Tag Archive: U.S. Unemployment Rate

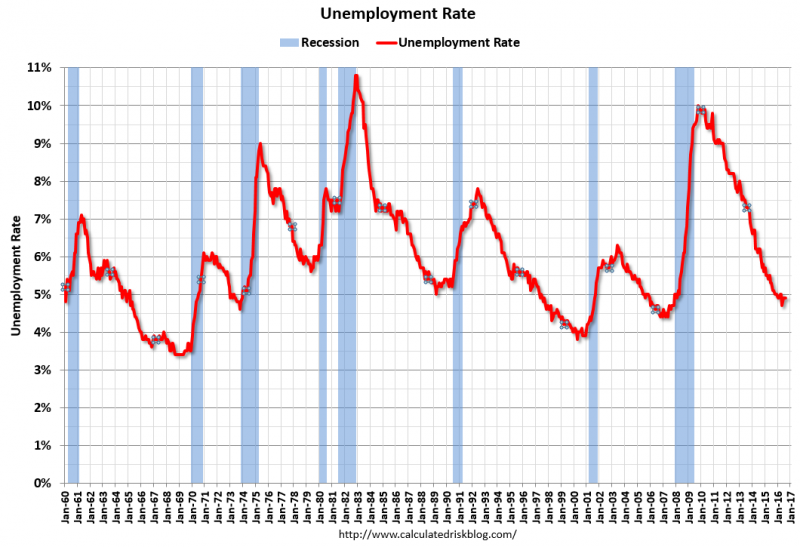

Unemployment rate measures the percentage of the total work force that is unemployed and actively seeking employment during the reported month.

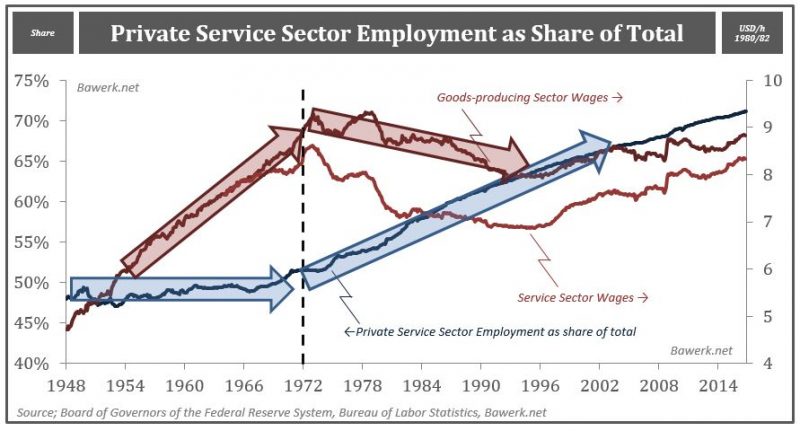

Toward A New World Order, part III

A new world order is coming of age and the transition is painful to accept for a Western middle class with a deep-seated sense of entitlement. We showed how the West feels threatened globally in Toward a New World Order and followed up explaining how this translate into domestic politics in Toward a New World Order Part II. We will now continue this series by showing how gross economic mismanagement have created the new political class that we...

Read More »

Read More »

