Tag Archive: USD/CHF

FX Daily, February 20: Covid-19 Hits Yen and Korean Won

The increase of Covid-19 cases in South Korea and Japan, coupled with China's changing reverting back to its previous methodology of calculation, dropping clinically-diagnosed cases have again weakened risk appetites and sent the dollar broadly higher. Fears of a Japanese recession are sapping the yen's role as a safe haven, and this helps explain why Japanese equities did react as positively to the weaker yen than is often the case.

Read More »

Read More »

FX Daily, February 19: Investors’ Confidence Snaps Back

Overview: After shunning risk yesterday, investors re-entered the fray today, and the animal spirits returned. The MSCI Asia Pacific Index snapped a four-day slide, and China's markets were among the few losers in the region today. Europe's Dow Jones Stoxx 600 recovered yesterday's losses in full and is again at record highs. US shares are also trading firmer and are poised to recoup yesterday's decline.

Read More »

Read More »

FX Daily, February 18: Apple’s Warning Weighs on Sentiment

Overview: Apple's warning that it will miss Q1 revenue due to the knock-on effects of the coronavirus seemed to be a modest wake-up call to investors, who, judging from the equity market, were looking beyond. Equities have fallen, and bonds have rallied. Japan, Hong Kong, and South Korean stocks fell by more than 1%, and only China and Indonesia were able to post gains.

Read More »

Read More »

FX Daily, February 17: Dismal Q4 Japanese GDP Fails to Spur Yen Movement

Overview: It is only a US holiday today, but the global capital markets are subdued. In the Asia-Pacific region, equities traded lower with China and Hong Kong, the main advancers. The MSCI Asia Pacific Index has fallen in only two weeks since the end of last November, and that was during the last two weeks of January. Europe's Dow Jones Stoxx 600 slipped in the previous two sessions but is recouping the losses fully today.

Read More »

Read More »

FX Daily, February 14: Investors Continue to Look Past the Coronavirus

Overview: The capital markets are heading into the weekend, still trying to look past the coronavirus despite the new cases in Hubei. Tokyo was a notable exception in the Asia Pacific region, as the other major equity markets, like in Hong Kong, China, Taiwan, South Korea, and Australia, advanced. The MSCI Asia Pacific Index rose for the second week.

Read More »

Read More »

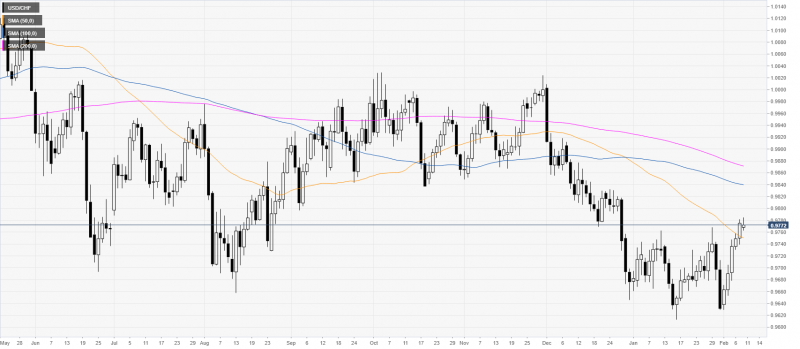

USD/CHF Price Analysis: Greenback grinding up vs. Swiss franc, clings to 2020 highs

USD/CHF is slowly advancing printing fresh 2020 highs by a few pips. The rising wedge formations can limit the upside on USD/CHF. USD/CHF is printing new 2020 highs while the quote is trading below the 100/200-day simple moving averages suggesting an overall bearish momentum.

Read More »

Read More »

FX Daily, February 13: Surprise? China Undercounts Afflictions and Fatalities, Curbs Risk Taking

Overview: There is one overriding driver today, and that is the incorporation of CAT scan diagnoses of the virus in Hubei, ground-zero. This follows the arrival of WHO officials into China a couple days ago. Not only have the cases jumped, but so did the number of deaths. It plays on fears that China's figures are not reliable. But it is not just China.

Read More »

Read More »

FX Daily, February 12: The Greenback Slips in Subdued Activity

Investors appear to be increasingly looking past the latest coronavirus from China as new afflictions slow. Despite the soggy close of US equities yesterday, Asia Pacific bourses are nearly all higher, led by more than 1% gains in Singapore and Thailand. The Dow Jones Stoxx 600 is at new record highs, led by consumer discretionary and materials sectors.

Read More »

Read More »

USD/CHF Price Analysis: Rising wedge can halt the bulls

USD/CHF created a rising wedge pattern suggesting potential exhaustion in the medium term. The level to beat for bears is the 0.9770 support. USD/CHF is pulling back down slightly from the 2020 highs while reintegrating Friday’s range. The spot is trading below the 100/200-day simple moving averages suggesting an overall bearish bias.

