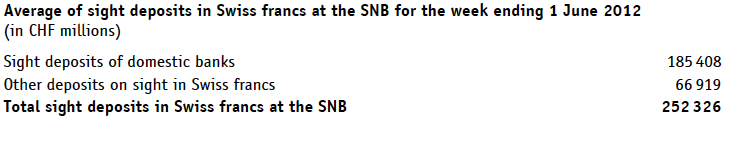

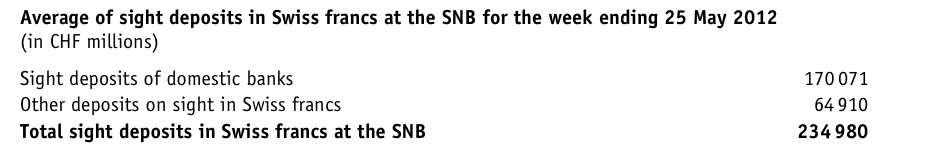

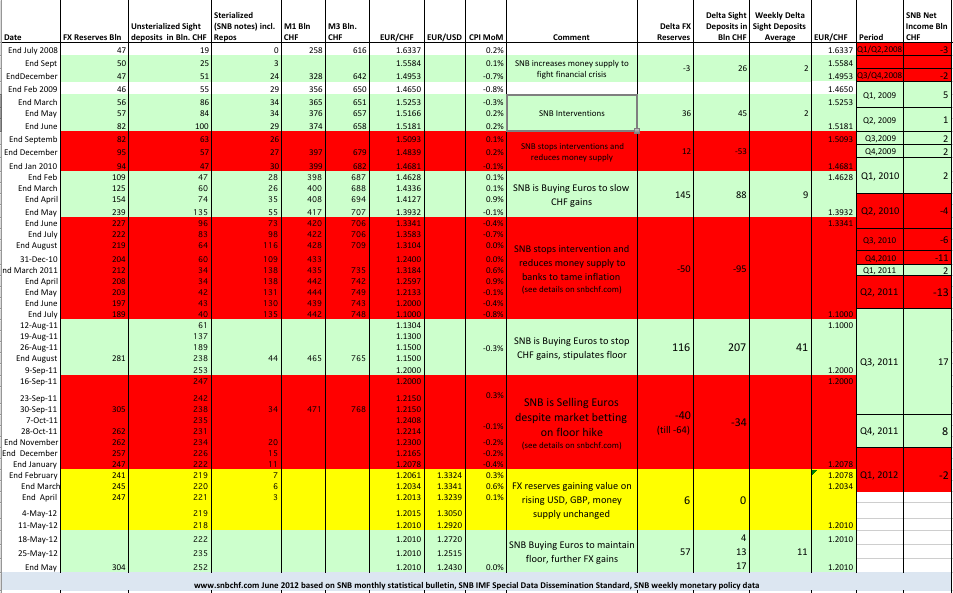

These numbers were not seen since August 2011 when the SNB increased money supply by 50 bln and 40 bln per week buying the EUR/CHF at rates between 1.00 and 1.13. Now, however they are buying at 1.20 and are risking extreme losses, especially because many other central banks are dumping euros.

In the 6 winter months the SNB managed to reduce money supply by 34 billion CHF selling euros from its balance sheet. However, only in the last three weeks, the SNB lost all these "gains" and had to buy euros for a similar amount.

These numbers were not seen since August 2011 when the SNB increased money supply by 50 bln and 40 bln per week buying the EUR/CHF at rates between 1.00 and 1.13. Now, however they are buying at 1.20 and are risking extreme losses, especially because many other central banks are dumping euros.

In the 6 winter months the SNB managed to reduce money supply by 34 billion CHF selling euros from its balance sheet. However, only in the last three weeks, the SNB lost all these "gains" and had to buy euros for a similar amount.

