Tag Archive: U.S. Treasuries

Year-end Rate Hike Once Again Proves To Be Launchpad For Gold Price

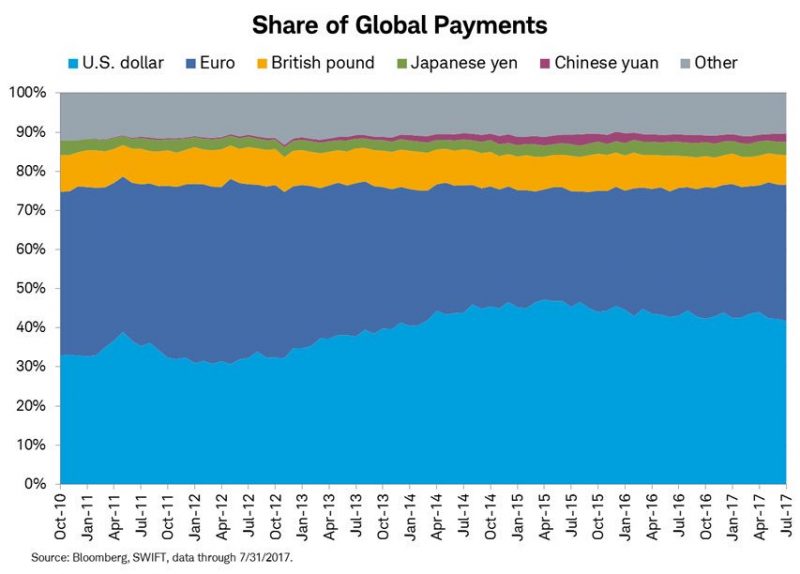

Year-end rate hike once again proves to be launchpad for gold price. FOMC follows through on much anticipated rate-hike of 0.25%. Spot gold responds by heading for biggest gain in three weeks, rising by over 1%. Final meeting for Federal Reserve Chair Janet Yellen. Yellen does not expect Trump's tax-cut package to result in significant, strong growth for US economy. No concern for bitcoin which 'plays a very small role in the payment system'.

Read More »

Read More »

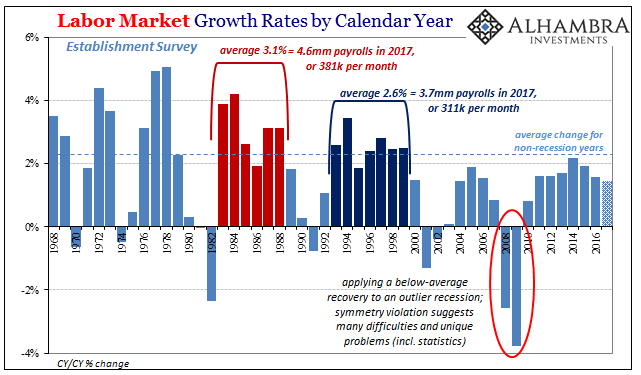

Defining The Economy Through Payrolls

The year 2000 was a transition year in a lot of ways. Though Y2K amounted to mild mass hysteria, people did have to get used to writing the date with 20 in front of the year rather than 19. It was a new millennium (depending on your view of Year 0) that seemed to have started off under the best possible terms. Not only were stocks on fire at the outset, the economy was, too.

Read More »

Read More »

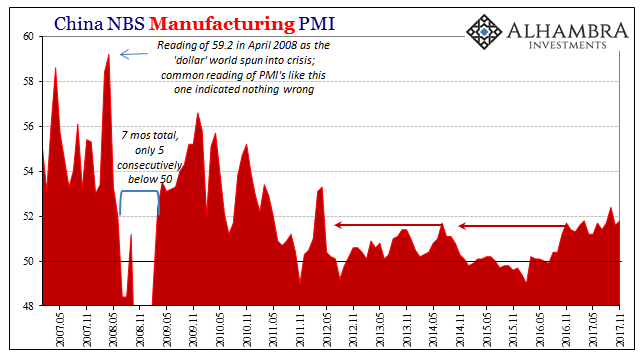

Three Years Ago QE, Last Year It Was China, Now It’s Taxes

China’s National Bureau of Statistics reported last week that the official manufacturing PMI for that country rose from 51.6 in October to 51.8 in November. Since “analysts” were expecting 51.4 (Reuters poll of Economists) it was taken as a positive sign. The same was largely true for the official non-manufacturing PMI, rising like its counterpart here from 54.3 the month prior to 54.8 last month.

