Tag Archive: U.S. Trade Balance

The balance of trade, commercial balance, or net exports (sometimes symbolized as NX), is the difference between the monetary value of a nation’s exports and imports over a certain period. Sometimes a distinction is made between a balance of trade for goods versus one for services. If a country exports a greater value than it imports, it is called a trade surplus, positive balance, or a “favourable balance”, and conversely, if a country imports a greater value than it exports, it is called a trade deficit, negative balance, “unfavorable balance”, or, informally, a “trade gap”.

FX Daily, June 4: Risk Taking Pauses Ahead of the ECB

Overview: After several days of aggressive risk-taking, investors are pausing ahead of the ECB meeting. Equities were mostly higher in the Asia Pacific region, though China was mixed, and Indian shares slipped. Europe's Dow Jones Stoxx 600 is snapping a five-day advance, and US shares are trading with a heavier bias. The S&P 500 gapped higher yesterday, and that gap (~3081-3099) offers technical support.

Read More »

Read More »

Government “Fixes” for the Trade Balance Are Far Worse Than Any Trade Deficit

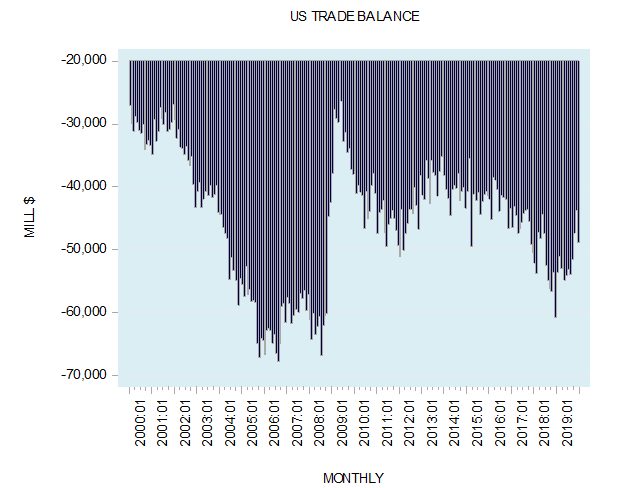

In December 2019, the US trade account balance stood at a deficit of $48.9 billion, against a deficit of $43.7 billion in November and $60.8 billion in December 2018.

Most commentators consider the trade account balance the single most important piece of information about the health of the economy. According to the widely accepted view, a surplus on the trade account is considered a positive development while a deficit is perceived negatively....

Read More »

Read More »

FX Daily, February 5: Markets Extend Recovery, but Look for a Pause

Overview: The S&P 500 gapped higher and surged 1.5% yesterday, the most since in six months, helping set the stage for a continued recovery in global equities, and stoked risk appetites more broadly. An experimental antiviral treatment is to begin clinical testing. All of the markets in the Asia Pacific region advanced, with Japan, China, and Singapore gaining more than 1%.

Read More »

Read More »

FX Daily, December 5: Sterling Sent Higher as Market Discounts Next Week’s Election

Overview: Global equity markets have resumed their climb after a wobble at the end of last week and earlier this week. A strong recovery in the S&P 500 on Tuesday signaled yesterday's strong advance that left a bullish one-day island low in its wake. MSCI Asia Pacific Index snapped a two-day decline today with nearly all the market with the notable exception of South Korea advanced.

Read More »

Read More »

FX Daily, November 5: Animal Spirits Remain Animated

The prospects that the US-China deal could include some rolling back of existing US tariffs helped underpin risk appetites. After new record highs in the US S&P 500 and NASDAQ, Asia Pacific markets marched higher, and the MSCI Asia Pacific reached its highest level since August 2018. A small rate cut by China and catch-up by Tokyo, which was on holiday on Monday, helped extended the regional rally for the 14th session in the past 17.

Read More »

Read More »

FX Daily, October 4: The US Jobs Data to Close a Sobering Week

Overview: The recovery of US shares yesterday signaled today's fragile stability. Gains in Japan, Australia, and Taiwan blunted the losses elsewhere in the region, including a 1% slide in Hong Kong. The MSCI Asia Pacific Index fell for the third week. China's markets have been closed since Monday and will re-open Monday and may play some catch-up.

Read More »

Read More »

FX Daily, June 6: US Tariff Threats on Mexico Compete with ECB for Attention

Overview: The implications of President Trump's assessment that there has not been "nearly enough" progress in negotiations with Mexico that would avert the tariff on June 10 competing for investors' attention, which had been squarely today's ECB meeting. Minutes before Trump spoke Fitch cut its sovereign rating for Mexico to BBB from BBB+, while Moody's cut its outlook to negative from stable.

