Tag Archive: U.S. Treasuries

Weekly Technical Analysis: 05/03/2018 – USDJPY, EURUSD, GBPUSD, EURGBP, AUDUSD

The USDCHF pair shows sideways trading around the EMA50, noticing that the EMA50 shows clear negative signals on the four hours’ time frame, while the price settles below the intraday bullish channel’s support line that appears on the chart.

Read More »

Read More »

Weekly Technical Analysis: 20/02/2018 – USD/JPY, EUR/USD, GBP/USD, USD/CAD, USD/CHF

The USDCHF pair approached our waited target yesterday, represented by the bearish channel’s resistance that appears on the above chart, noticing that the price faces good resistance at the EMA50, which forms negative pressure that we expect to push the price to resume its main bearish track again.

Read More »

Read More »

Weekly Technical Analysis: 12/02/2018 – USD/JPY, EUR/USD, GBP/USD, WTI Oil Futures, USD/CHF

The USDCHF pair trading settles below the previously broken support that appears in the image, while stochastic provides negative overlapping signal on the four hours time frame, which supports the continuation of our bearish trend expectations in the upcoming sessions, reminding you that our next target at 0.9254.

Read More »

Read More »

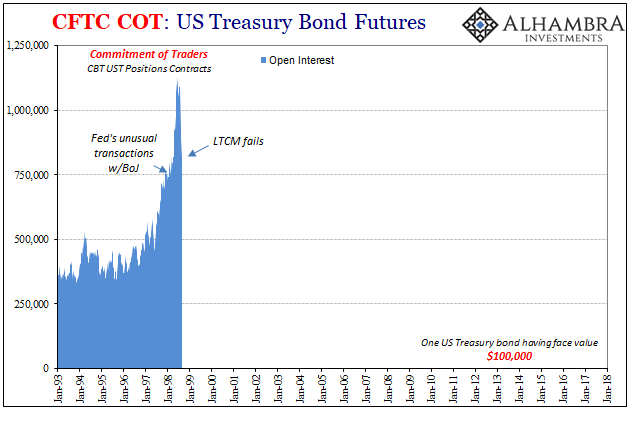

COT Blue: Interest In Open Interest

For me, the defining characteristic of the late nineties wasn’t the dot-coms. Most people were exposed to the NASDAQ because, frankly, at the time there was no getting away from it. It had seeped into everything, transforming from a financial niche bleeding eventually into the entire worldwide culture. We all remember the grocery clerks who became day traders.

Read More »

Read More »

Weekly Technical Analysis: 05/02/2018 – USD/JPY, EUR/USD, GBP/USD, AUD/USD, USD/CHF

The USDCHF pair traded with clear negativity yesterday to approach our waited target at 0.9418, to keep the bullish trend scenario active until now, being away that it is important to monitor the price behavior when touching the mentioned level, as breaching it will push the price to extend its gains and head towards 0.9530 as a next station, while its stability will push the price to decline again.

Read More »

Read More »

Globally Synchronized What?

In one of those rare turns, the term “globally synchronized growth” actually means what the words do. It is economic growth that for the first time in ten years has all the major economies of the world participating in it. It’s the kind of big idea that seems like a big thing we all should pay attention to. In The New York Times this weekend, we learn.

Read More »

Read More »

Weekly Technical Analysis: 29/01/2018 – USDJPY, EURUSD, GBPUSD, GBPJPY

The USDCHF pair shows some bullish bias to approach retesting the previously broken support that turns into key resistance now at 0.9418, noticing that stochastic loses its bullish momentum clearly to reach the overbought areas, while the EMA50 forms continuous negative pressure against the price.

