Part 1: Swiss investments abroad

[This paper includes some of the S&P critique, but also aims to clarify some of S&P’s misleading points]

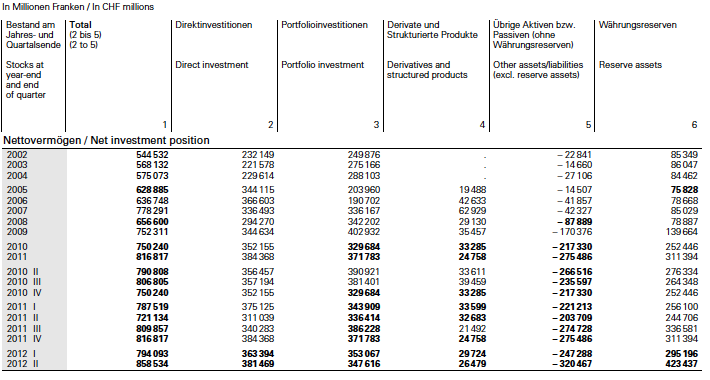

One day later, the SNB monthly bulletin was published. It revealed a huge increase of the Swiss Net International Investment Position (NIIP) by 65 billion francs in the second quarter, a whopping 9% of Swiss GDP. We wrote about it here and on Daily FX. Between May and July, the SNB currency reserves rose by more than 50 billion francs per month, to which these foreign incomes contributed largely because most were converted into francs.

Switzerland improved its net foreign position by 43 billion francs per year since 2005, 7% of GDP. If we exclude the Great Recession years 2008 and 2009, then this number is even 10% per year.

When the global crisis started, the Swiss simply converted its foreign currency (albeit weaker) profits into the rising Swiss franc and were therefore largely immune against the decline (more details in our article on Seeking Alpha on Sept. 18; you can read an improved version here).

One Seeking Alpha commentator critized our bullish francs position. But Standard & Poor’s came to our help and said:

Since the onset of the global financial crisis, the dynamics of Switzerland’s balance of payments have fundamentally changed.

Instead of investing its large current account surpluses abroad via purchases of overseas assets, as it did habitually before the crisis, the Swiss private sector has been accumulating savings at home. … The resulting twin current and financial account surpluses have driven an unprecedented surge in the foreign exchange reserves held at the Swiss National Bank. (Source: Standard & Poor’s.)

Standard & Poor’s is actually only partially correct. When it speaks of “habitually before the crisis,” this concerns only the period between 1997 and 2007 when, thanks to the upcoming euro, yields and risks in Europe decreased significantly.

