicators closely. We note that especially in the current environment, political considerations also warrant close monitoring.

Tags: U.S. Participation Rate