Read More »

Read More »

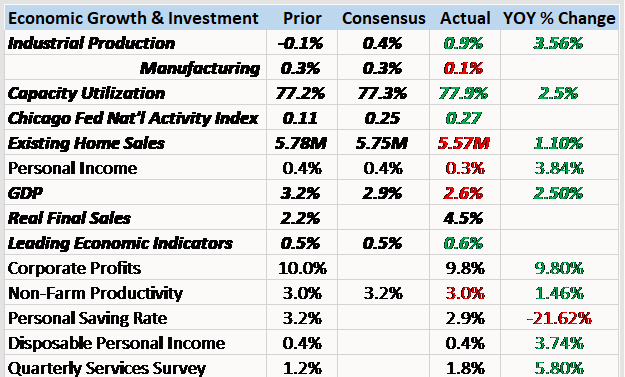

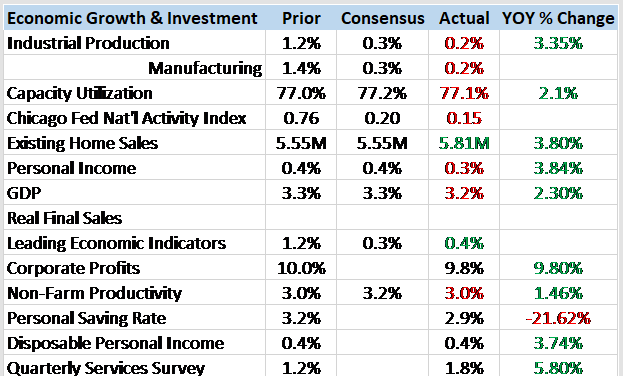

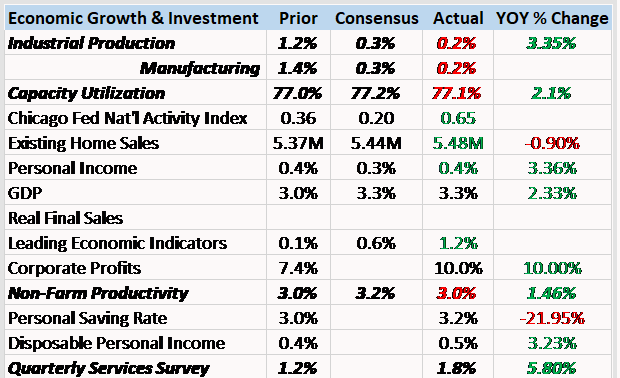

Bi-Weekly Economic Review: Markets At Extremes

Production ended the year on a strong note but early readings from January are not as positive. The December industrial production report headline was strong at a 0.9% gain but a lot of that strength was in the mining (oil drilling) and utility sectors. Mining has actually led the way the last year as rig count has risen with drilling activity. I’d love to see our economy less dependent on the price of oil but that is what we’ve become over the...

Read More »

Read More »

Did Mnuchin Signal a Policy Shift Today?

Did US Treasury Secretary Mnuchin signal a change in the US dollar policy? Probably not. As Mnuchin and President Trump have done before, a distinction was drawn between short- and longer-term perspectives. In the short-term, a weaker dollar says Mnuchin, is good for US trade and "other opportunities". In the longer-term, Mnuchin explicitly acknowledged, "the strength of the dollar is a reflection of the strength of the US economy."

Read More »

Read More »

Weekly Technical Analysis: 22/01/2018 – USD/JPY, EUR/USD, GBP/USD, USD/CHF

The USDCHF pair found solid support at 0.9564 barrier, which forced the price to rebound bullishly to approach testing the key resistance 0.9655, met by the EMA50 to add more strength to it, while stochastic shows clear overbought signals now.

Read More »

Read More »

