Tag Archive: #USD

FX Daily, February 09: Dollar Bounce in Asia is Sold in the European Morning

The US dollar is firmer against most of the major currencies in fairly quiet Asian turnover, but is seeing those gains pared in early Europe. The highlights include the RBNZ meeting that left rates on hold, as widely expected. The concern about the strength of the Kiwi saw the market reduce the perceived likelihood of a rate hike. NZD came off.

Read More »

Read More »

Is a Strong or Weak Dollar Good for the US? The $16 trillion Question

Dollar movement helps some economic interest and hurts others. From a strategic point of view, the best thing for the US is the market-generated rate. It was an important achievement that the forex market was de-weaponized. Many observers have been crying wolf about a currency war for many years, which may have de-sensitized investors to the threat of a real one.

Read More »

Read More »

Cool Video: Around the World with Katie Martin of the Financial Times

I am in London as part of a larger business trip. I had the chance today to talk to Katie Martin, who runs Fast FT and is often writing about foreign exchange. They show was live on Facebook. It is about a 22 minute interview and although foreign exchange is the key issue, to get to it we end up talking about many things, including US interest rates, Trump, and even cooking frogs.

Read More »

Read More »

FX Daily, February 08: EUR/CHF down to 1.630, Swiss Boom Starting?

The reader might have seen the latest Swiss Consumer Sentiment and the UBS consumption indicator. They suggest that the Swiss boom phase should finally come.

I anticipated the boom already in my slides for the CFA Society. The Swiss boom was postponed when the SNB decided to remove the euro peg in early 2015.

Read More »

Read More »

The Dollar: Real or Nominal Rates?

Real interest rates are nominal rates adjusted for inflation expectations.Inflation expectations are tricky to measure. The Federal Reserve identifies two broad metrics. There are surveys, like the University of Michigan's consumer confidence survey, and the Fed conducts a regular survey of professional forecasters. There are also market-based measures, like the breakevens, which compare the conventional yield to the inflation-linked, or protected...

Read More »

Read More »

FX Weekly Preview: Politics Not Economics is Driving the Markets

The Fed is more confident this year of stable growth and rising inflation. The new US Administration's economic agenda is beginning to take shape, though it is not clear that consumer interests will be pursued. There are several considerations, including politics in Europe, that are driving European rates higher. The RBA and RBNZ meet next week. Neither is expected to change policy.

Read More »

Read More »

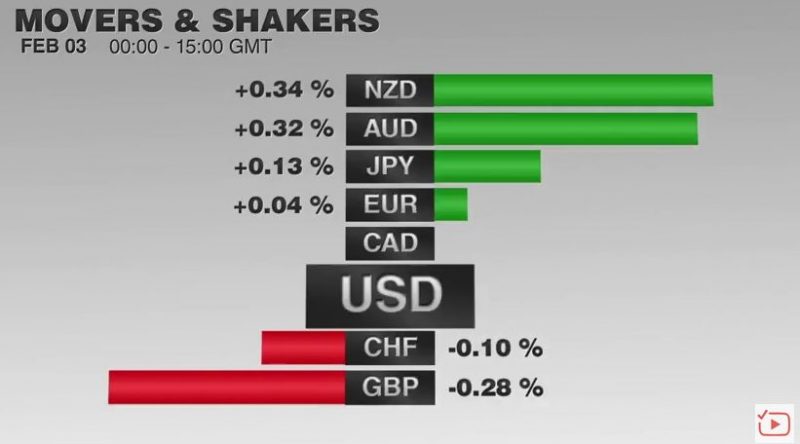

FX Daily, February 03: US Jobs Trump Europe’s Service PMIs

Ahead of the weekend, there are two series of economic reports. The first are Europe's service PMI reports and the second is the US employment report. Neither report is likely to alter views significantly, but the latter has greater potential to move the market.

Read More »

Read More »

Thoughts about the Fed’s Balance Sheet

Several regional Fed presidents want to begin talking about shrinking Fed's balance sheet. Leadership does not appear to have great urgency, so don't expect anything in this week's statement. First step more hikes, then refrain from reinvesting payments and maturities, but slowly.