Read More »

Read More »

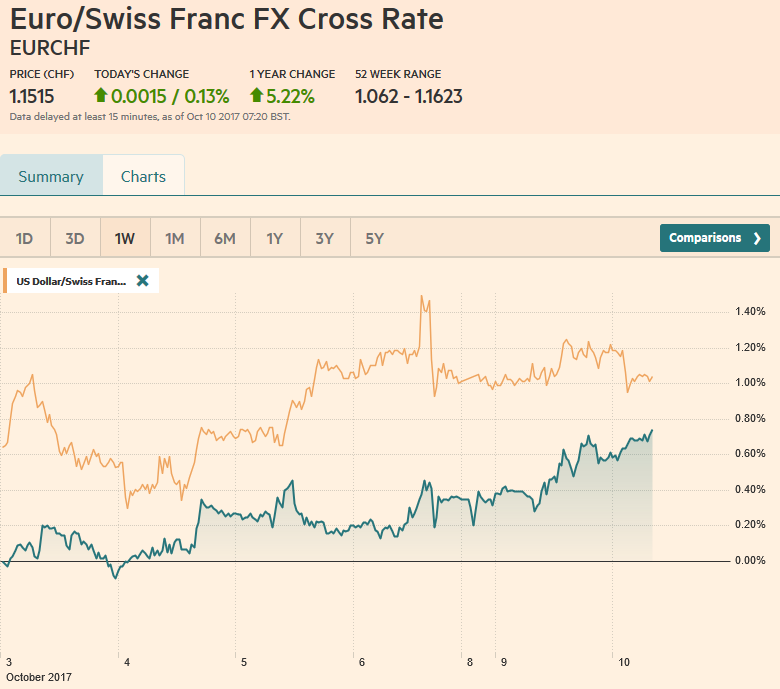

Weekly Technical Analysis: 11/12/2017 – USD/CHF, USD/JPY, EUR/USD, GBP/USD, Gold

The USDCHF pair begins to bounce higher after approaching from 0.9892 level, supported by the EMA50 that meets the mentioned level, while stochastic shows clear bullish trend signals on the four hours time frame. Therefore, these factors encourage us to keep our positive expectations in the upcoming period, waiting for visiting 1.0038 level as a next main station, being aware that breaking 0.9892 will stop the expected rise and turns the price back...

Read More »

Read More »