Read More »

Read More »

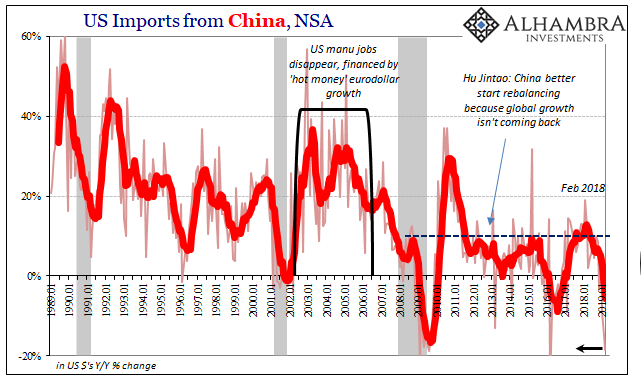

Trade Wars Have Arrived, But It’s Trade Winter That Hurts

There is truth to the trade war. That’s a big problem because it’s not the only problem. It isn’t even the main one. Given that, it’s easy to look at tariffs and see all our current ills in them. The Census Bureau reports today that the trade wars have definitely arrived. In March 2019, US imports from China plummeted by nearly 19% year-over-year.

Read More »

Read More »

FX Daily, May 09: De-Risking as US-China Trade Talks Resume

The end of the tariff truce between the US and China continues to dominate investment considerations. The truce was often cited in narratives explaining the recovery of equities from the Q4 18 slide. Ahead of the midnight US tariff hike, global equities are being smashed. Korea's Kospi was off 3%, and Hong Kong's Hang Seng was shed 2.4%. Shanghai lost 1.5%.

Read More »

Read More »

FX Daily, April 17: Veracity of Chinese Data Questioned, but Lifts Sentiment Nevertheless

The veracity of Chinese data will be questioned by economists, but today's upbeat reports round out a picture that began with stronger exports and a surge in lending. Chinese officials, we argue, had a "Draghi moment" and decided to do "whatever it takes" to strengthen the economy in the face of US tariffs and during the 70th anniversary of the Revolution.

Read More »

Read More »

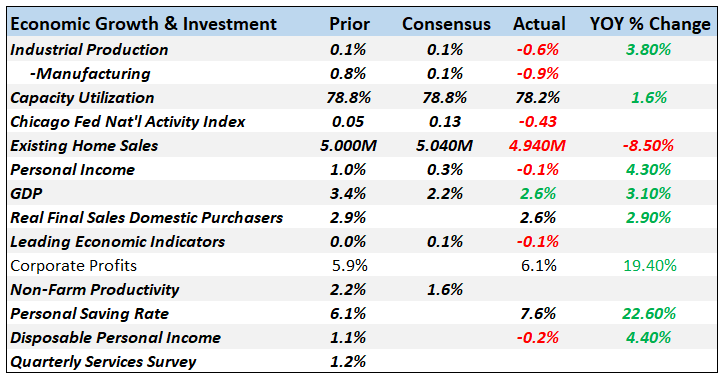

Monthly Macro Chart Review – March

We’re changing the format on our Macro updates, breaking the report into two parts. This is part one, a review of the data released the previous month with charts to highlight the ones we deem important. We’ll post another one next week that will be more commentary and the market based indicators we use to monitor recession risk.

Read More »

Read More »

FX Daily, September 05: Continuing EM Pain Helps the Dollar, but does Little for Yen

The dollar is posting gains against most of the emerging market and major currencies. The MSCI Emerging Markets Index is off 1.6% and extending the drop to a sixth consecutive session. Indonesia's bourse saw the largest decline (~3.75%) in the region. In part, it reflects concern that the rupiah's weakness (falling now nine of the past 10 sessions) will boost corporate debt servicing costs.

Read More »

Read More »

Greenback Corrects Lower

The consensus narrative is that with rising inflation it is understandable that next week's meeting is live and that the confirmation of such has lifted the euro to ten-day highs, dragging the dollar broadly. However, to accept this is to accept the debasement of language. Until now, we dubbed central bank meeting that could result in action as "live." For example, given that the Fed has not changed interest rates since the hiking cycle began in...

Read More »

Read More »

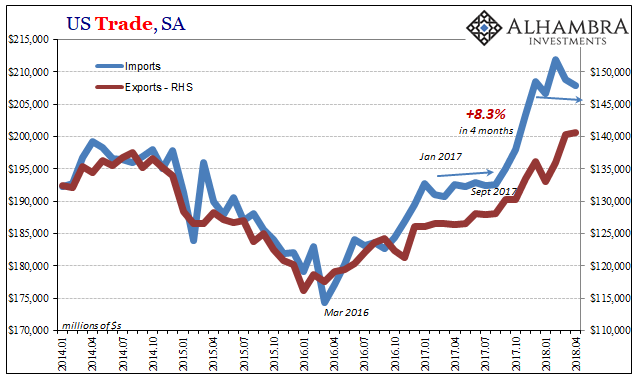

US Trade Settles Down Again

US trade is further leveling off after several months of artificial intrusions. On the import side, in particular, first was a very large and obvious boost following last year’s big hurricanes along the Gulf Coast. Starting in September 2017, for four months the value of imported goods jumped by an enormous 8.3% (revised, seasonally-adjusted). Most of the bump related to consumer and capital goods.