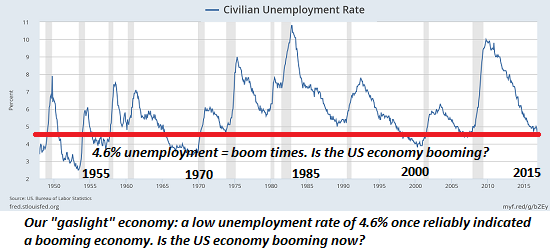

Our “Gaslight” Economy

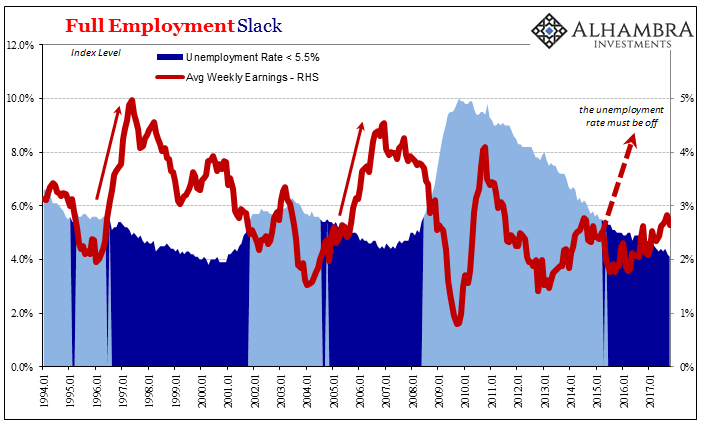

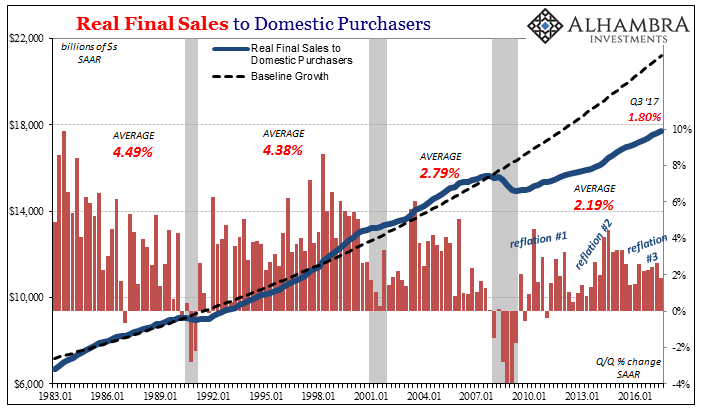

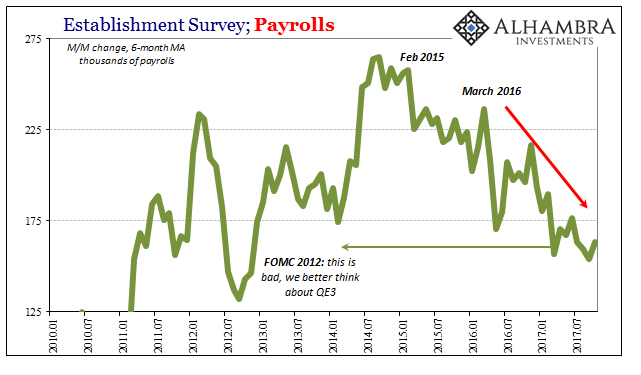

If you don't like what these charts are saying, please notify The Washington Post to add the St. Louis Federal Reserve to its list of Russian propaganda sites. Yesterday I described our gaslight financial system. Today we'll look at our gaslight economy. Correspondent Jason H. alerted me to the work of author Thomas Sheridan ( Puzzling People: The Labyrinth of the Psychopath), who claims to have coined the term gaslighting.

Read More »

Read More »

FX Daily, December 02: Is it About US Jobs Today?

The capital markets are finishing the week amid speculation that the driving forces of the past three weeks are ebbing. Global equities and the dollar may be snapping three-week advances. The issue is whether it is a consolidation or trend change. The former is a more prudent assumption until proven otherwise. As a rough and ready signal, the 100.60 level in the Dollar Index, which corresponds to the lows November 22 and November 28 is reasonable.

Read More »

Read More »

Mixed Jobs Report, but Unlikely to Deter Expectations for Fed Hike

The US dollar has slipped lower in response to the jobs data, but quickly recovered. The details are mixed, but is unlikely to change views on the outlook for Fed policy. The headline job creation was in line with expectations at 178k. Job growth of the back two months were shaved by 2k, concentrated in October. The unemployment rate dropped to 4.6%, the lowest since 2007.

