Tag Archive: USD/CHF

FX Daily, April 8: Flavor of the Day: Consolidation

Overview: Global equities are struggling after the S&P 500 staged a dramatic reversal yesterday. The early 3.5% gain was completely unwound and closed slightly lower. With few exceptions (e.g., Japan and the Philippines), most equity markets in the Asia Pacific region and Europe are lower.

Read More »

Read More »

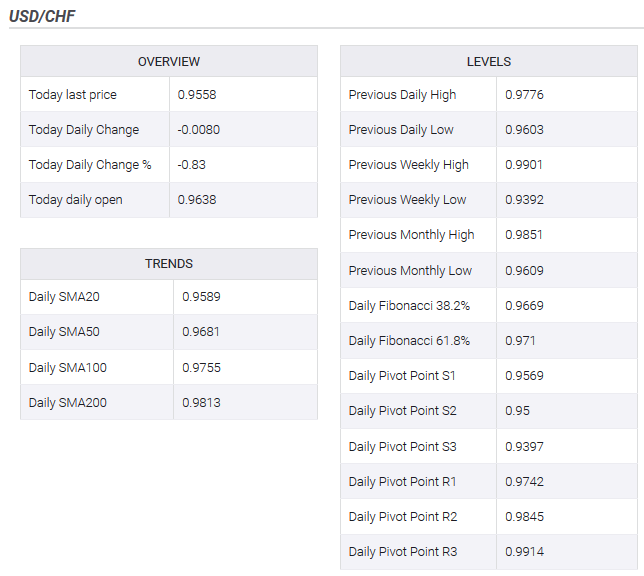

USD/CHF Price Analysis: Technical set-up remains tilted in favour of bullish traders

USD/CHF traded with a positive bias for the sixth consecutive session on Monday. Bulls are likely to wait for a sustained move beyond the very important 200-DMA. The USD/CHF pair built on last week's goodish positive move of around 300 pips and continued gaining traction for the sixth straight session on Monday.

Read More »

Read More »

FX Daily, April 6: Glimmer of Hope Lifts Markets

Overview: Reports suggesting that some of the hot spots for the virus contagion appear to be leveling off, and this is helping underpin risk appetites today. The curve seems to be flattening in Italy, Spain, and France. In the US, there are some early signs of leveling off in NY, and now, the number of states with infection rates above 20% is less than 10 from over 40 last week.

Read More »

Read More »

FX Daily, April 2: Optimism on Oil Deal Steadies Risk Appetites…for the Moment

Overview: After US stocks dropped more than 4% yesterday, investor sentiment has improved, apparently sparked by ideas that the pain will force oil producers to find a way to reduce supply. Oil prices have surged, with the May WTI contract rallying around 7%. Asia Pacific equities were mostly higher, with Japan and Australia the notable exceptions.

Read More »

Read More »

USD/CHF Price Analysis: US dollar bulls nearing 0.9700 handle vs. Swiss franc

USD/CHF is trading up for the third consecutive day. The level to beat for bulls is the 0.9700 resistance. USD/CHF is rebounding from the 0.9500 level while challenging the 50 SMA on the daily chart. DXY (US dollar index) is gaining some ground vs. most of its rivals.

Read More »

Read More »

FX Daily, April 1: Hemorrhaging Resumes

Overview: There is no reprieve for investors. Equities are falling sharply. Nearly all the Asia Pacific markets slumped but Australia. Chinese markets fared better than most, but the Nikkei was off 4.5%, and India was down almost as much in late dealings. Europe's Dow Jones Stoxx 600 is off more than 3% near midday, led by a sell-off in banks that are suspending dividends and share buybacks.

Read More »

Read More »

FX Daily, March 31: March Ends like a Lion, No Lamb in Sight

Overview: The coronavirus plague upended the world in March. Equities are finishing the month on a firm note. Strong gains in the US yesterday and an unexpectedly strong Chinese PMI (yes, to be taken with the proverbial grain of salt) helped lift most Asia Pacific and European markets today. Japan and Australia are exceptions to the generalization.

Read More »

Read More »

USD/CHF Price Analysis: Intraday positive move stalls near the 0.9590 confluence region

USD/CHF finds decent support near 0.9500 mark and snaps four days of losing streak. The set-up warrants some caution before positioning for any further recovery move. The USD/CHF pair found a decent support near the key 0.9500 psychological mark and staged a goodish recovery on the first day of a new trading week, snapping four consecutive days of losing streak.

Read More »

Read More »

FX Daily, March 30: Monday Blues

Overview: Risk appetites remain in check as the spread of the coronavirus is leading to more and longer shutdowns. Asia Pacific equities fell with Australia, the notable exception. Its benchmark rallied a record 7%, encouraged by additional stimulus measures.

