Why the big Q1 loss of the SNB was actually a big win for the central bank

Anybody watching the EUR/CHF exchange rate this year was wondering why the volatility the pair saw last year had completely left. The pair slowly fell from 1.2156 over 1.2040 at the end of Q1 to 1.2014 today. FX traders hoped on a hike of the floor from 1.20 to 1.25, as many Swiss politicians and companies requested. Banks sold masses of Long EUR/CHF certificates and options. The retail market measured in SSI (Speculative Sentiment Index) was 96% long EUR/CHF.

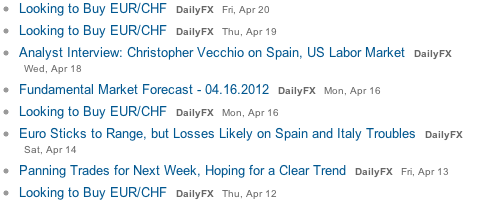

We saw the typical Forex web sites telling regularly their masses of followers that the protagonists of these web sites were going long EUR/CHF in the hope that the SNB is going to act. This happened at multiple critical levels, at 1.2070, 1.2050, at 1.2030 and finally at 1.2010 (see picture). The small FX trader was begging for months that the SNB would finally intervene.

We saw the typical Forex web sites telling regularly their masses of followers that the protagonists of these web sites were going long EUR/CHF in the hope that the SNB is going to act. This happened at multiple critical levels, at 1.2070, 1.2050, at 1.2030 and finally at 1.2010 (see picture). The small FX trader was begging for months that the SNB would finally intervene.

When all these people were long EUR/CHF, who was actually short, when the exchange rate continued to fall ? We speculated that some big accounts wanted their clients to be knocked out with their EUR/CHF longs, we thought that Swiss pension funds and big investors continued to repatriate their foreign funds.

What did the SNB ? Did they support the hopes of the masses, of all these SNB rooters ?

Yes, psychologically they did. For months they continued to vow that they might take further measures to weaken the franc, even if wording changed from the “massively overvalued franc” in August 2011 over “significantly overvalued franc” in January 2012 to “overvalued franc” recently.

But on the back-door of all this rhetorics they did the complete opposite: The central bank was happy to get rid of their Euros at a higher price than the floor they had set in September 2011 !

Unfortunately for the SNB, it is a public company and must reveal their balance sheet quarterly and could not continue this strategy: The Q1 balance sheet has revealed that the SNB had reduced their Euro holding from 57% in Q4/2011 to 50% of the reserves in Q1/2012, a decrease of 17 bln. Euros. The central bank managed to further reduce the balance sheet: The foreign currency reserves fell from 305 bln. francs in Q3/2011 to 245 bln. in Q1/2012. They managed to further reduce the money supply, measured in “sight deposits from domestic banks” from 202 bln. CHF in Q3/2011 to 157 bln. in Q1/2012. Instead of continuing to provide cheap money to banks and to fuel the Swiss real estate bubble the SNB decided to increase its liabilities with the Swiss state from 5.6 bln. in Q4/2011 to 12.5 bln. CHF in Q1/2012. Therewith the SNB also fulfilled its own strong monetarist ideas and tradition, namely that the money supply shock of summer 2011 should not be repeated so soon, and they must return to steady predictable growth of money supply.

The reduction of the balance sheet also means that the central bank can start borrowing again from banks and increase the fire power when it is really time to defend the 1.20 floor. Moreover it becomes clear that any thoughts about a hike of the floor are just rumors, when even the SNB itself buys Swiss francs and sells euros.

Sure, selling Euros at an average of 1.2079 in the first quarter, was certainly a loss game for the SNB compared with the 1.2167 at the end of Q4/2011 (average value in Q1 computed e.g. here), but sometimes they picked the tops of 1.21 and more for example at the latest SNB “marketing” event, when the Forex crowds were speculating on a hike of the floor. Additional euro-denominated losses came from price changes in the German Bunds, the main SNB euro position: 10 year Bund prices fell from 139.12 on Dec 30th to 138.03 on March 31st. Moreover the Japanese yen, 8% of the Swiss foreign currency reserves, lost over 11 percent of its value in Q1: The CHF/JPY rose from nearly 82 to 92 during the first quarter. Last but not least the central bank increased their holdings in British pounds from 4.2% to 8.5%, a change which is partially due to the rising pound. In total the SNB had a loss of 1.7 bln. francs in the first quarter.

But if we look at current prices for these assets it becomes clear that the SNB will have a very positive quarter in Q2/2012, if current market conditions do not change.

1) 10 year German Bunds have risen from 138 to 141 since the end of March.

2) The CHF/JPY has fallen from 92 to 89.

3) The GBP/CHF continues to appreciate from 1.4444 to 1.47 since the first quarter.

Two things, however, should be clear: anybody who has hoped on a hike of the EUR/CHF floor was trading not with but against the SNB. The central bank will consider a floor hike only in a strongly recessionary and deflationary scenario. On the other side the SNB has increased its firepower and its reputation: breaking the floor will be very difficult for the next 2 years.

The result: a EUR/CHF peg at 1.20

The post appeared on Zerohedge.

Tags: Deflation,Deposits,floor,franc,German Bund,Gold,intervention,Japanese yen,Jordan,Monetarist,peg,SNB sight deposits,Swiss National Bank,Swiss real estate,Switzerland Money Supply