Read More »

Read More »

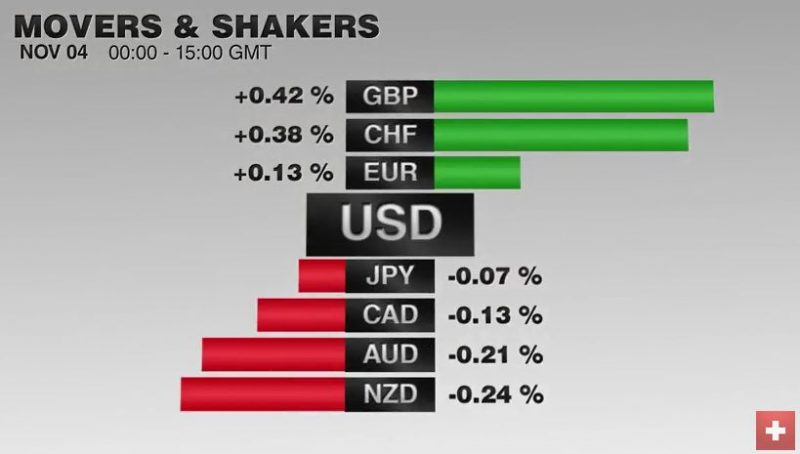

FX Daily, November 04: US Jobs Figures: Another Time the Swiss Franc Strengthens

With the not convincing U.S. jobs number, both the EUR and, in particular, the Swiss Franc could improve. With continuing political uncertainty in the U.S., more speculators closed their short CHF positions

Read More »

Read More »

FX Daily, October 07: Sterling Stabilizes After Harrowing Drop, Now Jobs

Sterling again steals the limelight. In early Asia, sterling inexplicably dropped nearly eight cents in minutes (to ~$1840), and on some platforms, may have traded below $1.1380. It almost immediately rebounded but has not resurfaced above $1.2480.

Read More »

Read More »

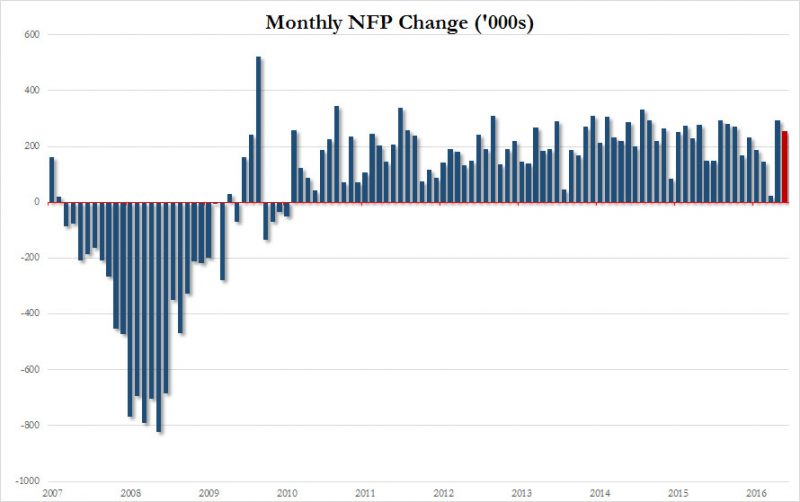

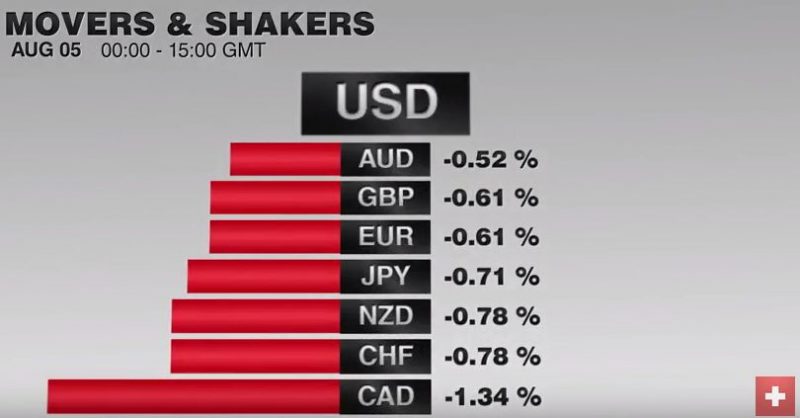

US Jobs Disappoint, Risk of Sept Hike Recedes, Dollar Falls

Underlying concerns about US labor market ease after two robust reports. Sept Fed views will not change much. Canada’s data is disappointing, BOC optimism may be challenged.

