Dear Mr. Taft: I eagerly read your piece Warriors for Opportunity on Wednesday, as I often do about pieces that argue that capitalism is not working today. You begin by saying: “Financial capitalism – free markets powered by a robust financial system – is the dominant economic model in the world today. Yet many who have benefited from the system agree it’s not working the way it ought to.”

Read More »

Tag Archive: Volcker

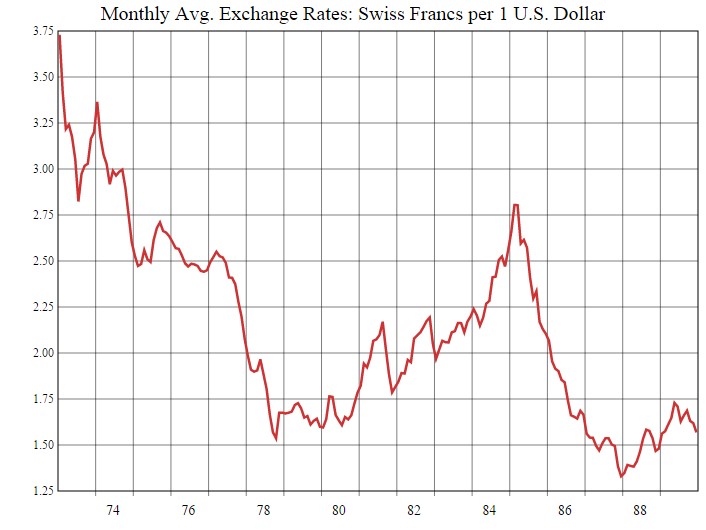

Swiss Franc History: Volcker Shock, Oil Glut and the Breakdown of Gold and Emerging Markets

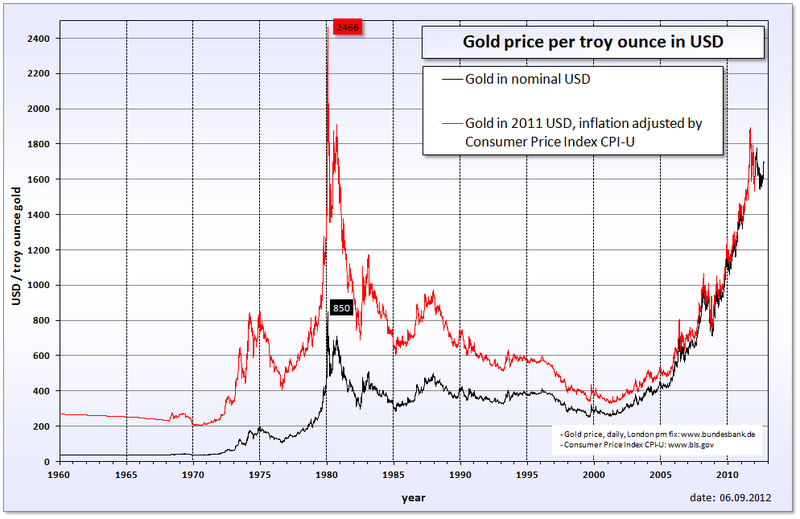

After the Volcker moment or sometimes called "Volcker shock", commodity prices plunged, the gold price collapsed. Thanks to additional supply, e.g. from Northsea oil, a so-called oil glut appeared. After the increase of debt in the 1970s, some economies in Southern America collapsed. The major reason was Volcker's tight monetary policy with high interest rates and the dependency on US funds.

Read More »

Read More »

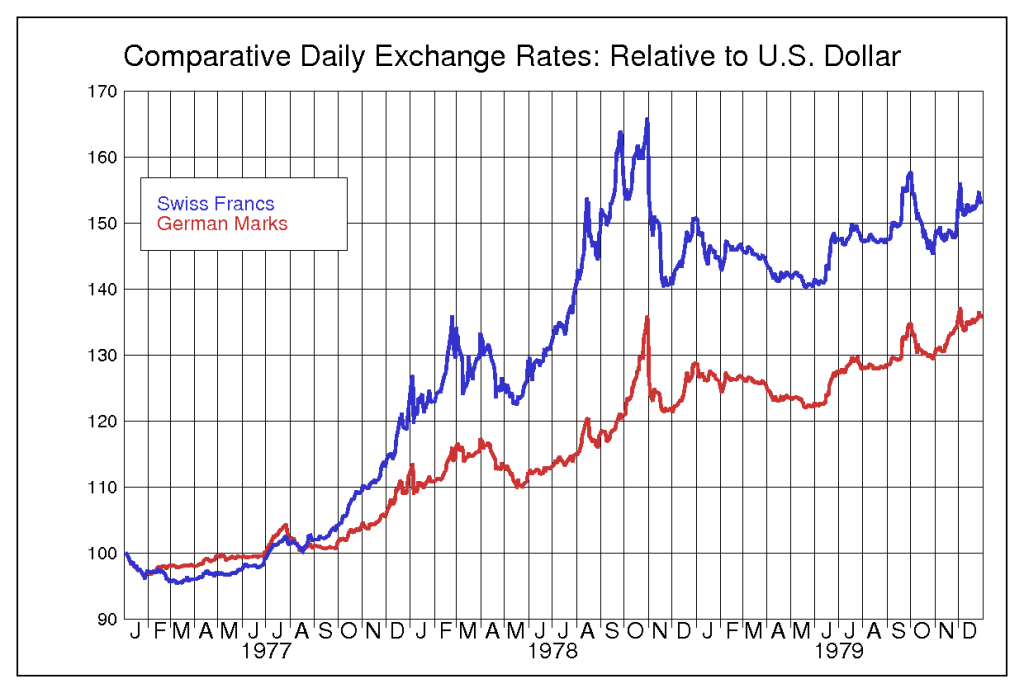

Swiss Franc History, 1970s: Due to US Stagflation CHF Strengthens Massively

We shows the massive appreciation of Swiss franc and German mark in the 1970s, the reasons were: stagflation and the wage-price spiral.