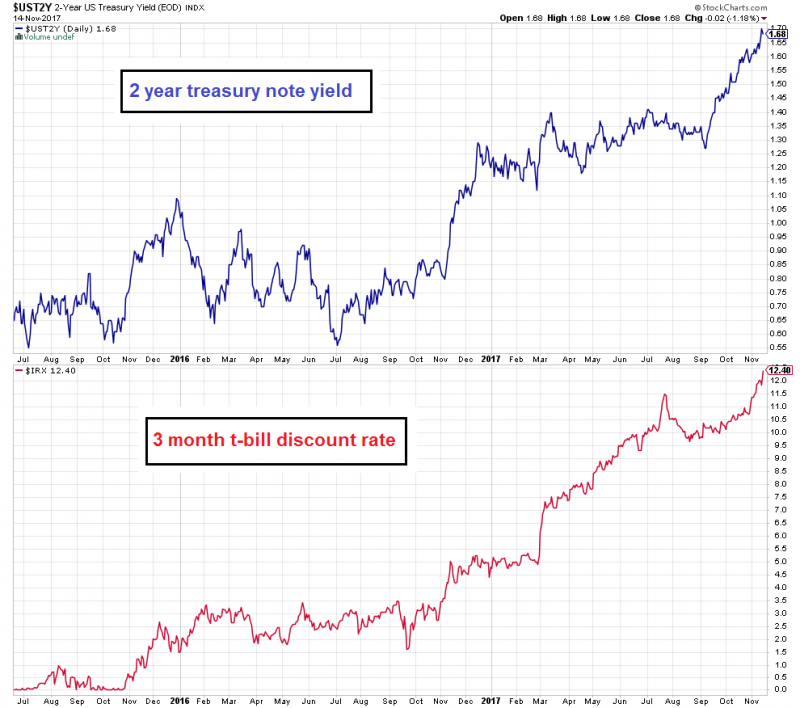

Business Cycles and Inflation, Part II

We recently received the following charts via email with a query whether they should worry stock market investors. They show two short term interest rates, namely the 2-year t-note yield and 3 month t-bill discount rate. Evidently the moves in short term rates over the past ~18 – 24 months were quite large, even if their absolute levels remain historically low.

Read More »

Read More »

Aligning Politics To economics

There is no argument that the New Deal of the 1930’s completely changed the political situation in America, including the fundamental relationship of the government to its people. The way it came about was entirely familiar, a sense from among a large (enough) portion of the general population that the paradigm of the time no longer worked. It was only for whichever political party that spoke honestly to that predicament to obtain long-term...

Read More »

Read More »