Read More »

Read More »

FX Daily, 01 February: Markets Stabilize, Investors Await Signals from US data and FOMC, and POTUS

(commentary will be sporadic for the next couple of weeks during a European business trip) The US dollar is consolidating yesterday's losses that were spurred speculation that the US was abandoning the more than 20-year old strong dollar policy. The meaning of that policy was clear to global investors even if it was often parodied.

Read More »

Read More »

FX Daily, January 31: Markets Look for Solid Footing

The immigration imbroglio in the United States is being cited in various accounts for the price action, including yesterday's drop in the S&P 500, where the intraday loss was the largest since before the election. The drama is also being blamed for the dollar's losses yesterday, which it is consolidating today.

Read More »

Read More »

Trump and the Dollar

US official comments on the FX market appear to have increased in frequency. They are mostly warnings about a strong dollar, but not all comments are dollar-negative. Policy is the ultimate driver but comments pose headline risk.

Read More »

Read More »

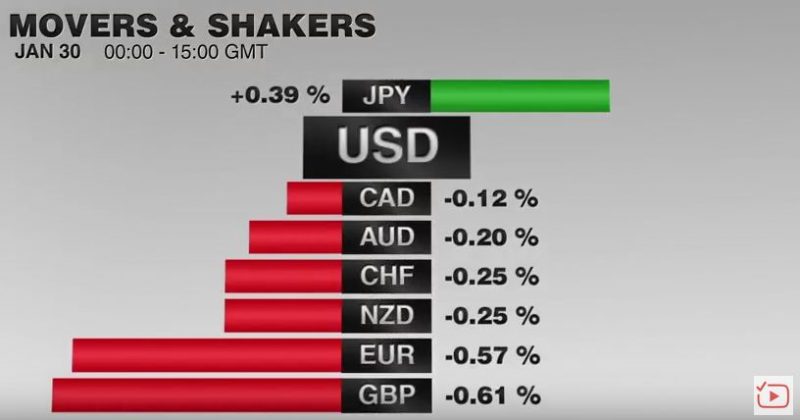

FX Daily, January 30: EUR/CHF falls further to 1.650

The EUR/CHF collapsed once again to 1.0650. This rate broke the 1.0680 - 1.0700 that constituted the previous intervention area.

Reasons can be found in the weak U.S. GDP weak, in Trump's foreign trade policy and in the strong Swiss trade balance.

Read More »

Read More »

FX Weekly Preview: Yellen nor Kuroda nor Carney will Take the Spotlight from Trump

Fed, BOJ, and BOE meet next week, each may adjust economic assessments in more favorable direction. Key challenge for many investors is the new US Administration. US employment, EMU inflation, Q4 GDP, and China's PMI are among the data highlights.

Read More »

Read More »

The Grand Strategy: Fixed Spheres of Influence or Variable Shares?

The US has a direct investment strategy for historical reasons. It competes against export-oriented strategies. The FDI strategy does make low-skilled domestic labor compete with low-skilled foreign worker, but skilled workers abroad complement the skilled domestic worker.

Read More »

Read More »

FX Daily, January 27: Week Ending on Mixed Note as Year of Rooster Begins

The Lunar New Year celebration thinned participation in Asia, where several centers are closed. Although the MSCI Asia Pacific Index slipped slightly, it rose 1.5% on the week, the fourth weekly gain in the past five weeks. The Nikkei advanced 0.35%, the third rise in a row. The 1.75% gain for the week snaps a two-week decline.

Read More »

Read More »

Are Interest Rates No Longer Driving the Dollar?

Many are concerned that the dollar and interest rates have become decoupled. We are not convinced. Correlations, not to be eyeballed, are still robust.

Read More »

Read More »