Read More »

Read More »

FX Daily, September 2: US Jobs Data–Higher Anxiety, Thank You Mr. Fischer

The US dollar is little changed ahead of the job report. Our near-term bias is for a lower dollar. Sterling is flat and is holding on to about a 1% gain this week. The Japanese yen is about a 0.3% lower and is off 1.7% this week. The euro was coming into today for the week.

Read More »

Read More »

US Jobs Surprise, Canada Disappoints

Underlying concerns about US labor market ease after two robust reports. Sept Fed views will not change much. Canada’s data is disappointing, BOC optimism may be challenged.

Read More »

Read More »

FX Daily, August 05: US Jobs Data on Tap, but Don’t Expect Miracles

The focus is squarely on the US employment data today, ahead of which the capital markets are mostly consolidating yesterday's Bank of England inspired moved. The Australian and New Zealand dollars, alongside sterling, which is up about half a cent after losing two yesterday.

Read More »

Read More »

FX Daily, July 08: US Jobs Data, Little Policy Significance, Swiss Unemployment falls

Positive job data in the United States are typically positive for both USD and EUR, because the odds of a rate hike are increasing. Consequently the EUR/CHF rose. In the last two days SNB interventions should have been smaller. The Swiss unemployment rate fell from 3.5% to 3.3%.

Read More »

Read More »

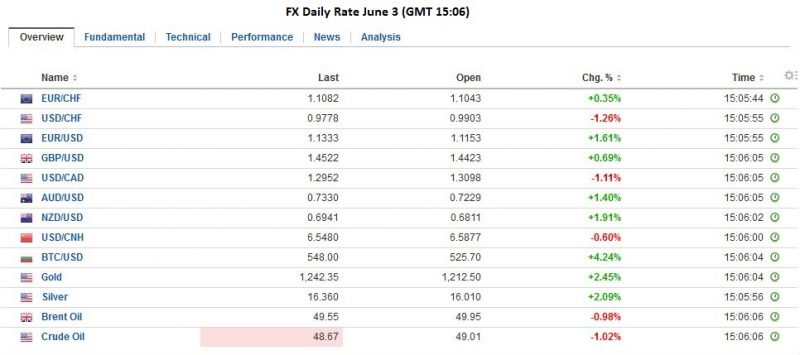

FX Daily, June 3: FX Market Shocked by Non-Farm Payrolls

Massive surprise in the US job report was reflected in currency rates. The EUR/CHF surprisingly increased, despite weak US data. This reflects the fact that the ECB is currently considered the most dovish central bank. The dollar lost 2% against the yen, 1.6% against the euro and 1.3% vs. the Swiss franc.

Read More »

Read More »

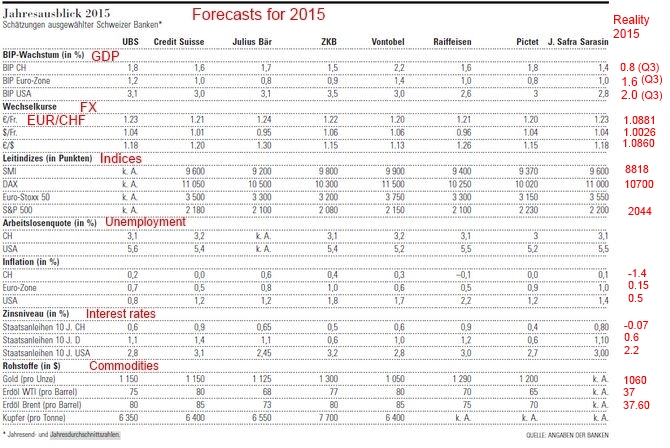

Economic Forecasts for 2015: Swiss Banks were too Optimistic

Our analysis of the forecasts of economic data for 2015 shows that the Swiss banks were too optimistic for most data. US growth, the oil price, inflation and interest rates are far lower than expected. The errors for stock indices were smaller.

Read More »

Read More »