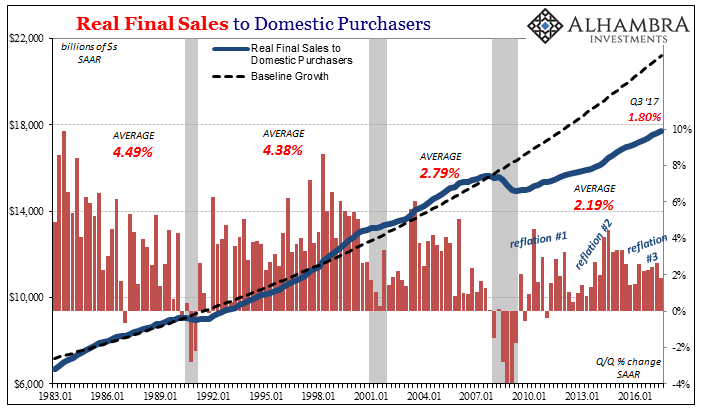

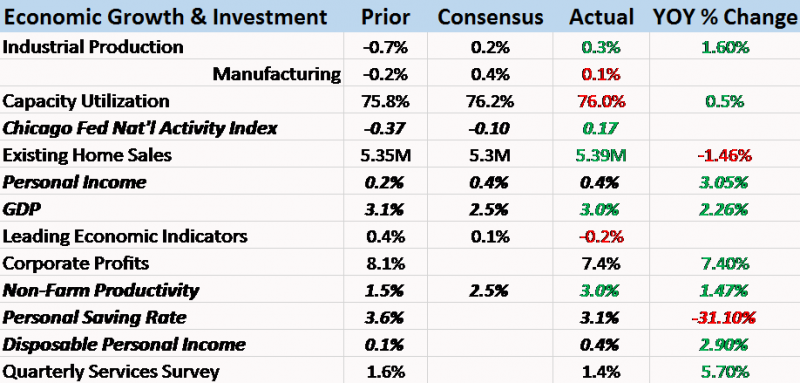

Bi-Weekly Economic Review: Gridlock & The Status Quo

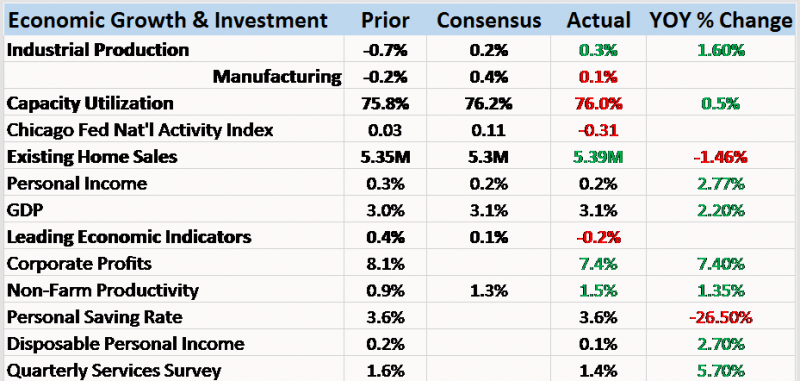

The good news is that the economy just printed its second consecutive quarter of 3% growth, a feat not accomplished since Q2 and Q3 2014. The bad news is that the growth spurt in 2014 was better, quantitatively and qualitatively. Those two quarters produced gains of 4.6% and 5.2% (annualized) in GDP, much better than the most recent 3.1% and 3% prints of Q2 and Q3 2017.

Read More »

Read More »

An Unexpected (And Rotten) Branch of the Maestro’s Legacy

The most significant part of China’s 19th Party Congress ended in the usual anticlimactic fashion. These events are for show, not debate. Like any good trial lawyer will tell you, you never ask a question in court that you don’t already know the answer to. For China’s Communists, that meant nominating Xi Jinping’s name to be written into the Communist constitution with the votes already tallied.

Read More »

Read More »

Bi-Weekly Economic Review: Yawn

When I wrote the update two weeks ago I said that we might be nearing the point of maximum optimism. Apparently, there is another gear for optimism in this market as stocks have just continued to slowly but surely reach for the sky.

Read More »

Read More »

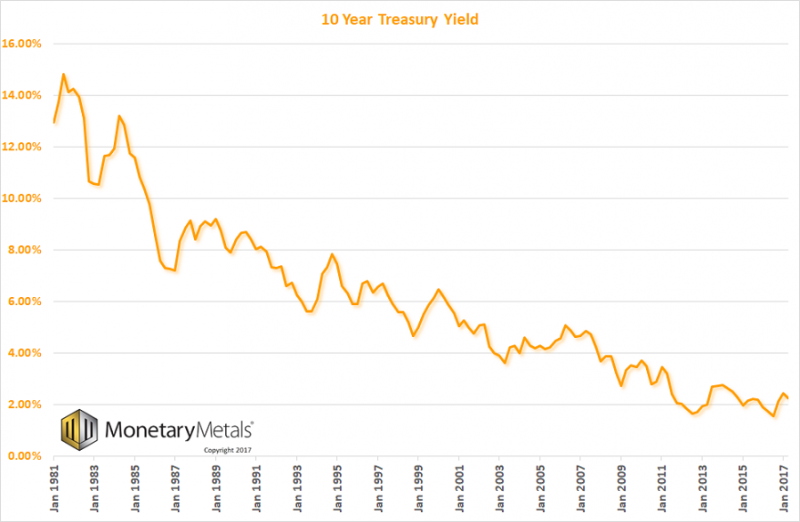

Is This The Best Way To Bet On The Fed Losing Control Of The Bond Market?

Authored by Kevin Muir via The Macro Tourist blog, Lately, one of my biggest duds of a call has been for the yield curve to steepen. Sure, I have all sorts of fancy reasons why it should steepen, but reality glares back at me in black and white on my P&L run. Sometimes fighting with the market is an exercise in futility.

Read More »

Read More »

The Gold-Backed-Oil-Yuan Futures Contract Myth

On September 1, 2017, the Nikkei Asian Review published an article titled, “China sees new world order with oil benchmark backed by gold”, written by Damon Evans. Just below the headline in the introduction it states, “China is expected shortly to launch a crude oil futures contract priced in yuan and convertible into gold in what analysts say could be a game-changer for the industry”. Not long after the Nikkei piece was released ‘the story’ was...

Read More »

Read More »