Read More »

Read More »

USD/CHF hits ten-day lows near 0.9550 as the greenback remains under pressure

US Dollar Index tumbles to fresh weekly lows at 98.73, down 4% from the top. US data: Consumer Sentiment Index suffers second-largest monthly decline in March. The USD/CHF pair is falling for the fourth consecutive day amid an ongoing sell-off of the US dollar. The DXY approached earlier on Friday the 100.00 area and recently bottomed at 98.73, the lowest level since March 17.

Read More »

Read More »

FX Daily, March 27: Nervousness Ahead of the Weekend

Overview: Officials appear to have persuaded investors that they have put into place measures that will cushion the economic blow and ensure that the financial system continues to function. After seemingly goading officials into action, investors are choosing not to resist. Moreover, there is a recognition that many programs are scalable.

Read More »

Read More »

FX Daily, March 26: Rumor Bought, Fact Sold

Overview: Speculation that the US Senate would pass the large stimulus bill worth around 10% of US GDP is thought to have fueled a bounce in equities in recent days. The bill was approved and will now go to the House, where a vote is expected tomorrow. If the rumor was bought, the fact has been sold. The first to crack was the Asia Pacific region.

Read More »

Read More »

FX Daily, March 25: Relief, but…

Overview: Global equities are marching higher. While the Dow Jones Industrials posted its biggest advance since 1933, the US is lagging behind other leading benchmarks. The MSCI Asia Pacific advanced, led by Japan's Nikkei's 8% gain. It was third consecutive gain, during which time the Nikkei has rallied 17%. Europe's Dow Jones Stoxx 600 is up about 3.5% after bouncing 8.4% yesterday.

Read More »

Read More »

FX Daily, March 24: Relief Bounce On Tuesday, but Turn Around not Secure

Overview: Bottom-picking, after officials step up efforts and some optimism creeps in, is helping lift spirits today. As one looks at the equity bounces, it is important to remember that among the biggest rallies take place in bear markets. Nearly all the bourses in Asia-Pacific rallied, led by a 7% advance by Japan's Nikkei and an 8%+ surge in South Korea's Kospi. Most other markets were up 2%-5%.

Read More »

Read More »

USD/CHF Price Analysis: US dollar eases from 2020 highs, stabilizes near 0.9800 figure

USD/CHF consolidates gains for the second consecutive day. The level to beat for bulls is the 0.9900 resistance. The parity level might be on the bulls’ radar. USD/CHF is retreating slightly this Monday while the currency pair is consolidating gains for the second consecutive day above the main SMAs.

Read More »

Read More »

FX Daily, March 23: Greenback Demand Not Satisfied by Swap Lines

Overview: In HG Wells' "War of the Worlds," the common cold repelled a Martian invasion. Now, a novel coronavirus is disrupting everything and everywhere. Global equities continue to get hammered, though the apparent relative resilience of Japan may have spurred some buying of Japanese equities.

Read More »

Read More »

FX Daily, March 20: Markets Ending the Week on Better Note

Overview: Dramatic price action continues but in the other direction. Stocks and bonds have rallied strongly, and the US dollar is snapping a strong advance with a sharp and broad setback. The immediate trigger is hard to identify. Some accounts linking it to fears that the California shutdown will be repeated throughout the country, deepening the coming downturn.

Read More »

Read More »

FX Daily, March 19: ECB’s Bazooka Support Bonds but not the Euro

Overview: It is not just that the dollar soared while stocks and bonds continued to plunge. The dollar's strength is, in effect, a powerful short-covering rally. It was used to fund a great part of the global circuit of capital. The circuit of capital is in reverse now, and the funding currency is being bought back. The dollar's strength is a function of the sell-off of other assets.

Read More »

Read More »

USD/CHF Price Analysis: Dollar trading in fresh March’s highs, challenging 0.9750 level

USD/CHF is reversing up sharply from the 2020 lows. The level to beat for bulls is the 0.9750 resistance. USD/CHF is rebounding sharply from 2020 lows while nearing the 100 SMA on the daily chart. The demand for the greenback is dring the currency pair towards the 2020 highs.

Read More »

Read More »

FX Daily, March 18: Bonds Join Equities in the Carnage

Overview: A new phase of the market turmoil is at hand. Bonds are no longer proving to be the safe haven for investors fleeing stocks. The tremendous fiscal and monetary efforts, with more likely to come, have sparked a dramatic rise in yields. Meanwhile, equities are getting crushed again.

Read More »

Read More »

-637217795705356366-800x391.png)

-637211742211799359-800x391.png)