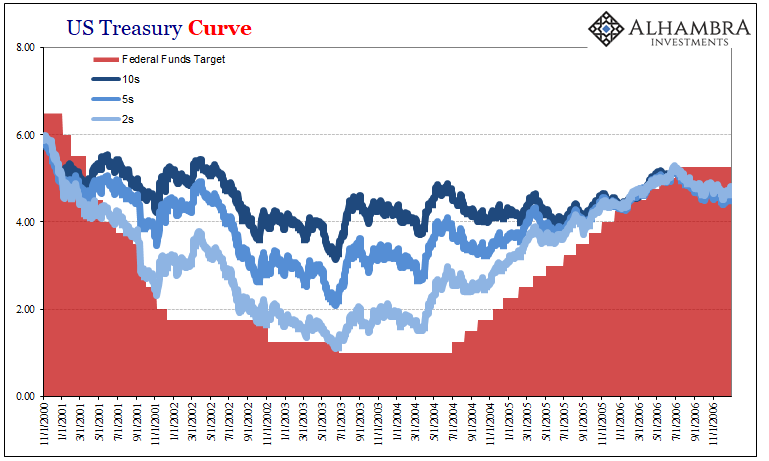

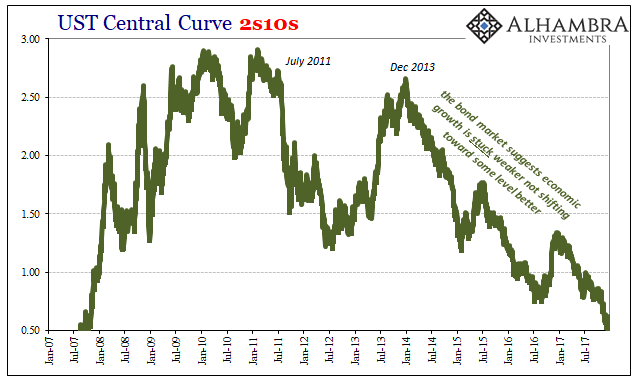

What About 2.62 percent?

There’s nothing especially special about 2.62%. It’s a level pretty much like any other, given significance by only one phrase: the highest since 2014. It sounds impressive, which is the point. But that only lasts until you remember the same thing was said not all that long ago.

Read More »

Read More »

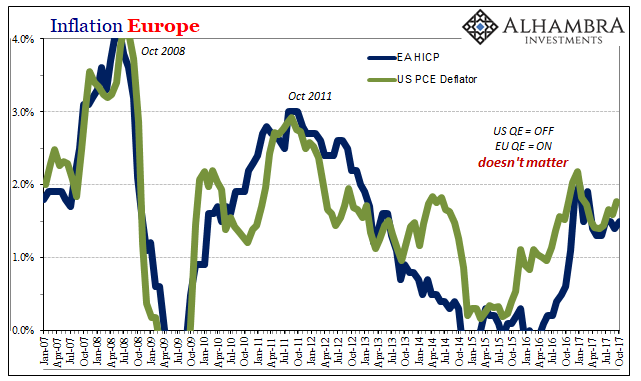

Good or Bad, But Surely Not Transitory

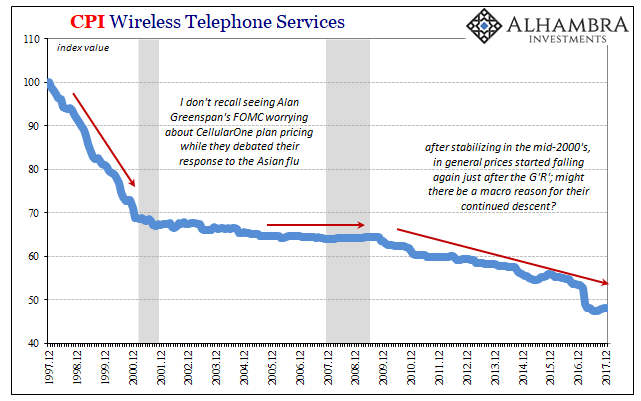

When Federal Reserve officials first started last year to mention wireless network data plans as a possible explanation for a fifth year of “transitory” factors holding back consumer price inflation, it seemed a bit transparent. One of the reasons for immediately doubting their sincerity was the history of that particular piece of the CPI (or PCE Deflator).

Read More »

Read More »

China and US Treasuries

The US Treasury market was consolidating yesterday's 7.5 basis point jump in 10-year yields when Bloomberg's headline hit. The claim was that Chinese officials are "wary of Treasuries". Yields rose quickly to test 2.60% and the dollar moved lower. It is difficult to determine the significance of the claim as the Bloomberg story does not quote anyone.

Read More »

Read More »

Weekly Technical Analysis: 15/01/2018 – USDJPY, EURUSD, GBPUSD, WTI Oil Futures

The USDCHF pair succeeded to break 0.9656 level and hold with a daily close below it, which confirms opening the way to extend the bearish wave towards our yesterday's mentioned next target at 0.9566, noticing that the price approaches retesting the broken level now.