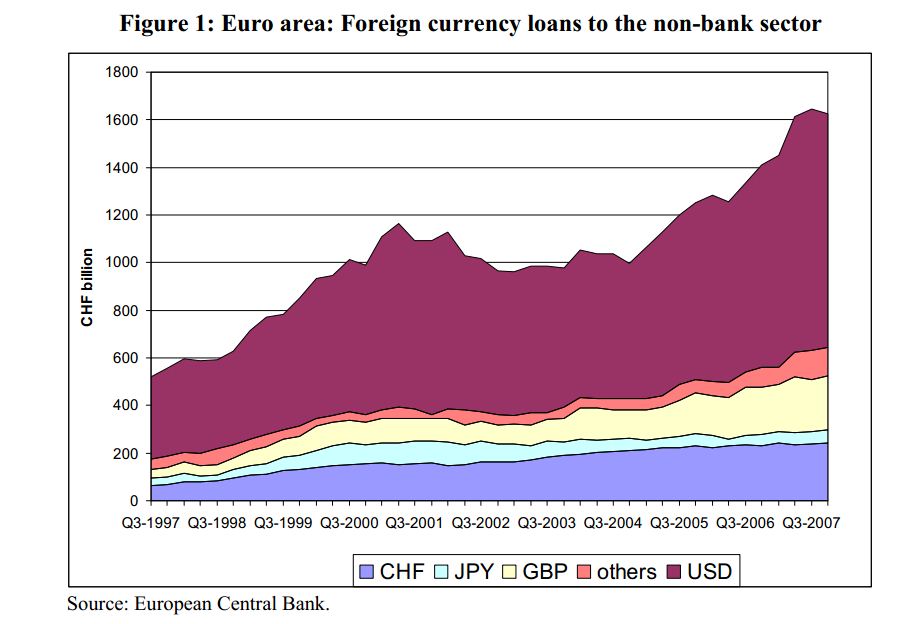

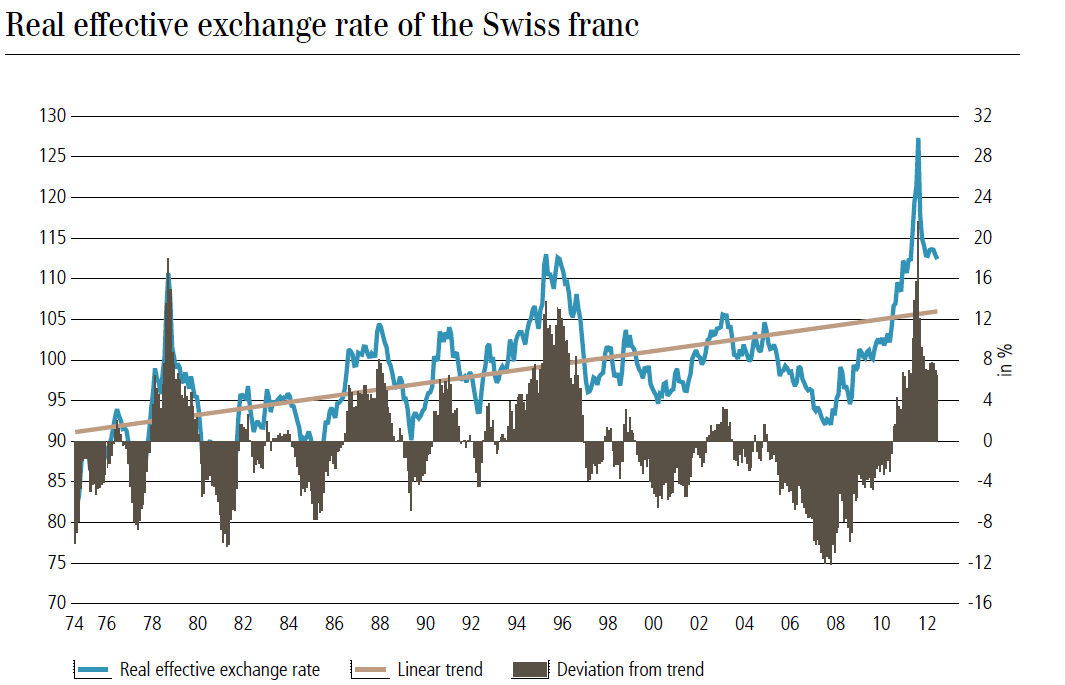

During the carry trade era until 2007, or the “great moderation” like Ben Bernanke misleadingly named the period of excessive expansion of private and public debt, the franc fell strongly. Many used the CHF as the financing currency in carry trades. Austrians and Eastern Europeans signed mortgages in francs, thus weakening the Swiss currency even further. Swiss companies kept on holding their profits in foreign currencies.

After the SNB printed money with the 1987 Black Friday recession and the Swiss government declared private pension funds to be obligatory, a period started when Swiss pension funds and private investors rushed into Swiss real estate. As a result the franc became strongly overvalued in 1995.

These developments were then followed by a housing bust and deep recession for the Swiss economy: a basis for the upcoming carry trade.

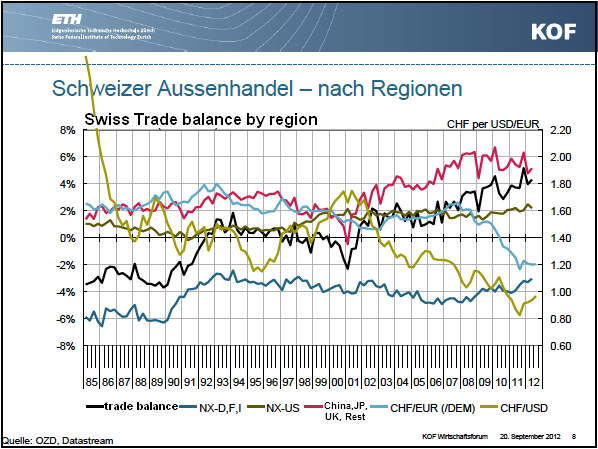

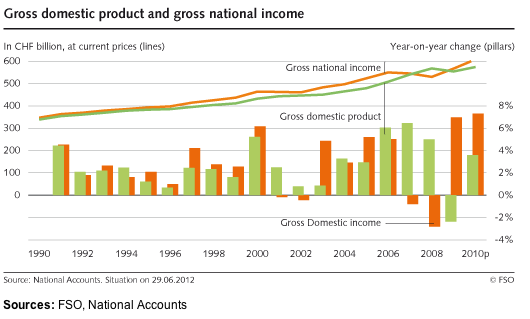

During the “great moderation,” the Swiss managed to achieve strong profits in the emerging markets (see red line in the graph below) and kept them in foreign currency. At the same time, the Swiss balance of payments was negative despite these current account surpluses and money flew out of the country. In Switzerland many were asking why growth was so limited at home (see the 2005 article “The Swiss Economy Is Expanding More Strongly Than It Seems” by former SNB chief economist Georg Rich), not realizing that growth in the eurozone (e.g., in the PIIGS) was not sustainable and often just credit-financed with excessively cheap SNB money.

After 2008 everything changed, money returned to Switzerland at accelerating speed. The SNB stopped these inflows with the EUR/CHF floor and exporters recovered.

The latest rise of the NIIP contributed to a 1.8% Q2 appreciation of the Swiss Gross National Income (GNI).