Read More »

Read More »

FX Daily, February 11: New Calm in the Capital Markets Continues, Powell Moves to Center Stage

Overview: Investors are taking solace from reports indicating that the increase in the new coronavirus at ground zero (Hubei) is slowing. After the S&P 500 reversed early losses yesterday to close at new record highs helped keep the bullish sentiment intact. Benchmarks in Hong Kong, South Korea, Australia, and China rose for the sixth session.

Read More »

Read More »

FX Daily, February 10: Quiet Start to the New Week in which Politics may Dominate

Overview: The global capital markets have begun the new week on a cautious tone as investors seek to assess the latest news on the new coronavirus. Nearly all the markets in Asia fell but China. European bourses are lower as well, with the Dow Jones Stoxx 600 off about 0.3%. US shares are soft but little changed.

Read More »

Read More »

USD/CHF Price Analysis: Greenback approaching January highs vs. Swiss franc

USD/CHF created a strong bullish recovery while nearing the 2020 highs. The level to beat for bulls is the 0.9770 resistance. USD/CHF is attempting to form a base near multi-month lows while trading below the main daily simple moving averages.

Read More »

Read More »

FX Daily, February 7: Dollar Rides High as Eurozone Disappoints, and Caution Sets In

Overview: A more cautious tone is evident today in the markets, which seem to have run well ahead of macro developments and evidence that the new coronavirus is not yet contained. After a roughly 3.5% advance in the past three sessions, the MSCI Asia Pacific index pulled back with nearly the markets in the region slipping.

Read More »

Read More »

USD/CHF Price Analysis: Bulls await a sustained move beyond 0.9765-70 supply zone

USD/CHF trades with a positive bias for the fourth consecutive session. The 0.9700 mark might now act as a strong base for bullish traders. The USD/CHF pair edged higher for the fourth consecutive session on Thursday and is currently placed near one-week tops, levels just below mid-0.9700s.

Read More »

Read More »

FX Daily, February 6: Stocks Push Higher but more Cautious Tone may be Emerging

Overview: The bullish enthusiasm that carried the S&P 500 to new closing highs yesterday is helping Asia Pacific and European shares today. The MSCI Asia Pacific Index rose for the third session with Tokyo, Hong Kong, and Korea jumping two percent. Europe's Dow Jones Stoxx 600 gapped to new record highs before stabilizing in mid-morning turnover. US shares are mostly firmer.

Read More »

Read More »

FX Daily, February 5: Markets Extend Recovery, but Look for a Pause

Overview: The S&P 500 gapped higher and surged 1.5% yesterday, the most since in six months, helping set the stage for a continued recovery in global equities, and stoked risk appetites more broadly. An experimental antiviral treatment is to begin clinical testing. All of the markets in the Asia Pacific region advanced, with Japan, China, and Singapore gaining more than 1%.

Read More »

Read More »

FX Daily, February 4: Relief Rally Fueled by Liquidity not Peak in Coronavirus

Overview: The combination of the rally in US shares yesterday and the continued efforts of China to inject liquidity helped lift sentiment today. The MSCI Asia Pacific Index snapped an eight-day slide, and many markets jumped more than 1%. Led by energy and materials, Europe's Dow Jones Stoxx 600 is posting broad gains and is up over 1% in late morning turnover.

Read More »

Read More »

FX Daily, January 31: Stocks Finishing on Poor Note, while the Dollar and Bonds Firm

Overview: It was as if the World Health Organization's recognition of that the new coronavirus is an international health emergency was the catalyst that the markets needed. US equities recovered smartly and managed to close higher on the session. However, the coattails were short, and follow-through buying of US shares fizzled.

Read More »

Read More »

FX Daily, January 30: Contagion Impact not Peaked, Weighs on Risk Appetites

Overview: The ongoing concerns about the geometric progression of the new coronavirus continues to swamp other considerations for investors. Risk continues to be unwound, as the World Health Organization meets to decide if this is indeed a global health emergency. Several large equity markets in Asia were hit particularly hard.

Read More »

Read More »

FX Daily, January 29: Escaped from a Crocodile’s Mouth, Entered a Tiger’s Mouth

Overview: This colorful Malay saying captures the spirit of the animal spirits. Narrowly escaping an escalation of a trade war between the world's two largest economies, the outbreak of a deadly virus has spurred moves, especially the sell-off in stocks and rally in bonds, for which many investors seemed ill-prepared. Even though the virus contagion has not peaked, the recovery in US equities yesterday points to a break the fear and anxiety.

Read More »

Read More »

-637165949140085624-800x391.png)