Read More »

Read More »

Bi-Weekly Economic Review: A Weak Dollar Stirs A Toxic Stew

We received several employment related reports in the first two weeks of the year. The rate of growth in employment has been slowing for some time – slowly – and these reports continue that trend. The JOLTS report showed a drop in job openings, hires and quits.

Read More »

Read More »

The Great Risk of So Many Dinosaurs

The Treasury Borrowing Advisory Committee (TBAC) was established a long time ago in the maelstrom of World War II budgetary as well as wartime conflagration. That made sense. To fight all over the world, the government required creative help in figuring out how to sell an amount of bonds it hadn’t needed (in proportional terms) since the Civil War. A twenty-person committee made up of money dealer bank professionals and leaders was one of the few...

Read More »

Read More »

Bubble Watch: Warning Signs That The Everything Bubble Will Burst in 2018

I believe 2018 will be the year inflation arrives. The reason, as I’ve noted throughout mid-2017, is that multiple Central Banks, particularly the European Central Bank (ECB), Bank of Japan (BoJ) and Swiss National Bank (SNB) have maintained emergency levels of QE and money printing, despite the fact that globally the economy is performing relatively well.

Read More »

Read More »

Bi-Weekly Economic Review: Animal Spirits Haunt The Market

The economic data over the last two weeks continued the better than expected trend. Some of the data was quite good and makes one wonder if maybe, just maybe, we are finally ready to break out of the economic doldrums. Is it possible that all that new normal, secular stagnation stuff was just a lack of animal spirits?

Read More »

Read More »

Weekly Technical Analysis: 18/12/2017 – USD/CHF, USD/JPY, EUR/USD, GBP/USD, EUR/CHF

The USDCHF pair traded with clear negativity yesterday to break 0.9892 level and settles below it, which stops the recently suggested positive scenario and put the price within the correctional bearish track again, noting that there is a bearish pattern that its signs appear on the chart, which means that breaking its neckline at 0.9840 will extend the pair's losses to surpass 0.9800 and reach 0.9730 as a next station.

Read More »

Read More »

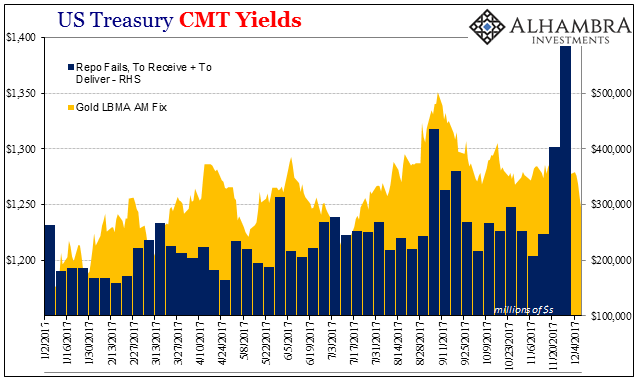

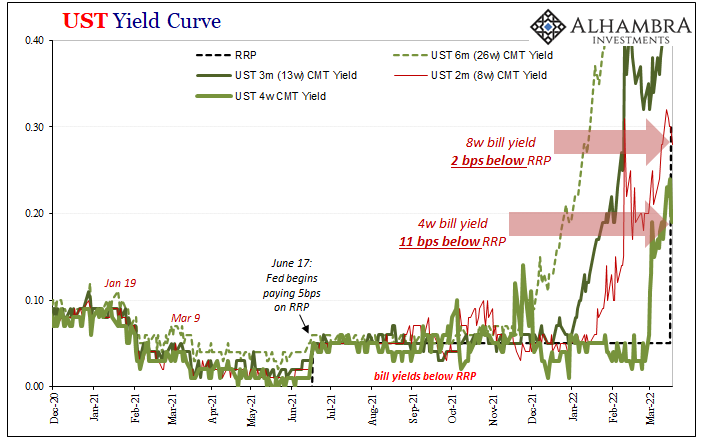

Chart of the Week: Collateral

It’s been a week of quite righteous focus on collateral. The 4-week bill equivalent yield closes it at just 114 bps, with only three days left before the RRP “floor” is moved up by the FOMC to 125 bps. That’s too much premium in price, though we know why given what FRBNY reported for repo fails last week.

Read More »

Read More »