Read More »

Read More »

Watching Imports

The US trade deficit, a sensitive political topic these days, declined sharply in March. It had expanded significantly (more deficit) in January and February, reaching nearly -$76 billion (seasonally adjusted) in the latter month, before posting -$68 billion in the latest figures. Exports rose while imports fell in March, making for the largest single month change in the trade condition in many years.

Read More »

Read More »

US Imports Don’t Quite Match Chinese Exports

In early 2015, a contract dispute between dockworkers’ unions and 29 ports on the West Coast of the US escalated into what was a slowdown strike. Cargoes piled up especially at some of the largest facilities like those in Oakland, LA, and Long Beach, threatening substantial economic costs far and away from just those directly involved. Each side predictably blamed the other for it.

Read More »

Read More »

FX Daily, March 07: Renewed Threat of Trade War Makes Investors Angry

In response to the resignation of one of the few "globalist" advisers in the US Administration, the resignation Cohn has sent ripples through the capital markets. Stocks have been marked down across the world. The prospects of a trade war are also not good for growth and it may be adding to the pressure on yields.

Read More »

Read More »

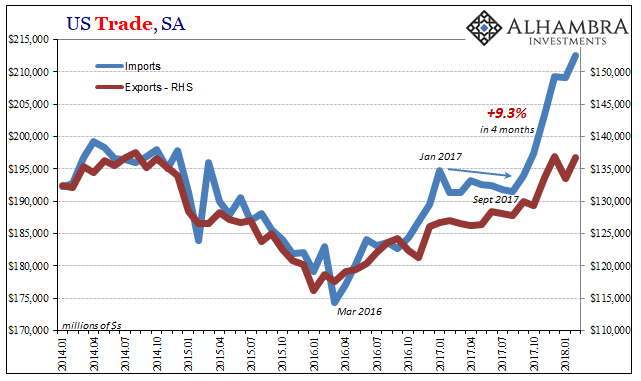

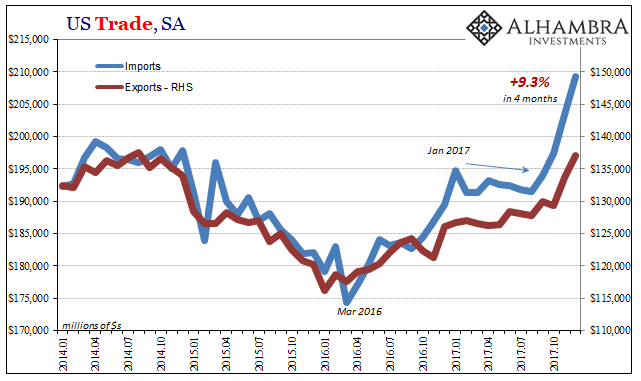

US Imports: A Little Inflation For Yellen, A Little More Bastiat

US imports rocketed higher once again in December, according to just-released estimates from the Census Bureau. Since August 2017, the US economy has been adding foreign goods at an impressive pace. Year-over-year (SA), imports are up just 10.4% (only 9% unadjusted) but 9.3% was in just those last four months. For most of 2017, imports were flat and even lower.

Read More »

Read More »

US Trade Balance is Deteriorating, Despite Record Exports

The US trade deficit swelled in December, and the $53.1 bln shortfall was a bit larger than expected. It was the largest deficit since October 2008. For the 2017, the US recorded a trade deficit of goods and services of $566 bln, the largest since 2008. The deterioration of the trade balance may be worse than it appears. There has been significant improvement in the oil trade balance. In 2017, the real petroleum balance was just shy of $96 bln, the...

Read More »

Read More »

FX Daily, February 06: Recovering US Equities Puts Floor Under Europe after Asia Tanks

After the dramatic fall in US equities, Asian equities followed suit. The MSCI Asia Pacific Index fell 3.4% following Monday's slide of 1.7%. European bourses gapped lower and spent most of the morning moving higher, though large gaps remain. At its worst, the Dow Jones Stoxx 600 was off about 3.3%, and at the time of this writing, it is half as much. US equities initially extended yesterday's losses, but the S&P 500 has turned higher in the...

Read More »

Read More »