The continuation of the above graph looks as follows (source SECO and Yahoo finance):

| Gross domestic product (GDP) | Gross national income (GNI) | avg. EUR/CHF | |||

| Year | Quarter | y-o-y | y-o-y | ||

| 2010 | 1 | 2.73% | 8.0% | 1.45 | |

| 2 | 4.14% | 6.5% | 1.37 | ||

| 3 | 3.13% | 10.3% | 1.33 | ||

| 4 | 4.38% | 4.6% | 1.30 | ||

| 2011 | 1 | 3.55% | -1.8% | 1.28 | |

| 2 | 2.79% | -1.0% | 1.23 | ||

| 3 | 1.75% | -3.3% | 1.17 | ||

| 4 | 0.64% | 1.8% | 1.23 | ||

| 2012 | 1 | 1.15% | 3.2% | 1.22 | |

| 2 | 0.48% | 5.4% | 1.20 |

When the EUR/CHF floor will be removed ?

It becomes obvious that the SNB introduced the floor exactly when Swiss foreign incomes were subject to a strong fall (Q3: -3.3%). At Tuesday’s hedge fund conference in Pfäffikon, I asked Jordan if the SNB’s aim was to stop a fall in Swiss foreign incomes. Jordan replied that his only objective was to save Switzerland from deflation. The Q2 2012 NIIP data shows that the SNB already managed to safeguard foreign incomes of Swiss companies and that Swiss companies are competitive enough.

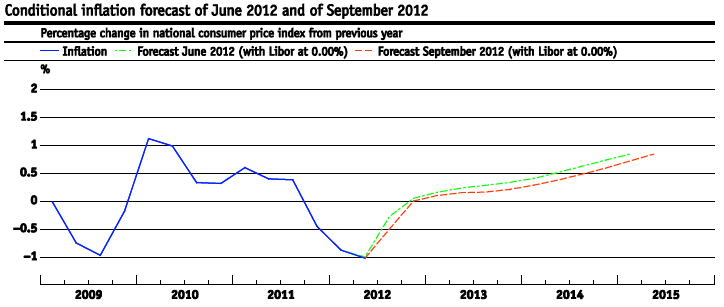

In a first step, demands by Swiss politicians and exporters to hike the EUR/CHF floor have become silent after the huge Q2 inflows into the franc. The second step for the floor removal is this increase in GNI and NIIP. The third and final step is Swiss inflation. According to Jordan, year-over-year inflation should begin at the end of this year, far later than we expected. The reasons are the European recession and the fact that importers’ contracts are mostly long term or based on company internal transfer prices (Source: phone call with Swiss Statistics, department Producer Price Index). Therefore, import prices go up more slowly than we and the SNB expected.

Rising incomes (via the GNI) lead to the ability to pay more for flats, rentals, or consumption. Hence, except in the case of a global recession that includes the Swiss’ most profitable trading partners, the emerging markets, Swiss inflation must rise. Swiss nominal wages are expected to remain steady this year, but wages of the main import partner Germany are rising by 3%.

Jordan’s answer to my second question — “What comes first: the end of the eurozone crisis or Swiss inflation?” — was laughter and saying that inflation will be rising very slowly. This question decides where Swiss companies, private investors, and pension funds will invest. The precondition for a EUR/CHF rise are for us higher real returns in the eurozone than in Switzerland, which should compensate for the higher foreign risk, see more.

Investment recommendation

Long-term

We think that a quick end of the euro crisis can be excluded (we will offer reasons in a forthcoming article) and recommend long-term investors hold Swiss francs in form of ETFs (FXF) or long-term Swiss government bonds with maturities over 20 years (e.g., CH0127181169, CH0127181193). We would give these positions a higher share than gold because since September 2011, the franc did not follow the usually correlated yellow metal. Both gold and CHF/USD move in line with stronger emerging markets and a weaker U.S. dollar.

Mid-term

We see risks in the mid-term for emerging markets; therefore we hedge a significant part of our portfolios. Apart from being long CHF, we continue to be short the euro (ETF: DRR) against the yen and the Scandinavian currencies. We short German stocks (ETF: EWG) and the Australian dollar (ETF: FXA). Take a look at our latest Seeking Alpha article, when we shifted from long euro to short euro.

The Aussie is another currency that is correlated to emerging markets, similar to the Swiss franc. I remember well when FT’s James Mackintosh questioned why the safest currency (the franc) and the riskiest one (the Australian dollar) were the best performing ones in 2011. As opposed to the Aussie, the Swiss franc profits from low private debt, the interest rate parity, and the demand of emerging markets for technology and human capital — not for recession-sensitive commodities.

See the second part of the S&P critique: we call it “Is Standard and Poor’s a Rating or a Rumor Agency?“

Are you the author? Previous post See more for Next post

Tags: Carry Trade,current account,Deflation,Emerging Markets,Georg Rich,international investment position,Monthly Bulletin,NIIP,PPI,Seeking Alpha,Swiss government bonds,Swiss National Bank,Swiss real estate,Switzerland,Switzerland Gross Domestic Product,Trade Balance