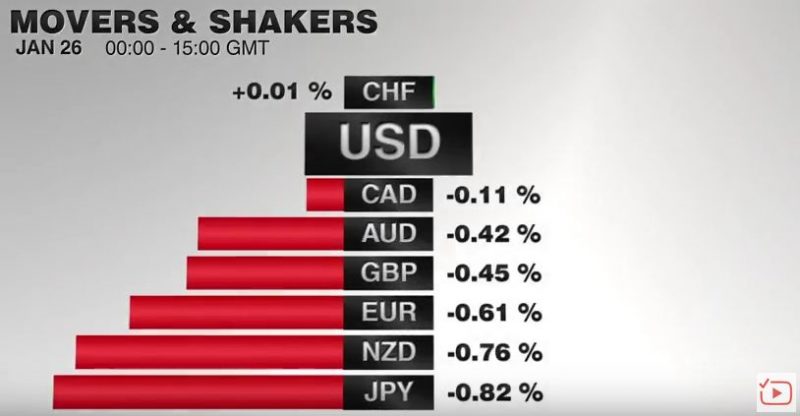

FX Daily, January 26: EUR/CHF collapses to 1.670

The US dollar is mostly firmer against the major currencies but is confined to narrow ranges, and well-worn ranges at that, but the focus has shifted to the strong advance in equities. Yesterday, the Dow Jones Industrials finally rose through the psychologically-important 20k level, and the S&P 500 gapped higher to new record levels.

Read More »

Read More »

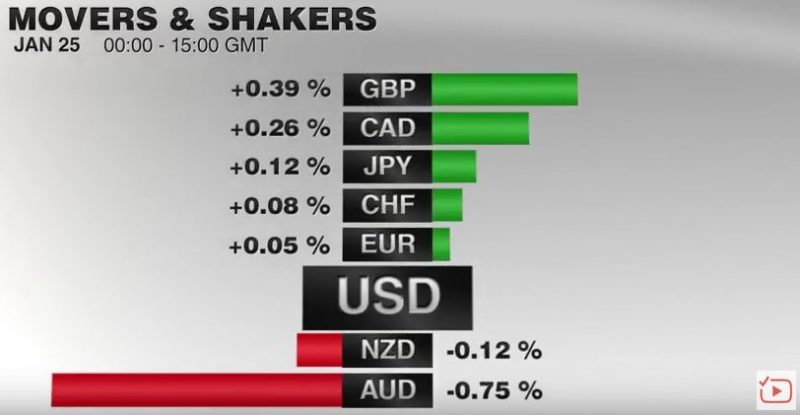

FX Daily, January 25: Dollar is on the Defensive Despite Firmer Rates

The US dollar is softer against nearly all the major currencies. Participants appear to be growing increasingly frustrated with emerging priorities of the new US Administration. They want to hear more details and discussion of the tax reform, deregulation, and infrastructure plans.

Read More »

Read More »

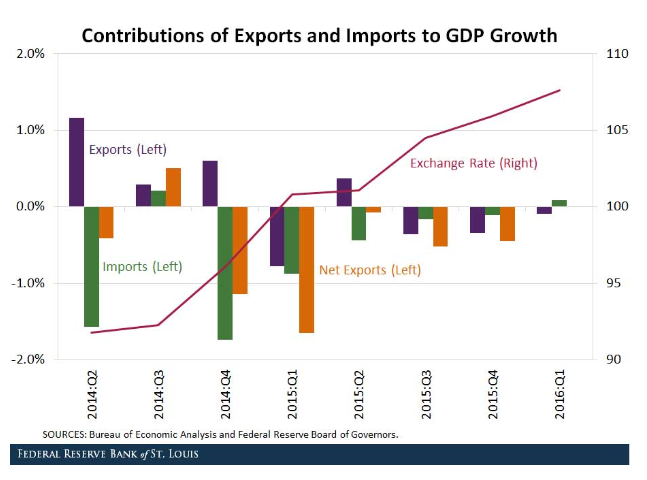

Great Graphic: How a Strong Dollar Weighs on Net Exports

Investors appreciate that a strong dollar can impact US growth through the net export component of GDP. The dollar's appreciation can push up the price of exports and lower the cost of imports. The St. Louis Fed took a look at how the strong dollar from 2014 to the beginning of 2016 impacted the net export function of GDP.

Read More »

Read More »

FX Daily, January 23: Dollar’s Pre-Weekend Retreat Extended in Asia Before Stabilizing in Europe

The US dollar had a poor close in the North American session before the weekend as investors appear increasing anxious about the new US Administration's economic policies and priorities.With no fresh details emerging over the weekend, some stale dollar longs exited. The dollar stabilized in the European morning, but broader risk appetites were not rekindled, and the Dow Jones Stoxx 600, led by financials, was sold to its lowest level this month.

Read More »

Read More »