Read More »

Read More »

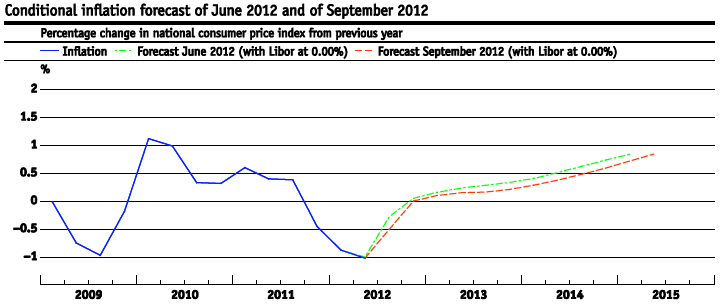

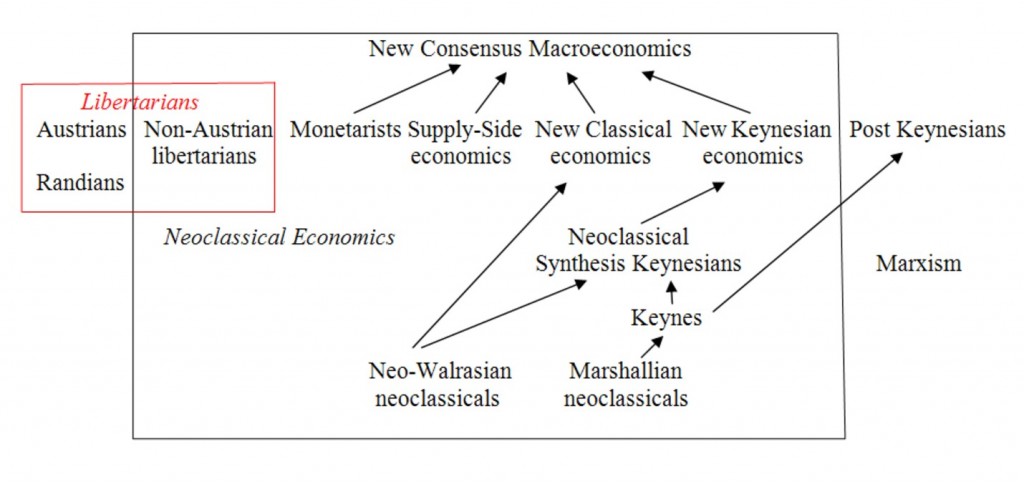

Traditional Monetarist vs. Market Monetarists

Along the double mandate of the federal reserve, monetarists can be divided into. - traditional monetarists that focus on a slow increase of money supply in order to avoid price inflation. - Market monetarists that want to target growth and income instead of inflation.

Read More »

Read More »

History: The Lost 1980s Decade in Latin America

Peripheral Europe is going to follow step and step the Mexican and the resulting Latin American debt crisis of the 1980s.

Read More »

Read More »

Die Wiederwahl Obamas bedeutet nichts Gutes für die Schweiz

Barack Obama war und ist der präferierte Kandidat vieler Schweizer. Obama scheint der Mann von Welt zu sein, während vom konservativen Mitt Romney eher feindselige Politik gegen Russland, China und Iran zu erwarten ist. Daher sind die Neutralität- und Frieden-liebenden Schweizer eher auf Obamas Seite. Aber auch wirtschaftspolitisch scheinen viele Eidgenossen Obama zu mögen. …

Read More »

Read More »

How former central bankers stepped up against the central banks

There are already three former European central bankers who criticize more or less openly the European Central Bank (ECB).

Read More »

Read More »

Written in February 2012: Will the EUR/CHF never rise over 1.22 or 1.23 again?

Our analysis from February 2012 shows astonishing accurateness: It predicted that the euro would not rise against CHF and that the commodity currencies were overvalued and subject to correction.

Basic foreign exchange theory, the SNB price stability mandate and strong fundamentals for Switzerland and bad ones for the peripheral countries of the euro zone speak for the thesis that the EUR/CHF exchange rate might never go over the level of around...

Read More »

Read More »

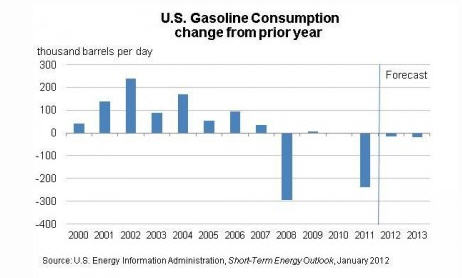

Oil price increases in 2012 and why they are not real

Oil prices Oil prices will rise quickly this year along with the recovery, the Iran issues and last but not least driven by investor demands of yield, implemented in the HFT algos. Interestingly the Iran issues already existed in December, but oil prices were falling, at that moment investors did not believe in a global recovery yet, …

Read More »

Read More »