Last week rumors at CNBC about some developments at the SNB before the release of the Swiss GDP led us to the conclusion that the SNB either drops the floor or prints enormous amounts. A better than expected Swiss GDP and very bad US jobless figures were the reasons that the SNB had to print even more than in the preceding week. We calculated last week that if the speed of 13 bln. CHF per week is maintained, then currency reserves will more than double this year, a weekly increase by 17.3 bln. would mean they rise by 3 to 4 times. A member of the SNB board, Jean-Pierre Danthine said that the central bank is worried about the size of the balance sheet, but pledged that the central bank will defend the floor. No reference was made to capital controls.

Earlier in March he told that Swiss inflation will come back. In earlier posts (here, here and here) we also showed that Swiss inflation will pick up sooner or later and that at this point the SNB must adhere to its main principle of price stability, will stop printing and realize its losses like it already did in 2009 at 1.50 and 2010 at 1.40.

Some economists think that SNB can print as much as it wants. But similarly as central banks do not posses unlimited forex reserves (like the Bank of England vs. George Soros), a central bank cannot print ad infinitum without risking that inflation will strongly hit back. This inflation hit after SNB money printing has often happened to Switzerland and caused e.g. the huge Swiss real estate crisis of the 1990s.

Last week rumors at CNBC about some developments at the SNB before the release of the Swiss GDP led us to the conclusion that the SNB either drops the floor or prints enormous amounts. A better than expected Swiss GDP and very bad US jobless figures were the reasons that the SNB had to print even more than in the preceding week. We calculated last week that if the speed of 13 bln. CHF per week is maintained, then currency reserves will more than double this year, a weekly increase by 17.3 bln. would mean they rise by 3 to 4 times. A member of the SNB board, Jean-Pierre Danthine said that the central bank is worried about the size of the balance sheet, but pledged that the central bank will defend the floor. No reference was made to capital controls.

Earlier in March he told that Swiss inflation will come back. In earlier posts (here, here and here) we also showed that Swiss inflation will pick up sooner or later and that at this point the SNB must adhere to its main principle of price stability, will stop printing and realize its losses like it already did in 2009 at 1.50 and 2010 at 1.40.

Some economists think that SNB can print as much as it wants. But similarly as central banks do not posses unlimited forex reserves (like the Bank of England vs. George Soros), a central bank cannot print ad infinitum without risking that inflation will strongly hit back. This inflation hit after SNB money printing has often happened to Switzerland and caused e.g. the huge Swiss real estate crisis of the 1990s.

Tags: Capital Controls,Deflation,Deposits,floor,franc,money printing,peg,Reserves,SNB sight deposits,Swiss National Bank,Swiss real estate,Switzerland,Switzerland Money Supply

2 comments

Christian Gross

2012-06-06 at 08:22 (UTC 2) Link to this comment

I guess you like to lose money? Why are you short the EUR-CHF? On the potential that it might drop? Why are you so sure that this is running suicide? You need to explain yourself other than, “suicide”.

Remember the following, this is not a George Soros moment. The Bank of England was trying to attract flows. In this case they are trying to push away flows. And they can, so long as they have ink to print, they can print, and print, and print, and print…

Here is the irony, people think fiat is fake, and only gold is real. So in this case with them printing, is that not an indication of fake???

toby

2012-06-13 at 03:34 (UTC 2) Link to this comment

It is an interesting dilemma is it not. If they sterilize by selling bonds they prevent inflationary problems and potentially earn foreign exchange reserves that can be used to buy offshore assets or even goods and services. These are effectively being paid for by people outside of switzerland and all for the price of printing a swiss franc..ie free and interst payments. These bonds will have to be “serviced” with interest payments, but these can presumably pay very little since people seem to want chf irrespective of its actual return because they are looking for a safe haven.

On top of this we have the ECB printing money and lending it at 1% so banks can buy bonds paying as much as 7%! all to keep interest costs on bonds below the unpayable threshold (6-7%).

Isnt this a perfect example of fiat currency at work and if so is it not a strong sign that the financial markets face imminent and neccersary collapse?